How US Tariffs Reshaped China's LPG Market: The Middle East's Growing Role

Table of Contents

The Impact of US Tariffs on Global LPG Supply Chains

While not directly targeting LPG, US tariffs on other goods indirectly impacted global LPG trade flows. The tariffs led to increased costs for LPG imports into the US, reducing overall US demand. This ripple effect disrupted established supply chains and global LPG pricing. The reduced US demand created an opportunity for alternative suppliers to step in and fill the gap, significantly altering the dynamics of the global LPG market.

- Increased costs for LPG imports into the US: Tariffs added to the cost of goods, making US imports less competitive and impacting overall demand.

- Shifts in global LPG pricing: Reduced US demand led to lower global prices, making LPG from other regions more attractive to importers like China.

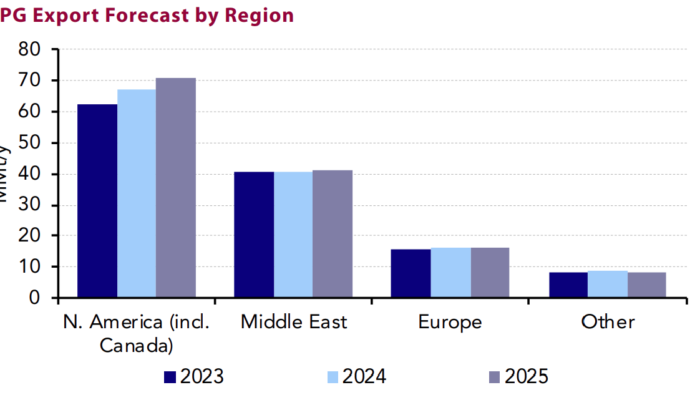

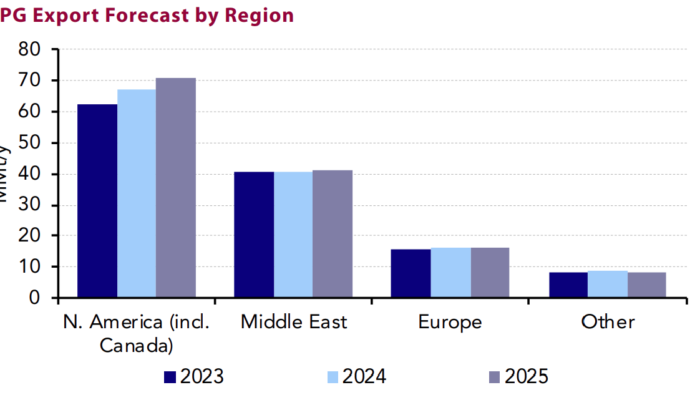

- Opportunities for alternative suppliers: Middle Eastern and other LPG producing countries capitalized on the shift in demand, increasing their market share.

China's Increased Reliance on Middle Eastern LPG

Following the implementation of US tariffs, China witnessed a substantial surge in LPG imports from Middle Eastern countries. This shift can be attributed to several key factors: geographical proximity, competitive pricing, and the reliability of supply from these nations. The Middle East's strategic location significantly reduces transportation costs and time, a crucial factor in the global energy market.

- Increased trade agreements between China and Middle Eastern nations: Strengthened bilateral agreements facilitated increased trade volume and smoother import processes.

- Development of new infrastructure: Investments in port facilities, pipelines, and storage infrastructure have improved LPG transportation efficiency between the Middle East and China.

- Growth of joint ventures and investment in Middle Eastern LPG production: Increased collaboration on production and infrastructure development solidified the long-term relationship.

The Middle East's Strategic Advantage in the LPG Market

The Middle East possesses abundant natural gas reserves, the primary feedstock for LPG production. This natural resource advantage, coupled with significant investments in LPG infrastructure and export capabilities, has provided the region with a considerable competitive edge in the global LPG market. This growing influence on China's energy security has significant geopolitical implications.

- Lower production costs compared to other regions: Abundant natural gas resources translate to lower production costs, making Middle Eastern LPG highly competitive.

- Access to significant natural gas resources: The Middle East’s vast reserves guarantee a stable and long-term supply of LPG.

- Strategic partnerships with China for long-term LPG supply: Long-term contracts and collaborative ventures ensure a reliable energy supply for China.

Economic and Geopolitical Implications of this Shift

The shift in China's LPG import sources has significant economic and geopolitical consequences. For China, it means increased economic ties with the Middle East, potentially improving regional stability through energy cooperation. However, it also presents challenges related to energy security and diversification. For Middle Eastern nations, increased LPG exports translate to economic growth and strengthened geopolitical influence.

- Increased economic ties between China and the Middle East: This shift strengthens trade relationships and fosters economic interdependence.

- Potential for increased regional stability through energy cooperation: Shared energy interests can foster diplomatic ties and improve regional security.

- New challenges related to energy security and diversification: China needs to manage risks associated with relying heavily on a single region for LPG supply.

Conclusion: Understanding How US Tariffs Reshaped China's LPG Market

The implementation of US tariffs undeniably reshaped China's LPG market, leading to a significant shift toward Middle Eastern suppliers. This change reflects the Middle East's strategic advantage in LPG production and export capabilities, fueled by abundant natural gas reserves and strategic investments. This development underscores the interconnectedness of global energy markets and the complex interplay of economic policies and geopolitical factors influencing energy trade. Understanding how US tariffs reshaped China's LPG market is crucial for navigating the evolving dynamics of the global energy landscape. Stay informed about the continuing evolution of the global LPG market and the significant impact of US tariffs reshaping China's LPG market by subscribing to our newsletter.

Featured Posts

-

Could Open Ai Buy Google Chrome Speculation Following Ceos Remarks

Apr 24, 2025

Could Open Ai Buy Google Chrome Speculation Following Ceos Remarks

Apr 24, 2025 -

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025 -

Child Actor Sophie Nyweide Mammoth Noah Dead At 24

Apr 24, 2025

Child Actor Sophie Nyweide Mammoth Noah Dead At 24

Apr 24, 2025 -

Analyzing The Canadian Dollars Current Market Position

Apr 24, 2025

Analyzing The Canadian Dollars Current Market Position

Apr 24, 2025 -

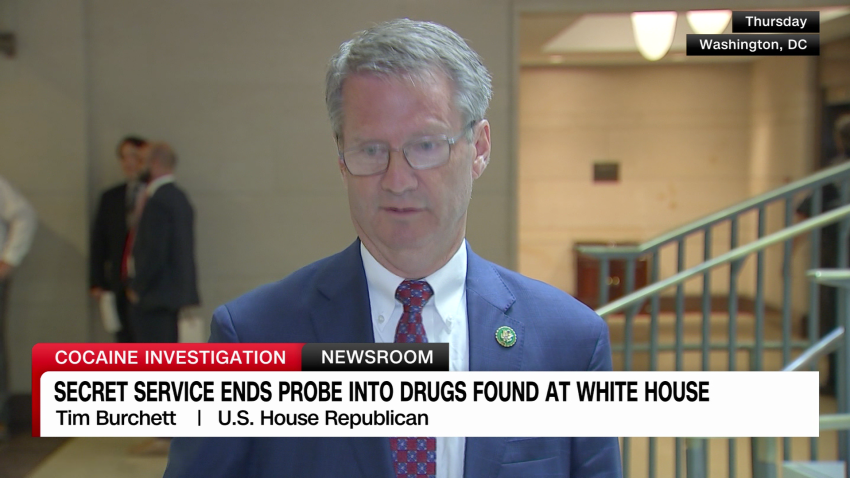

Secret Service Investigation Findings On Cocaine At The White House Released

Apr 24, 2025

Secret Service Investigation Findings On Cocaine At The White House Released

Apr 24, 2025