High Stock Market Valuations: A BofA Analyst's Case For Investor Calm

Table of Contents

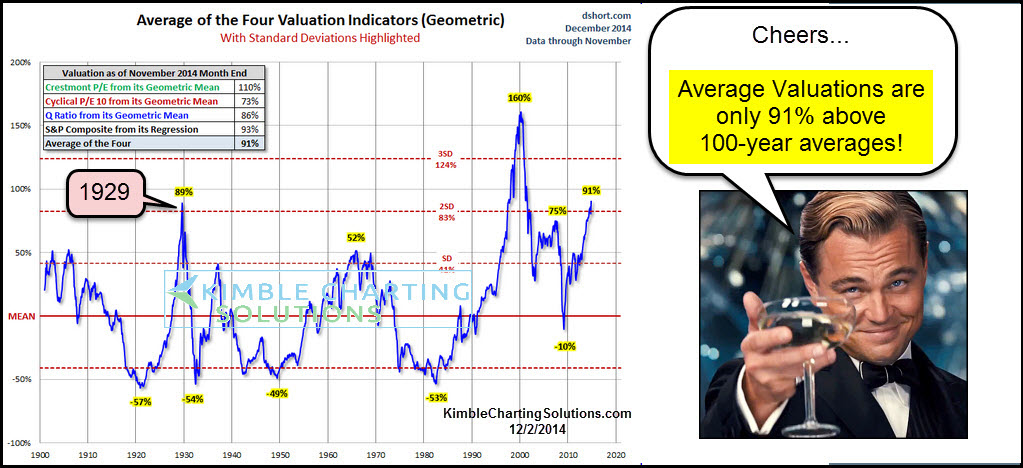

Understanding Current Market Valuations

H3: Metrics Beyond the P/E Ratio

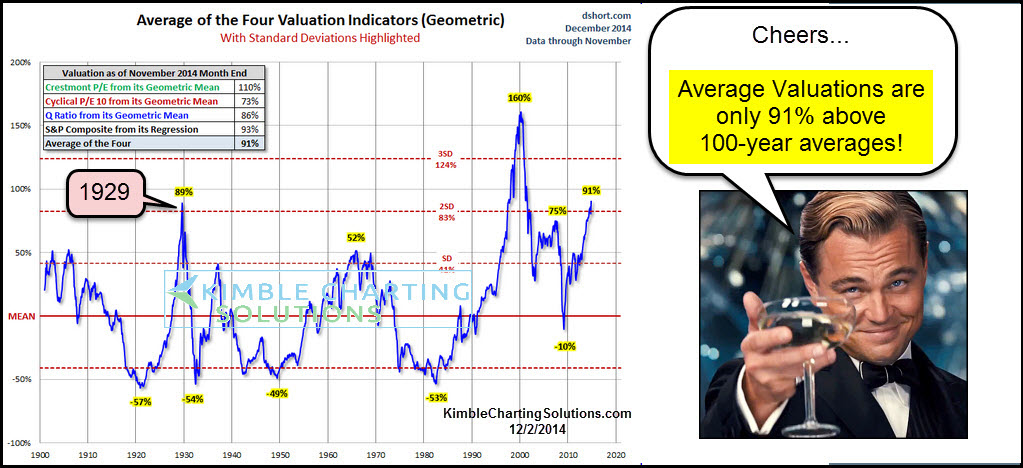

The Price-to-Earnings (P/E) ratio, while widely used, provides an incomplete picture of stock valuation. Relying solely on this metric can be misleading. A comprehensive valuation approach requires considering other key stock valuation metrics, including:

-

Price-to-Sales (P/S): This ratio compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings or those in high-growth sectors. For example, a high-growth tech company with negative earnings might have a high P/E ratio, but a reasonable P/S ratio.

-

Price-to-Book (P/B): This ratio compares a company's market value to its book value (assets minus liabilities). It’s useful for valuing asset-heavy companies, but less so for service-based businesses. A low P/B ratio might indicate undervaluation, while a high ratio might suggest overvaluation.

-

Dividend Yield: This metric represents the annual dividend payment relative to the stock price. It's a crucial factor for income-focused investors and helps assess the return on investment relative to the current market valuation. A high dividend yield can offset a potentially high P/E ratio.

These market valuation analysis tools, used together, offer a more nuanced understanding of market valuation than the P/E ratio alone.

H3: The Impact of Low Interest Rates

Historically low interest rates significantly influence valuations. Lower interest rates reduce the discount rate used in valuation models. This means future earnings are discounted less heavily, leading to higher present values and, consequently, higher P/E ratios.

-

The discount rate reflects the opportunity cost of capital. Low interest rates imply lower opportunity costs, justifying higher valuations for companies with strong future growth prospects.

-

Historically, periods of low interest rates have been associated with higher stock valuations, suggesting the current environment isn't entirely anomalous.

This impact of interest rates on valuations is a critical consideration when evaluating whether current market valuations are truly excessive.

H3: Analyzing Growth Prospects

Future earnings growth is paramount when assessing valuations. Companies with robust growth potential can justify seemingly high P/E ratios. Focusing solely on current earnings ignores the potential for future expansion.

-

Sectors like technology, renewable energy, and biotechnology are often characterized by high valuations due to their expected future growth.

-

Long-term investment strategies are crucial. Focusing on the long-term growth trajectory of a company can help mitigate the perceived risks associated with high current valuations.

Investors should prioritize companies with strong fundamentals and demonstrable growth potential when navigating high stock market valuations.

BofA Analyst's Perspective and Supporting Arguments

H3: BofA's Key Arguments for Maintaining a Calm Approach

Recent BofA reports suggest maintaining a measured approach. Their arguments typically center on:

-

The sustained low interest rate environment continues to support higher valuations.

-

Strong corporate earnings growth, albeit potentially slowing, justifies current market levels for many companies.

-

Long-term economic growth projections remain positive, mitigating concerns over a significant market correction.

H3: Addressing Potential Risks and Counterarguments

While BofA presents a relatively optimistic outlook, acknowledging potential risks is crucial.

-

Inflationary pressures could lead to interest rate hikes, impacting valuations negatively.

-

Geopolitical instability and unexpected economic shocks remain potential catalysts for market corrections.

BofA's response typically emphasizes the importance of diversification and a long-term investment strategy to mitigate these potential market corrections and navigate market risk.

Practical Strategies for Investors

H3: Portfolio Diversification

Diversification remains a cornerstone of sound risk management, particularly in high valuation markets.

-

Diversify across asset classes (stocks, bonds, real estate).

-

Diversify across sectors (technology, healthcare, consumer staples).

-

Consider international diversification to reduce exposure to regional economic downturns.

This portfolio diversification strategy allows investors to mitigate risk and potentially improve returns.

H3: Long-Term Investment Horizon

A long-term investment approach is paramount to weathering short-term market fluctuations.

-

A buy-and-hold strategy can help mitigate the impact of market volatility.

-

Regularly rebalancing your portfolio ensures your asset allocation remains aligned with your risk tolerance and financial goals.

This long-term investment approach is particularly beneficial during periods of high market valuations.

Maintaining Calm Amidst High Stock Market Valuations

In conclusion, while high stock market valuations are a valid concern, a measured approach is advisable. BofA's analysis highlights that low interest rates, growth prospects, and a focus on long-term investment strategies can help navigate this environment. Don't let high stock market valuations deter you from long-term investing. Develop a well-diversified portfolio, carefully consider your risk tolerance, and consult with a financial advisor to create a personalized plan that aligns with your financial goals. Remember to regularly review your investment strategy to adapt to changing market conditions.

Featured Posts

-

Why Current Stock Market Valuations Are Not A Cause For Investor Alarm Bof A

Apr 24, 2025

Why Current Stock Market Valuations Are Not A Cause For Investor Alarm Bof A

Apr 24, 2025 -

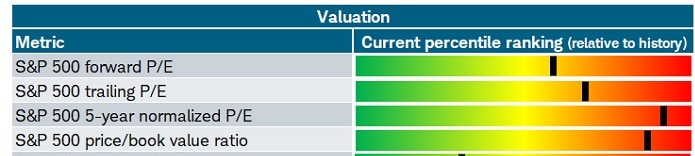

Niftys Ascent Examining The Tailwinds Driving Indias Market

Apr 24, 2025

Niftys Ascent Examining The Tailwinds Driving Indias Market

Apr 24, 2025 -

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025 -

Canadian Conservatives Vow To Lower Taxes Shrink Budget Deficits

Apr 24, 2025

Canadian Conservatives Vow To Lower Taxes Shrink Budget Deficits

Apr 24, 2025 -

The Unseen Side Of Luxury Skiing The Stories Of Chalet Girls In Europe

Apr 24, 2025

The Unseen Side Of Luxury Skiing The Stories Of Chalet Girls In Europe

Apr 24, 2025