Chinese Buyout Firm Weighs Sale Of Chip Tester UTAC

Table of Contents

H2: UTAC's Significance in the Semiconductor Industry

UTAC holds a considerable position within the complex ecosystem of semiconductor testing. Its advanced capabilities and established client base make it a key player in ensuring the quality and reliability of chips worldwide.

H3: Market Position and Technology

UTAC boasts a significant market share, particularly within specific niches of the chip testing market. While precise figures remain undisclosed, industry analysts estimate UTAC holds a considerable percentage of the market for testing [Specific type of chip, e.g., high-bandwidth memory chips].

- Technological Advantages: UTAC utilizes cutting-edge technologies, including [mention specific technologies, e.g., AI-powered defect detection, advanced automated test equipment (ATE)], offering superior speed, accuracy, and efficiency compared to competitors.

- Market Leadership: UTAC is a recognized leader in testing [mention specific types of chips and applications], securing its position as a crucial partner for numerous major semiconductor manufacturers.

- Specific Types of Chips Tested: UTAC's expertise spans various chip types, including memory chips (DRAM, NAND flash), logic chips (microprocessors, microcontrollers), and specialized chips for automotive and industrial applications.

H3: Client Base and Revenue

UTAC's client list includes some of the world's leading semiconductor companies, encompassing both established players and emerging innovators. Although precise client names are often kept confidential due to non-disclosure agreements, the geographical distribution of its clientele is notably diverse, with a significant presence in both East Asia and North America.

- Key Clients (General Categories): Major players in memory, logic, and specialized chip manufacturing.

- Revenue Figures (if available): While exact figures are not publicly available, industry sources suggest substantial annual revenue, reflecting UTAC’s strong market standing.

- Growth Trajectory: Prior to the news of the potential sale, UTAC demonstrated consistent revenue growth, reflecting its ability to adapt to the demands of the evolving semiconductor industry.

H2: Reasons Behind the Potential Sale of UTAC

The decision to potentially sell UTAC likely stems from a confluence of factors related to both the financial performance of the Chinese buyout firm and its broader strategic direction.

H3: Financial Considerations

- Debt Levels: The Chinese buyout firm may be seeking to reduce its overall debt burden by divesting from less strategically crucial assets.

- Profitability Issues (if applicable): While UTAC's performance has generally been strong, potential challenges in profitability or reduced margins within the semiconductor testing market might influence the decision.

- Investment Opportunities Elsewhere: The firm may be looking to reallocate capital to more promising investment opportunities within other sectors of the economy.

H3: Strategic Realignment

The sale may also reflect a strategic realignment within the buyout firm itself.

- Focus on Core Competencies: The firm may be focusing its resources on its core business areas, deciding to exit the relatively specialized semiconductor testing market.

- Exit Strategy: This might represent a calculated exit strategy from a sector deemed less strategically aligned with the firm's long-term growth objectives.

H2: Potential Buyers and Implications of the Sale

The sale of UTAC is expected to attract significant interest from various potential buyers.

H3: Potential Acquirers

- Competitors in the Semiconductor Testing Market: Existing players in the chip testing market could seek to acquire UTAC to expand their market share and gain access to its technology and client base.

- Private Equity Firms: Private equity firms specializing in technology investments are likely to view UTAC as a lucrative acquisition target.

- Other Chinese or International Companies: Companies seeking to bolster their presence in the semiconductor sector, both within and outside of China, may be interested.

H3: Impact on Competition and the Global Chip Market

The sale of UTAC could significantly impact the competitive dynamics of the semiconductor testing market.

- Increased Concentration of Market Power: A sale to a major competitor could lead to a more concentrated market, potentially impacting pricing and innovation.

- Potential Price Hikes: Depending on the buyer and resulting market structure, chip testing costs could potentially increase.

- Changes in Technological Development: The buyer's priorities and investment strategies could influence the direction of technological development in semiconductor testing.

3. Conclusion

The potential sale of UTAC by a Chinese buyout firm is a significant development with far-reaching implications for the global semiconductor industry. UTAC's crucial role in chip testing, combined with the strategic considerations driving the sale, makes this a pivotal moment for the sector. The ultimate buyer and resulting market adjustments will undoubtedly impact competition, pricing, and technological innovation in the years to come.

Call to Action: Stay updated on the future of UTAC and the broader implications for the semiconductor testing market. Follow the latest news on the potential sale of this crucial chip tester by subscribing to our newsletter [link to newsletter signup] for in-depth analysis and expert insights.

Featured Posts

-

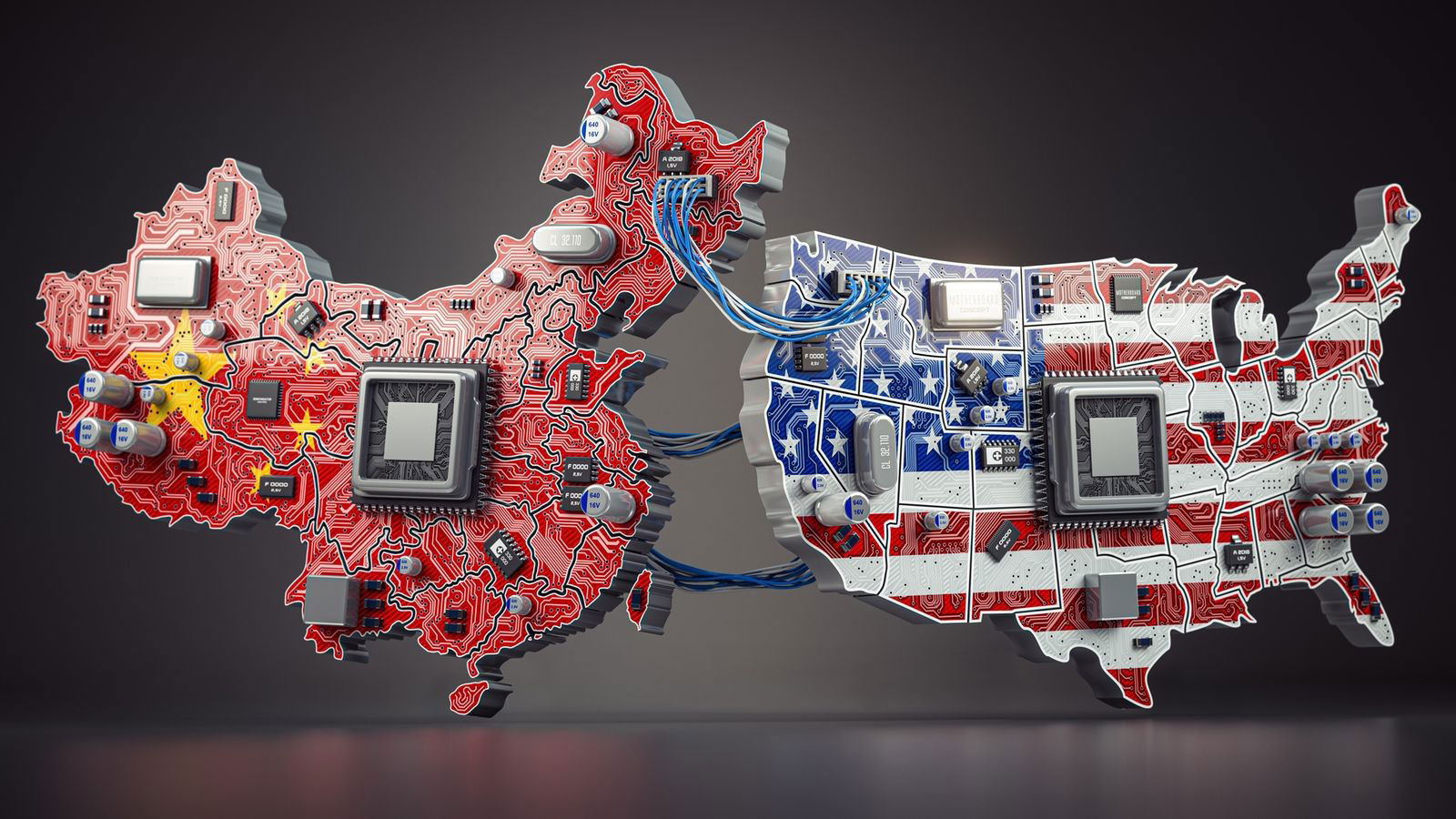

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

Apr 24, 2025

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

Apr 24, 2025 -

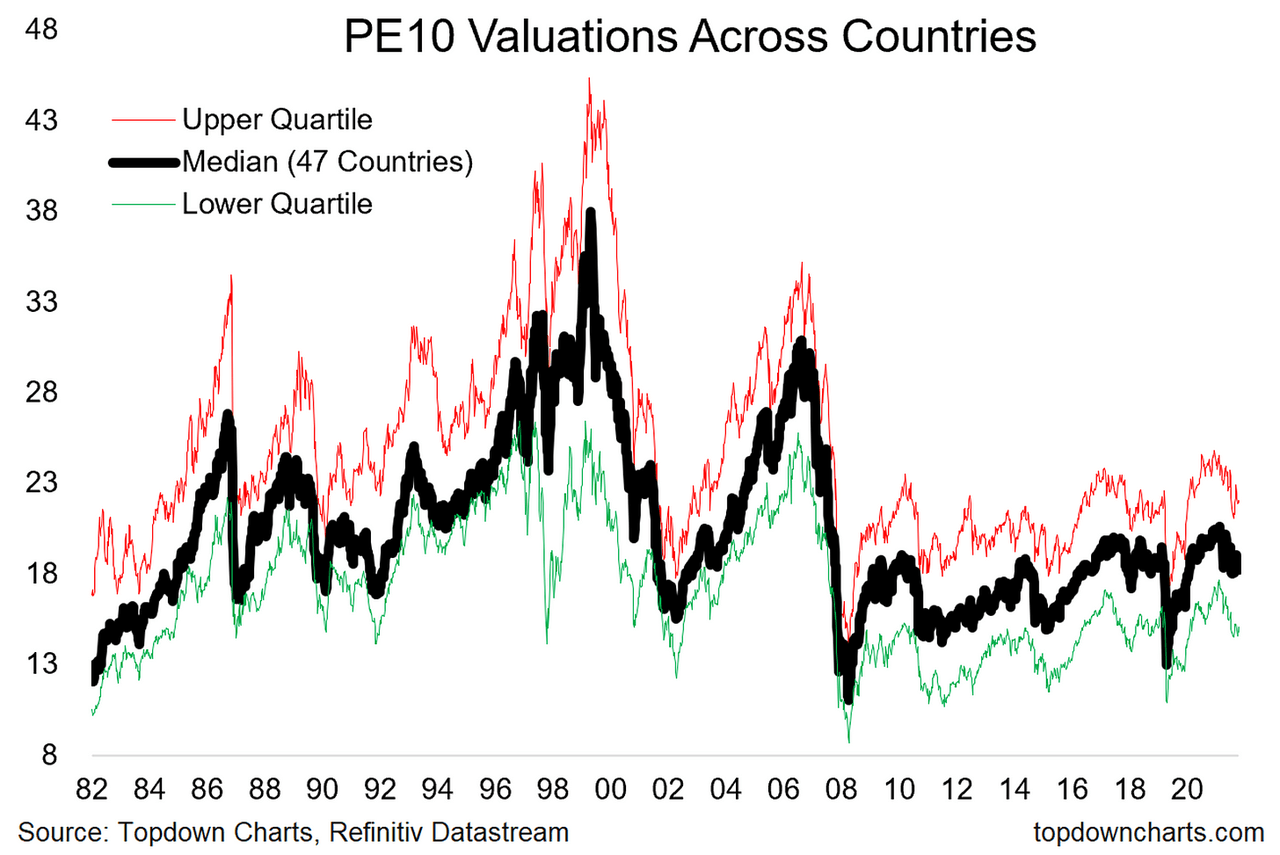

How Us Tariffs Reshaped Chinas Lpg Market The Middle Easts Growing Role

Apr 24, 2025

How Us Tariffs Reshaped Chinas Lpg Market The Middle Easts Growing Role

Apr 24, 2025 -

Las Vegas Airport Safety Faas Investigation Into Collision Risks

Apr 24, 2025

Las Vegas Airport Safety Faas Investigation Into Collision Risks

Apr 24, 2025 -

Cocaine Found At White House Secret Service Investigation Complete

Apr 24, 2025

Cocaine Found At White House Secret Service Investigation Complete

Apr 24, 2025 -

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025