US-China Trade War Impact: Dow Futures And Economic Outlook

Table of Contents

The US-China Trade War: A Retrospective

The US-China trade war wasn't a single event but a series of escalating actions and counter-actions. It began under the Trump administration with the imposition of tariffs on various Chinese goods, ostensibly to address trade imbalances and intellectual property theft. Xi Jinping's administration responded with retaliatory tariffs, triggering a tit-for-tat cycle that significantly disrupted global trade.

-

Key Dates:

- July 6, 2018: First round of tariffs imposed by the US.

- September 24, 2018: China retaliates with tariffs on US goods.

- January 15, 2020: "Phase One" trade deal signed, offering temporary tariff relief.

-

Affected Industries: The conflict heavily impacted numerous sectors, including:

- Agriculture (soybeans, pork)

- Technology (semiconductors, telecommunications equipment)

- Manufacturing (various goods subject to tariffs)

-

Economic Impact: Each phase of the trade war brought varying levels of economic disruption, impacting consumer prices, investment decisions, and global supply chains. Uncertainty reigned supreme, affecting business confidence and investment.

Dow Futures Volatility and Trade War Correlation

The escalation of trade tensions between the US and China directly correlated with increased volatility in Dow Futures. News of new tariffs or trade negotiations often triggered sharp fluctuations in the market. The uncertainty surrounding future trade relations created a climate of fear and uncertainty for investors, leading to rapid market swings.

-

Specific Examples: Announcements of new tariff increases frequently resulted in immediate Dow Futures declines, reflecting investor pessimism. Conversely, news of potential trade deals often led to rallies, indicating renewed confidence.

-

Statistical Data: While a precise correlation coefficient would require extensive statistical analysis, anecdotal and readily available data clearly shows a strong negative correlation between escalating trade tensions and Dow Futures performance during this period.

-

Market Sentiment: Investor confidence plummeted during periods of heightened trade war uncertainty. Risk aversion increased, leading to capital flight from equities and a shift towards safer assets like government bonds.

Impact on Specific Sectors: Analyzing the Fallout

The US-China trade war didn't impact all sectors equally. Some industries felt the brunt of the conflict far more acutely than others.

-

Manufacturing: Many US manufacturers experienced significant challenges due to increased input costs from tariffs and disrupted supply chains. Job losses and factory closures were reported in some sectors.

-

Agriculture: The US agricultural sector, particularly soybean and pork producers, suffered heavily from retaliatory tariffs imposed by China. This led to significant price drops and financial hardship for many farmers.

-

Technology: The tech sector faced both direct and indirect impacts. Tariffs on technology components increased production costs, while broader uncertainty impacted investment and innovation. Supply chain disruptions were widespread. The impact on consumer prices was also significant in many areas.

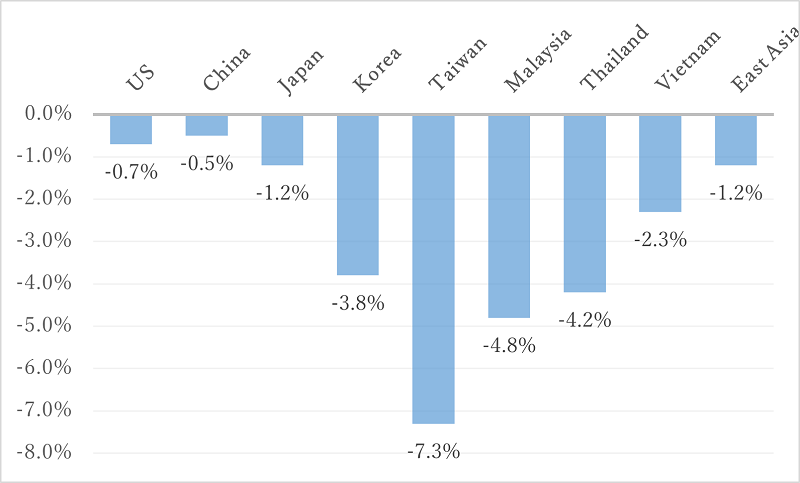

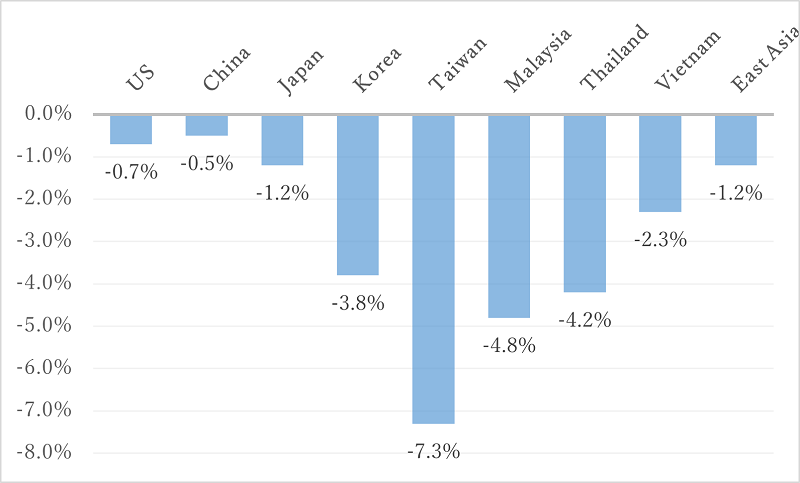

Global Economic Outlook: Ripple Effects of the Trade War

The US-China trade war's effects extended far beyond the two countries directly involved. Global supply chains were disrupted, leading to increased production costs and inflationary pressures worldwide.

-

Emerging Markets: Emerging markets felt the impact through reduced export demand and increased uncertainty in global financial markets. Many dependent on exports to either China or the US suffered significantly.

-

Global Supply Chains: The trade war highlighted the vulnerability of global supply chains, prompting companies to explore diversification and "reshoring" strategies to reduce reliance on single-country suppliers.

-

International Cooperation: The trade war strained international cooperation and raised questions about the future of multilateral trade agreements and global governance.

Predicting Future Dow Futures Performance and Economic Trends

Predicting future Dow Futures performance requires considering numerous factors beyond the legacy of the US-China trade war. While the trade war itself has somewhat subsided, lingering effects remain.

-

Future Trade Agreements: The nature of future US-China trade agreements and their impact on tariffs will play a key role in shaping market sentiment and Dow Futures performance.

-

Geopolitical Factors: Other geopolitical events – global pandemics, political instability in key regions – will continue to influence investor confidence and market volatility.

-

Future Dow Futures Performance: Under a scenario of continued de-escalation and strengthened global cooperation, Dow Futures are likely to see more stable growth. However, renewed tensions could trigger another round of market volatility.

Conclusion: Understanding the US-China Trade War's Lasting Impact

The US-China trade war had a significant and demonstrable impact on Dow Futures volatility and the global economic outlook. The correlation between escalating trade tensions and market fluctuations was clear, highlighting the crucial role of geopolitical factors in shaping financial markets. Understanding this relationship is essential for informed investment decisions and accurate economic forecasting. To remain informed about developments in US-China trade relations and their impact on Dow Jones performance and the broader economic forecast, it’s crucial to monitor reputable financial news sources and economic reports. Stay informed about the evolving dynamics of US-China trade to navigate the complexities of the global economy and make informed decisions regarding your investments.

Featured Posts

-

Stock Market Analysis Dow Futures Chinas Economic Response And Tariff Concerns

Apr 26, 2025

Stock Market Analysis Dow Futures Chinas Economic Response And Tariff Concerns

Apr 26, 2025 -

Memoir On The Horizon Cassidy Hutchinsons Account Of The January 6th Hearings

Apr 26, 2025

Memoir On The Horizon Cassidy Hutchinsons Account Of The January 6th Hearings

Apr 26, 2025 -

Investing In The Future A Map Of The Countrys Promising Business Regions

Apr 26, 2025

Investing In The Future A Map Of The Countrys Promising Business Regions

Apr 26, 2025 -

Legal Battle In America A Fight Against The Worlds Richest Man

Apr 26, 2025

Legal Battle In America A Fight Against The Worlds Richest Man

Apr 26, 2025 -

Nfl Draft First Round Green Bays Thursday Night Kickoff

Apr 26, 2025

Nfl Draft First Round Green Bays Thursday Night Kickoff

Apr 26, 2025