Is The Stock Market Rally Sustainable? Investors Face Uncertain Future

Table of Contents

Analyzing the Drivers of the Current Rally

Understanding the current market rally requires examining several key drivers. These interconnected factors contribute to the overall market sentiment and the sustainability of the upward trend.

Inflation and Interest Rates

Inflation and interest rates are intrinsically linked to stock market performance. High inflation erodes purchasing power and often prompts central banks, like the Federal Reserve (Fed), to raise interest rates to cool down the economy.

- Inverse Relationship: Rising interest rates typically lead to higher bond yields, making bonds more attractive to investors compared to stocks. This can cause a shift in investment capital away from the stock market, leading to lower stock prices.

- Fed's Tightrope Walk: The Fed faces the difficult task of controlling inflation without triggering a recession. Aggressive interest rate hikes risk stifling economic growth and sending the market into a downturn. Their communication regarding future policy adjustments significantly influences market sentiment and volatility.

- Market Volatility: Uncertainty surrounding future interest rate decisions contributes significantly to market volatility. Investors react to each announcement, causing short-term fluctuations in stock prices.

Corporate Earnings and Profitability

Corporate earnings reports are a crucial driver of market sentiment. Strong earnings generally signal healthy economic growth and support higher stock prices. Conversely, weak earnings often foreshadow a market correction.

- Strong Performers: Certain sectors, such as technology and energy, have demonstrated robust earnings growth recently, contributing to the overall market rally.

- Challenges Ahead: Other sectors face significant headwinds, including supply chain disruptions and rising input costs, potentially leading to earnings downgrades and impacting stock performance.

- Geopolitical Impacts: Geopolitical events, such as trade wars or sanctions, can significantly affect corporate earnings and profitability, creating uncertainty for investors.

Geopolitical Factors and Global Uncertainty

Geopolitical events introduce significant uncertainty into the market. Wars, trade tensions, and political instability can all trigger market volatility and influence investor confidence.

- Market Reactions: Major geopolitical events often lead to immediate market reactions, as investors assess the potential impact on global economies and individual companies.

- Supply Chain Disruptions: Geopolitical instability frequently disrupts global supply chains, affecting production, increasing costs, and impacting corporate profitability.

- International Relations: The complex interplay of international relations greatly influences global market stability. Positive developments often foster investor confidence, while negative developments can fuel market uncertainty.

Assessing the Risks of a Market Correction

While the current rally shows positive signs, several factors point towards potential risks and the possibility of a market correction.

Valuation Concerns

Current market valuations are a significant concern for some investors. High valuations, particularly in specific sectors, increase the risk of a sharp correction.

- Price-to-Earnings Ratio (P/E): Analyzing the P/E ratio, a key valuation metric, can help determine whether stocks are overvalued relative to their earnings. High P/E ratios often suggest overvaluation and increased risk.

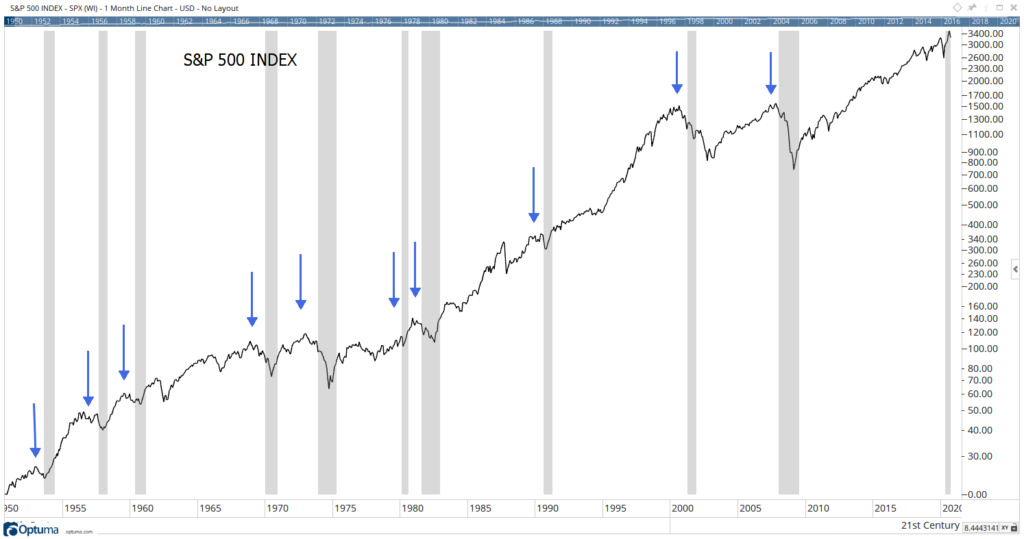

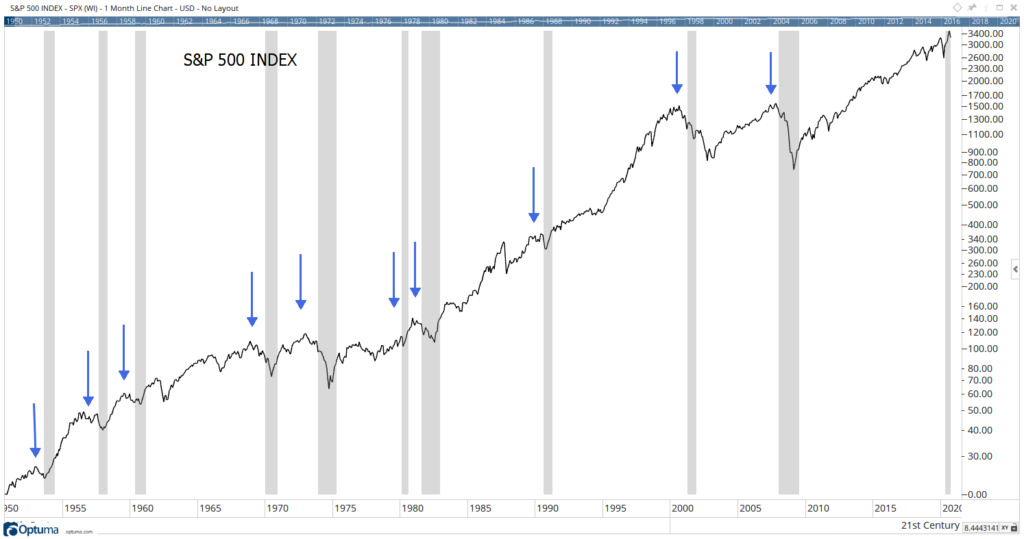

- Historical Averages: Comparing current valuations to historical averages provides context and helps gauge whether current prices are sustainable.

- Overvalued Sectors: Some sectors might show signs of overvaluation, posing a higher risk of price declines in the event of a correction.

Potential Economic Slowdown

The risk of an economic slowdown or even a recession significantly influences market outlook. Leading economic indicators provide clues about the future trajectory of the economy.

- Impact on Earnings: A recession generally leads to lower corporate earnings, affecting stock prices negatively.

- Historical Correlation: Historically, economic slowdowns have been strongly correlated with market corrections.

- Soft Landing Scenario: The possibility of a "soft landing," where the economy slows down without a full-blown recession, is a factor to consider, albeit with considerable uncertainty.

Unforeseen Black Swan Events

Unpredictable events, often termed "black swan" events, can significantly impact market stability. These are difficult, if not impossible, to anticipate.

- Past Examples: The 2008 financial crisis and the COVID-19 pandemic are examples of black swan events that dramatically impacted global markets.

- Predictability Challenges: The inherent unpredictability of these events highlights the importance of robust risk management strategies.

- Diversification and Risk Management: Diversification across various asset classes and effective risk management are vital for mitigating the impact of unforeseen events.

Developing a Sustainable Investment Strategy

Navigating market uncertainty requires a well-defined, sustainable investment strategy.

Long-Term Investing vs. Short-Term Gains

Focusing on long-term investment goals, rather than chasing short-term gains, is crucial for sustainable wealth creation.

- Dollar-Cost Averaging: Dollar-cost averaging, a strategy of investing a fixed amount regularly, helps mitigate the risk of market timing.

- Patience and Discipline: Successful long-term investing requires patience and discipline, especially during periods of market volatility.

- Market Timing Risks: Attempting to time the market—buying low and selling high—is notoriously difficult and often unsuccessful.

Diversification and Risk Management

Diversification across different asset classes is essential for mitigating risk and improving the overall portfolio's resilience.

- Asset Allocation: A well-defined asset allocation strategy, tailored to individual risk tolerance and financial goals, is crucial.

- Risk Tolerance: Understanding your personal risk tolerance is vital for making informed investment decisions.

- Diversification Strategies: Examples of diversification strategies include investing in stocks, bonds, real estate, and alternative investments.

Professional Financial Advice

Seeking professional financial advice can be invaluable for developing a personalized investment strategy tailored to individual needs and risk tolerance.

- Risk Tolerance Assessment: A financial advisor can help assess your risk tolerance and identify appropriate investment options.

- Expertise in Market Navigation: Financial advisors possess the expertise to navigate market uncertainty and make informed investment decisions.

Conclusion

The sustainability of the current stock market rally is far from guaranteed. While positive factors exist, significant risks remain. Inflation, geopolitical instability, and potential overvaluation all present challenges. Building a robust, long-term investment strategy that incorporates diversification and risk management is crucial for weathering market storms. Don't focus solely on short-term stock market rally gains; instead, consult with a financial advisor to create a personalized investment plan aligned with your risk tolerance and long-term financial goals. Start building your sustainable investment strategy today.

Featured Posts

-

Open Ais Chat Gpt Under Ftc Scrutiny Implications For The Future Of Ai

Apr 22, 2025

Open Ais Chat Gpt Under Ftc Scrutiny Implications For The Future Of Ai

Apr 22, 2025 -

Bmw Porsche And The Shifting Sands Of The Chinese Automotive Market

Apr 22, 2025

Bmw Porsche And The Shifting Sands Of The Chinese Automotive Market

Apr 22, 2025 -

Conclave 2023 Assessing Pope Francis Impact And The Path Forward

Apr 22, 2025

Conclave 2023 Assessing Pope Francis Impact And The Path Forward

Apr 22, 2025 -

Razer Blade 16 2025 Deep Dive Ultra Performance Portability And Price

Apr 22, 2025

Razer Blade 16 2025 Deep Dive Ultra Performance Portability And Price

Apr 22, 2025 -

Post Easter Truce Russias Renewed Assault On Ukraine

Apr 22, 2025

Post Easter Truce Russias Renewed Assault On Ukraine

Apr 22, 2025