Credit Card Industry Faces Headwinds Amidst Reduced Consumer Spending

Table of Contents

Declining Transaction Volumes and Revenue Streams

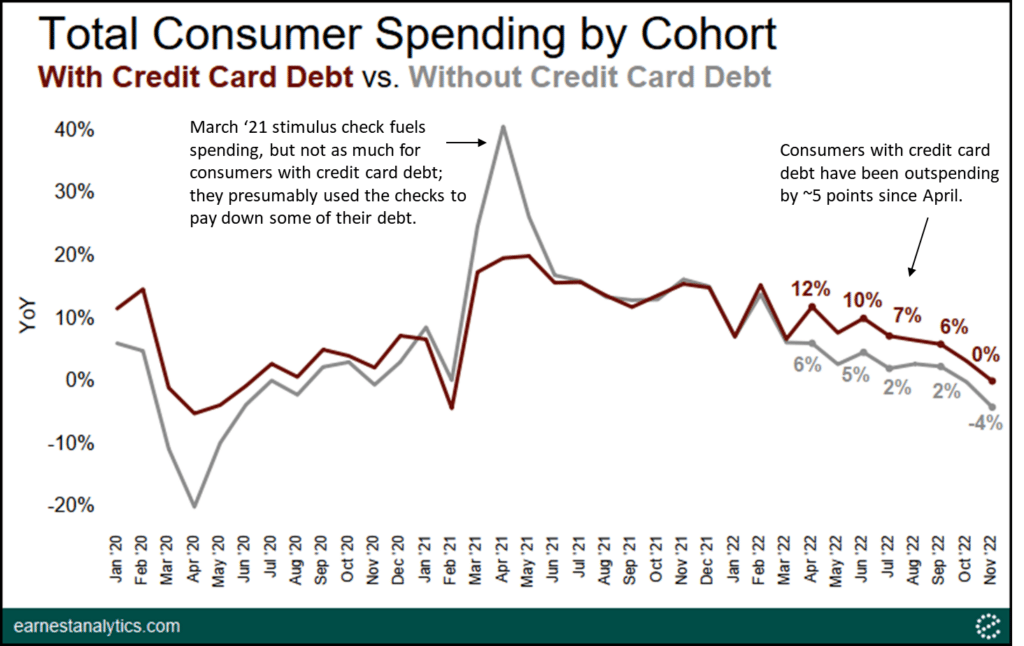

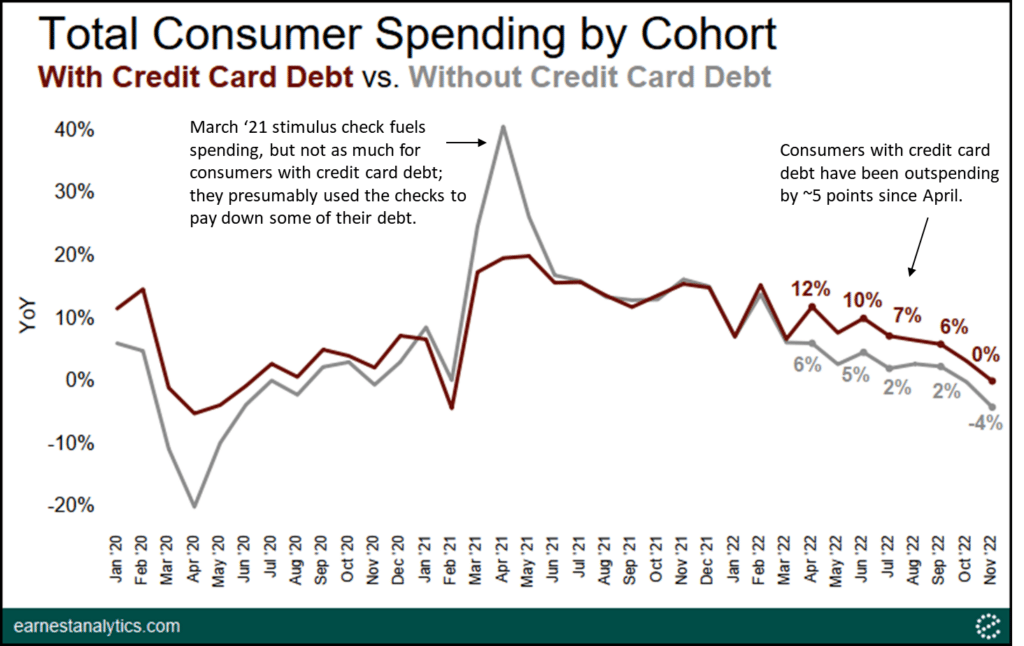

The direct correlation between reduced consumer spending and lower credit card transaction volumes is undeniable. As consumers tighten their belts, they naturally make fewer purchases, leading to a decrease in credit card transactions. This has a ripple effect throughout the credit card ecosystem.

- Impact on Merchant Fees: Credit card companies earn significant revenue from merchant fees, a percentage charged to businesses for each transaction processed. A decline in transaction volume directly translates to lower merchant fees, impacting their bottom line.

- Reduced Interest Income: Lower spending leads to lower outstanding credit card balances. This directly reduces the interest income earned by credit card companies, a major component of their profitability.

- Decline in Rewards Programs Profitability: Many credit cards offer rewards programs, which can be costly to maintain. With reduced transaction volumes, the cost-benefit ratio of these programs becomes less favorable, forcing credit card companies to reassess their rewards strategies or cut back on benefits. This impacts customer loyalty and satisfaction, further complicating the situation for the credit card companies.

Rising Credit Card Defaults and Delinquencies

The economic downturn is contributing to a rise in credit card defaults and delinquencies. As inflation rises and unemployment remains a concern for many, more consumers are struggling to manage their credit card debt.

- Economic Factors Contributing to Higher Default Rates: Inflation erodes purchasing power, while job losses and reduced income leave many households with less disposable income to service their credit card debts.

- Increased Provisioning for Loan Losses: Credit card companies are forced to increase their provisioning for loan losses—setting aside funds to cover anticipated defaults—which reduces their profitability and impacts their financial stability.

- Impact on Credit Card Company Profitability and Stock Prices: The rising risk of defaults directly affects credit card company profitability, ultimately impacting their stock prices and investor confidence in the sector. The credit risk associated with increased delinquencies is a major concern for investors and analysts.

Intensified Competition and Fintech Disruption

The credit card industry is facing intensified competition, not only from established players but also from the rapid growth of fintech companies. This disruption is forcing traditional credit card companies to adapt and innovate.

- Emergence of Buy Now Pay Later (BNPL) services and their impact on traditional credit cards: BNPL services offer consumers alternative payment options, often with lower upfront costs and interest-free periods. This poses a significant challenge to the traditional credit card model.

- Increased pressure on credit card interest rates and fees: Increased competition forces credit card companies to be more competitive on interest rates and fees, potentially impacting their profit margins.

- Innovative credit card features and benefits offered by competitors: Competitors are constantly introducing innovative features and benefits, such as personalized rewards, enhanced security features, and seamless mobile integration, to attract and retain customers. This requires established players to innovate rapidly and adapt to consumer preferences.

Strategic Responses from Credit Card Companies

Credit card companies are implementing various strategies to navigate these headwinds and maintain their position in the market. These strategic responses focus on cost-cutting, innovation, and risk management.

- Cost-cutting measures and efficiency improvements: Credit card companies are streamlining operations, reducing expenses, and improving efficiency to enhance profitability in the face of declining revenues.

- New product offerings and marketing strategies to attract customers: They are developing new credit card products and implementing innovative marketing strategies to attract and retain customers in a competitive market.

- Focus on responsible lending practices to mitigate risk: Implementing stricter credit checks and responsible lending practices helps to reduce the risk of defaults and improve the overall financial health of the portfolio. This focus helps manage the increasing credit risk seen in the industry.

Conclusion: Navigating the Headwinds in the Credit Card Industry

The credit card industry is facing significant challenges due to reduced consumer spending, including declining transaction volumes, rising credit card defaults, and intensified competition from fintech disruptors. These challenges necessitate strategic responses from credit card companies, focusing on cost optimization, innovative product offerings, and responsible lending practices. Understanding the impact of reduced consumer spending on the credit card industry is crucial for both consumers and businesses. Stay informed about the latest trends affecting the credit card industry and analyze the impact of reduced consumer spending on your financial decisions. Adapting to these challenges and understanding the evolving landscape of credit card industry challenges is key to navigating the future.

Featured Posts

-

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Case

Apr 24, 2025

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Case

Apr 24, 2025 -

Working As A Chalet Girl In Europe Expectations Vs Reality For Wealthy Clients

Apr 24, 2025

Working As A Chalet Girl In Europe Expectations Vs Reality For Wealthy Clients

Apr 24, 2025 -

Abrego Garcia Judge Orders End To Stonewalling Tactics By Us Lawyers

Apr 24, 2025

Abrego Garcia Judge Orders End To Stonewalling Tactics By Us Lawyers

Apr 24, 2025 -

John Travoltas Miami Steak Dinner A Pulp Fiction Tribute

Apr 24, 2025

John Travoltas Miami Steak Dinner A Pulp Fiction Tribute

Apr 24, 2025 -

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

Apr 24, 2025

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

Apr 24, 2025