USD Strengthens: Dollar Gains Against Major Currencies As Trump Softens Stance On Fed

Table of Contents

Trump's Shift in Fed Policy Rhetoric and its Impact on the USD

From Criticism to Acceptance

President Trump's past criticisms of the Fed, particularly regarding interest rate decisions, were frequent and often harsh. He consistently blamed the Fed for slowing economic growth and hindering his administration's economic agenda. However, his recent comments reflect a more conciliatory approach, noticeably reducing his public attacks on the central bank's independence.

- Examples of past criticisms: Public statements on Twitter criticizing rate hikes, accusations of the Fed working against his economic policies.

- Quotes from recent statements: Identify and cite specific instances where Trump has praised the Fed's actions or refrained from criticism. Analyze the shift in tone and the potential impact on market sentiment. This change in rhetoric signals a lessening of political pressure on the Fed.

- Analysis of the impact of this shift on market sentiment: This reduced pressure has calmed markets, as investors now have greater confidence in the Fed's ability to make independent and objective decisions based solely on economic data. This improved confidence directly translates into increased demand for the USD.

Reduced Uncertainty, Increased Investor Confidence

The decreased uncertainty surrounding the Fed's independence has significantly boosted investor confidence in the USD. Investors view a politically independent central bank as more credible and reliable in managing inflation and maintaining economic stability.

- Statistics showing increased investment in US assets: Cite data illustrating increased foreign investment in US Treasury bonds, stocks, and other assets. This increased investment directly supports the USD’s value.

- Analysis of market indices reflecting investor confidence: Discuss the performance of key market indices (e.g., S&P 500, Dow Jones) and their correlation with the USD’s strength. A rising stock market often indicates greater confidence in the US economy, which in turn supports the USD.

- Expert opinions on the effect of reduced political pressure on the Fed: Include quotes from economists and financial analysts highlighting the positive impact of Trump’s altered stance on market confidence and the subsequent strengthening of the USD.

Global Economic Factors Contributing to USD Strengthening

Weakening Euro and Other Major Currencies

The USD’s recent gains are not solely attributable to domestic factors. The relative weakness of other major currencies, such as the Euro, Yen, and Pound, has also contributed significantly to the USD’s rise.

- Economic factors affecting the Eurozone, Japan, and the UK: Detail the economic challenges faced by these regions – Brexit uncertainty impacting the Pound, slow growth in the Eurozone, and deflationary pressures in Japan – which have weakened their respective currencies.

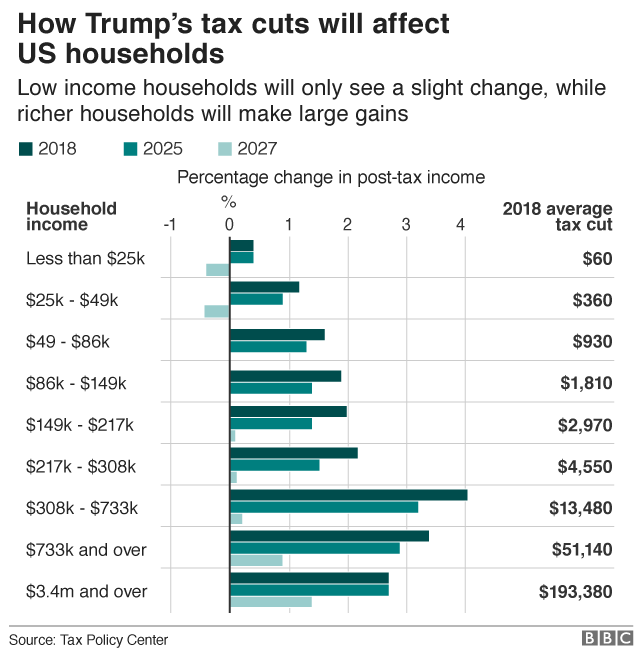

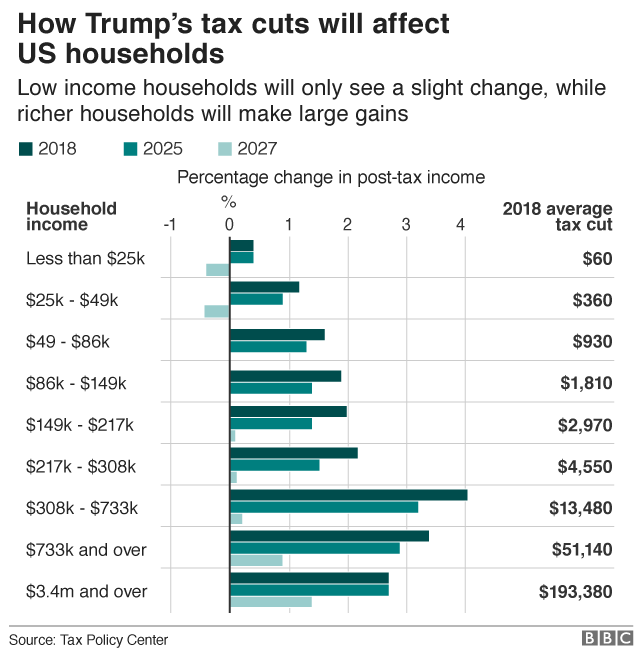

- Comparisons of their economic performance with the US: Present a comparative analysis of the economic performance of the US against these other major economies, highlighting the relatively better performance of the US economy, leading to increased demand for the USD.

- Currency exchange rate charts illustrating the relative strengths: Include relevant charts visually displaying the USD's appreciation against these other currencies, providing concrete evidence of the USD's strengthening position in the forex market.

Safe-Haven Status of the USD

The USD maintains its status as a safe-haven currency, attracting investors seeking stability during periods of global economic uncertainty. When global markets experience turmoil, investors often flock to the USD, driving up its value.

- Examples of global economic uncertainties: Cite recent global economic uncertainties such as geopolitical tensions, trade wars, or emerging market crises, which have boosted the USD's safe-haven appeal.

- Analysis of capital flows into US assets during periods of uncertainty: Demonstrate how capital flows into US assets, including government bonds and equities, increase during times of global uncertainty, fueling USD demand.

- Comparison of the USD with other safe-haven currencies like the Swiss Franc and the Japanese Yen: Highlight the USD’s relative attractiveness compared to other safe havens, illustrating why investors prefer the USD during turbulent times. The USD's deep and liquid market makes it a particularly attractive safe haven.

Implications of a Strong USD for the Global Economy

Impact on US Exports and Imports

A strong USD has significant consequences for US businesses engaged in international trade. While making imports cheaper for US consumers, it simultaneously makes US exports more expensive in foreign markets, potentially impacting the US trade balance.

- Potential effects on the US trade balance: Discuss the potential for a widening trade deficit as imports increase and exports decrease due to the stronger dollar.

- Impact on different sectors of the US economy (e.g., manufacturing, agriculture): Analyze how different sectors will be differentially affected, with export-oriented industries potentially facing challenges while import-dependent industries benefit.

- Examples of specific companies affected: Mention examples of companies heavily reliant on exports that may experience difficulties due to the stronger USD.

Effects on Emerging Markets

Emerging markets with substantial USD-denominated debt face significant challenges with a strong USD. The rising value of the USD increases the cost of servicing this debt, potentially leading to financial instability.

- Increased debt servicing costs for emerging economies: Explain how a stronger USD directly translates into higher repayment costs for these countries.

- Potential for financial instability in vulnerable nations: Discuss the risk of debt crises and potential economic turmoil in vulnerable emerging economies facing increased debt burdens.

- Possible ripple effects on global trade: Explain how financial instability in emerging markets can disrupt global trade and supply chains, impacting global economic growth.

Conclusion

The recent USD strengthening is a complex phenomenon driven by several interconnected factors. President Trump’s softened stance on the Fed has reduced market uncertainty, boosting investor confidence. Concurrently, the relative weakness of other major currencies and the USD’s inherent safe-haven status have contributed to its rise. This trend has significant implications for the global economy, impacting US trade, emerging markets, and global financial stability.

Call to Action: Stay informed about the evolving situation regarding USD strengthening and its impact on global markets. Monitor currency exchange rates and economic indicators closely to make informed decisions regarding your investments and financial planning in this dynamic environment. Understanding the forces behind US dollar gains is crucial for navigating the complexities of the global financial landscape.

Featured Posts

-

A Body Found Sharks Present Israeli Beachs Shift From Attraction To Incident

Apr 24, 2025

A Body Found Sharks Present Israeli Beachs Shift From Attraction To Incident

Apr 24, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 24, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 24, 2025 -

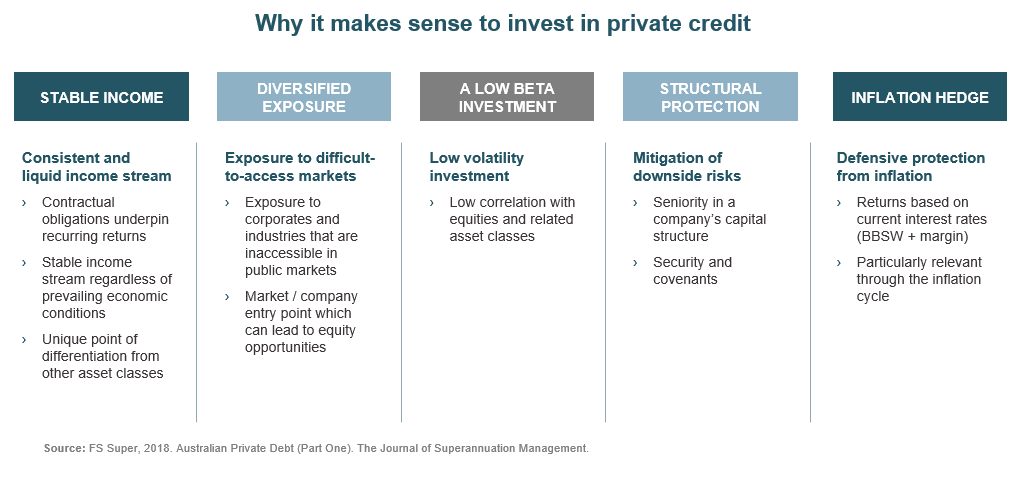

5 Dos And Don Ts For Landing A Private Credit Job

Apr 24, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 24, 2025 -

Sophie Nyweide Mammoth Noah Death Of Child Actor At 24 Confirmed

Apr 24, 2025

Sophie Nyweide Mammoth Noah Death Of Child Actor At 24 Confirmed

Apr 24, 2025 -

Actors And Writers Strike What It Means For Hollywoods Future

Apr 24, 2025

Actors And Writers Strike What It Means For Hollywoods Future

Apr 24, 2025