Dollar's Ascent: Trump's Changing Narrative And Its Effect On USD Exchange Rates

Table of Contents

Trump's Initial Economic Policies and their Predicted Impact on the USD

Trump's initial economic platform presented a seemingly contradictory narrative regarding the USD.

The "Strong Dollar" Rhetoric

Early in his presidency, Trump frequently espoused the desire for a "strong dollar," a statement seemingly at odds with his protectionist trade policies.

- Contradictory Policies: The emphasis on a strong dollar clashed with the implementation of tariffs and trade wars, actions generally expected to weaken a nation's currency. A strong dollar makes exports more expensive and imports cheaper, potentially harming US manufacturers.

- Expert Predictions: Many economic experts predicted that the combination of protectionist measures and a strong dollar rhetoric would create volatility and uncertainty in the foreign exchange market, leading to unpredictable USD exchange rates. The initial market reaction was indeed mixed, reflecting this uncertainty.

Trade Wars and Their Unintended Consequences

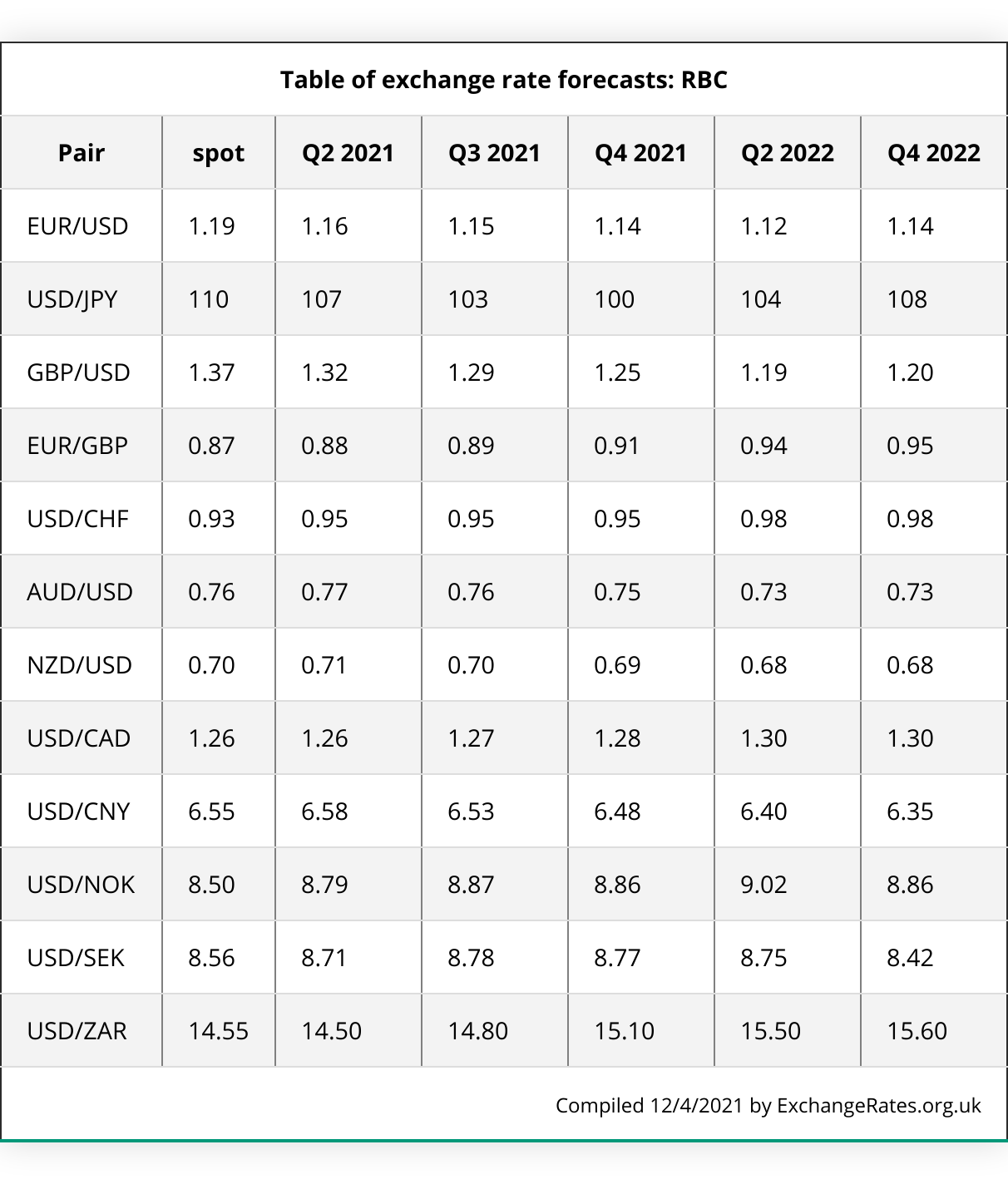

Trump's initiation of trade wars, particularly with China, significantly impacted investor confidence and capital flow, influencing USD exchange rates.

- Investor Sentiment: The imposition of tariffs led to uncertainty and a decline in investor confidence, affecting capital inflows and outflows. Businesses faced increased costs and supply chain disruptions.

- Short-Term vs. Long-Term Effects: While some argued that trade wars initially strengthened the dollar as a safe haven currency, the long-term effects were largely negative, creating market instability and dampening economic growth.

- Exchange Rate Fluctuations: Data from this period shows significant fluctuations in USD exchange rates against major currencies like the Euro and the Yen, reflecting the market's reaction to the escalating trade disputes. (Charts and data would be inserted here).

The Evolving Narrative and Shifting Global Dynamics

The relationship between the USD and the global economic landscape is complex and constantly evolving.

Changes in Monetary Policy under the Trump Administration

The Federal Reserve's monetary policy decisions played a crucial role in shaping the USD's trajectory during Trump's presidency.

- Interest Rates and the USD: Changes in interest rates directly impact the value of the USD. Higher interest rates generally attract foreign investment, increasing demand for the dollar and strengthening its value.

- Federal Reserve Influence: The Federal Reserve's actions, influenced by various economic indicators and the overall economic climate, directly affected the strength or weakness of the dollar.

Geopolitical Factors and Their Influence

Global events beyond US domestic policy significantly impacted the USD's value.

- Safe-Haven Status: The USD often acts as a "safe-haven" currency during times of global uncertainty. Events like Brexit and the COVID-19 pandemic saw increased demand for the dollar as investors sought stability.

- Investor Sentiment: Global events significantly influenced investor sentiment toward the USD. Positive global news tended to weaken the dollar while negative news (e.g., geopolitical instability) strengthened it.

Analyzing the Current State of the USD Exchange Rates

Understanding the current state of USD exchange rates requires examining key indicators and trends.

Key Indicators and Current Trends

Currently, the USD is exhibiting [insert current data and trends, e.g., strength against the Euro, weakness against the Yen].

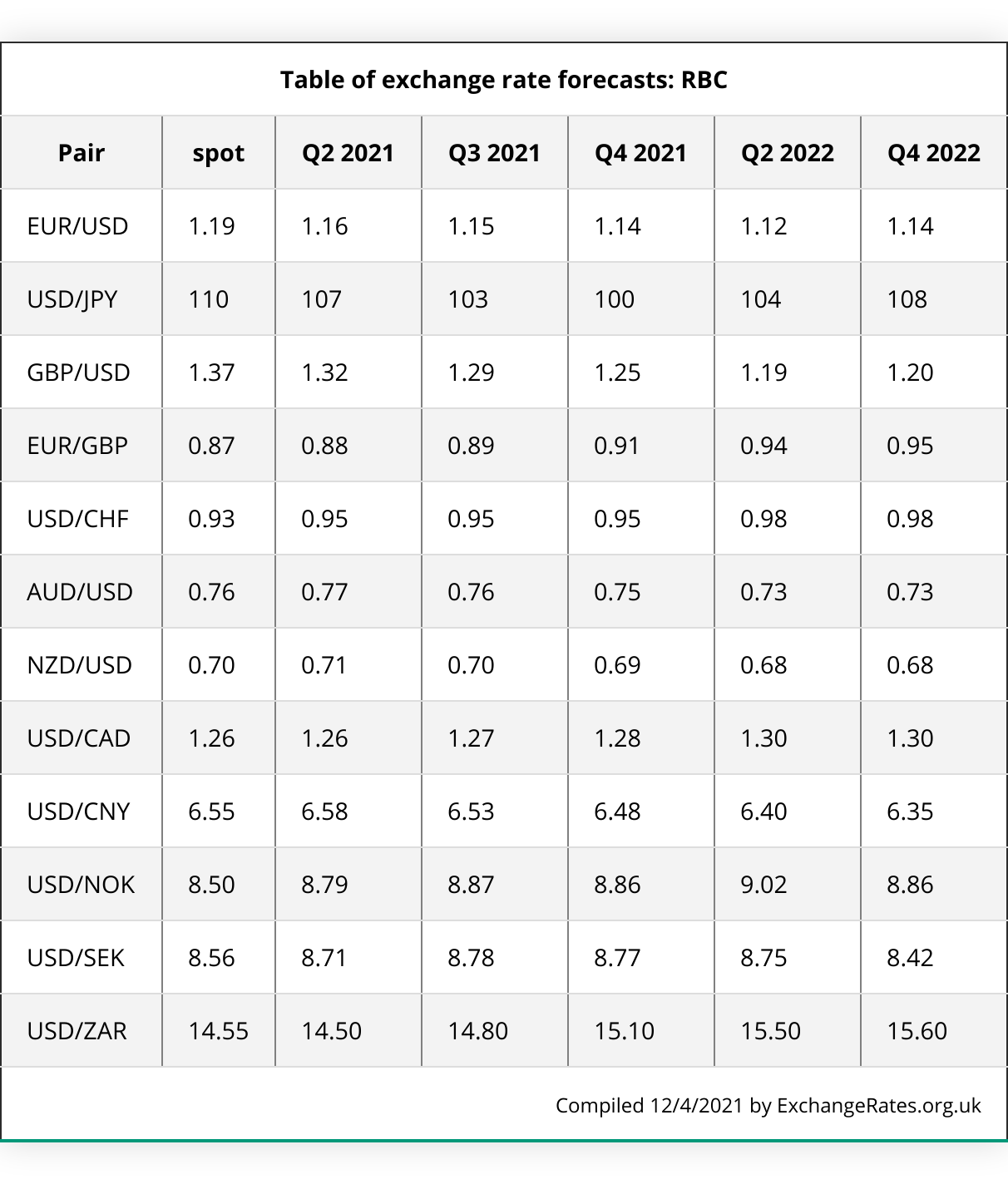

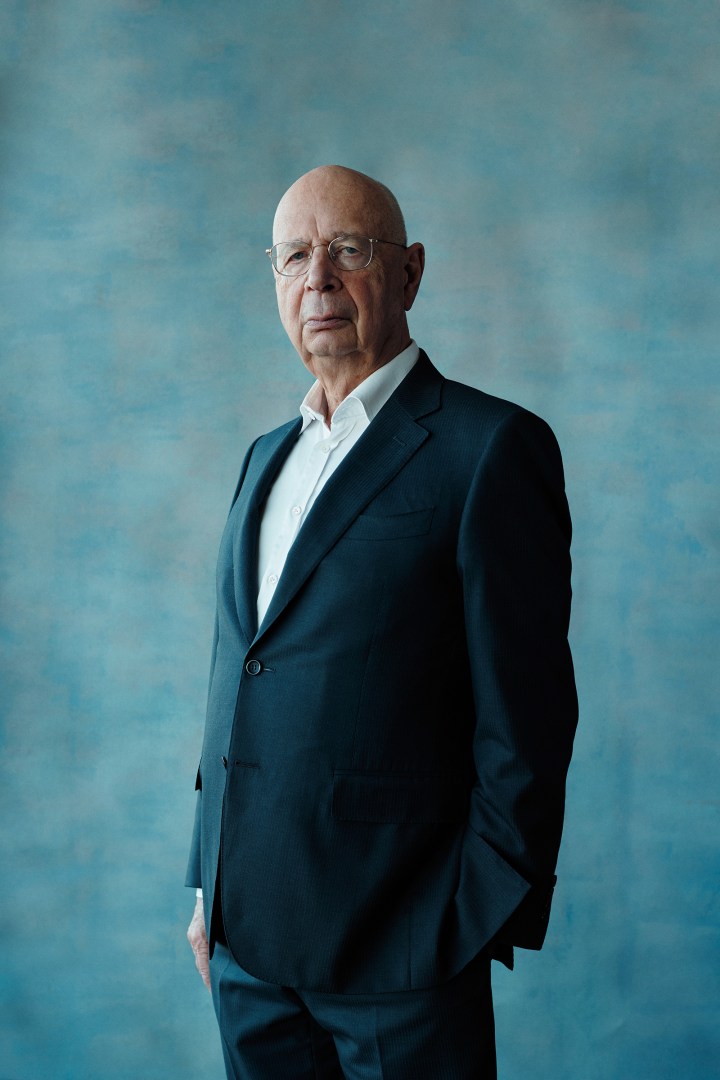

- Exchange Rate Data: [Include a current table or chart displaying USD exchange rates against major currencies (EUR, JPY, GBP, CAD, AUD).]

- Driving Factors: The current ascent or descent of the dollar is driven by a complex interplay of factors including [list current factors, such as interest rate differentials, global economic growth, geopolitical events].

Future Predictions and Outlook

Predicting the future trajectory of the USD is inherently challenging, but current economic indicators and geopolitical events offer some clues.

- Expert Opinions: [Include a summary of expert opinions and forecasts on future USD exchange rates.]

- Risks and Uncertainties: Potential risks include [list potential risks, e.g., further escalation of geopolitical tensions, unexpected economic slowdowns, changes in Federal Reserve policy].

Conclusion

The "dollar's ascent" under Trump's presidency is a multifaceted story, a complex interplay of his initially contradictory economic policies, shifting global dynamics, and the unpredictable nature of the foreign exchange market. Understanding the factors influencing USD exchange rates requires continuous monitoring of economic indicators and geopolitical developments. The value of the USD remains highly sensitive to these interwoven factors. Staying informed about the latest changes in USD exchange rates is crucial for making sound investment and business decisions. Follow our blog for regular updates on the dollar's continuing evolution and for in-depth analysis of USD exchange rates.

Featured Posts

-

Chinese Stocks Listed In Hong Kong See Significant Gains

Apr 24, 2025

Chinese Stocks Listed In Hong Kong See Significant Gains

Apr 24, 2025 -

Bethesda Confirms Oblivion Remastered Launch

Apr 24, 2025

Bethesda Confirms Oblivion Remastered Launch

Apr 24, 2025 -

Klaus Schwab Under Scrutiny World Economic Forum Faces New Inquiry

Apr 24, 2025

Klaus Schwab Under Scrutiny World Economic Forum Faces New Inquiry

Apr 24, 2025 -

Betting On Natural Disasters The La Wildfires And The Changing Times

Apr 24, 2025

Betting On Natural Disasters The La Wildfires And The Changing Times

Apr 24, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 24, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 24, 2025