Tesla Q1 Earnings: Net Income Plunge Highlights Political Headwinds

Table of Contents

Price Wars and Reduced Margins

Tesla's Q1 earnings were significantly impacted by a combination of aggressive pricing strategies and persistent challenges in the supply chain.

Aggressive Pricing Strategies

Tesla's decision to slash prices across its vehicle lineup, aiming to boost sales volume and maintain market share in the face of increased competition, directly impacted profit margins. This strategy, while successful in increasing deliveries, significantly reduced profitability per unit.

- Increased competition: The EV market is rapidly expanding, with numerous established and new automakers launching competitive models. This fierce competition forced Tesla to engage in price wars to retain its market dominance.

- Lower profit margins per vehicle: The price reductions, while boosting sales numbers, directly translated to lower profit margins on each vehicle sold, significantly impacting overall net income for the Tesla Q1 earnings.

- Analysis of price reductions: A closer look at the price cuts across different Tesla models (Model 3, Model Y, Model S, Model X) reveals varying degrees of impact on sales figures. While some models saw substantial sales increases, others experienced less dramatic growth, indicating the need for a more nuanced pricing strategy moving forward.

Supply Chain Challenges and Increased Costs

Ongoing supply chain disruptions and increased raw material costs further squeezed profit margins, compounding the negative impact of price cuts. These factors are external pressures that Tesla, like many other manufacturers, had little control over in the short term.

- Specific examples of raw material price increases: The rising costs of crucial raw materials such as lithium, cobalt, and nickel, essential components in EV batteries, significantly impacted production costs.

- Impact of supply chain bottlenecks: Delays in the procurement of essential components led to production slowdowns and impacted Tesla's ability to meet the increased demand fueled by price reductions.

- Potential mitigation strategies: Tesla has been actively pursuing strategies to mitigate these challenges, including exploring alternative suppliers, investing in vertical integration, and optimizing its manufacturing processes.

Geopolitical Risks and Regulatory Uncertainty

Geopolitical risks and regulatory uncertainties also played a crucial role in the disappointing Tesla Q1 earnings.

China Market Volatility

The Chinese market, a significant revenue generator for Tesla, presented challenges in Q1 2024 due to regulatory scrutiny and evolving consumer preferences.

- Analysis of sales figures in China: Comparing sales figures in China for Q1 2024 with previous quarters highlights a slowdown in growth, contributing to the overall decline in net income.

- Specific regulatory hurdles: Tesla faced increased regulatory scrutiny in China, including investigations and potential policy changes that added uncertainty and complexity to its operations.

- Impact of geopolitical tensions: Escalating geopolitical tensions between the US and China created a challenging environment for Tesla's operations in the Chinese market, affecting both sales and production.

US Government Regulations and Subsidies

The US government's evolving regulatory landscape and the dynamics of EV subsidies also contributed to the uncertainty surrounding Tesla's future profitability.

- Review of current US legislation: Changes in US legislation concerning EV incentives and tax credits impact Tesla's competitiveness and profitability.

- Impact of potential changes to EV subsidies: The possibility of adjustments to EV subsidies could significantly influence consumer demand and Tesla's market positioning.

- Tesla's lobbying efforts: Tesla actively engages in lobbying efforts to shape government policies and regulations affecting the EV industry, aiming to secure favorable conditions for its operations.

Increased Competition in the EV Market

The rising tide of competition in the electric vehicle market represents a significant challenge for Tesla's future.

Rise of New EV Players

The emergence of new EV players, both established automakers and startups, is intensifying competition and putting pressure on Tesla to maintain its market share.

- Discussion of key competitors: Major automakers like Volkswagen, Ford, and GM are aggressively expanding their EV portfolios, posing a substantial competitive threat to Tesla.

- Comparison of Tesla's market share: Analyzing Tesla's market share against its key competitors demonstrates the increasing pressure it faces in maintaining its leadership position.

- Impact of increased competition on pricing and sales: The heightened competition directly impacts pricing strategies and sales volumes, influencing Tesla's overall profitability.

Technological Advancements and Innovation

The rapid pace of technological advancements in the EV sector requires continuous investment in research and development (R&D), putting additional strain on profitability.

- Advancements in battery technology and autonomous driving: Competitors are making significant strides in battery technology and autonomous driving capabilities, forcing Tesla to invest heavily in R&D to maintain its competitive edge.

- Analysis of Tesla's R&D spending: Examining Tesla's R&D spending in relation to its revenue and profitability underscores the substantial investments necessary to stay ahead in this rapidly evolving industry.

- Assessment of Tesla's competitive advantage: While Tesla holds certain technological advantages, the rate of innovation necessitates ongoing significant investment to ensure sustained market leadership.

Conclusion

Tesla's Q1 earnings report paints a complex picture, highlighting the significant challenges the company faces in navigating a turbulent geopolitical and economic landscape. The net income plunge is largely attributable to aggressive pricing strategies, supply chain issues, intensifying competition, and regulatory uncertainties. While the price cuts aimed to boost sales, they significantly impacted margins, underscoring the delicate balance between volume and profitability. Understanding the multifaceted factors contributing to this downturn is crucial for investors and industry analysts alike. Further analysis of Tesla's Q2 and subsequent earnings reports will be essential in assessing the long-term sustainability of their current strategies and their ability to overcome these significant political headwinds affecting Tesla Q1 earnings. Keep an eye on future Tesla Q[Number] earnings reports for further insight into the company's performance and its ability to navigate these challenges.

Featured Posts

-

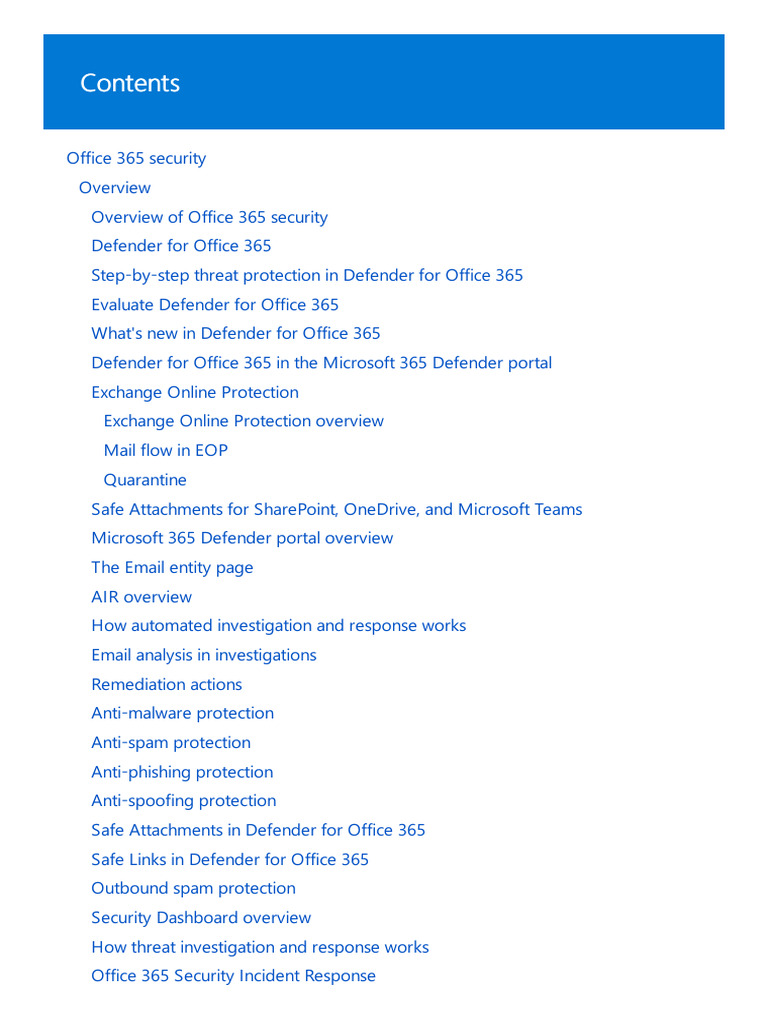

Office365 Security Breach Millions Stolen Targeting High Level Executives

Apr 24, 2025

Office365 Security Breach Millions Stolen Targeting High Level Executives

Apr 24, 2025 -

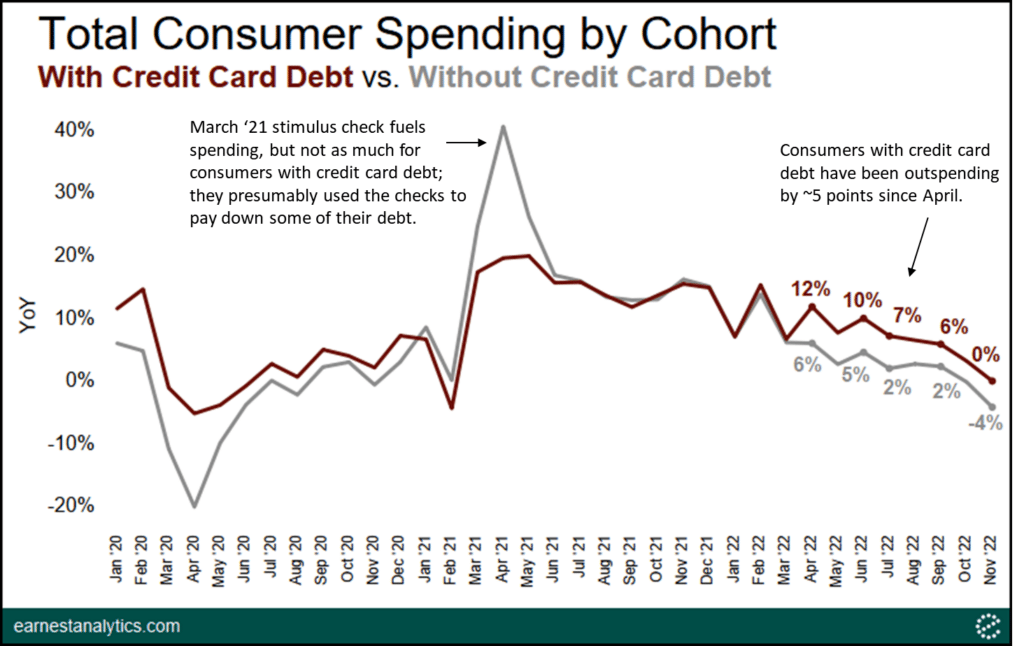

Credit Card Industry Faces Headwinds Amidst Reduced Consumer Spending

Apr 24, 2025

Credit Card Industry Faces Headwinds Amidst Reduced Consumer Spending

Apr 24, 2025 -

Where To Invest A Geographic Analysis Of The Countrys Top Business Locations

Apr 24, 2025

Where To Invest A Geographic Analysis Of The Countrys Top Business Locations

Apr 24, 2025 -

Five Point Plan Unveiled By Canadian Auto Dealers Amidst Us Trade Tensions

Apr 24, 2025

Five Point Plan Unveiled By Canadian Auto Dealers Amidst Us Trade Tensions

Apr 24, 2025 -

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025