5 Do's And Don'ts For Landing A Private Credit Job

Table of Contents

DO: Network Strategically to Find Private Credit Jobs

Building a strong network is crucial in the competitive private credit industry. It's often not what you know, but who you know that opens doors.

Attend Industry Events

- Relevant Events: Attend conferences like the Private Equity International (PEI) events, industry-specific workshops, and smaller networking gatherings hosted by private credit firms.

- Networking Strategies: Prepare a concise elevator pitch highlighting your skills and experience in private credit. Carry professional business cards and actively engage in conversations, focusing on building genuine relationships, not just collecting contacts. Remember that private credit networking is about quality over quantity.

- Keyword Integration: Actively participate in conversations surrounding topics like private credit lending, private debt investments, and distressed debt strategies.

Leverage Online Networking Platforms

- Key Platforms: LinkedIn is your primary tool. Optimize your profile with relevant keywords such as "private credit analyst," "credit underwriting," "portfolio management," "financial modeling," and "due diligence." Highlight your experience and achievements using quantifiable results whenever possible.

- Effective Strategies: Connect with recruiters specializing in private credit placements and actively engage with posts and discussions within relevant private credit groups. Follow industry leaders and firms to stay updated on opportunities and gain insights into the private credit market.

- Keyword Integration: Use relevant hashtags like #privatecredit, #fintech, #alternativeinvestments, and #privateequity in your posts and profile.

DON'T: Neglect Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression – make it count! A generic application won't cut it in this competitive market.

Tailor Your Resume to Each Application

- Customization is Key: Don't use a generic resume. Carefully review each job description and tailor your resume to match the specific requirements and keywords used. Highlight the skills and experiences that align directly with the position.

- Keyword Optimization: Incorporate relevant keywords from the job description throughout your resume, naturally integrating them within your accomplishments and responsibilities. Use action verbs to showcase your achievements.

- Keyword Integration: Use keywords like “private credit analyst,” “financial modeling,” “credit risk assessment,” and “debt restructuring” as appropriate.

Submit Generic Cover Letters

- Personalization is Paramount: Never submit a generic cover letter. Research the company thoroughly and personalize each letter to demonstrate your understanding of their investment strategy, recent deals, and company culture. Show them you've done your homework!

- Showcasing Interest: Clearly articulate why you are interested in this specific private credit job and this particular firm. Explain how your skills and experience align with their needs and how you can contribute to their success.

- Keyword Integration: Your cover letter should reiterate key skills and accomplishments from your resume, using relevant keywords like "private debt," "direct lending," and "special situations" where appropriate.

DO: Showcase Your Financial Acumen and Private Credit Expertise

Demonstrating your understanding of the private credit market and your relevant skills is critical.

Highlight Relevant Skills in Your Application Materials

- Essential Skills: Emphasize your skills in financial modeling, credit analysis, portfolio management, due diligence, and valuation. Showcase your proficiency in relevant software such as Excel, Bloomberg Terminal, and other financial modeling tools.

- Quantifiable Achievements: Whenever possible, quantify your achievements. Instead of simply stating "managed a portfolio," say "managed a $50 million portfolio, exceeding return targets by 15%." This demonstrates the impact you've made.

- Keyword Integration: Use keywords that highlight your quantitative abilities, such as "IRR," "cash flow modeling," "LTV," and "debt covenants."

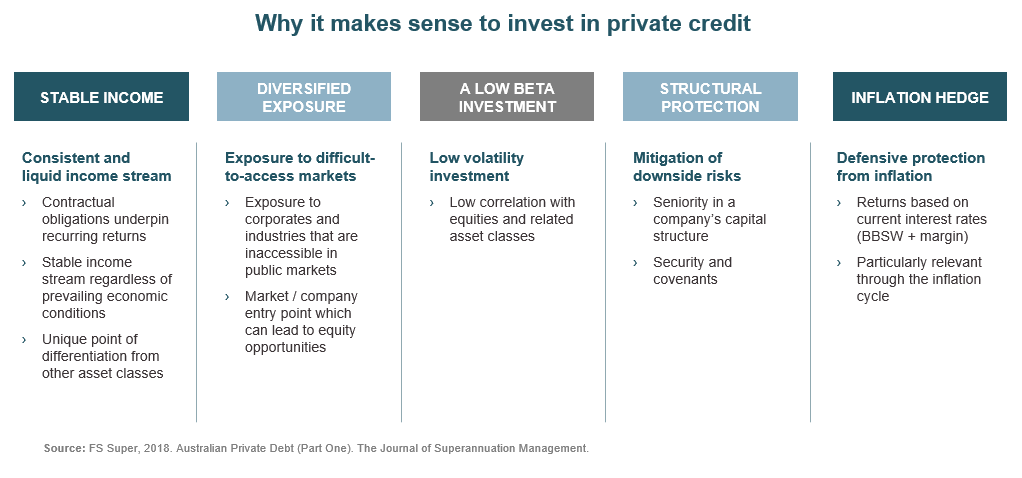

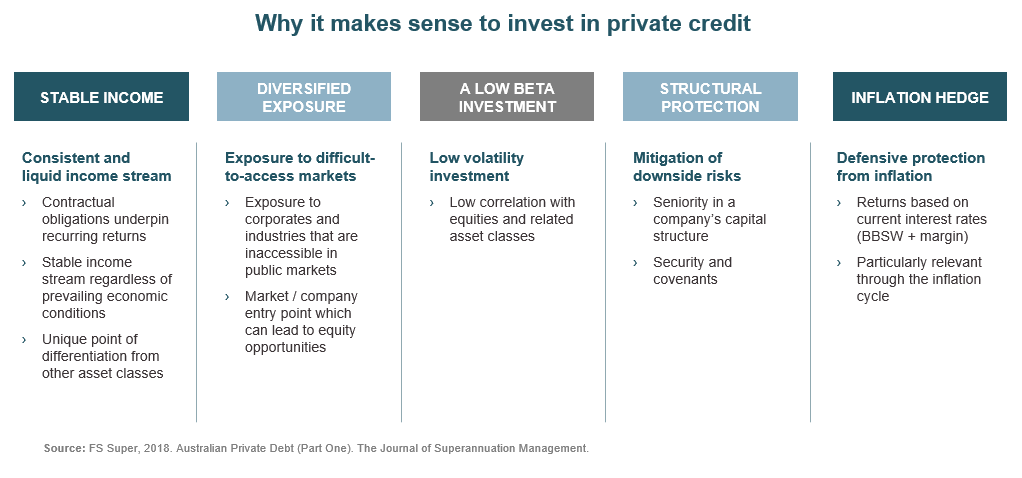

Demonstrate Your Understanding of the Private Credit Market

- Industry Knowledge: Stay updated on industry trends, regulations, and market cycles. Demonstrate your understanding of different private credit strategies, including direct lending, mezzanine financing, distressed debt investing, and special situations.

- Market Awareness: Show your awareness of current economic conditions and how they impact the private credit market. This showcases your ability to analyze market dynamics and make informed investment decisions.

- Keyword Integration: Use terms like "private debt market," "leveraged loans," "collateralized loan obligations (CLOs)," and "private equity funds" to show your breadth of knowledge.

DON'T: Underestimate the Importance of the Interview Process

The interview is your opportunity to shine. Thorough preparation is essential.

Prepare Thoroughly for Behavioral and Technical Questions

- STAR Method: Practice answering common behavioral interview questions using the STAR method (Situation, Task, Action, Result). Focus on showcasing your experience in private credit and your problem-solving abilities.

- Technical Proficiency: Be prepared for technical questions related to financial modeling, credit analysis, and valuation. Review fundamental concepts and practice your responses. Be prepared to discuss your previous private credit work experience in detail.

- Keyword Integration: Use keywords like "credit risk," "portfolio diversification," "yield curve analysis," and "capital structure" in your answers.

Neglect to Ask Thoughtful Questions

- Show Your Engagement: Asking insightful questions demonstrates your genuine interest in the role and the company. Prepare a few thoughtful questions beforehand, focusing on the firm's investment strategy, recent deals, and company culture.

- Question Examples: Ask about the team's dynamic, the firm’s growth plans, the types of deals they are currently pursuing, or the challenges faced in the current market.

- Keyword Integration: Use keywords that reflect your understanding of the industry. For example, you could ask about their approach to "distressed debt investing" or their strategies for managing "credit risk."

DO: Follow Up After the Interview for Private Credit Opportunities

A simple follow-up can significantly increase your chances.

Send a Thank-You Note

- Personalized Email: Send a personalized thank-you email within 24 hours of your interview. Reiterate your interest and highlight key discussion points that resonated with you.

- Reinforce Key Skills: Briefly mention specific skills or experiences you discussed that align with the job requirements. Re-emphasize your enthusiasm for the private credit job opportunity.

- Keyword Integration: Use keywords that showcase your enthusiasm for the role and the company.

Maintain Contact

- Stay Connected: Maintain contact with recruiters and hiring managers through LinkedIn or other professional networks. Share relevant industry articles or insights to stay top-of-mind.

- Networking: Use LinkedIn to connect with other professionals in the private credit space. These connections can provide valuable insights and potential referrals.

- Keyword Integration: Regularly search for and engage with content related to private credit jobs and opportunities.

Secure Your Dream Private Credit Job

Landing a private credit job requires a strategic approach. By following these dos and don'ts – focusing on strategic networking, tailoring your application materials, showcasing your financial acumen, preparing for interviews, and following up effectively – you'll significantly improve your chances of securing your dream private credit job. Start networking, tailor your application materials, and prepare for a successful interview today! Don't delay in pursuing your private credit career aspirations!

Featured Posts

-

Elite Universities Respond To Increased Funding Challenges Under Trump

Apr 24, 2025

Elite Universities Respond To Increased Funding Challenges Under Trump

Apr 24, 2025 -

Anchor Brewing Companys Closure The Impact On Craft Beer

Apr 24, 2025

Anchor Brewing Companys Closure The Impact On Craft Beer

Apr 24, 2025 -

Five Point Plan Unveiled By Canadian Auto Dealers Amidst Us Trade Tensions

Apr 24, 2025

Five Point Plan Unveiled By Canadian Auto Dealers Amidst Us Trade Tensions

Apr 24, 2025 -

Hollywood Shut Down Double Strike Impacts Film And Television

Apr 24, 2025

Hollywood Shut Down Double Strike Impacts Film And Television

Apr 24, 2025 -

Auto Dealerships Push Back Against Mandatory Ev Sales

Apr 24, 2025

Auto Dealerships Push Back Against Mandatory Ev Sales

Apr 24, 2025