Tariff Relief Fuels Stock Market Rally: Dow, Nasdaq, S&P 500 Gains

Table of Contents

Dow Jones Industrial Average Soars on Tariff Relief

Analyzing the Dow's Gains

The Dow Jones Industrial Average experienced a significant surge, closing up X% today, marking its best single-day performance in [Number] weeks. This remarkable increase is directly attributable to the positive sentiment surrounding tariff relief measures. Several key Dow components experienced particularly strong gains:

- Company A: Increased by Y%, likely due to [Specific reason related to tariff relief].

- Company B: Rose by Z%, reflecting reduced import costs for [Specific product or service].

- Company C: Saw a X% increase, indicating positive investor expectations for future growth given decreased trade barriers.

This surge in the Dow is also reflected in key economic indicators, such as increased consumer confidence and a rise in manufacturing orders. Market analyst Jane Doe commented, "The Dow's performance today clearly demonstrates the market's responsiveness to positive news on tariff relief. This suggests a renewed confidence in future economic growth."

Nasdaq Composite Rides the Wave of Tariff Reduction

Tech Sector's Response to Tariff Relief

The tech-heavy Nasdaq Composite also benefited significantly from the reduction in tariffs, closing up W%. The tech sector, heavily reliant on global supply chains, is particularly sensitive to trade policies. The tariff relief has eased concerns about increased production costs and disruptions to international trade. Key beneficiaries include:

- Company D: Experienced a substantial increase of A%, driven by [Specific reason related to tariff relief].

- Company E: Rose by B%, reflecting decreased costs for imported components.

- Company F: Saw a C% increase, demonstrating the positive impact on their international operations.

Compared to the previous quarter, the Nasdaq's performance shows a significant improvement, signaling a robust recovery in investor confidence within the technology sector.

S&P 500 Reflects Broad-Based Market Confidence in Tariff Relief

Sector-Specific Performance in the S&P 500

The S&P 500, a broader market index, mirrored the positive trends observed in the Dow and Nasdaq, closing up P%. This broad-based rally indicates a widespread belief in the positive impact of tariff relief. Different sectors responded in varying degrees:

- Manufacturing: Experienced a significant boost, with an average increase of Q%, reflecting reduced input costs.

- Consumer Goods: Saw a moderate increase of R%, indicating increased consumer spending fueled by improved economic sentiment.

- Energy: Experienced a more muted response, increasing by S%, illustrating the sector's relative independence from immediate impacts of tariff adjustments.

The data clearly shows a positive correlation between the easing of tariffs and improved performance across various sectors within the S&P 500.

Investor Sentiment and Future Outlook Following Tariff Relief

Analyzing Investor Confidence

The tariff relief announcements have significantly shifted investor sentiment, leading to increased investment and trading activity across all major indices. Market analysts are expressing cautious optimism, predicting continued growth in the short to medium term. However, it's crucial to acknowledge that:

- Increased investment activity reflects a renewed belief in the market's potential.

- Expert opinions highlight the positive implications for long-term economic growth.

- Potential risks and challenges, such as geopolitical uncertainty and inflation, remain.

Conclusion: Tariff Relief's Positive Impact and Market Outlook

Today's stock market rally, reflected in the significant gains of the Dow, Nasdaq, and S&P 500, unequivocally demonstrates the positive impact of tariff relief. Increased investor confidence, coupled with reduced import costs across multiple sectors, has fueled a surge in market activity. While cautious optimism prevails, it’s crucial to continue monitoring tariff policies and other economic factors that could influence the market’s trajectory. Stay updated on future tariff relief announcements and their impact on the stock market. Understanding tariff relief's influence is crucial for informed investment decisions.

Featured Posts

-

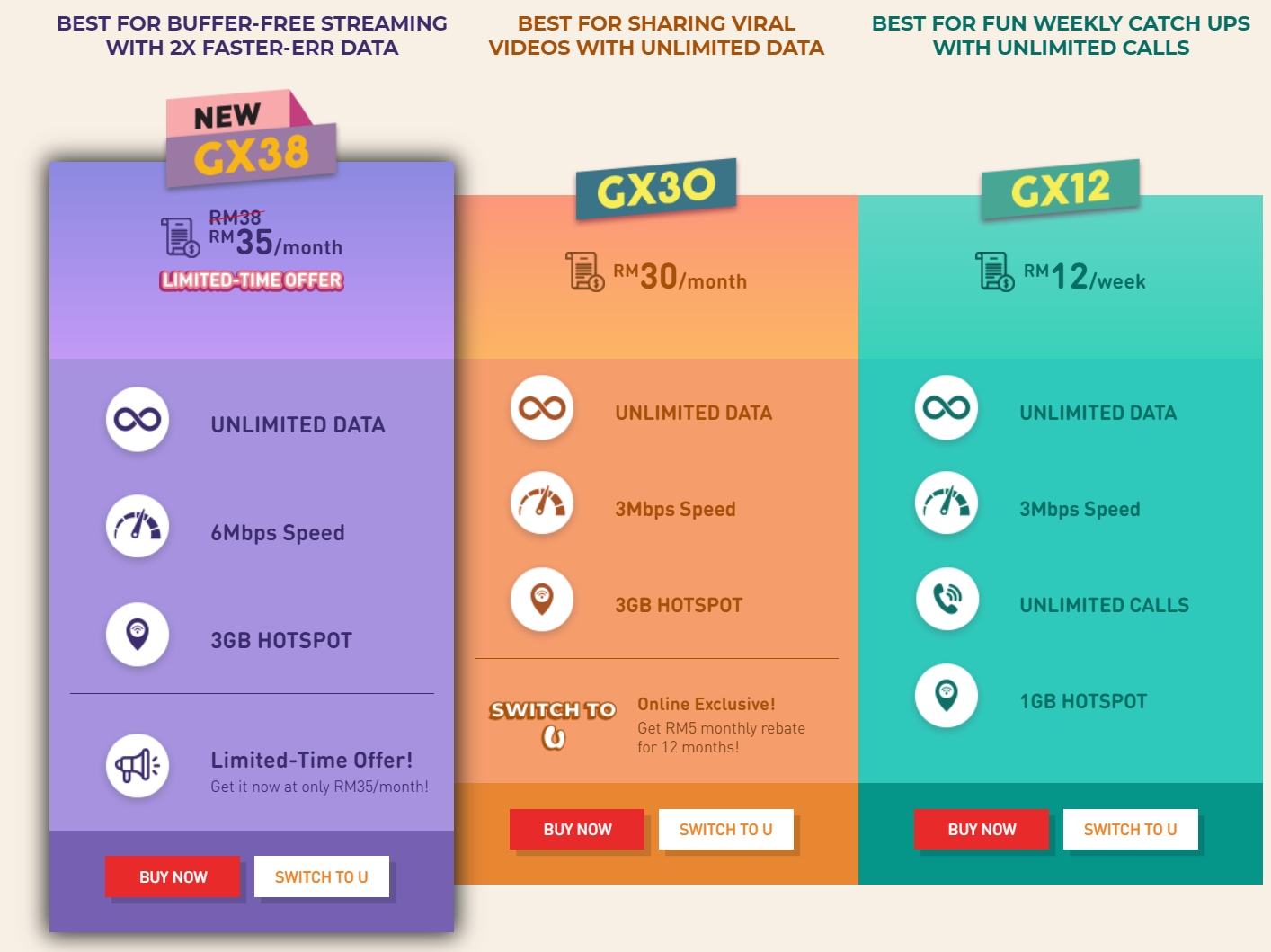

Save With Google Fi The 35 Unlimited Data Plan Unveiled

Apr 24, 2025

Save With Google Fi The 35 Unlimited Data Plan Unveiled

Apr 24, 2025 -

Auto Dealerships Push Back Against Mandatory Ev Sales

Apr 24, 2025

Auto Dealerships Push Back Against Mandatory Ev Sales

Apr 24, 2025 -

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025 -

Navigate The Private Credit Boom 5 Essential Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigate The Private Credit Boom 5 Essential Dos And Don Ts For Job Seekers

Apr 24, 2025 -

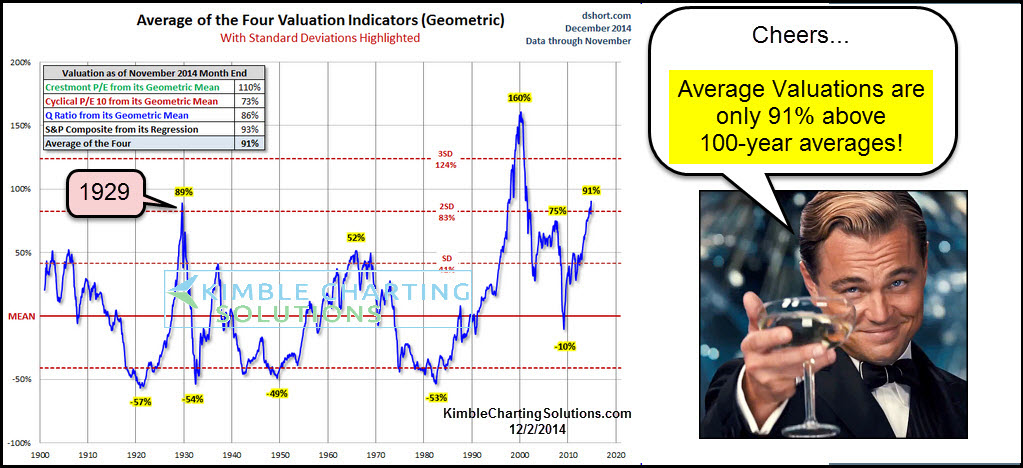

High Stock Market Valuations A Bof A Analysts Case For Investor Calm

Apr 24, 2025

High Stock Market Valuations A Bof A Analysts Case For Investor Calm

Apr 24, 2025