Cantor's $3 Billion Crypto SPAC Deal: Tether And SoftBank Involvement

Table of Contents

Cantor Fitzgerald's Ambitious Crypto Play

Cantor Fitzgerald, a renowned global financial services firm with a rich history in trading and brokerage, is making a bold foray into the cryptocurrency market. Their $3 billion SPAC (Special Purpose Acquisition Company) deal represents a substantial commitment to the long-term potential of crypto assets. SPACs, essentially shell companies that raise capital to acquire private companies, are increasingly utilized in the tech and crypto sectors to facilitate rapid growth and access to public markets.

This massive undertaking signals Cantor's belief in crypto's future. The details remain somewhat shrouded in secrecy, but the sheer scale suggests a broad acquisition strategy targeting potentially multiple companies within the crypto ecosystem.

- Size and scope: A staggering $3 billion, making it one of the largest crypto-focused SPAC deals to date.

- Potential target companies: While specifics are yet to be revealed, potential targets could include blockchain infrastructure providers, decentralized finance (DeFi) platforms, or companies developing innovative crypto applications.

- Cantor's long-term vision: The deal points to a long-term strategy aiming to establish Cantor as a major player in the evolving crypto finance landscape, capitalizing on the industry's expected growth and institutional adoption.

Tether's Involvement: A Deeper Look

Tether, the controversial yet dominant stablecoin, plays a significant, albeit unclear, role in Cantor's crypto SPAC. While the exact nature of Tether's participation hasn't been fully disclosed, its involvement raises several important questions and concerns. Is Tether an investor, a strategic partner, or perhaps providing some form of backing or guarantee?

Tether's massive market capitalization and its role as a crucial on-ramp for fiat currency into the crypto world make its involvement a pivotal factor in the deal's success. However, the ongoing debate surrounding Tether's reserves and transparency remains a significant concern.

- Tether's market capitalization: Tether boasts a substantial market cap, influencing its potential impact on the deal.

- Tether's financial reserves and transparency: The lack of complete transparency regarding Tether's reserves continues to fuel skepticism, casting a shadow on the deal's stability.

- Potential risks associated with Tether's involvement: Concerns about Tether's stability could negatively impact investor confidence and potentially jeopardize the entire venture.

The SoftBank Factor

Adding another layer of complexity and intrigue is the involvement of SoftBank, a prominent Japanese multinational conglomerate known for its substantial investments in technology and fintech. SoftBank's participation likely brings not only significant capital but also strategic expertise and a vast network of connections within the tech world.

SoftBank's history of investing in disruptive technologies suggests a strategic alignment with Cantor's crypto ambitions. Their involvement strengthens the deal's credibility and could open doors to further collaborations and opportunities.

- SoftBank's investment history in technology: SoftBank has a proven track record of successful investments in technology companies, including several in the fintech space.

- SoftBank's strategic goals for this investment: Their involvement likely reflects a belief in the transformative potential of crypto and a desire to capitalize on the industry's growth.

- Potential impact of SoftBank's involvement on the crypto market: SoftBank's participation lends considerable weight to the deal, potentially attracting further institutional investment into the crypto space.

Implications and Potential Outcomes

Cantor's $3 billion crypto SPAC deal holds substantial implications for the future of crypto finance. In the short term, it could lead to increased institutional adoption of cryptocurrencies, providing legitimacy and attracting further investment. In the long term, the deal could accelerate the maturation of the crypto market, driving innovation and potentially influencing regulatory frameworks.

- Increased institutional adoption of crypto: The deal could serve as a catalyst for increased institutional involvement in the crypto market.

- Potential impact on crypto regulation: The deal's success could influence regulatory discussions and potentially lead to clearer, more defined guidelines for the crypto industry.

- Effect on crypto market volatility: The influx of capital could impact market volatility, potentially leading to both increased growth and increased risk.

Risks and Challenges

Despite its potential benefits, Cantor's crypto SPAC deal faces several significant risks and challenges. Regulatory uncertainty remains a considerable hurdle, with varying legal frameworks across different jurisdictions posing a complex landscape for crypto investments. Market volatility, inherent in the crypto space, also poses a significant threat to the deal's success. Furthermore, intense competition within the crypto industry presents challenges to achieving the desired return on investment.

- Regulatory uncertainty in the crypto space: Navigating the complexities of global crypto regulations is a major challenge.

- Market risks and potential downturns: The crypto market is notoriously volatile, posing a substantial risk to the investment.

- Competitive landscape and potential challenges: Intense competition from other established and emerging players in the crypto space presents a significant hurdle.

Conclusion

Cantor Fitzgerald's $3 billion crypto SPAC deal, with the involvement of key players like Tether and SoftBank, represents a pivotal moment in the evolution of crypto finance. This significant investment holds immense potential to reshape the crypto landscape, accelerating institutional adoption, influencing regulatory frameworks, and driving innovation. However, the deal also carries substantial risks, emphasizing the need for careful consideration and risk management. Stay updated on the latest developments in Cantor's $3 billion crypto SPAC deal to understand its far-reaching implications for the future of cryptocurrency. Learn more about the impact of Tether and SoftBank's involvement in this significant crypto investment.

Featured Posts

-

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025 -

Tzin Xakman O Tzon Travolta Thrinei Ton Thanato Toy Agapimenoy Ithopoioy

Apr 24, 2025

Tzin Xakman O Tzon Travolta Thrinei Ton Thanato Toy Agapimenoy Ithopoioy

Apr 24, 2025 -

The Canadian Dollars Paradox Strength Against Usd Weakness Elsewhere

Apr 24, 2025

The Canadian Dollars Paradox Strength Against Usd Weakness Elsewhere

Apr 24, 2025 -

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

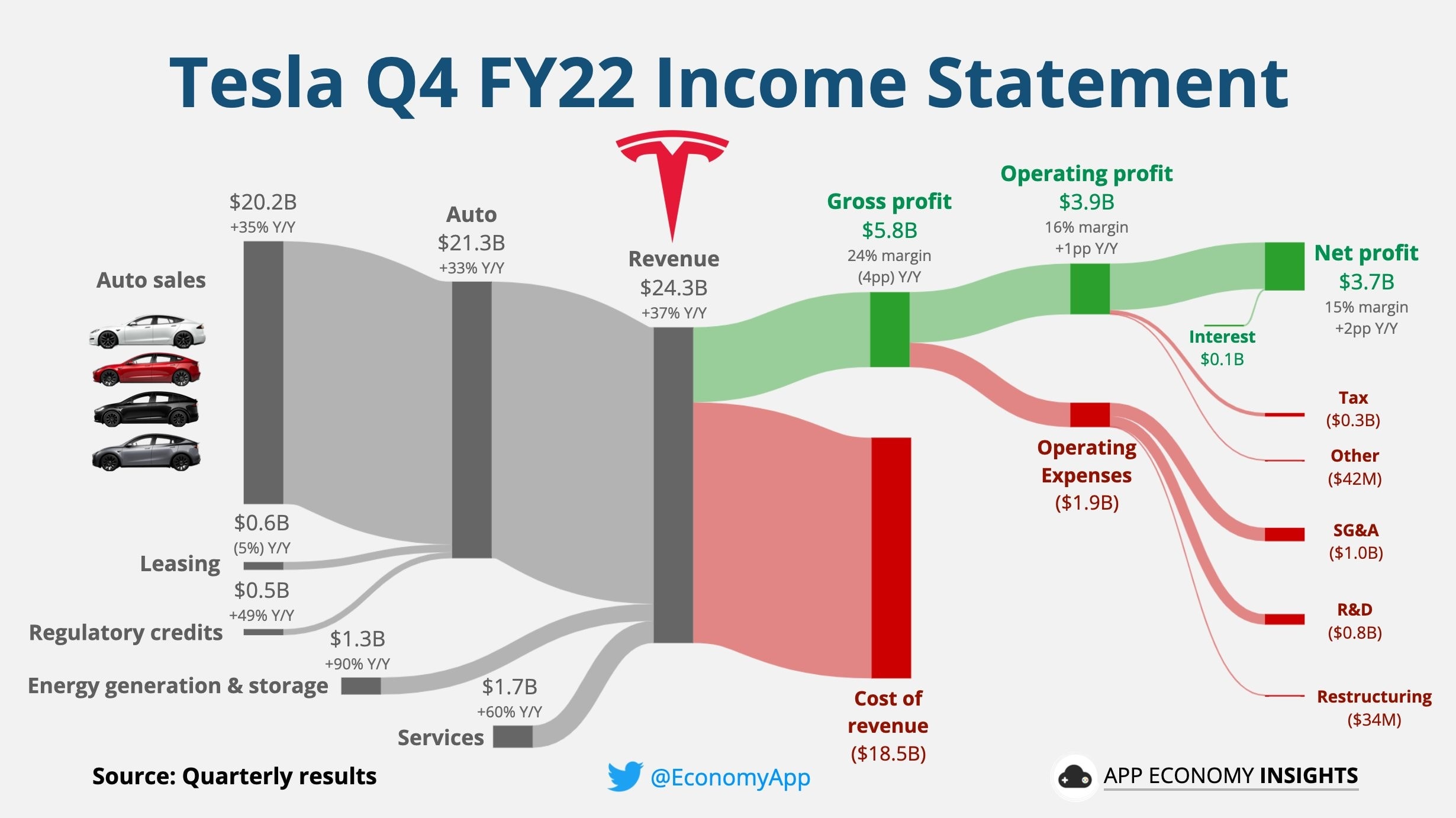

Analysis Of Teslas Q1 2024 Earnings Impact Of Political Backlash On Net Income

Apr 24, 2025

Analysis Of Teslas Q1 2024 Earnings Impact Of Political Backlash On Net Income

Apr 24, 2025