Tesla's Q1 2024 Earnings Report: A 71% Drop In Net Income

Table of Contents

Analyzing the 71% Decline in Tesla's Net Income

The dramatic 71% fall in Tesla's net income for Q1 2024 is a multi-faceted issue, stemming from a confluence of factors. Let's delve into the key contributors:

Impact of Price Cuts

Tesla's aggressive price cuts implemented during Q1 2024 significantly impacted profitability margins. The strategy aimed to boost sales volume in a competitive market, but the trade-off was a lower profit per vehicle.

- Price reductions ranged from 10% to 20% across different Tesla models, depending on the region and specific vehicle.

- While sales volume increased, the profit margin per vehicle decreased substantially, directly impacting the overall net income.

- Analysts remain divided on the long-term effectiveness of this strategy, with some questioning its sustainability and others pointing to the potential for capturing greater market share in the long run.

Increased Production Costs

Soaring production costs added further pressure to Tesla's bottom line during Q1 2024. Increases in raw materials, logistics, and manufacturing expenses contributed to reduced profitability.

- Raw material costs, particularly for lithium and certain metals essential for battery production, experienced significant price increases.

- Logistics costs, including shipping and transportation, also rose due to global supply chain disruptions and inflationary pressures.

- Manufacturing expenses, encompassing labor and energy costs, also played a significant role in the overall increase in production costs. The exact quantitative impact of these cost increases on Tesla's bottom line needs further detailed analysis from Tesla's official statements.

Competition and Market Saturation

The increasingly competitive electric vehicle market played a crucial role in Tesla's Q1 2024 performance. New entrants and established automakers are aggressively pursuing the EV market, leading to market saturation and intense price competition.

- Key competitors, including BYD, Volkswagen, and others, are launching new EV models with increasingly competitive pricing and features.

- Tesla's market share, while still significant, appears to be facing pressure from this growing competition, affecting its pricing power and overall profitability.

- The increased competition, coupled with Tesla's price cuts, created a perfect storm, impacting the overall profitability of the company in Q1 2024.

Other Key Financial Metrics from Tesla's Q1 2024 Report

Beyond the significant drop in net income, several other key financial metrics from Tesla's Q1 2024 report provide a more comprehensive picture of the company's performance:

Revenue Growth and Sales Figures

Despite the decline in net income, Tesla still reported substantial revenue and vehicle sales figures in Q1 2024. However, the growth rate compared to previous quarters and the same period last year was significantly lower than expectations.

- Exact figures for vehicle deliveries and total revenue will need to be pulled from the official Q1 2024 earnings report.

- The relatively slower growth in revenue compared to previous periods indicates a potential slowdown in market momentum. Further detailed analysis of these figures is crucial to fully understanding the financial status of the company.

Cash Flow and Liquidity

Tesla's cash flow and liquidity position remain crucial factors in assessing its financial health. The Q1 2024 report needs to be reviewed for an accurate assessment of this aspect.

- Data on operating cash flow, free cash flow, and debt levels will be crucial in determining Tesla's ability to manage its financial obligations and invest in future growth.

- A strong cash flow position is vital for Tesla to navigate potential economic headwinds and continue its investments in research, development, and expansion.

Elon Musk's Commentary and Future Outlook

Elon Musk's commentary following the release of the Q1 2024 earnings report provides valuable insight into the company's future outlook and plans. His statements, when released, should be closely scrutinized.

- Direct quotes from Musk's statements or press releases should be included here, providing a deeper understanding of his perspective on the Q1 results and the company's strategic direction.

- Analyzing his outlook is key to forecasting Tesla's potential performance in subsequent quarters.

Conclusion: Understanding the Implications of Tesla's Q1 2024 Earnings Report

Tesla's Q1 2024 earnings report highlights a significant drop in net income, primarily driven by aggressive price cuts, increased production costs, and intensifying competition within the EV market. While revenue and sales figures remain substantial, the slower growth rate and reduced profitability raise concerns. Analyzing Tesla's cash flow and liquidity position, alongside Elon Musk's commentary on the future outlook, is crucial for a comprehensive understanding of the company's financial health and strategic direction. The long-term outlook for Tesla depends on its ability to navigate these challenges and adapt its strategies to maintain a competitive edge in the rapidly evolving EV landscape. Stay tuned for further analysis of Tesla's financial performance and learn more about how to interpret future Tesla's Q2 earnings reports to make informed investment decisions.

Featured Posts

-

John Travolta Honors Late Son Jett On His Birthday With A Shared Photo

Apr 24, 2025

John Travolta Honors Late Son Jett On His Birthday With A Shared Photo

Apr 24, 2025 -

Zuckerbergs Meta In A Trumpian World Challenges And Opportunities

Apr 24, 2025

Zuckerbergs Meta In A Trumpian World Challenges And Opportunities

Apr 24, 2025 -

Tesla Q1 Earnings Net Income Plunge Highlights Political Headwinds

Apr 24, 2025

Tesla Q1 Earnings Net Income Plunge Highlights Political Headwinds

Apr 24, 2025 -

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025 -

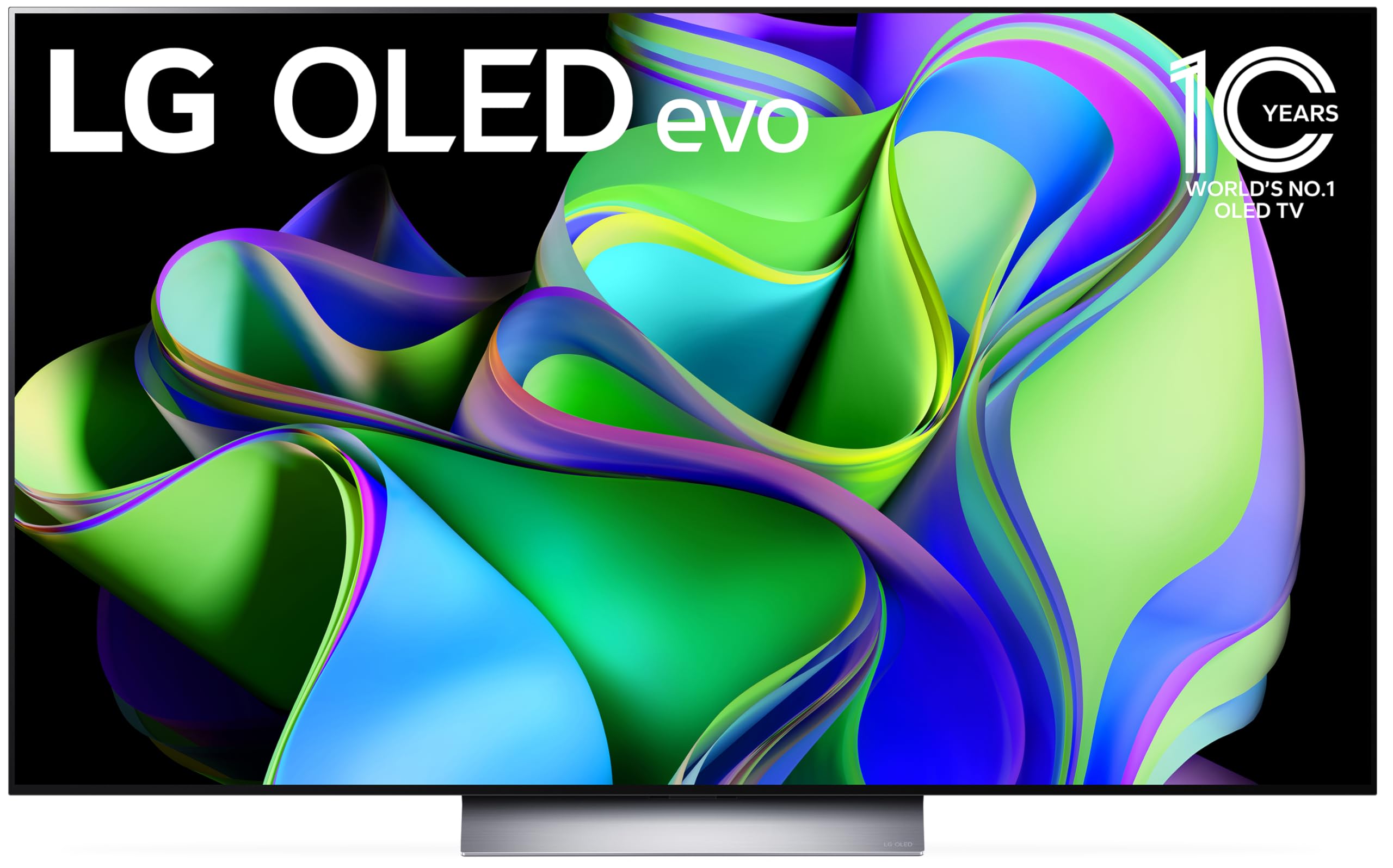

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025