Addressing Investor Concerns: BofA On Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

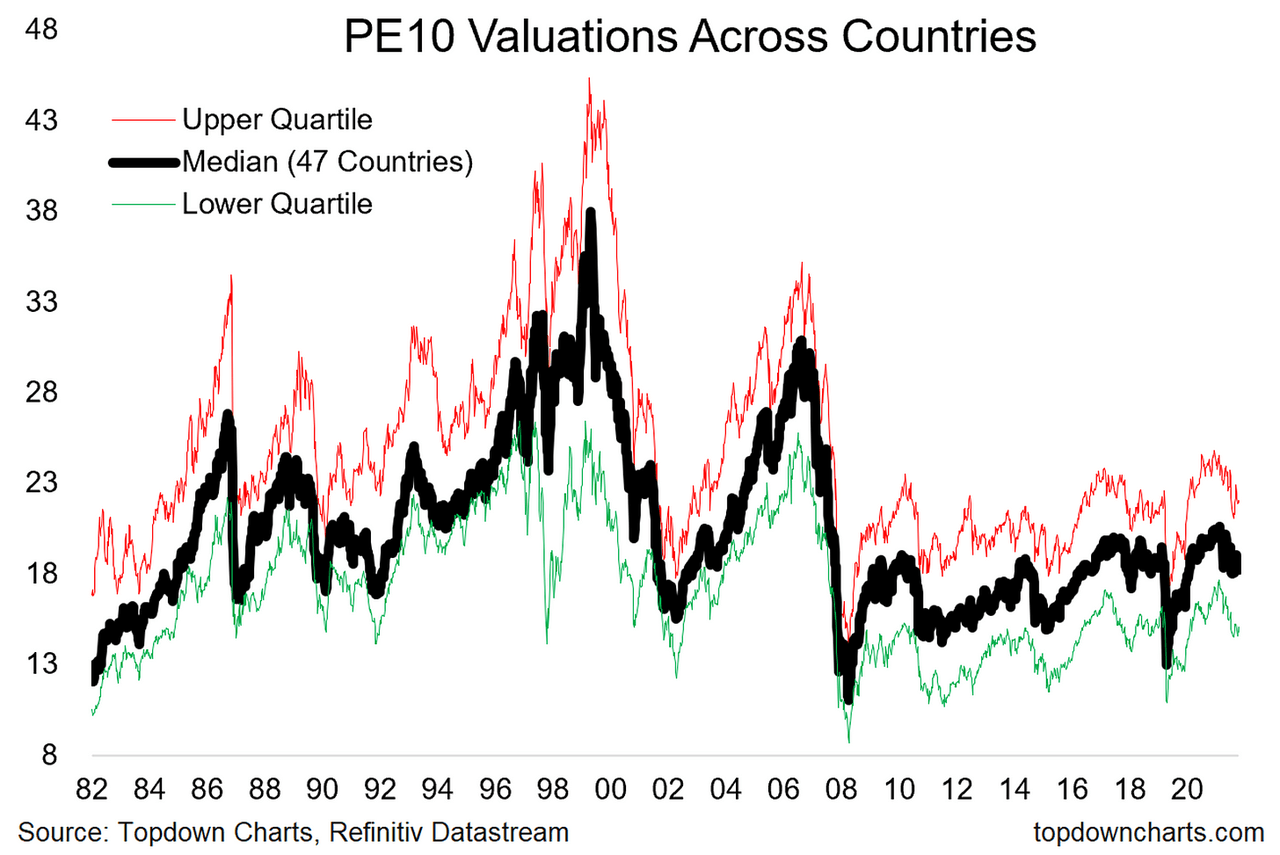

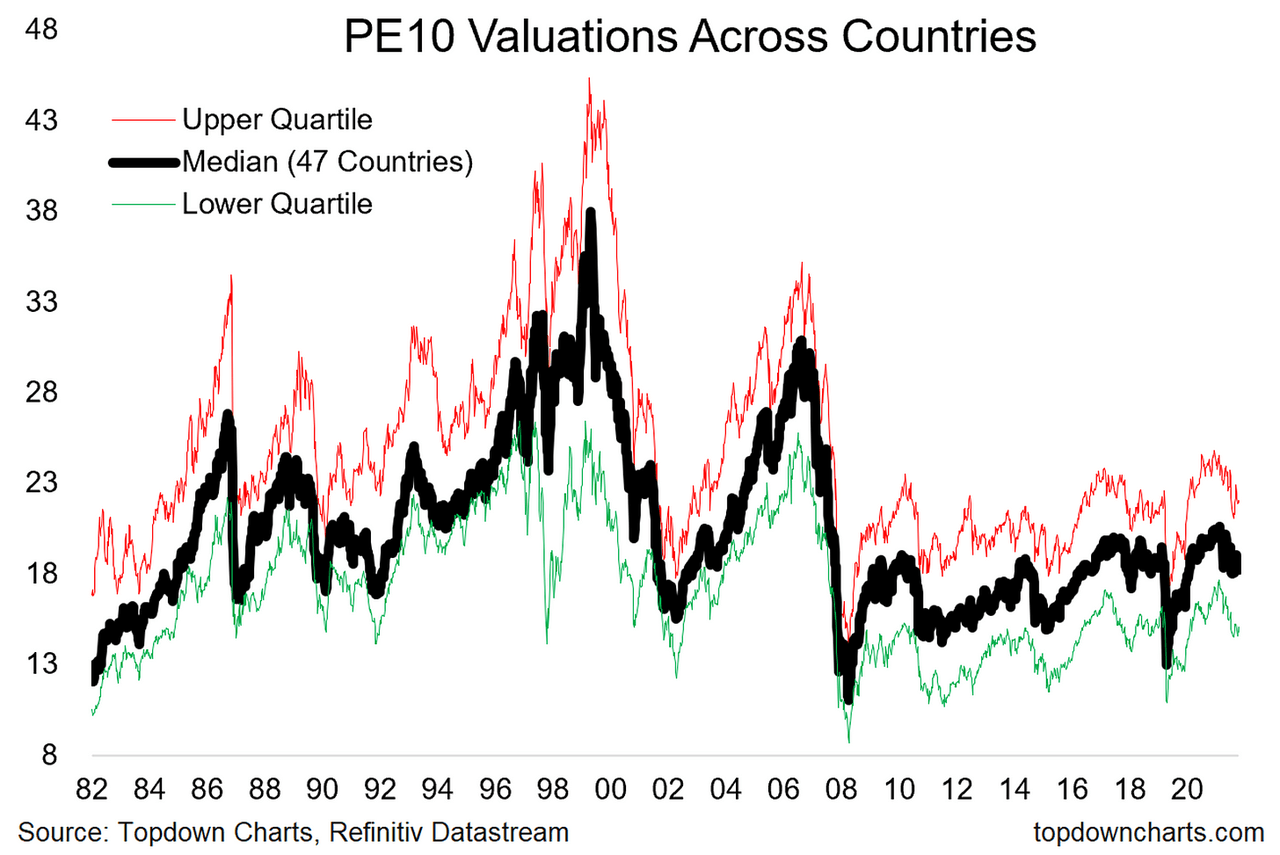

BofA's stance on current stock market valuations is generally cautious, acknowledging the elevated price levels while also identifying pockets of opportunity. While they don't predict an immediate crash, their analysts express concern about the sustainability of current growth rates given prevailing macroeconomic conditions. Their reports often highlight the widening gap between market valuations and historical averages, suggesting a potential for future volatility.

- Key metrics used by BofA to assess valuations: BofA utilizes a range of metrics, including price-to-earnings ratios (P/E), price-to-sales ratios (P/S), and price-to-book ratios (P/B), to assess the valuation of various sectors and individual companies. They also consider factors like dividend yields and earnings growth projections.

- BofA's predicted market performance based on current valuations: BofA's predictions are typically presented as ranges rather than precise figures, reflecting the inherent uncertainty in market forecasting. Their recent reports often suggest a moderate to high probability of a market correction, although the timing and severity remain uncertain.

- Specific sectors or industries BofA highlights as being particularly overvalued or undervalued: BofA's analysis often points to specific sectors, such as technology and consumer discretionary, as potentially overvalued based on their current valuations relative to earnings and growth prospects. Conversely, they may identify sectors like energy or financials as potentially undervalued depending on the prevailing market conditions and their forecast.

Addressing Key Investor Concerns Regarding Elevated Valuations

The Risk of a Market Correction

BofA acknowledges the significant risk of a market correction, driven by several factors. While the current bull market has been fueled by low interest rates and strong corporate earnings, these factors are not guaranteed to continue.

- Factors contributing to elevated valuations: Low interest rates, quantitative easing policies, robust corporate earnings, and strong investor sentiment have all contributed to the current elevated stock market valuations.

- Potential downside risks: Rising interest rates, inflation, geopolitical instability, and unexpected economic slowdowns are among the potential triggers for a market correction. A significant change in investor sentiment could also exacerbate existing vulnerabilities.

- BofA's recommended strategies to mitigate market correction risks: BofA typically recommends a diversified investment portfolio, incorporating assets that tend to perform well during market downturns, such as high-quality bonds and gold. They often emphasize the importance of having a long-term investment horizon and avoiding panic selling during periods of market volatility.

The Impact of Inflation on Stock Market Valuations

Inflation significantly impacts stock market valuations. Rising prices erode the purchasing power of future earnings, making current valuations less attractive. BofA closely monitors inflation rates and their potential effects on different market sectors.

- BofA's inflation predictions: BofA's inflation predictions are subject to constant revision based on economic data and market trends. They provide forecasts encompassing various inflation measures, considering both short-term and long-term perspectives.

- How inflation impacts different sectors of the market: Sectors sensitive to interest rate changes, like consumer discretionary and real estate, are particularly vulnerable to inflation. On the other hand, sectors like energy and commodities may benefit from inflationary pressures.

- Strategies to protect portfolios from inflation's impact on stock valuations: BofA suggests incorporating inflation-hedging assets, such as commodities and inflation-protected securities (TIPS), into investment portfolios to mitigate the negative impacts of inflation on stock valuations.

Opportunities Within an Elevated Market

Even in a potentially overvalued market, BofA identifies opportunities for discerning investors. Their analysts actively seek undervalued companies and sectors within the broader market.

- Identifying undervalued sectors or companies within an overall elevated market: This requires in-depth analysis, comparing individual company performance and growth prospects against industry peers and overall market metrics.

- Strategies for investing in specific sectors identified by BofA as promising: BofA’s research often highlights specific industries and companies believed to be undervalued relative to their potential. Investing in these areas requires thorough due diligence.

- Importance of diversification to reduce risk: BofA consistently stresses the crucial role of portfolio diversification in mitigating risk. This involves spreading investments across different asset classes, sectors, and geographic regions.

Conclusion

This article examined BofA's insights into elevated stock market valuations, addressing investor concerns regarding market corrections, inflation's impact, and identifying potential opportunities. BofA's analysis provides a crucial framework for navigating the current market landscape. Their cautious outlook emphasizes the need for careful risk assessment and a well-diversified investment strategy.

Call to Action: Understanding BofA's perspective on elevated stock market valuations is critical for informed investment decisions. Stay informed about market trends and consult with a financial advisor to develop a robust investment strategy that addresses your individual risk tolerance and financial goals. Continue researching current stock market valuations and market analysis to make the best choices for your portfolio. Remember, careful analysis of stock market valuations is crucial for long-term investment success.

Featured Posts

-

How Middle Managers Contribute To A Thriving Company Culture And High Performing Teams

Apr 24, 2025

How Middle Managers Contribute To A Thriving Company Culture And High Performing Teams

Apr 24, 2025 -

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025 -

Cad Decline A Deeper Look At Recent Currency Movements

Apr 24, 2025

Cad Decline A Deeper Look At Recent Currency Movements

Apr 24, 2025 -

Chinas Automotive Market Obstacles And Opportunities For Premium Brands Bmw Porsche

Apr 24, 2025

Chinas Automotive Market Obstacles And Opportunities For Premium Brands Bmw Porsche

Apr 24, 2025 -

Nba 3 Point Contest 2024 Tyler Herros Victory Over Buddy Hield

Apr 24, 2025

Nba 3 Point Contest 2024 Tyler Herros Victory Over Buddy Hield

Apr 24, 2025