Broadcom's VMware Acquisition: A 1050% Price Hike Claim Sparks Outrage

Table of Contents

The 1050% Price Hike Allegation: Fact or Fiction?

The claim of a 1050% price increase originated from leaked internal documents and subsequent reports from various news outlets and industry analysts. While Broadcom hasn't directly confirmed this specific figure, the potential for significant price increases on certain VMware products, particularly those related to licensing and support, is undeniable. The alleged increases aren't uniform across the entire VMware product portfolio; rather, they seem to target specific enterprise-level solutions and support contracts.

- Specific product examples allegedly facing price increases: While precise details remain scarce, reports suggest increases for vSphere, vSAN, and NSX licensing are among the most concerning.

- Comparison of pre- and post-acquisition pricing: Currently, definitive post-acquisition pricing is unavailable. However, analysts are comparing existing pricing models with Broadcom's historical pricing strategies for acquired companies to project potential increases.

- Analysis of potential methodologies used to calculate the 1050% figure: The 1050% figure likely represents a worst-case scenario, potentially calculated by comparing specific, high-cost support contracts or bundled licensing options before and after hypothetical price changes. The lack of transparency from Broadcom makes independent verification challenging.

Antitrust Concerns and Regulatory Scrutiny

Broadcom's acquisition of VMware faces intense regulatory scrutiny from multiple bodies, including the Federal Trade Commission (FTC) in the United States and the European Commission (EC) in Europe. These bodies are investigating potential antitrust violations, focusing on whether the merger would substantially lessen competition in the virtualization and networking markets. The combined market share of Broadcom and VMware is significant, raising concerns about reduced choice and potential monopolistic practices.

- List of relevant regulatory bodies and their ongoing investigations: The FTC and EC are leading the investigations, with other national competition authorities potentially involved.

- Potential impacts on competition within the virtualization and networking sectors: Reduced competition could lead to higher prices, less innovation, and decreased quality of service for customers.

- Analysis of past antitrust cases relevant to the situation: Precedents involving similar mergers and acquisitions, particularly those concerning dominant players in the technology sector, are being closely examined by regulators.

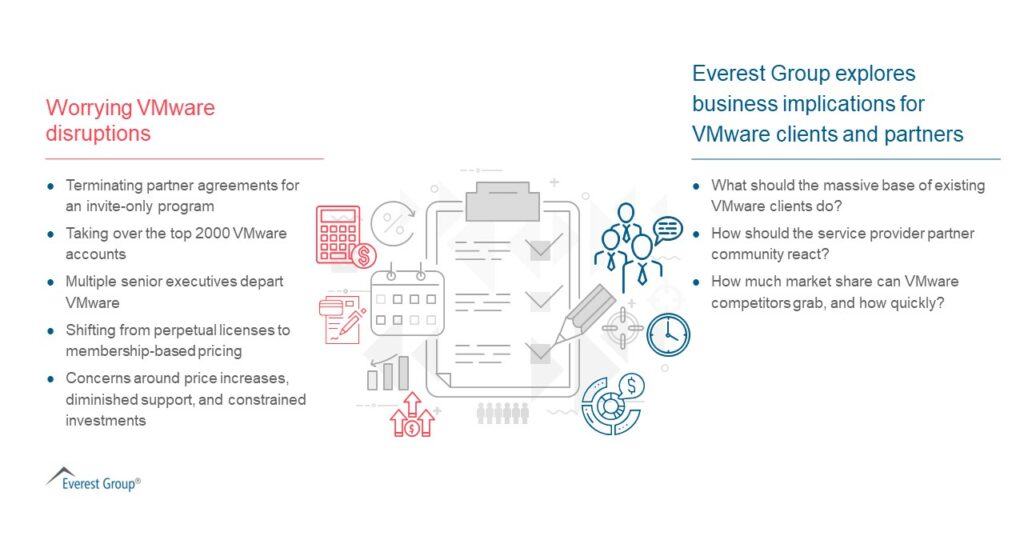

Impact on VMware Customers and the Broader Market

The potential price hikes pose a serious challenge for existing VMware customers, particularly those in industries heavily reliant on VMware's virtualization solutions. Organizations might need to revise their IT budgets and explore alternative virtualization platforms, potentially disrupting ongoing projects and increasing transition costs. This situation also sets a concerning precedent for future software acquisitions.

- Examples of industries heavily reliant on VMware products: Data centers, cloud providers, financial institutions, and healthcare providers are among the many industries dependent on VMware products.

- Potential for migration to alternative virtualization platforms: Organizations may consider migrating to competing platforms like Microsoft Azure Stack HCI, Red Hat Virtualization, or Citrix Hypervisor to mitigate increased costs.

- Analysis of the long-term impact on software licensing costs: The acquisition may embolden other software vendors to increase their pricing, leading to a broader increase in software licensing costs across the industry.

The Future of Virtualization Technology

The Broadcom-VMware merger has the potential to significantly reshape the virtualization landscape. While Broadcom has pledged to continue supporting VMware's existing product lines, the long-term impact on innovation and competition remains uncertain. The acquisition could either stifle innovation due to reduced competition, or it may spur improvements in VMware's offerings through Broadcom's resources. The actual outcome will depend largely on the regulatory decisions and the market’s response.

Conclusion

Broadcom's acquisition of VMware is shrouded in controversy, primarily due to the alleged 1050% price hike and the significant antitrust concerns raised by regulators. The potential impact on VMware customers, the broader software market, and the future of virtualization technology is immense. The merger’s ultimate effects will hinge on regulatory approvals, Broadcom's pricing strategies, and the industry's reaction.

Call to Action: Stay informed about the ongoing developments in the Broadcom-VMware acquisition. Monitor regulatory decisions and industry analysis to understand the long-term implications of this significant deal on software pricing and competition in the virtualization market. Further research into the Broadcom VMware acquisition is crucial to fully understanding its potential effects.

Featured Posts

-

How Instagrams New Video Editor Will Challenge Tik Tok

Apr 24, 2025

How Instagrams New Video Editor Will Challenge Tik Tok

Apr 24, 2025 -

Recent Gains In Hong Kong Analyzing The Rally In Chinese Stocks

Apr 24, 2025

Recent Gains In Hong Kong Analyzing The Rally In Chinese Stocks

Apr 24, 2025 -

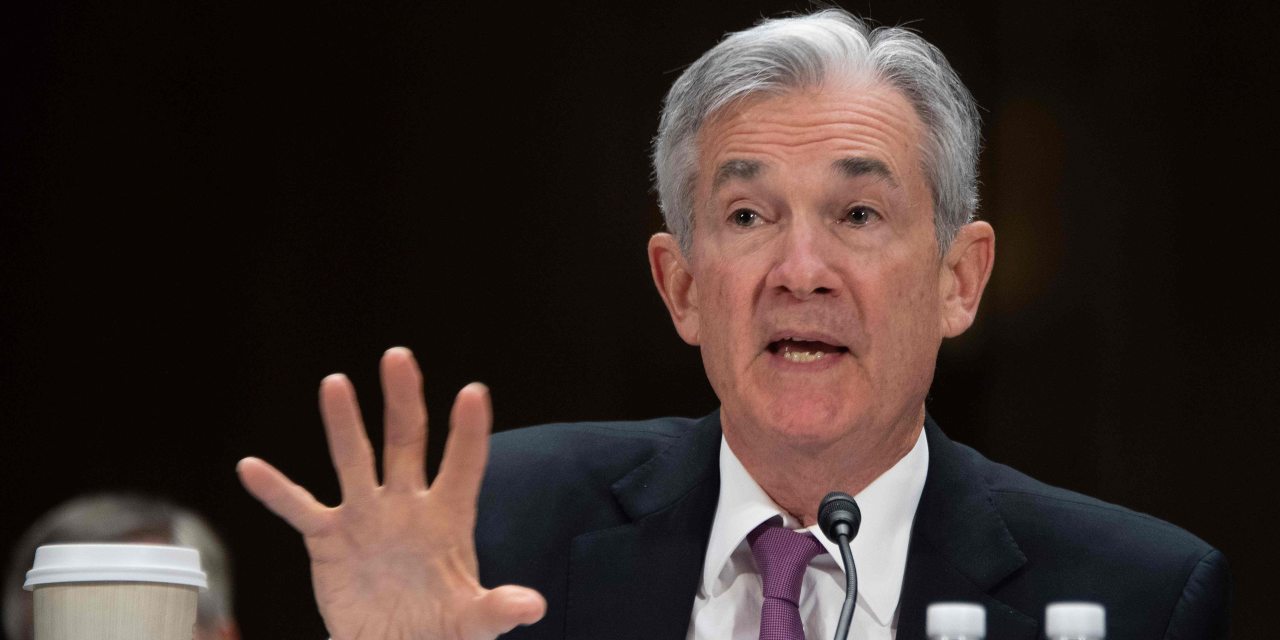

Is Powell Safe Trump Denies Plans To Fire Federal Reserve Chair

Apr 24, 2025

Is Powell Safe Trump Denies Plans To Fire Federal Reserve Chair

Apr 24, 2025 -

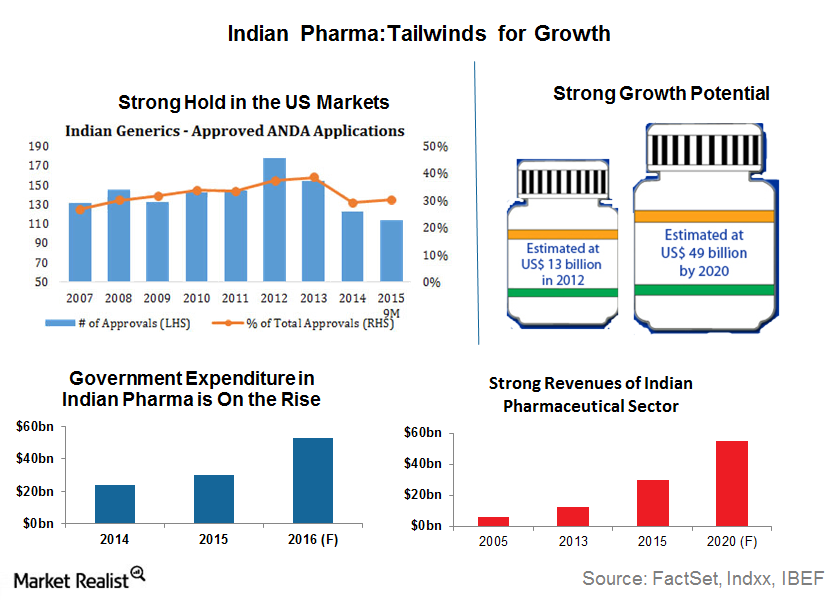

Niftys Ascent Examining The Tailwinds Driving Indias Market

Apr 24, 2025

Niftys Ascent Examining The Tailwinds Driving Indias Market

Apr 24, 2025 -

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Gambling And Disaster

Apr 24, 2025

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Gambling And Disaster

Apr 24, 2025