Stock Market Analysis: Dow Futures, China's Economic Response, And Tariff Concerns

Table of Contents

Understanding Dow Futures and their Sensitivity to Global Events

Dow Futures contracts are a powerful barometer of investor sentiment, acting as a leading indicator of potential market movements. Their inherent volatility reflects the market's immediate reaction to news, particularly regarding trade disputes and economic data releases. Analyzing Dow Futures provides crucial insights for short-term and long-term investment strategies.

Dow Futures as a Leading Indicator

Dow Futures' sensitivity to global events stems from their direct reflection of investor expectations. A surge in Dow Futures often signals optimism and anticipated market growth, while a decline can indicate growing pessimism and potential market corrections.

- Examples of recent Dow Futures movements: The recent announcement of a new trade agreement saw a significant upward surge in Dow Futures, while negative economic data from major economies has led to sharp declines.

- Interpreting Dow Futures charts: Identifying trends requires analyzing volume alongside price movements. High volume during price increases suggests strong buying pressure, while high volume during price decreases points to significant selling pressure.

The Impact of Geopolitical Uncertainty

Geopolitical events, such as trade wars and political instability, exert a profound influence on Dow Futures prices. These events introduce uncertainty, affecting investor confidence and triggering shifts in market sentiment.

- Examples of geopolitical impact: The escalation of trade tensions between the US and China in the past has often resulted in significant drops in Dow Futures, showcasing their vulnerability to international conflict.

- Correlation with global indices: Dow Futures are closely correlated with other major global indices, reflecting the interconnected nature of the world economy. A downturn in one major market often triggers a ripple effect across others, impacting Dow Futures accordingly.

China's Economic Response and its Global Implications

China's economic policies and their response to global trade tensions play a crucial role in shaping the global economic landscape and consequently, influencing stock market performance. Analyzing these policies, including key economic indicators, is crucial for understanding the broader impact on the market.

Analyzing China's Economic Policies

China's economic growth rate, inflation levels, consumer spending, and industrial production are key economic indicators to monitor. Changes in these indicators can significantly affect global supply chains and demand, influencing both domestic and international markets.

- Key economic indicators to watch: GDP growth, inflation rates, consumer confidence index, and manufacturing PMI offer critical insight into the health of the Chinese economy.

- China's countermeasures to tariffs: China’s strategies to mitigate the impact of tariffs include implementing counter-tariffs, seeking alternative trade partners, and stimulating domestic demand.

Ripple Effects on the Global Market

China's economic actions and reactions to tariffs create ripple effects throughout global markets. Its role as a major manufacturing hub and a significant consumer market means that disruptions in its economy have far-reaching consequences.

- Interconnectedness of global supply chains: Disruptions in Chinese manufacturing, caused by tariffs or economic slowdowns, can severely impact global supply chains, leading to shortages and price increases in various sectors.

- Impact on specific sectors: Sectors such as technology and manufacturing are particularly sensitive to changes in the Chinese economy and trade relations.

The Ongoing Impact of Tariff Concerns on Global Trade and Investment

Tariff policies continue to significantly impact global trade and investment. Understanding the current tariff landscape and its implications for various industries is essential for investors to make informed decisions.

Understanding the Tariff Landscape

Tariffs are taxes imposed on imported goods, influencing the price and competitiveness of products in the global marketplace. Retaliatory tariffs, imposed in response to initial tariffs, can escalate trade tensions and negatively impact economic growth.

- Examples of specific tariffs: Tariffs on steel, aluminum, and agricultural products have had significant impacts on affected industries and countries.

- Retaliatory tariffs and trade wars: The imposition of retaliatory tariffs can quickly escalate into trade wars, disrupting global trade flows and investor confidence.

Investor Sentiment and Risk Assessment

Tariff uncertainty significantly impacts investor confidence and investment decisions. Investors often become hesitant, delaying investment plans until the uncertainty subsides. Effective risk assessment becomes crucial in navigating this landscape.

- Strategies for mitigating risks: Diversification across different asset classes and geographic regions can help mitigate the risks associated with tariff disputes.

- Diversification strategies: Investing in sectors less susceptible to trade disputes and focusing on companies with strong domestic markets can provide a measure of protection against tariff impacts.

Conclusion

This stock market analysis highlights the crucial relationship between Dow Futures, China's economic response, and ongoing tariff concerns. These factors are deeply interconnected, exerting a significant influence on global stock market performance. Understanding this relationship is key for successful investment strategies. The volatility of Dow Futures acts as a real-time indicator of the market's response to these ongoing challenges. China's economic policies and their impact on global supply chains, coupled with the uncertainty surrounding tariff policies, are critical aspects to continuously monitor.

Key Takeaways: Continuous monitoring of Dow Futures, close observation of China's economic indicators and responses to trade tensions, and a thorough understanding of the current tariff landscape are essential for navigating today's complex market conditions.

Call to Action: Conduct in-depth stock market analysis, focusing on monitoring Dow futures and understanding China's economic response to tariffs. Use this insight to make informed decisions and develop robust investment strategies that can weather the volatility caused by global trade uncertainties. Regularly review your portfolio and adjust your investment strategy based on evolving developments in these key areas.

Featured Posts

-

Where To Start A Business Mapping The Countrys Best New Locations

Apr 26, 2025

Where To Start A Business Mapping The Countrys Best New Locations

Apr 26, 2025 -

The Zuckerberg Trump Dynamic Shaping The Future Of Tech And Politics

Apr 26, 2025

The Zuckerberg Trump Dynamic Shaping The Future Of Tech And Politics

Apr 26, 2025 -

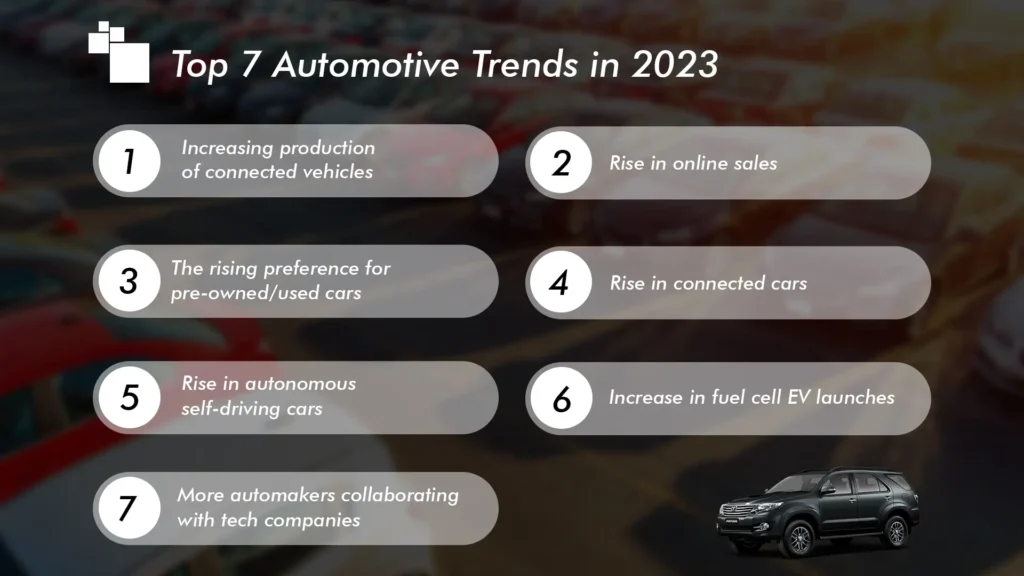

Chinas Automotive Industry Assessing Its Global Impact

Apr 26, 2025

Chinas Automotive Industry Assessing Its Global Impact

Apr 26, 2025 -

La Fires Fuel Landlord Price Gouging A Selling Sunset Star Speaks Out

Apr 26, 2025

La Fires Fuel Landlord Price Gouging A Selling Sunset Star Speaks Out

Apr 26, 2025 -

Capitalizing On Connections Selling Stakes In Elon Musks Private Ventures

Apr 26, 2025

Capitalizing On Connections Selling Stakes In Elon Musks Private Ventures

Apr 26, 2025