Stock Market Rally: Trump's Influence On US Futures

Table of Contents

Tax Cuts and Their Impact on the Stock Market Rally

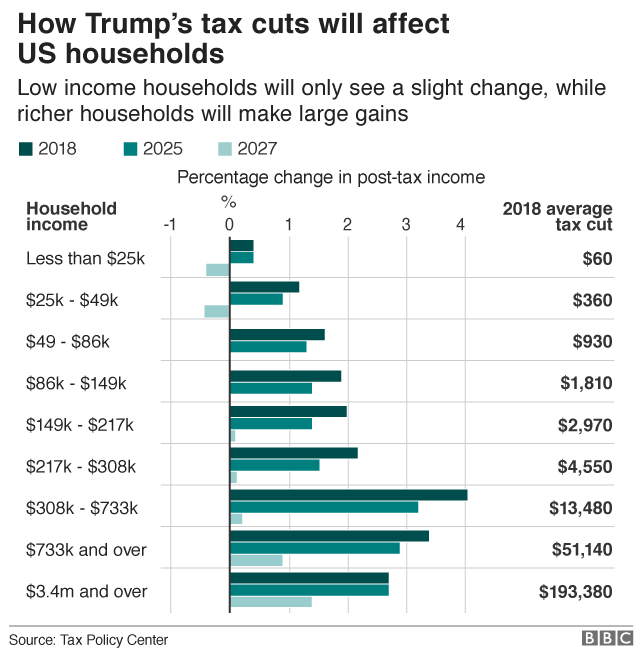

One of the key pillars of Trump's economic agenda was significant tax reform. The Tax Cuts and Jobs Act of 2017 slashed the corporate tax rate from 35% to 21%, a dramatic reduction intended to stimulate economic activity.

Corporate Tax Cuts: A Boon for Stock Prices?

This substantial corporate tax cut had several potential effects on the stock market rally:

- Increased Investment: Lower taxes freed up capital for businesses, theoretically leading to increased investments in research and development, expansion, and job creation.

- Stock Buybacks: Many companies used the extra cash to buy back their own stock, artificially increasing demand and driving up share prices.

- Dividend Payouts: Higher profits also led to increased dividend payouts to shareholders, further boosting investor returns and contributing to the positive market sentiment.

- Potential for Job Growth: While the promised job growth wasn't universally realized, the tax cuts were intended to incentivize hiring by reducing the cost of labor for businesses.

However, it's crucial to acknowledge counterarguments:

- Increased National Debt: The tax cuts significantly increased the national debt, raising concerns about long-term economic stability and potential future inflation, which could negatively impact the stock market rally in the long run.

Data from this period shows a noticeable rise in corporate profits following the tax cuts, which correlated with growth in major stock market indices like the S&P 500 and the Dow Jones. However, isolating the tax cuts' precise contribution to the overall stock market rally is challenging.

Deregulation and its Effect on US Futures

Trump's administration pursued a policy of deregulation across various sectors, aiming to reduce the burden on businesses and foster economic growth.

Financial Deregulation: A Double-Edged Sword?

Deregulation's impact on the stock market rally was multifaceted and complex. Some argue that it boosted investor confidence and market liquidity, while others warn that it increased systemic risk.

- Examples of Deregulated Sectors: Financial services experienced some deregulation, potentially impacting market confidence and leading to increased trading activity.

- Effect on Market Confidence: Reduced regulatory oversight could have spurred greater risk-taking among investors, potentially fueling the rally but also increasing vulnerability to market shocks.

- Increased Risk vs. Reward Scenarios: Deregulation created opportunities for higher returns but also amplified potential losses.

The impact of specific deregulatory measures on the market is difficult to isolate. While some sectors might have experienced short-term gains, the long-term effects of reduced regulation remain a topic of ongoing debate. For instance, changes to environmental regulations may have influenced certain sectors' performance, though isolating these effects from other contributing factors is difficult.

Trade Policies and their Influence on Market Sentiment

Trump's trade policies, characterized by tariffs and renegotiated trade deals, significantly impacted market sentiment and investor confidence.

Trade Wars and their Effect on US Futures: Volatility and Uncertainty

Trump's trade wars created considerable market volatility. While some sectors benefited from tariffs, others suffered significantly.

- Positive and Negative Impacts: Certain industries saw increased domestic demand due to tariffs on imports, while others faced higher input costs and reduced export opportunities.

- Short-Term Volatility vs. Long-Term Effects: The short-term market reactions were often dramatic, with sharp swings in stock prices depending on the specific trade actions. Assessing the long-term effects requires more time and analysis.

Examples include the trade war with China, which initially led to increased uncertainty and market volatility but ultimately resulted in some trade agreements with significant impacts on specific industries and stock prices. However, analyzing the net impact on the overall stock market rally remains complex.

Other Contributing Factors to the Stock Market Rally

While Trump's policies played a role, attributing the entire stock market rally solely to them would be an oversimplification. Several other factors significantly influenced market performance.

Global Economic Conditions: A Favorable Environment

- Low Interest Rates: Globally low interest rates made borrowing cheaper, encouraging investment and contributing to economic growth.

- Global Economic Growth: A period of relatively strong global economic growth provided a supportive backdrop for the US stock market.

- Technological Advancements: Continued technological innovation in sectors like technology and healthcare fueled significant growth in certain areas of the market.

Investor Sentiment and Confidence: The Psychology of the Market

- Market Psychology: Investor confidence and expectations played a crucial role. Positive news, regardless of its source, often boosts market sentiment.

- Impact of News and Media Coverage: Media coverage of economic indicators and policy changes influenced investor decisions and contributed to market volatility.

- Speculation: Market speculation also plays a critical role, especially during periods of rapid change and uncertainty.

Conclusion: Understanding Trump's Influence on the Stock Market Rally

The relationship between Trump's policies and the stock market rally is complex and multifaceted. While tax cuts, deregulation, and trade policies had undeniable impacts, attributing the entire market performance solely to these policies ignores the significant contributions of global economic conditions and investor sentiment. The interplay between these factors created a dynamic and often unpredictable market environment. Ultimately, understanding this period's stock market rally requires a comprehensive analysis, considering the numerous elements that influenced its trajectory.

Want to delve deeper into the factors influencing stock market rallies? Explore our resources on [link to related content] to learn more about US futures trading strategies and Trump's economic policies.

Featured Posts

-

Auto Dealerships Push Back Against Mandatory Ev Sales

Apr 24, 2025

Auto Dealerships Push Back Against Mandatory Ev Sales

Apr 24, 2025 -

William Watson On The Liberal Platform Key Policies To Consider

Apr 24, 2025

William Watson On The Liberal Platform Key Policies To Consider

Apr 24, 2025 -

Nba All Star Weekend Green Moody And Hield Among Participants

Apr 24, 2025

Nba All Star Weekend Green Moody And Hield Among Participants

Apr 24, 2025 -

Economic Slowdown Impact On Credit Card Companies And Consumer Behavior

Apr 24, 2025

Economic Slowdown Impact On Credit Card Companies And Consumer Behavior

Apr 24, 2025 -

Usd Strengthens Dollar Gains Against Major Currencies As Trump Softens Stance On Fed

Apr 24, 2025

Usd Strengthens Dollar Gains Against Major Currencies As Trump Softens Stance On Fed

Apr 24, 2025