Private Credit Jobs: 5 Do's And Don'ts For Applicant Success

Table of Contents

5 Do's for Private Credit Job Applications

Do 1: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression – make it count. Generic applications are easily overlooked. Instead, meticulously tailor each application to the specific requirements and culture of the firm and role.

- Highlight relevant experience and skills: Showcase expertise in financial modeling, credit analysis, debt structuring, and portfolio management. Quantify your achievements whenever possible. Did you increase portfolio returns? Reduce defaults? Quantify these successes.

- Incorporate keywords: Carefully review the job description and incorporate relevant keywords like "due diligence," "loan origination," "LBO modeling," and "DCF analysis" naturally throughout your resume and cover letter.

- Showcase soft skills: Emphasize your communication, teamwork, and problem-solving abilities. Private credit roles often involve collaborating with diverse teams and communicating complex financial information effectively.

- Example: Instead of saying "worked on a portfolio," say "Managed a $50 million portfolio of middle-market loans, resulting in a 12% annualized return, exceeding the benchmark by 3%."

Do 2: Network Strategically

Networking is paramount in the private credit industry. Building relationships can open doors that applications alone cannot.

- Attend industry events: Conferences, workshops, and networking events offer opportunities to meet professionals, learn about industry trends, and make valuable connections.

- Leverage LinkedIn: Optimize your LinkedIn profile, connect with professionals in private credit, and engage in relevant industry discussions.

- Informational interviews: Reach out to professionals in private credit for informational interviews. These conversations can provide invaluable insights into the industry and potential job opportunities.

- Recruiters: Build relationships with recruiters specializing in finance and private credit. They often have exclusive access to unadvertised job opportunities.

Do 3: Master the Private Credit Interview

The interview process is where you demonstrate your knowledge and personality. Thorough preparation is key.

- Practice behavioral questions (STAR method): Use the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions, showcasing your problem-solving skills and experiences.

- Prepare technical questions: Expect questions on financial modeling, credit analysis, valuation techniques (DCF, LBO), and your understanding of various credit strategies (direct lending, mezzanine financing, distressed debt).

- Demonstrate market knowledge: Stay updated on current market trends and their impact on private credit investments.

- Research the firm: Thoroughly research the firm's investment strategy, portfolio, and recent deals. Ask insightful questions that demonstrate your genuine interest.

Do 4: Highlight Relevant Financial Modeling Skills

Proficiency in financial modeling is essential for most private credit roles.

- Showcase software expertise: Demonstrate your skills in Excel, financial modeling software (Bloomberg Terminal, Argus), and programming languages (Python, R).

- Valuation techniques: Exhibit a solid understanding of DCF analysis, LBO modeling, and other relevant valuation techniques.

- Portfolio of work: Include examples of your financial modeling work in your portfolio to showcase your abilities.

Do 5: Showcase Your Understanding of Private Credit Strategies

Demonstrate a comprehensive understanding of various private credit strategies and their nuances.

- Different strategies: Show familiarity with direct lending, mezzanine financing, distressed debt, and other private credit investment strategies.

- Risks and rewards: Understand the risks and potential rewards associated with each strategy.

- Market awareness: Demonstrate awareness of current market conditions and their impact on private credit investments.

5 Don'ts for Private Credit Job Applications

Don't 1: Submit a Generic Application

Avoid generic applications. Tailor each application to the specific job description and the firm's investment strategy.

Don't 2: Neglect Networking

Don't underestimate the power of networking. Actively build relationships with professionals in the private credit industry.

Don't 3: Underestimate Technical Skills

Mastering financial modeling and analytical skills is crucial. Practice and hone your skills continuously.

Don't 4: Lack Enthusiasm and Passion

Let your genuine interest and passion for private credit shine through in your applications and interviews.

Don't 5: Fail to Follow Up

Always send thank-you notes after interviews and follow up appropriately to show your continued interest.

Land Your Dream Private Credit Job Today!

Securing a private credit job requires a strategic approach. By following these "do's" and avoiding the "don'ts," you significantly improve your chances of success. Remember to tailor your applications, network effectively, master the interview process, and highlight your technical and strategic knowledge. Start applying for private credit jobs today and find your ideal private credit career!

Featured Posts

-

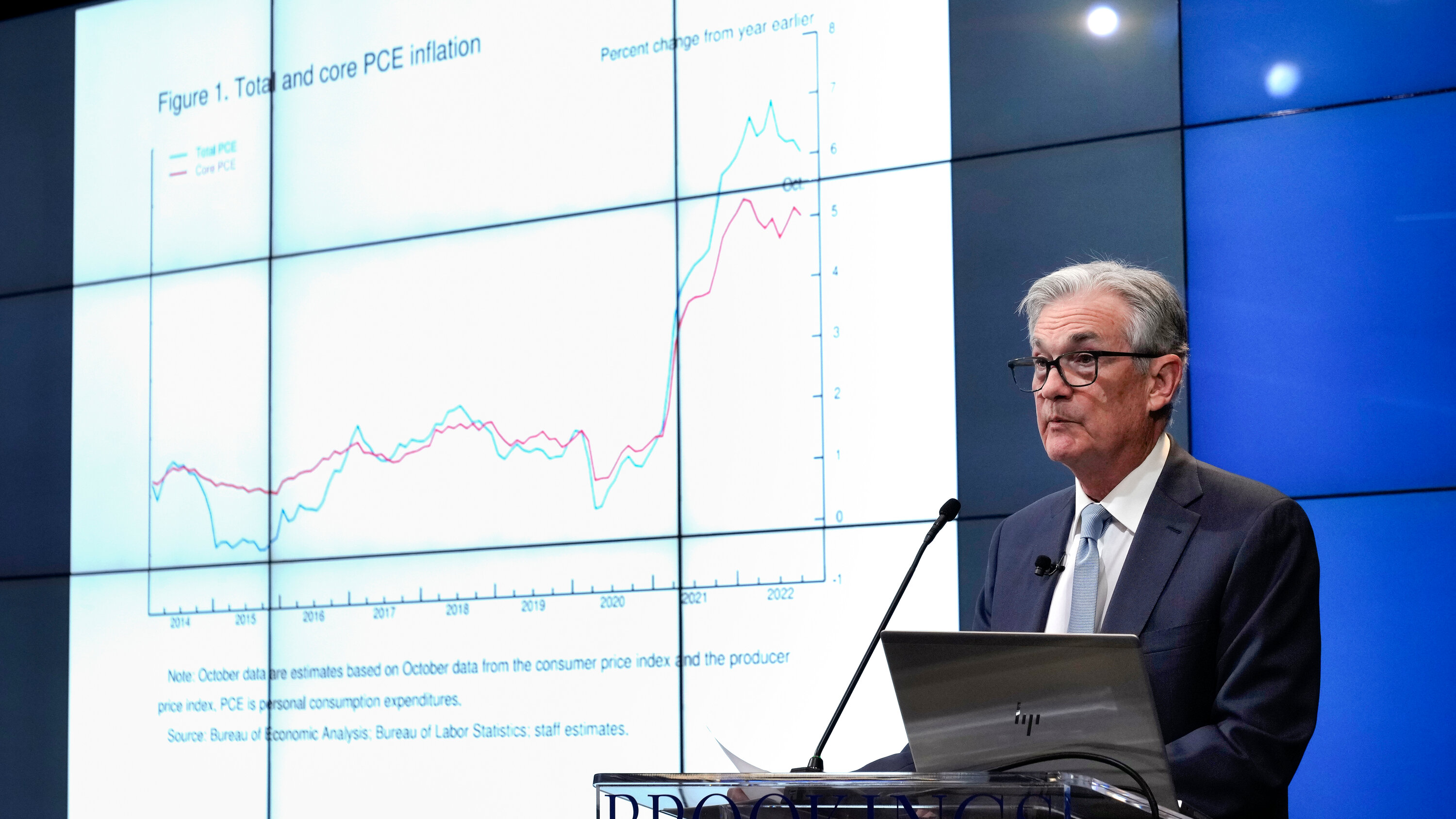

Trump Says He Wont Fire Powell Fed Chairs Job Secure

Apr 24, 2025

Trump Says He Wont Fire Powell Fed Chairs Job Secure

Apr 24, 2025 -

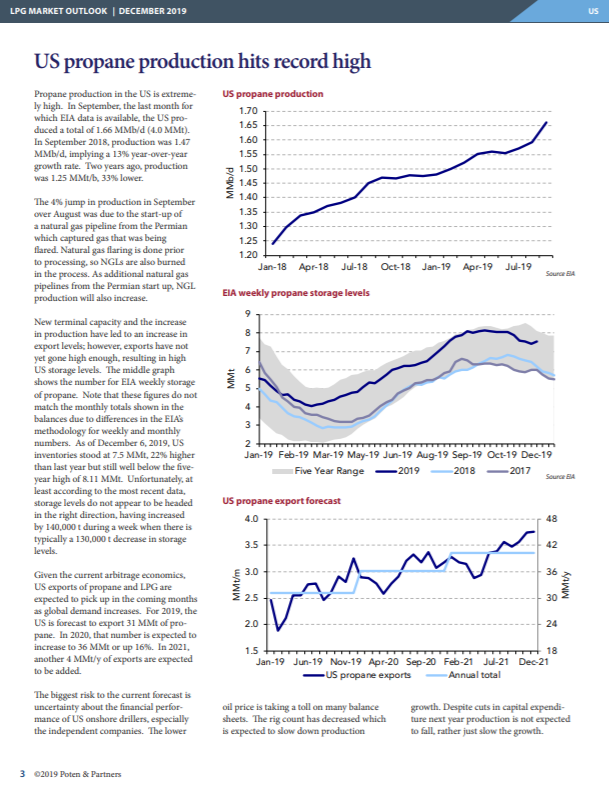

The Changing Landscape Of Chinas Lpg Market From Us To Middle East

Apr 24, 2025

The Changing Landscape Of Chinas Lpg Market From Us To Middle East

Apr 24, 2025 -

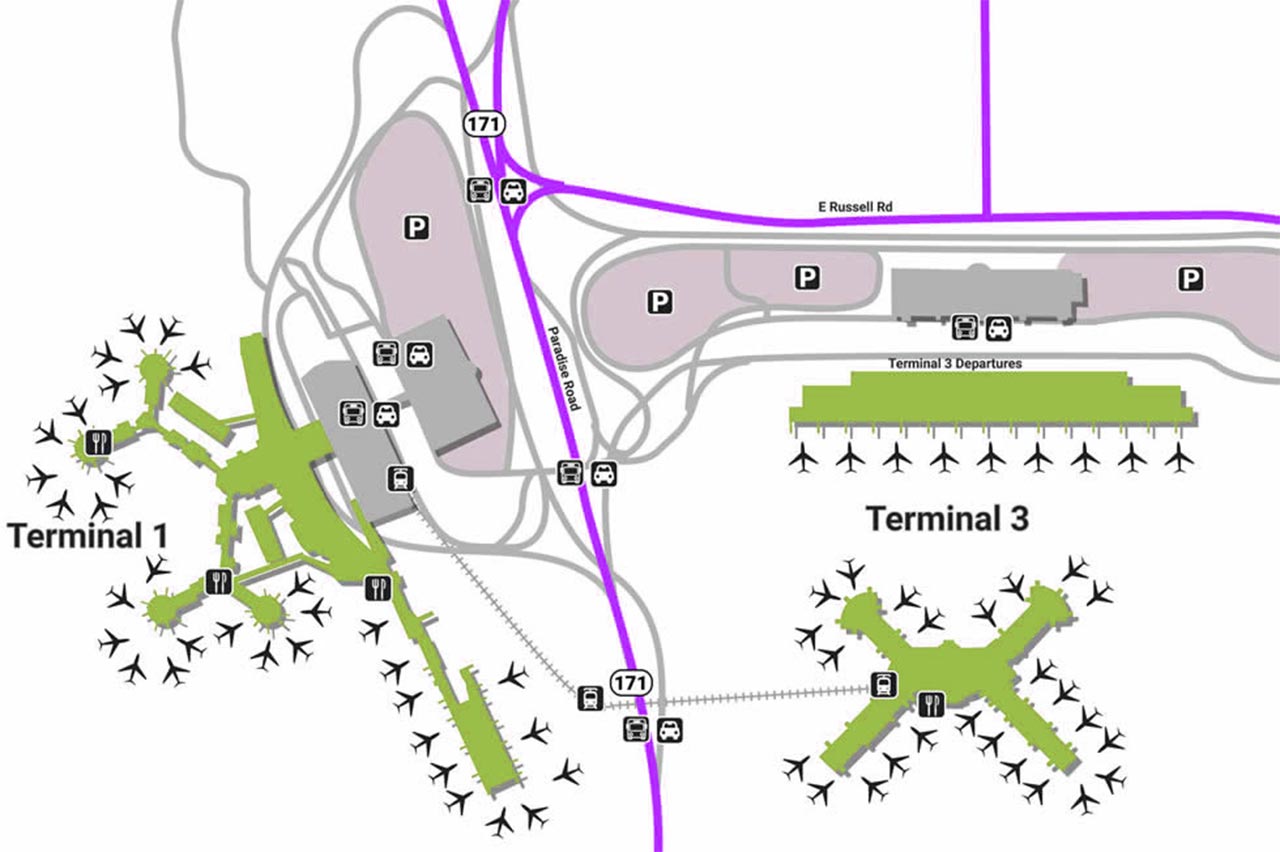

Faa Study Highlights Collision Concerns At Las Vegas Mc Carran International Airport

Apr 24, 2025

Faa Study Highlights Collision Concerns At Las Vegas Mc Carran International Airport

Apr 24, 2025 -

Trumps Powell Remarks Boost Us Stock Futures

Apr 24, 2025

Trumps Powell Remarks Boost Us Stock Futures

Apr 24, 2025 -

Canadian Conservatives Vow To Lower Taxes Shrink Budget Deficits

Apr 24, 2025

Canadian Conservatives Vow To Lower Taxes Shrink Budget Deficits

Apr 24, 2025