Trump's Trade Offensive And The Future Of American Financial Dominance

Table of Contents

The Impact of Tariffs on Global Trade and US Competitiveness

Trump's trade offensive relied heavily on the imposition of tariffs, significantly impacting global trade and US competitiveness. These actions triggered retaliatory measures from other countries, leading to a complex web of trade wars.

Increased Tariffs and Retaliatory Measures

- Specific Tariffs: Notable examples include tariffs on steel and aluminum imports from numerous countries, and particularly aggressive tariffs on goods from China, impacting sectors like consumer electronics, textiles, and agricultural products.

- Economic Impact: US companies faced increased input costs, reducing profitability and competitiveness. Foreign companies saw reduced access to the US market, leading to job losses and economic hardship in their respective countries.

- Consumer Prices: Studies suggest that tariffs contributed to higher consumer prices in the US, increasing inflation and impacting household budgets. The increased cost of imported goods was passed on to consumers, eroding purchasing power.

Shifting Global Supply Chains

The trade disruptions caused by the Trump administration's policies forced businesses to reconsider their global supply chains.

- Reshoring Limitations: While there was a push for reshoring (bringing manufacturing back to the US), this proved challenging due to higher labor costs and infrastructure limitations within the US.

- Nearshoring: Many companies opted for nearshoring, shifting production to countries geographically closer to the US, such as Mexico and Canada, to mitigate some of the risks associated with longer and more complex supply chains.

- Impact on Competitiveness: The uncertainty created by the trade wars hurt US businesses' competitiveness in the global marketplace, making it more difficult to plan for long-term investments and growth.

The Effect on US-China Relations and Financial Markets

The Trump administration's trade offensive significantly exacerbated tensions between the US and China, impacting financial markets globally.

Escalation of Trade Tensions

- Specific Disputes: Disputes over intellectual property theft, trade imbalances, and technology dominance fueled the escalation of trade tensions between the two economic superpowers.

- Foreign Investment: Uncertainty surrounding trade policies discouraged foreign investment in both the US and China, creating a climate of risk aversion.

- Role of the WTO: The effectiveness of the World Trade Organization (WTO) in resolving trade disputes was questioned, highlighting the limitations of existing international mechanisms for managing trade conflicts.

Volatility in Financial Markets

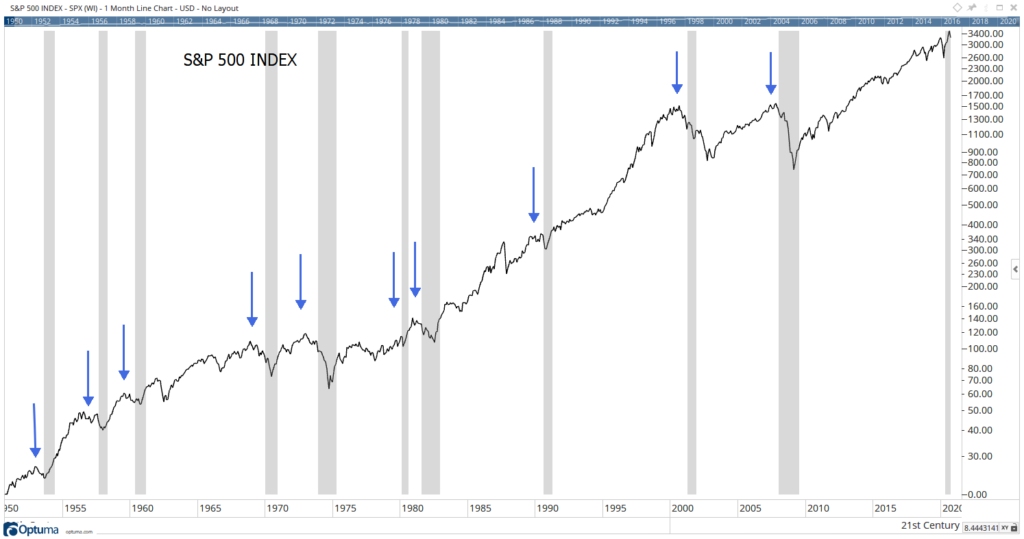

The uncertainty surrounding trade policies created significant volatility in financial markets worldwide.

- Market Fluctuations: Stock markets experienced significant fluctuations in response to announcements regarding new tariffs or trade negotiations. Currency exchange rates also showed considerable volatility.

- Investor Sentiment: Investor sentiment shifted dramatically, with a significant increase in risk aversion as uncertainty grew around the future of global trade.

- Market Manipulation: Concerns arose about potential market manipulation as investors attempted to profit from the volatility created by trade policy announcements.

Long-Term Consequences for American Financial Dominance

Trump's trade offensive may have long-term consequences for the future of American financial dominance.

Weakening of the Dollar's Global Reserve Status

The trade wars and resulting economic uncertainty could potentially weaken the US dollar's status as the world's primary reserve currency.

- Alternative Currencies: The rise of alternative currencies, such as the Euro and the Chinese Yuan, presents a potential challenge to the dollar's hegemony.

- Monetary Policy Implications: The US Federal Reserve's ability to conduct monetary policy independently might be affected by a decline in the dollar's global dominance.

- Global Financial Stability: A weakening of the dollar could have significant implications for global financial stability, potentially increasing volatility and creating systemic risks.

Impact on US Economic Growth and Employment

The long-term effects of the trade offensive on the US economy remain a subject of debate.

- Reshoring vs. Reduced Trade: While reshoring might create some jobs, the overall economic impact of reduced trade could outweigh any potential benefits.

- Job Creation and Wages: The effect on job creation and wages is complex, with potential gains in some sectors offset by losses in others.

- Sectoral Impacts: Different economic sectors experienced varying impacts, with some benefiting from protectionist measures and others suffering from reduced exports.

Conclusion: Trump's Trade Offensive and the Lasting Impact on American Financial Power

Trump's trade offensive had a profound and multifaceted impact on the global economy. While some argued that it aimed to protect American industries and jobs, the resulting trade wars and heightened uncertainty led to significant volatility in financial markets, strained international relations, and potentially weakened the long-term dominance of the US dollar. The full consequences of these policies are still unfolding, and further research is needed to fully understand their lasting impact on the American and global economies. Understanding the complexities of "Trump's trade offensive and the future of American financial dominance" remains critical for navigating the evolving global financial landscape. We encourage you to delve deeper into this topic through further reading and analysis of relevant economic data.

Featured Posts

-

Is The Stock Market Rally Sustainable Investors Face Uncertain Future

Apr 22, 2025

Is The Stock Market Rally Sustainable Investors Face Uncertain Future

Apr 22, 2025 -

Russia Intensifies Ukraine Attacks Us Proposes Peace Initiative

Apr 22, 2025

Russia Intensifies Ukraine Attacks Us Proposes Peace Initiative

Apr 22, 2025 -

Google Breakup A Real Possibility And Its Implications

Apr 22, 2025

Google Breakup A Real Possibility And Its Implications

Apr 22, 2025 -

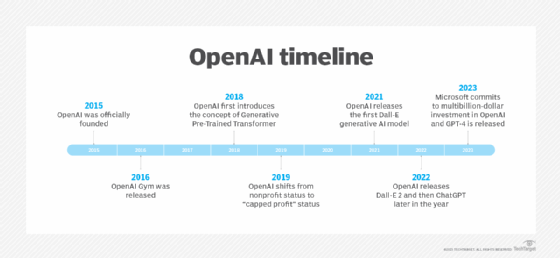

Revolutionizing Voice Assistant Development Open Ais 2024 Announcements

Apr 22, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Announcements

Apr 22, 2025 -

Fsu Announces New Plan For Classes After Campus Shooting Is It Too Soon

Apr 22, 2025

Fsu Announces New Plan For Classes After Campus Shooting Is It Too Soon

Apr 22, 2025