Dollar Rises: Trump's Softened Tone On Fed Chair Powell Boosts USD

Table of Contents

Trump's Shift in Stance Towards Jerome Powell

From Criticism to Cautious Praise

President Trump's relationship with Fed Chair Powell has been anything but smooth. For months, Trump publicly criticized Powell's monetary policy, often via Twitter, blaming him for slow economic growth and even accusing him of trying to sabotage his presidency. These criticisms frequently targeted Powell's interest rate hikes, which Trump viewed as detrimental to the US economy.

- Examples of past criticisms: Numerous tweets criticizing Powell's actions, public statements calling for lower interest rates, and press conferences expressing dissatisfaction with the Fed's performance.

- Examples of recent more conciliatory statements: A noticeable decrease in public criticism, less frequent mentions of Powell in negative contexts, and even some instances of subtle praise for the Fed's actions. This shift represents a departure from Trump's previous aggressive approach.

Impact on Market Sentiment

Trump's previous harsh criticisms of Powell significantly impacted market sentiment, creating uncertainty and volatility. The constant threat of political interference in the Federal Reserve's independence fueled fears among investors, leading to a decline in the USD's value.

- Specific examples of market reactions to past criticisms: Periods of USD depreciation following particularly critical statements from Trump; increased volatility in the Forex market reflecting uncertainty.

- Evidence of improved market sentiment following the shift: A noticeable appreciation of the USD following the change in Trump's rhetoric; decreased volatility in currency exchange rates suggesting increased investor confidence. The market interpreted the softer tone as a sign of reduced political risk.

The Federal Reserve's Role in USD Strength

Powell's Monetary Policy and its Effects

The Federal Reserve's monetary policy plays a crucial role in determining the value of the USD. Currently, the Fed's approach involves managing interest rates to balance economic growth and inflation. Decisions regarding interest rate hikes or cuts directly influence the attractiveness of the USD to international investors.

- Recent interest rate decisions: A detailed overview of recent Federal Open Market Committee (FOMC) meetings and their impact on interest rates. Analysis of the rationale behind these decisions.

- Explanation of how these decisions affect the attractiveness of the USD to investors: Higher interest rates generally attract foreign investment, increasing demand for the USD and strengthening its value. Conversely, lower rates may weaken the currency.

Independence of the Federal Reserve

The independence of the Federal Reserve is paramount for maintaining the stability and credibility of the USD. A central bank free from undue political influence is crucial for making objective decisions based on economic data rather than political expediency. Any perceived compromise of this independence can negatively affect investor confidence.

- Historical context of Fed independence: Briefly outlining the history and importance of the Fed's legal mandate for independence.

- The benefits of an independent central bank for currency stability: An independent central bank can make long-term strategic decisions without short-term political pressures, fostering trust and stability in the currency markets.

Wider Economic Factors Contributing to USD Rise

Global Economic Uncertainty

While Trump's shift in tone is a significant factor, other global economic factors contribute to the USD's rise. Periods of global economic uncertainty often lead to increased demand for safe-haven assets, including the USD.

- Examples of global economic uncertainties: Brexit developments, ongoing trade disputes, geopolitical instability in various regions.

- Explanation of why the USD is considered a safe-haven currency: Investors often flock to the USD during times of global uncertainty due to its perceived stability and liquidity.

US Economic Performance

The relative strength of the US economy compared to other major economies also influences the USD's value. Strong economic indicators like GDP growth, low unemployment, and controlled inflation make the USD more attractive to investors.

- Key economic indicators: Review of recent data on US GDP growth, inflation rates, and unemployment figures.

- Comparison with other major economies: Brief comparison of the US economy's performance against other major global economies, highlighting its relative strengths and weaknesses.

Conclusion

In summary, the recent rise of the dollar (USD) is a multifaceted event stemming from a confluence of factors. President Trump's softened stance towards Fed Chair Powell has significantly improved market sentiment, reducing uncertainty and bolstering investor confidence in the USD. However, it's crucial to remember that the USD's strength is also influenced by the Federal Reserve's monetary policies, global economic uncertainty, and the relative strength of the US economy. These factors are interconnected, highlighting the complex interplay between politics, economics, and currency exchange rates.

To fully understand the dynamics of the USD and its fluctuations, stay informed about the latest developments concerning the Federal Reserve, US economic policy, and global economic events. Further research into currency trading strategies and risk management techniques related to USD volatility is recommended for anyone interested in navigating the complexities of the Forex market. Stay updated on the latest developments affecting the dollar rises and how they influence the global economy.

Featured Posts

-

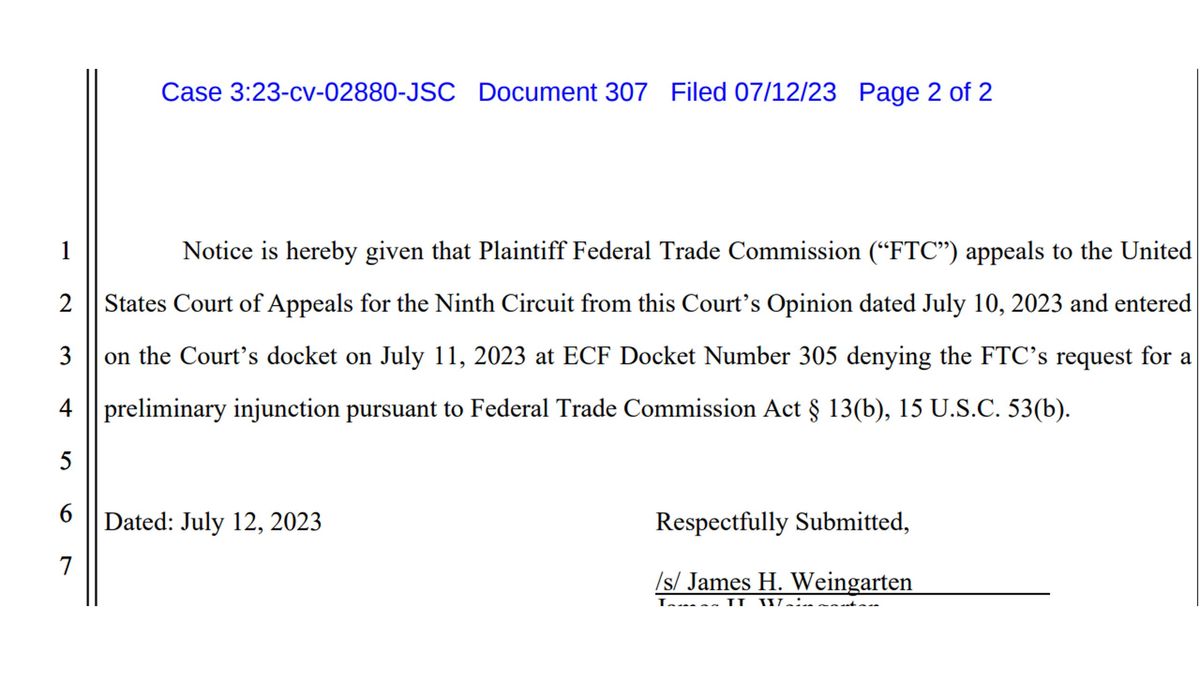

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025 -

Auto Dealerships Push Back Against Mandatory Ev Sales

Apr 24, 2025

Auto Dealerships Push Back Against Mandatory Ev Sales

Apr 24, 2025 -

Bold And The Beautiful Recap April 3 Liams Health Crisis And Hopes Housing Changes

Apr 24, 2025

Bold And The Beautiful Recap April 3 Liams Health Crisis And Hopes Housing Changes

Apr 24, 2025 -

John Travoltas Family Home Addressing A Recent Photo Controversy

Apr 24, 2025

John Travoltas Family Home Addressing A Recent Photo Controversy

Apr 24, 2025 -

Canadian Auto Industry Fights Back A Five Point Plan To Counter Us Trade War

Apr 24, 2025

Canadian Auto Industry Fights Back A Five Point Plan To Counter Us Trade War

Apr 24, 2025