Trump's Legacy: A Herculean Task For The Next Federal Reserve Chair

Table of Contents

Inflationary Pressures and the Fight Against Rising Prices

The inflationary environment inherited by the next Federal Reserve Chair is a direct consequence of policies implemented during the Trump administration. Fiscal stimulus, coupled with trade protectionism, created a perfect storm for rising prices. Understanding these interconnected factors is crucial for effective monetary policy.

-

Impact of tax cuts on the national debt and inflation: The 2017 tax cuts, while boosting short-term economic growth, significantly increased the national debt. This increased government borrowing put upward pressure on interest rates and contributed to inflationary pressures. The resulting debt burden will require careful management by the next Fed Chair.

-

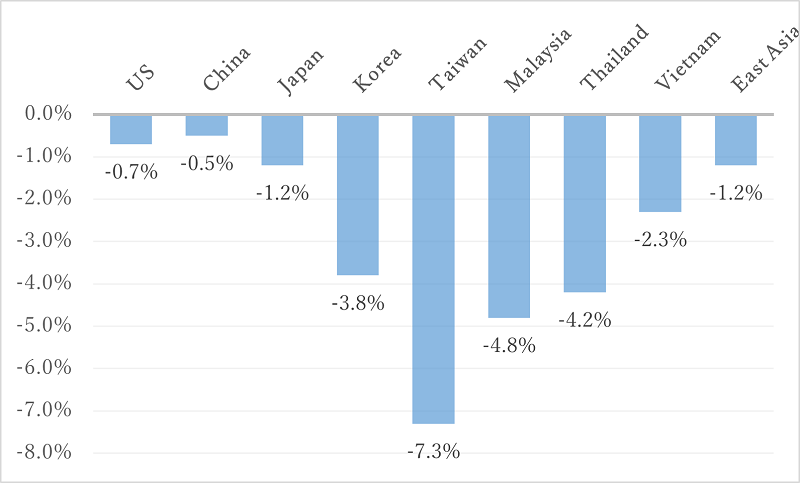

Trade wars and their effect on supply chains and pricing: Trump's trade wars, particularly with China, disrupted global supply chains and led to increased costs for businesses. These increased costs were often passed on to consumers in the form of higher prices, further fueling inflation. The lingering effects of these trade disruptions remain a significant challenge.

-

The role of quantitative easing in fueling inflation: While not solely a Trump-era policy, the continued use of quantitative easing (QE) – a monetary policy tool involving the creation of new money – contributed to the inflationary environment. The next Fed Chair must carefully navigate the exit from QE and manage inflation without triggering a recession.

Navigating the Economic Aftershocks of the Trump Era

The long-term economic consequences of Trump's policies extend beyond immediate inflation. Understanding these lingering effects is crucial for developing effective strategies for sustainable economic growth.

-

Analysis of deregulation and its potential long-term risks: Trump's administration pursued a significant deregulation agenda across various sectors. While proponents argued this boosted efficiency, critics raised concerns about potential risks to environmental protection, consumer safety, and financial stability. The next Fed Chair will need to assess these risks and their impact on macroeconomic stability.

-

The impact of Trump's "America First" approach on international economic relations: Trump's "America First" approach strained relationships with key trading partners, leading to uncertainty in global markets. This uncertainty can impact investment, trade, and overall economic growth. Repairing these relationships and fostering greater international cooperation will be vital for the next Fed Chair.

-

Long-term effects on labor markets and income inequality: The impact of Trump's policies on labor markets and income inequality requires careful consideration. While some sectors experienced job growth, others faced challenges. The next Fed Chair must address any lingering inequalities and promote inclusive economic growth.

The Political Landscape and the Independence of the Federal Reserve

The next Federal Reserve Chair will face a challenging political landscape. Trump's frequent criticisms of the Fed highlighted the potential for political interference in its decision-making. Maintaining the Fed's independence is paramount for its credibility and effectiveness.

-

The importance of maintaining the Fed's independence from political pressure: The Fed's independence is crucial for its ability to make objective decisions based on economic data, rather than political considerations. This independence is a cornerstone of a stable and predictable economic environment.

-

The potential challenges of navigating political scrutiny and maintaining credibility: The next Fed Chair must navigate potential political pressure while maintaining the credibility and trust of the markets and the public. Transparency and clear communication will be essential.

-

The implications for monetary policy transparency and accountability: Maintaining transparency in monetary policy decisions is crucial for building trust and accountability. The next Fed Chair must ensure that the Fed's actions are clearly communicated and justified to the public.

Maintaining Confidence in the US Dollar

The role of the Federal Reserve Chair extends beyond domestic policy. Maintaining confidence in the US dollar as a global reserve currency is vital for the stability of the global financial system.

-

The role of the Fed in managing exchange rates: The Fed plays a significant role in influencing the value of the US dollar through its monetary policy decisions. Managing exchange rates effectively is crucial for maintaining economic stability.

-

The impact of global economic uncertainty on the US dollar: Global economic uncertainty can impact the demand for the US dollar. The next Fed Chair must be prepared to respond to these external shocks and maintain confidence in the dollar.

-

Strategies to maintain confidence in the US dollar as a reserve currency: Maintaining the US dollar's status as a reserve currency requires consistent and predictable economic policies, a strong economy, and effective communication from the Federal Reserve.

Conclusion

The economic legacy of the Trump administration presents a significant challenge for the next Federal Reserve Chair. Successfully navigating inflation, addressing the lingering effects of past policies, and maintaining the Fed's independence will require exceptional skill and foresight. The next chair must not only manage immediate economic pressures but also lay the groundwork for sustainable long-term growth. Understanding and effectively addressing Trump's legacy on the economy will be crucial for the success of the next Federal Reserve Chair and the stability of the US economy. The upcoming appointment will be a critical moment in shaping the future of American economic policy and the role of the Federal Reserve Chair in this new landscape. The choice of the next Federal Reserve Chair is a matter of critical importance for the future economic health of the United States.

Featured Posts

-

Us China Trade War Impact Dow Futures And Economic Outlook

Apr 26, 2025

Us China Trade War Impact Dow Futures And Economic Outlook

Apr 26, 2025 -

Trumps Legacy A Herculean Task For The Next Federal Reserve Chair

Apr 26, 2025

Trumps Legacy A Herculean Task For The Next Federal Reserve Chair

Apr 26, 2025 -

Green Bay Hosts Nfl Draft 2024 First Round Preview And Predictions

Apr 26, 2025

Green Bay Hosts Nfl Draft 2024 First Round Preview And Predictions

Apr 26, 2025 -

Negotiating Ai The Trump Administration And Europes Regulatory Landscape

Apr 26, 2025

Negotiating Ai The Trump Administration And Europes Regulatory Landscape

Apr 26, 2025 -

Worlds Tallest Abandoned Skyscraper Construction To Restart After Decade Long Halt

Apr 26, 2025

Worlds Tallest Abandoned Skyscraper Construction To Restart After Decade Long Halt

Apr 26, 2025