India Market Buzz: Nifty's Bullish Run Fueled By Positive Trends

Table of Contents

Robust Economic Growth as a Catalyst for Nifty's Rise

India's impressive economic growth has been a primary catalyst for the Nifty's bullish run. Strong GDP figures and positive investor sentiment are intrinsically linked.

GDP Growth and its Impact on Market Sentiment

India's GDP growth has consistently outperformed expectations in recent quarters. This robust growth fuels investor confidence, leading to increased investment in the stock market.

- Manufacturing and Services Sectors Lead: The manufacturing and services sectors have shown remarkable growth, contributing significantly to the overall GDP expansion.

- Positive GDP Forecast Revisions: Reputable economic forecasters have consistently revised their GDP growth predictions upwards, reflecting a positive outlook for the Indian economy. For example, [insert source and specific data point here, e.g., "The IMF recently revised its forecast for India's GDP growth to X% for the fiscal year 2024, up from Y% in its previous projection."].

Increased Foreign Institutional Investor (FII) Inflows

Significant inflows of capital from Foreign Institutional Investors (FIIs) have played a crucial role in propelling the Nifty's rise.

- Record FII Investments: FIIs have poured billions of dollars into the Indian stock market, demonstrating strong confidence in the country's economic prospects. [Insert data and source, e.g., "FII investments totaled $Z billion in the first half of 2024, according to the [Source]." Include a relevant chart or graph here if possible].

- Reasons for Increased Investment: This surge in FII investment is primarily driven by factors such as India's strong economic fundamentals, structural reforms undertaken by the government, and the relatively attractive valuation of Indian equities compared to other global markets.

Government Policies and Initiatives Boosting Investor Confidence

Pro-growth government policies and initiatives have further bolstered investor confidence and contributed to the Nifty's upward trajectory.

- Infrastructure Development: Massive investments in infrastructure development, including roads, railways, and ports, are creating significant economic opportunities and stimulating growth across various sectors.

- Tax Reforms: Simplification and rationalization of tax policies have improved the ease of doing business in India, attracting both domestic and foreign investments. [Provide specific examples of tax reforms here].

- Ease of Doing Business Initiatives: The government's continued efforts to improve the ease of doing business ranking have made India a more attractive destination for investors.

Sector-Specific Drivers Contributing to Nifty's Performance

The Nifty's impressive performance is not solely driven by macroeconomic factors; several sectors have significantly contributed to its rise.

IT Sector's Strong Performance

The Indian IT sector has been a star performer, contributing substantially to the Nifty's growth.

- Global Demand: Strong global demand for IT services has boosted the revenues and profitability of Indian IT companies.

- Technological Advancements: Continuous innovation and adaptation to new technologies have enabled Indian IT firms to stay competitive in the global market.

- Strong Earnings: Robust earnings reports from leading IT companies have further strengthened investor confidence in this sector. [Include data on IT sector growth and market capitalization here].

Financial Services Sector's Robust Growth

The financial services sector has also exhibited strong growth, contributing positively to Nifty's performance.

- Credit Growth: Increased credit growth indicates a healthy economy and rising demand for financial services.

- Lending Activity: Strong lending activity reflects a positive business environment and growing investment opportunities.

- Banking Sector Reforms: Positive reforms in the banking sector have improved efficiency and stability, further boosting investor confidence. [Include relevant data on financial sector growth and market capitalization here].

Positive Outlook for Consumption-Based Sectors

Sectors like Fast-Moving Consumer Goods (FMCG) and automobiles are experiencing positive growth, driven by rising disposable incomes and increased consumer spending.

- Rising Disposable Incomes: Growth in disposable incomes has led to increased consumer spending across various product categories.

- Increased Consumer Spending: Positive consumer sentiment and increased purchasing power are driving growth in consumption-based sectors. [Cite data on consumer confidence indices and spending patterns here].

Analyzing Risks and Potential Challenges

While the outlook for the Nifty is currently positive, it's crucial to acknowledge potential risks and challenges.

Global Economic Uncertainty

Global factors such as inflation, geopolitical tensions, and interest rate hikes pose potential risks to the Indian stock market.

- Inflationary Pressures: High inflation globally can impact investor sentiment and lead to market corrections.

- Geopolitical Tensions: Global geopolitical instability can create uncertainty in the market and affect investor confidence.

- Interest Rate Hikes: Interest rate hikes by central banks globally can impact capital flows into emerging markets like India.

Inflationary Pressures and Their Impact

Inflationary pressures within India could also dampen the bullish run.

- Impact on Consumer Spending: High inflation can reduce consumer spending, affecting the performance of consumption-based sectors.

- Monetary Policy Response: The Reserve Bank of India's response to inflationary pressures through monetary policy adjustments can impact market sentiment.

Potential Market Corrections

The possibility of future market corrections should not be ignored. Investors should adopt a prudent approach.

- Diversification: Diversifying investments across different asset classes and sectors is crucial to mitigate risk.

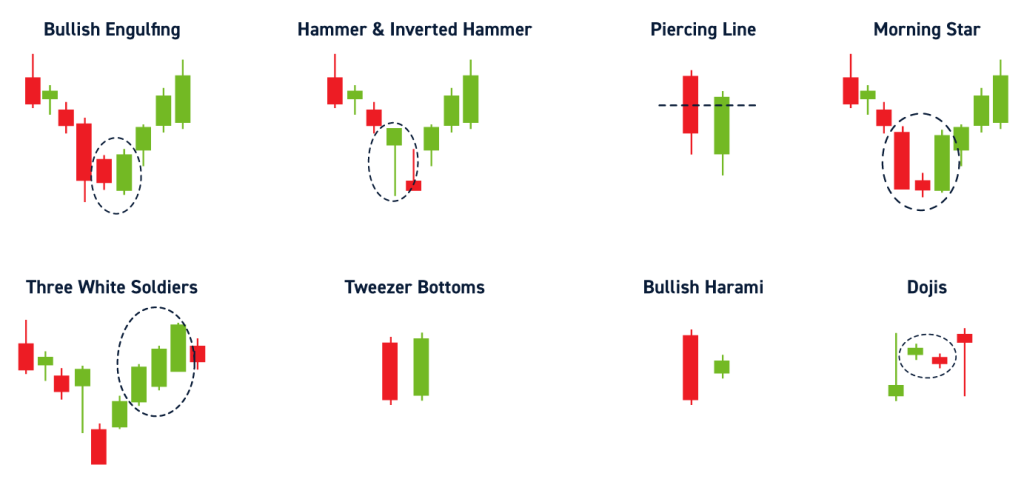

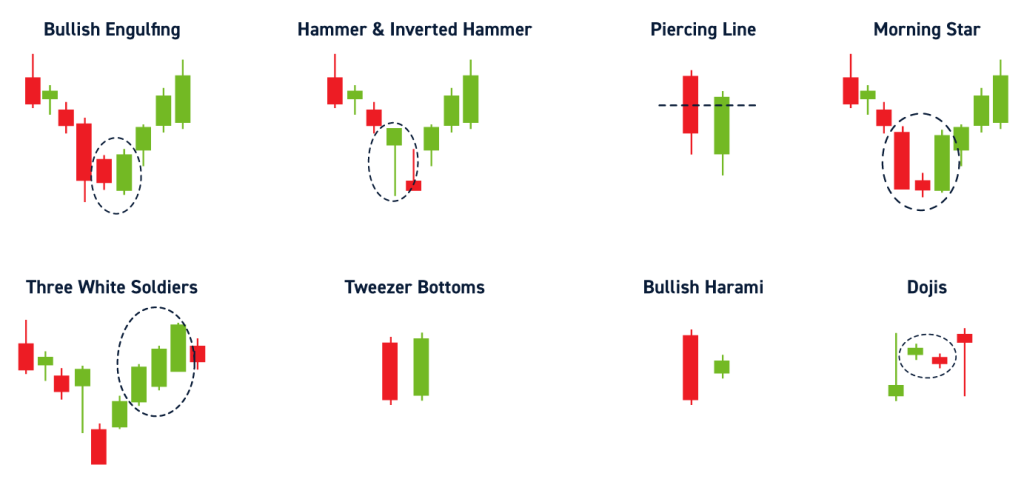

- Risk Management: Implementing appropriate risk management strategies, such as stop-loss orders, is essential.

Conclusion

The Nifty's bullish run is largely attributable to robust economic growth, positive government policies, and strong performance across key sectors. While the outlook appears positive, investors must remain aware of potential risks arising from global uncertainties and inflationary pressures. The India market buzz surrounding the Nifty presents exciting investment opportunities, but thorough research, a well-defined strategy, and diversification are paramount for success. Consult with a financial advisor before making any investment decisions. Learn more about Nifty investment strategies and explore the opportunities within the Indian market today. Stay updated on the latest India market buzz to make informed investment decisions.

Featured Posts

-

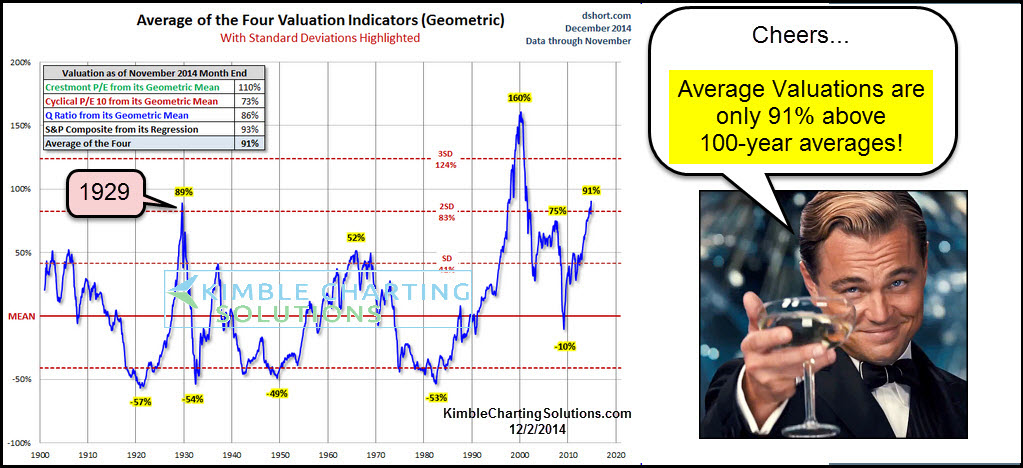

High Stock Market Valuations A Bof A Analysts Case For Investor Calm

Apr 24, 2025

High Stock Market Valuations A Bof A Analysts Case For Investor Calm

Apr 24, 2025 -

Canadian Dollar Slumps Against Major Currencies

Apr 24, 2025

Canadian Dollar Slumps Against Major Currencies

Apr 24, 2025 -

Child Actor Sophie Nyweide Mammoth Noah Dead At 24

Apr 24, 2025

Child Actor Sophie Nyweide Mammoth Noah Dead At 24

Apr 24, 2025 -

Anchor Brewing Companys Closure The Impact On Craft Beer

Apr 24, 2025

Anchor Brewing Companys Closure The Impact On Craft Beer

Apr 24, 2025 -

T Mobile Data Breaches Result In 16 Million Penalty

Apr 24, 2025

T Mobile Data Breaches Result In 16 Million Penalty

Apr 24, 2025