Village Roadshow Acquired By Alcon In $417.5 Million Stalking Horse Bid

Table of Contents

Details of the Alcon Acquisition

The Stalking Horse Bid Explained

A stalking horse bid, in the context of bankruptcy proceedings, is an initial bid submitted by a party (in this case, Alcon) to set a floor price for the assets of a company undergoing financial restructuring (Village Roadshow). It provides a benchmark for subsequent bids and helps expedite the bankruptcy process. This strategic move by Alcon secured a crucial advantage, essentially setting the stage for a relatively smooth acquisition. Other successful examples include [insert example of a successful stalking horse bid in a similar industry].

- Definition of stalking horse bid: A preliminary bid designed to attract higher competing offers in a bankruptcy auction.

- Benefits to the buyer (Alcon): Secures a foothold in the acquisition process, establishes a baseline value, and often gets preferential treatment if the bid is not outbid.

- Benefits to the seller (Village Roadshow): Provides a guaranteed minimum sale price, attracts other bidders, and potentially speeds up the bankruptcy proceedings.

- Common usage in bankruptcy scenarios: A common tool used in bankruptcy auctions to ensure a swift and efficient sale of assets.

The Financial Terms of the Deal

Alcon's $417.5 million bid represents a significant investment in the entertainment industry. While the exact breakdown of cash versus debt assumption remains undisclosed, it's crucial to analyze whether this price fairly reflects Village Roadshow's assets and liabilities. Industry analysts are currently evaluating the deal, comparing it to other recent media acquisitions to determine its overall value.

- Total acquisition cost: $417.5 million.

- Payment structure (cash vs. debt): Details to be disclosed upon further announcements.

- Valuation analysis and comparisons to other similar media acquisitions: Ongoing assessments by financial analysts are required to determine if this is a favorable acquisition for Alcon.

Alcon's Strategic Rationale

Alcon's acquisition of Village Roadshow is likely driven by multiple strategic factors. The potential for synergy between the two companies' existing assets, the expansion into new markets, and the diversification of Alcon's portfolio are key considerations. This move aligns with Alcon's ambition to solidify its position as a major force in the film industry.

- Alcon's business goals: Expansion, diversification, and market share growth.

- Potential benefits from acquiring Village Roadshow's assets: Access to a wider catalog of films, established distribution networks, and potentially valuable intellectual property.

- Market expansion possibilities: Access to new geographic markets and film genres.

- Risk mitigation strategies: Diversification of revenue streams and reduced reliance on individual projects.

Impact on Village Roadshow and its Stakeholders

Restructuring and Debt Relief

The acquisition will significantly impact Village Roadshow's debt structure. While the deal may not eliminate all outstanding obligations, it provides a pathway to substantial debt relief. The outcome for creditors will largely depend on the specifics of the deal's financial terms.

- Village Roadshow's debt prior to the acquisition: [Insert details of Village Roadshow's debt if available].

- Impact on creditors: Partial or complete repayment depending on the finalized agreement.

- Potential for future debt restructuring: Further restructuring might be necessary depending on the extent of the debt relief provided by the Alcon acquisition.

Future of Village Roadshow's Operations

Under Alcon's ownership, Village Roadshow's operations are likely to undergo significant changes. While the exact nature and extent of these changes remain unclear, the integration of Village Roadshow's assets into Alcon's existing structure will influence future projects and employment.

- Potential changes in management: Likely changes in leadership roles within Village Roadshow.

- Impact on employees: Potential job losses or reassignments cannot be ruled out.

- Anticipated changes in film production strategy: Alignment with Alcon's business strategy and potential focus on specific genres or distribution channels.

- Integration plans: Alcon will likely outline plans for integrating Village Roadshow into its existing operations.

Implications for the Film Industry

The Alcon-Village Roadshow acquisition has broad implications for the entertainment industry. It reflects ongoing consolidation trends in the media landscape and could potentially lead to increased competition or innovative collaborations. The long-term effects on film production and distribution remain to be seen.

- Market consolidation trends: This acquisition reinforces the ongoing consolidation trend within the entertainment sector.

- Impact on competition: Potential increase or decrease in competition depending on Alcon's future strategies.

- Potential for innovation: The combined resources could lead to innovative film production and distribution models.

- Effects on film production and distribution models: Potential changes in how films are produced, marketed, and distributed.

Conclusion

Alcon's successful $417.5 million stalking horse bid to acquire Village Roadshow represents a pivotal moment in the entertainment industry. This acquisition has significant implications for both companies, their stakeholders, and the broader film landscape. The strategic rationale behind the deal, focusing on synergy, market expansion, and diversification, highlights Alcon’s long-term vision. The financial details, though still partially undisclosed, indicate a substantial investment in the future of film production and distribution. Stay tuned for further updates on the Village Roadshow acquisition and its impact on the future of film production. Continue to follow our coverage for ongoing analysis of this significant Village Roadshow acquisition.

Featured Posts

-

Broadcoms Proposed V Mware Price Hike At And T Highlights A Staggering 1050 Increase

Apr 24, 2025

Broadcoms Proposed V Mware Price Hike At And T Highlights A Staggering 1050 Increase

Apr 24, 2025 -

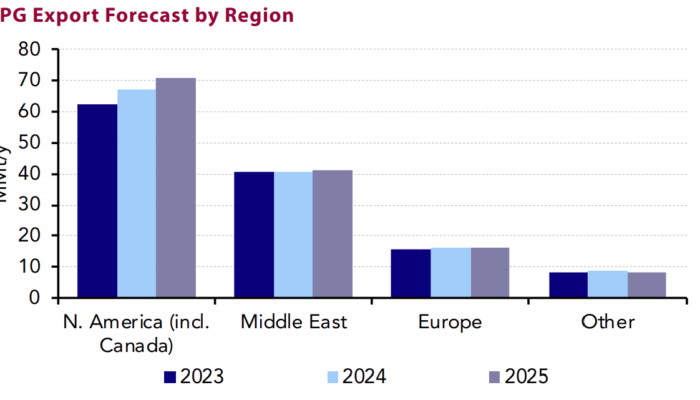

How Us Tariffs Reshaped Chinas Lpg Market The Middle Easts Growing Role

Apr 24, 2025

How Us Tariffs Reshaped Chinas Lpg Market The Middle Easts Growing Role

Apr 24, 2025 -

Usd Strengthens Dollar Gains Against Major Currencies As Trump Softens Stance On Fed

Apr 24, 2025

Usd Strengthens Dollar Gains Against Major Currencies As Trump Softens Stance On Fed

Apr 24, 2025 -

Dollar Rises Trumps Softened Tone On Fed Chair Powell Boosts Usd

Apr 24, 2025

Dollar Rises Trumps Softened Tone On Fed Chair Powell Boosts Usd

Apr 24, 2025 -

5 Dos And Don Ts For Landing A Private Credit Job

Apr 24, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 24, 2025