Canadian Dollar Slumps Against Major Currencies

Table of Contents

Factors Contributing to the Canadian Dollar's Weakness

Several interconnected factors contribute to the current weakness of the Canadian dollar. Understanding these factors is crucial for navigating the complexities of the forex market and its impact on the Canadian economy. Keywords: interest rate differential, oil prices, economic growth, inflation, Bank of Canada, global economic uncertainty, geopolitical risks

-

Lower Interest Rates in Canada: Compared to other major economies, Canada's interest rates have been relatively lower. This makes the CAD less attractive to foreign investors seeking higher returns, leading to decreased demand and a weaker currency. The interest rate differential between Canada and other countries like the US significantly influences the CAD/USD exchange rate.

-

Fluctuations in Global Oil Prices: Crude oil is a major export for Canada. Fluctuations in global oil prices directly impact the Canadian economy and the value of the CAD. A decline in oil prices reduces export revenue, weakening the demand for the Canadian dollar in the forex market. This correlation between oil prices and the CAD is well-established and a key factor to consider when analyzing CAD performance.

-

Slower than Expected Economic Growth: Slower-than-anticipated economic growth in Canada dampens investor confidence, leading to capital outflow and a weakening of the CAD. Economic indicators like GDP growth, employment rates, and consumer spending provide valuable insights into the health of the Canadian economy and its impact on the currency.

-

Inflationary Pressures: Rising inflation erodes purchasing power and can lead to a decline in the value of the CAD. The Bank of Canada's response to inflationary pressures through monetary policy adjustments also influences the currency's value. High inflation can make the CAD less attractive compared to currencies in countries with lower inflation.

-

Uncertainty Surrounding the Bank of Canada's Monetary Policy: The Bank of Canada's decisions on interest rates and monetary policy significantly impact the CAD. Uncertainty surrounding future policy adjustments can lead to volatility in the forex market and affect the currency's value. Investors closely monitor the Bank of Canada's announcements and statements for clues about future policy.

-

Global Economic Uncertainty and Geopolitical Risks: Global economic uncertainty, triggered by factors such as geopolitical instability, international trade disputes, and supply chain disruptions, negatively impacts investor sentiment and can lead to a flight to safety, weakening the CAD against more stable currencies. Global events often have a ripple effect on the forex market, impacting currencies like the CAD.

Impact on Canadian Businesses and Consumers

The weakening Canadian dollar has significant repercussions for both Canadian businesses and consumers. Keywords: import costs, export revenue, travel expenses, investment decisions, inflation, purchasing power

-

Increased Import Costs: Businesses importing goods from countries with stronger currencies face higher costs, potentially impacting their profitability and competitiveness. This can lead to price increases for consumers.

-

Reduced Export Revenue: While a weaker CAD can boost export competitiveness in theory, the reality is more nuanced. Reduced demand for Canadian goods in global markets due to other economic factors can offset any positive effects of a weaker currency on export revenue.

-

Higher Travel Expenses: Canadians traveling abroad will find their money buys less, resulting in increased travel expenses.

-

Impact on Foreign Investment: A weaker CAD might attract some foreign investment seeking to capitalize on lower asset prices, but it can also deter investment if the outlook for the Canadian economy is uncertain.

-

Inflation and Purchasing Power: A weaker CAD contributes to higher import prices, fueling inflation and eroding the purchasing power of Canadian consumers. This inflationary pressure puts additional strain on household budgets and can lead to reduced consumer spending.

Potential Future Outlook for the Canadian Dollar

Predicting the future value of any currency is inherently uncertain. However, analyzing current economic forecasts and market trends can provide a clearer picture of potential future scenarios for the Canadian dollar. Keywords: economic forecasts, currency predictions, market analysis, Bank of Canada outlook, future interest rates, global economic recovery, risk assessment

-

Economic Forecasts and Market Predictions: Various economic forecasting agencies and financial institutions regularly publish reports and analyses predicting the future trajectory of the CAD. These reports often consider factors like interest rate differentials, oil prices, and global economic growth.

-

Bank of Canada Outlook: The Bank of Canada’s outlook on interest rates and its monetary policy actions play a pivotal role in shaping the future direction of the Canadian dollar. Their statements and announcements are closely scrutinized by investors.

-

Risks and Uncertainties: Geopolitical risks, global economic shocks, and unexpected changes in commodity prices pose significant uncertainties that could further impact the CAD's value. A thorough risk assessment is essential for any prediction.

-

Potential Recovery Scenarios: The Canadian economy's resilience and the effectiveness of the Bank of Canada's monetary policy will influence the speed and extent of any potential recovery in the CAD's value. Factors like a rebound in oil prices or stronger-than-expected economic growth could contribute to a strengthening of the currency.

Conclusion

The recent slump in the Canadian dollar is a complex issue stemming from a combination of factors including lower interest rates, fluctuating oil prices, slower economic growth, and global uncertainties. This weakness has significant implications for Canadian businesses and consumers, affecting import costs, export revenue, travel expenses, and purchasing power. While predicting the future value of the CAD remains challenging, staying informed about economic indicators, the Bank of Canada's policy decisions, and global events is crucial. Monitor these developments and consult with financial experts to make informed decisions regarding currency exchange and investment strategies. Understanding the dynamics of the Canadian dollar and its relationship with major currencies is critical for navigating the current economic climate.

Featured Posts

-

Canadian Dollar Slumps Against Major Currencies

Apr 24, 2025

Canadian Dollar Slumps Against Major Currencies

Apr 24, 2025 -

Legal Battles Hamper Trumps Immigration Crackdown

Apr 24, 2025

Legal Battles Hamper Trumps Immigration Crackdown

Apr 24, 2025 -

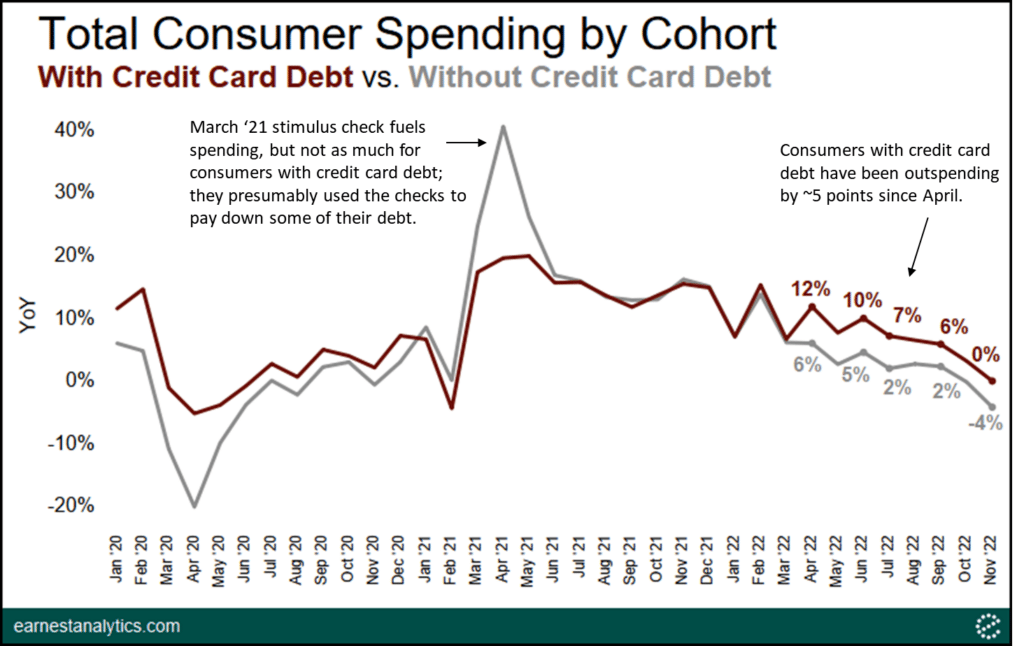

Credit Card Industry Faces Headwinds Amidst Reduced Consumer Spending

Apr 24, 2025

Credit Card Industry Faces Headwinds Amidst Reduced Consumer Spending

Apr 24, 2025 -

Destruction Of The Papal Signet Ring Tradition And The Case Of Pope Francis

Apr 24, 2025

Destruction Of The Papal Signet Ring Tradition And The Case Of Pope Francis

Apr 24, 2025 -

77 Inch Lg C3 Oled Performance And Features

Apr 24, 2025

77 Inch Lg C3 Oled Performance And Features

Apr 24, 2025