Dow Rallies 1000 Points: Stock Market Update And Analysis

Table of Contents

Causes of the 1000-Point Dow Rally

Several intertwined factors contributed to this remarkable 1000-point Dow rally, signaling a potential shift in market sentiment and economic conditions.

Positive Economic Indicators

Recent economic data releases painted a more optimistic picture than many anticipated, significantly influencing investor confidence.

- Lower-than-expected inflation: The Consumer Price Index (CPI) showed a smaller-than-predicted increase in inflation for [Insert Month, Year], suggesting that inflationary pressures might be easing. Source: [Insert Source - e.g., Bureau of Labor Statistics].

- Strong employment numbers: The latest employment report indicated robust job growth, with [Insert Number] jobs added in [Insert Month, Year]. Source: [Insert Source - e.g., Bureau of Labor Statistics].

- Positive Manufacturing Data: Reports showed a surge in manufacturing activity, indicating a healthy economic outlook. Source: [Insert Source]

These positive economic indicators signaled a potential slowdown in interest rate hikes by the Federal Reserve, boosting investor confidence and fueling buying activity in the stock market. This contributed significantly to the strength of the Dow rally.

Easing Inflation Concerns

Decreasing inflation rates played a crucial role in boosting market optimism. The expectation of lower inflation influences the Federal Reserve's monetary policy decisions.

- CPI and PPI Data: The Consumer Price Index (CPI) and Producer Price Index (PPI) both showed a decline in [Insert Month, Year], indicating easing inflationary pressures. Source: [Insert Source].

- Federal Reserve's response: The reduced inflation fueled speculation that the Federal Reserve might moderate the pace of interest rate increases, a key factor influencing stock market valuations.

Reduced inflation expectations lead to lower interest rates, making borrowing cheaper for businesses and consumers, stimulating economic growth and supporting higher stock prices. This positive feedback loop contributed significantly to the Dow's impressive gains.

Strong Corporate Earnings

Positive corporate earnings reports from major companies across various sectors further fueled the market rally.

- Technology Sector Strength: Companies like [Example Company 1] and [Example Company 2] reported exceeding expectations in their earnings, boosting investor confidence in the tech sector.

- Energy Sector Performance: Strong energy prices propelled significant earnings growth for companies in the energy sector, such as [Example Company 3] and [Example Company 4].

- Financial Sector Growth: Banks and financial institutions also reported strong performance, fueled by rising interest rates.

Strong corporate earnings demonstrate the underlying strength of the economy and provide a solid foundation for continued market growth, contributing to the positive momentum that drove the Dow's 1000-point rally.

Geopolitical Factors

Global events also played a role in shaping market sentiment and contributing to the upward trajectory of the Dow.

- Easing Geopolitical Tensions: A decrease in tensions between [Mention specific countries/regions] reduced uncertainty in the global markets, boosting investor confidence.

- Positive International Trade News: Positive developments in international trade, such as [Mention specific trade agreements or negotiations], helped to create a more favorable investment climate.

Reduced geopolitical uncertainty creates a more stable investment environment, encouraging investors to increase their risk appetite and invest more heavily in the stock market. This contributed significantly to the market's overall positive trend and the Dow rally.

Impact and Implications of the Dow Rally

The 1000-point Dow rally had a profound impact on investor sentiment, sector-specific performance, and the overall market outlook.

Investor Sentiment and Behavior

The rally marked a noticeable shift in investor sentiment, moving from fear and uncertainty to optimism and increased confidence.

- Increased Buying Activity: Trading volumes surged, indicating increased buying activity as investors rushed to capitalize on the perceived upward trend.

- Decreased Selling Pressure: The selling pressure significantly diminished as investors held onto their positions, further fueling the rally.

The psychological impact of such a significant market rally is substantial, fostering a positive feedback loop that reinforces the upward trend. This shift in sentiment is crucial in understanding the sustainability of the rally.

Sector-Specific Performance

The rally didn't impact all sectors uniformly. Some sectors outperformed others, reflecting varied responses to the underlying drivers of the market surge.

- Technology Sector Outperformance: The technology sector demonstrated strong performance, driven by positive corporate earnings and investor enthusiasm.

- Energy Sector Gains: The energy sector also saw substantial gains, fueled by rising oil prices.

- Consumer Staples Relative Stability: The consumer staples sector showed more muted gains, reflecting its defensive nature.

Analyzing sector-specific performance provides a more nuanced understanding of the market's response to the economic and geopolitical factors influencing the Dow rally.

Short-Term vs. Long-Term Outlook

While the 1000-point Dow rally is undoubtedly positive, maintaining a balanced perspective is crucial.

- Potential Risks: A resurgence of inflation, renewed geopolitical instability, or unexpected economic downturns could reverse the upward trend.

- Cautious Optimism: While the short-term outlook appears positive, long-term sustainability depends on sustained economic growth, controlled inflation, and a stable geopolitical environment.

The 1000-point Dow rally provides a glimpse of potential market strength, but investors must remain vigilant and monitor key economic indicators and global events to assess the long-term sustainability of this upward trend.

Conclusion

The 1000-point Dow rally resulted from a confluence of factors, including positive economic indicators, easing inflation concerns, strong corporate earnings, and reduced geopolitical uncertainty. This significant market movement impacted investor sentiment, sector-specific performance, and the overall market outlook. While the short-term outlook seems optimistic, investors should remain aware of potential risks and develop a robust investment strategy based on careful analysis and risk assessment. Stay updated on future Dow Jones Industrial Average movements, learn more about effective strategies for navigating stock market volatility, and understand the factors influencing the Dow rally to make informed investment decisions. Monitor the Dow and other market indicators for future opportunities.

Featured Posts

-

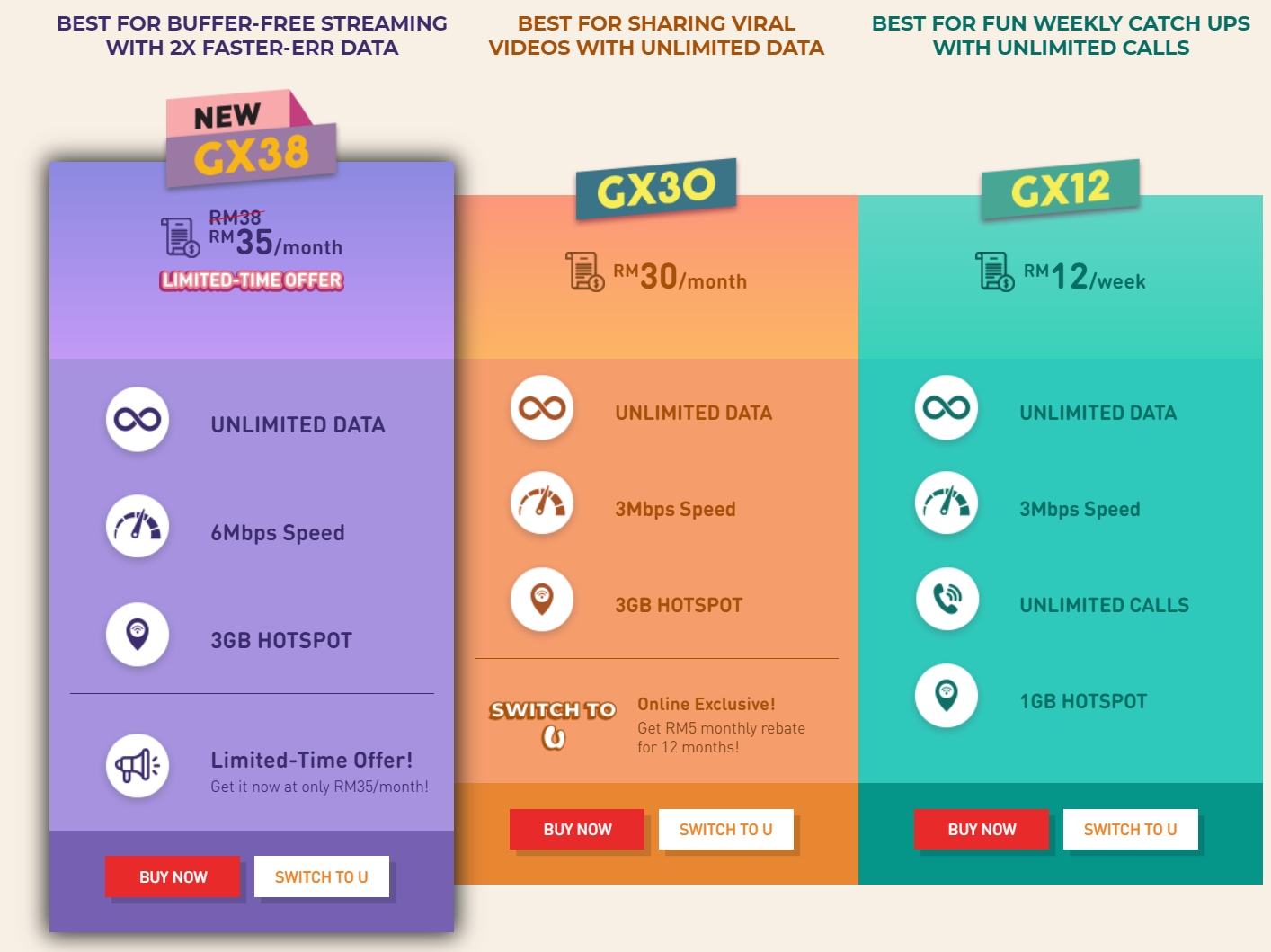

Save With Google Fi The 35 Unlimited Data Plan Unveiled

Apr 24, 2025

Save With Google Fi The 35 Unlimited Data Plan Unveiled

Apr 24, 2025 -

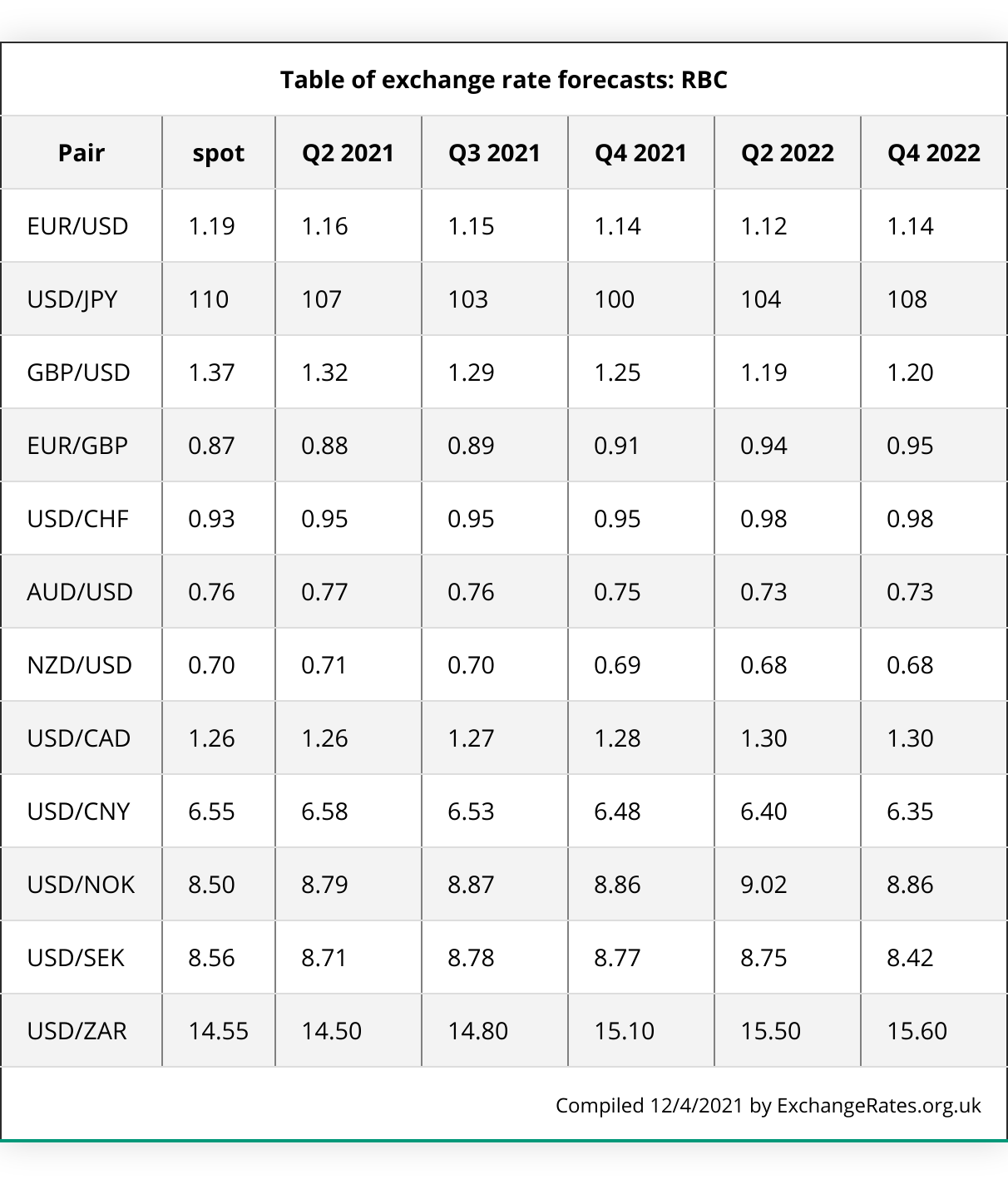

Dollars Ascent Trumps Changing Narrative And Its Effect On Usd Exchange Rates

Apr 24, 2025

Dollars Ascent Trumps Changing Narrative And Its Effect On Usd Exchange Rates

Apr 24, 2025 -

Shifting Sands Chinas Lpg Imports Turn Eastward Due To Us Tariffs

Apr 24, 2025

Shifting Sands Chinas Lpg Imports Turn Eastward Due To Us Tariffs

Apr 24, 2025 -

Bethesda Confirms Oblivion Remastered Launch

Apr 24, 2025

Bethesda Confirms Oblivion Remastered Launch

Apr 24, 2025 -

Private Credit Jobs 5 Dos And Don Ts For Applicant Success

Apr 24, 2025

Private Credit Jobs 5 Dos And Don Ts For Applicant Success

Apr 24, 2025