Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

Keywords: High Stock Market Valuations, BofA, Stock Market Valuation, Investment Strategy, Market Volatility, High P/E Ratios, Stock Market Analysis, Investment Advice.

The current stock market displays elevated valuations, leaving many investors feeling apprehensive. Images of past market crashes readily spring to mind, fueling anxieties about potential losses. However, Bank of America (BofA) offers a compelling counter-narrative, suggesting that high valuations don't necessarily equate to imminent market crashes. This article explores BofA's perspective and presents arguments supporting a more nuanced view of high stock market valuations. We will delve into their reasoning, address common concerns, and outline strategies for navigating this environment.

BofA's Rationale Behind Dismissing High Valuation Concerns

BofA's analysis suggests that the current high stock market valuations are not solely indicative of an impending market correction. Their rationale rests on several key pillars:

Low Interest Rates as a Supporting Factor

Historically low interest rates significantly impact stock valuations. Lower interest rates decrease the discount rate used in discounted cash flow (DCF) models, which are used to determine the present value of future earnings. This means that future earnings are worth more today, leading to higher present valuations.

- Relationship between Interest Rates and Present Value: Lower interest rates increase the present value of future cash flows, thereby justifying higher Price-to-Earnings (P/E) ratios. A higher P/E ratio indicates that investors are willing to pay more for each dollar of earnings, reflecting a belief in stronger future growth.

- Data Comparison: Current interest rates are significantly lower than historical averages. For example, (insert data comparing current rates to historical averages, referencing a BofA report if possible). This historically low rate environment directly supports higher valuations.

- BofA's Specific Analysis: (Insert a quote or reference directly from a BofA report explaining their stance on low interest rates and their impact on valuations. For example: "BofA analysts argue that the current low interest rate environment...").

Strong Corporate Earnings and Profitability

Despite high valuations, BofA highlights the strength of corporate earnings and profitability. Many companies are demonstrating robust revenue growth and efficient operations, supporting the current market levels.

- Strong Performing Sectors: (Cite examples of strong performing sectors and companies based on BofA's analysis. For example: "BofA points to the technology and healthcare sectors as particularly strong performers...")

- Earnings Growth Data: (Show data comparing current earnings growth to previous periods, referencing a BofA report if available). This sustained earnings growth provides a solid foundation for current valuations.

- BofA's Assessment of Future Earnings: (Discuss BofA's assessment of future earnings potential and growth prospects. For example: "BofA analysts foresee continued earnings growth driven by...")

Long-Term Growth Potential

BofA anticipates continued economic growth, a key factor influencing stock valuations. This optimism stems from several long-term trends:

- Factors Influencing Long-Term Growth: Technological advancements, ongoing innovation, and shifting demographics are expected to fuel long-term economic expansion.

- Long-Term Growth Projections: (Provide data supporting long-term growth projections and explain BofA's methodology. For instance: "BofA projects a [percentage]% annual GDP growth rate over the next [number] years, based on...")

- BofA's Methodology: Briefly describe BofA's approach to forecasting long-term growth, lending credibility to their analysis.

Addressing Common Concerns About High Valuations

Many investors harbor concerns about high valuations, often fueled by past market downturns. Let's address some common myths:

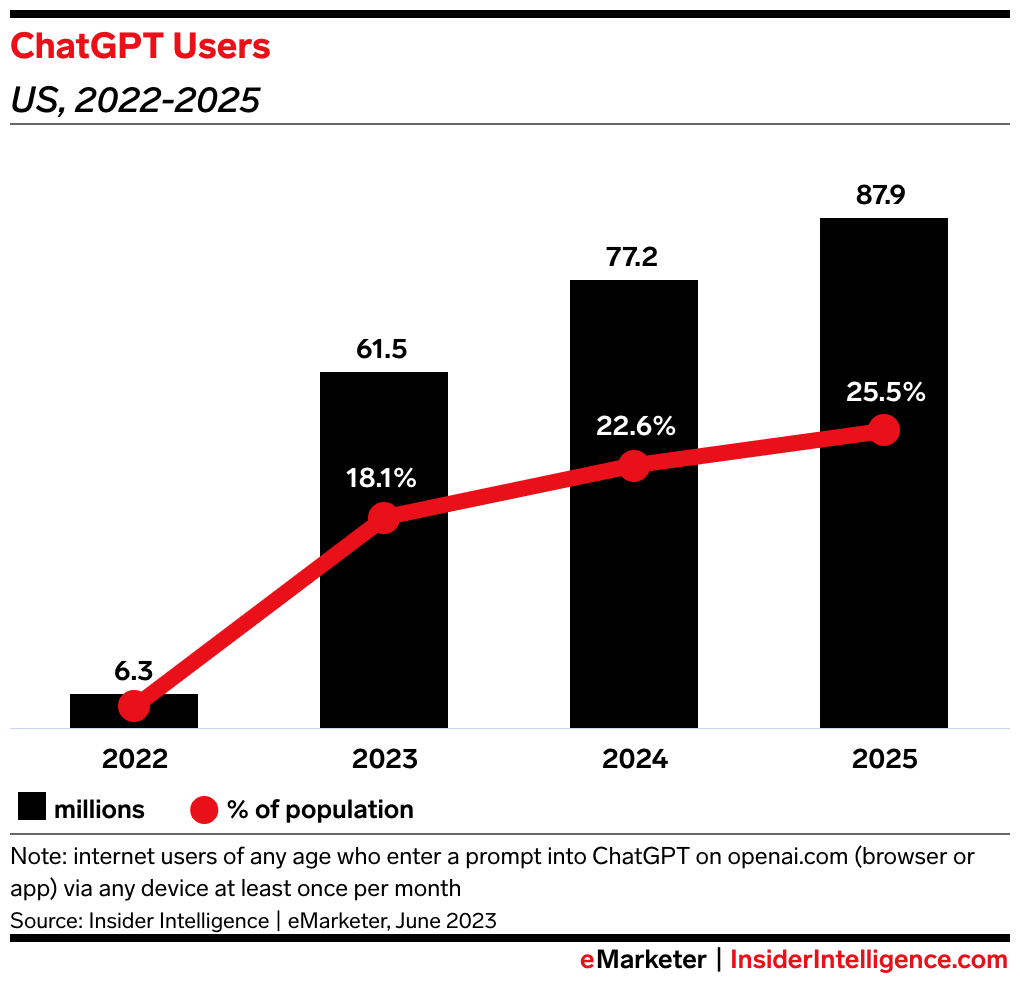

Mythbusting: High P/E Ratios Always Precede a Crash

The notion that high P/E ratios invariably precede market crashes is a simplification. Historical data can be easily misinterpreted; other factors significantly influence market performance.

- Counter-Examples: (Present counter-examples where high valuations didn't lead to immediate market corrections, citing specific instances). This demonstrates that high valuations, while a factor, don't automatically trigger a crash.

- Sectoral Differences: Different sectors react differently to high valuations. Some may be more susceptible to corrections than others.

- Historical Data Visualization: (Provide charts or graphs showcasing historical P/E ratios and market performance to illustrate the point). This visual representation will help solidify the argument.

Managing Risk in a High-Valuation Environment

Even with high valuations, investors can effectively navigate the market by employing prudent risk management strategies:

- Diversification: Spread investments across different asset classes and sectors to reduce risk.

- Value Investing: Focus on undervalued companies with strong fundamentals.

- Dividend-Paying Stocks: Consider stocks offering consistent dividend payments, providing a steady income stream.

- Strategic Asset Allocation: Tailor your portfolio based on your risk tolerance and investment goals.

- BofA's Recommendations: (Mention any specific recommendations from BofA regarding risk management in a high-valuation environment).

The Role of Inflation and Interest Rate Hikes

Inflation and potential interest rate increases are significant factors influencing stock valuations. BofA's analysis likely accounts for these:

- Potential Impact: Inflation erodes purchasing power, impacting corporate profits and potentially leading to higher interest rates which can decrease stock valuations.

- BofA's Inflation and Interest Rate Predictions: (Discuss BofA’s predictions for inflation and interest rates and how these projections are incorporated into their overall assessment of stock valuations.)

- BofA's Account for These Factors: Explain how BofA's analysis explicitly considers the potential impact of inflation and interest rate hikes.

Conclusion

BofA's analysis suggests that high stock market valuations, while noteworthy, don't automatically signal an impending market crash. Strong corporate earnings, historically low interest rates, and projected long-term growth prospects contribute to a more optimistic outlook. However, employing sound risk management strategies remains crucial. Diversification, value investing, and a focus on dividend-paying stocks can help mitigate risk in this environment.

While acknowledging the inherent uncertainties in the market, investors shouldn't necessarily panic over high stock market valuations. Instead, consider BofA's insights and adopt prudent investment strategies to navigate this environment effectively. Learn more about BofA's market research and investment strategies to make informed decisions regarding high stock market valuations and build a resilient portfolio.

Featured Posts

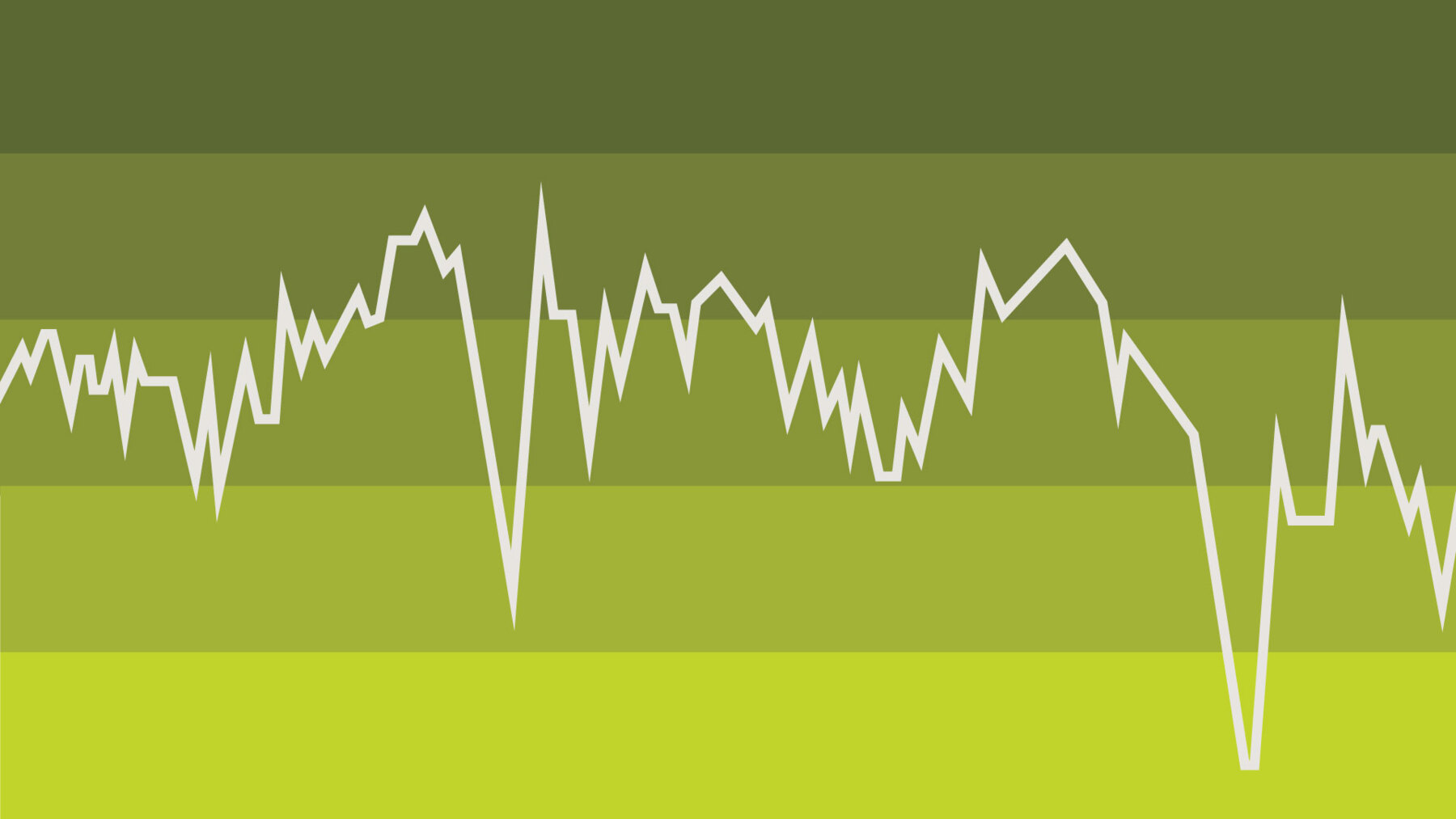

-

Open Ais Chat Gpt The Ftc Investigation And Its Potential Impact

Apr 26, 2025

Open Ais Chat Gpt The Ftc Investigation And Its Potential Impact

Apr 26, 2025 -

Stock Market Valuations Bof As Argument For Investor Calm

Apr 26, 2025

Stock Market Valuations Bof As Argument For Investor Calm

Apr 26, 2025 -

Metas Ceo And The Trump Presidency Challenges And Opportunities

Apr 26, 2025

Metas Ceo And The Trump Presidency Challenges And Opportunities

Apr 26, 2025 -

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 26, 2025

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 26, 2025 -

Elon Musks Network Monetizing Access To Private Company Investments

Apr 26, 2025

Elon Musks Network Monetizing Access To Private Company Investments

Apr 26, 2025