Economic Slowdown: Impact On Credit Card Companies And Consumer Behavior

Table of Contents

Impact on Credit Card Companies

Economic slowdowns create a ripple effect throughout the financial sector, and credit card companies are particularly vulnerable. Reduced consumer spending and increased defaults directly impact their bottom line.

Increased Delinquency Rates

Economic downturns often lead to job losses and reduced income, making it harder for consumers to repay their credit card debts. This results in a significant rise in delinquency rates, impacting credit card companies' profitability and leading to increased financial risk. The higher the delinquency rate, the greater the potential for losses.

- Higher charge-off rates: Credit card companies are forced to write off more bad debt as uncollectible.

- Increased loan loss provisions: Companies need to set aside more funds to cover potential future losses from delinquent accounts.

- Reduced credit card applications: Fewer people apply for new credit cards due to uncertainty and tighter lending criteria.

- Increased need for robust collections processes: Credit card companies need to invest in and improve their collections strategies to recover as much debt as possible.

Companies need to implement stricter lending criteria, sophisticated risk assessment models using credit scoring and alternative data, and proactive strategies to manage delinquent accounts effectively. This might include offering hardship programs and working with consumers to create manageable repayment plans.

Reduced Spending and Lower Transaction Volumes

Consumers tend to cut back on discretionary spending during economic slowdowns, focusing on essential purchases. This directly translates to lower transaction volumes for credit card companies, significantly affecting their revenue streams, which are largely dependent on merchant fees and interest income.

- Lower merchant fees: Reduced consumer spending leads to fewer transactions, resulting in decreased merchant fees earned by credit card companies.

- Decreased interest income: If consumers are more diligent in paying down their balances to manage debt, interest income may decline.

- Increased competition for market share: Credit card companies compete fiercely for a smaller pool of customers, leading to potentially lower profit margins.

- Need for innovative revenue streams: Companies may explore new revenue streams, such as subscription services or fee-based financial planning tools.

Strategic Adjustments by Credit Card Companies

To mitigate risks and maintain profitability during economic slowdowns, credit card companies employ various strategies.

- Balance transfer promotions: Attracting customers from competitors by offering lower interest rates on transferred balances.

- Temporary interest rate reductions: Incentives for existing customers to maintain their accounts and reduce their debt.

- Strengthened customer service: Proactive support to help struggling customers manage their debt and avoid delinquency.

- Enhanced fraud detection systems: Protecting against increased fraud attempts during times of economic hardship.

- Investments in digital channels: Adapting to changing customer preferences for online and mobile banking.

- Development of new financial products and services: Diversifying their offerings to reduce reliance on traditional credit card revenue.

Shifts in Consumer Behavior

Economic slowdowns force consumers to re-evaluate their spending habits and financial priorities. This leads to significant changes in consumer behavior and impacts the credit card industry in numerous ways.

Increased Budget Consciousness and Frugal Spending

Consumers become significantly more conscious of their spending habits during economic uncertainty. They prioritize essential purchases and cut back on non-essential spending. This frugal approach may lead to less reliance on credit cards.

- Increased use of budgeting apps: Consumers adopt budgeting tools and apps to track expenses and stick to a budget.

- More careful comparison shopping: Consumers actively seek out discounts and promotions before making purchases.

- Prioritization of needs over wants: Consumers focus on purchasing essential goods and services, deferring non-essential purchases.

- Increased use of cash and debit cards: To maintain tighter control over spending and reduce reliance on credit.

Debt Management Strategies

Facing financial difficulties, consumers actively seek strategies to manage their debt.

- Increased demand for debt consolidation loans: Consumers explore options to combine multiple debts into a single, lower-interest loan.

- Higher utilization of credit counseling services: Seeking professional guidance to create a debt management plan.

- Negotiation of payment plans: Working with creditors to establish more manageable payment terms.

- Increased use of balance transfer options: To lower interest rates and potentially reduce monthly payments.

Increased Reliance on Credit for Essential Expenses

Paradoxically, during economic downturns, some consumers might increase their reliance on credit cards to cover essential expenses. This is often driven by job losses or significantly reduced income, leaving them with no other option.

- Higher credit card utilization rates: Consumers may use a greater percentage of their available credit.

- Potential increase in minimum payment defaults: Inability to make even minimum payments on credit cards.

- Need for responsible lending practices: Credit card companies need to ensure responsible lending practices to avoid exacerbating the problem.

Conclusion

An economic slowdown presents both challenges and opportunities for credit card companies and consumers. Credit card companies must navigate increased delinquency rates, reduced spending, and adapt their strategies to maintain profitability. Consumers, meanwhile, must adjust their spending habits, manage their debt effectively, and make informed financial decisions. Understanding the interplay between economic conditions and consumer behavior is crucial for both parties to navigate an economic slowdown successfully. Learning to manage your finances during an economic slowdown, including understanding your credit card usage and exploring debt management strategies, is vital. Stay informed about the impacts of economic slowdowns on credit card companies and consumer behavior to make sound financial decisions.

Featured Posts

-

T Mobile To Pay 16 Million For Data Security Violations

Apr 24, 2025

T Mobile To Pay 16 Million For Data Security Violations

Apr 24, 2025 -

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025 -

Us Lawyers Face Judge Abrego Garcias Order To Cease Stonewalling

Apr 24, 2025

Us Lawyers Face Judge Abrego Garcias Order To Cease Stonewalling

Apr 24, 2025 -

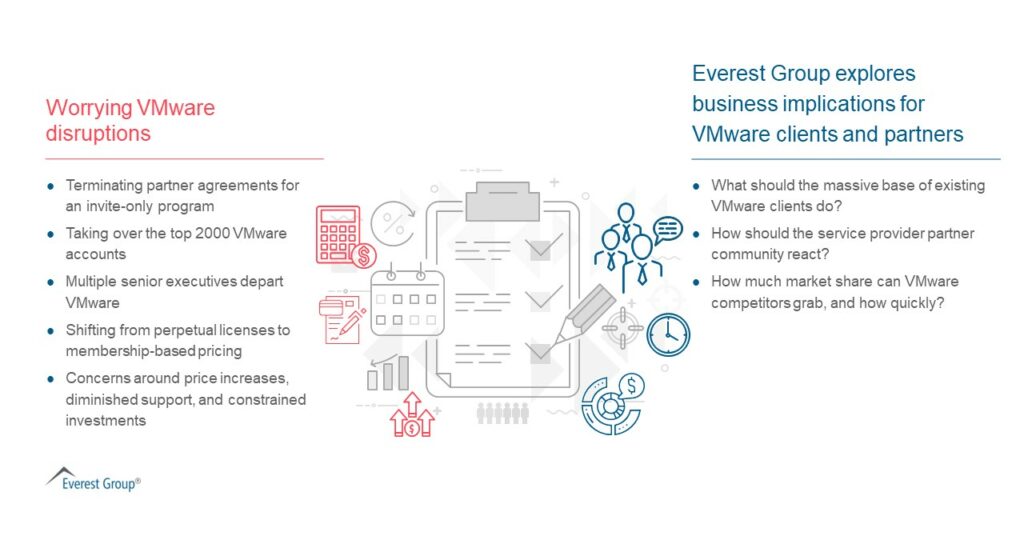

Broadcoms V Mware Acquisition A 1050 Price Hike Claim Sparks Outrage

Apr 24, 2025

Broadcoms V Mware Acquisition A 1050 Price Hike Claim Sparks Outrage

Apr 24, 2025 -

Discovering The Countrys Next Big Business Areas

Apr 24, 2025

Discovering The Countrys Next Big Business Areas

Apr 24, 2025