Stock Market Valuations: BofA's Argument For Investor Calm

Table of Contents

BofA's Valuation Metrics and Their Interpretation

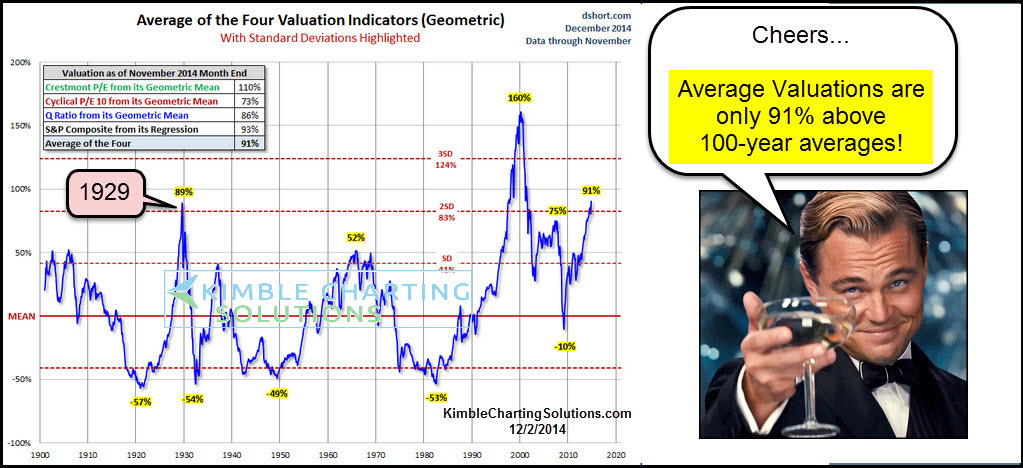

BofA employs a range of established valuation metrics to assess the current state of the market. These include the widely used Price-to-Earnings ratio (P/E), the Shiller PE (CAPE ratio, or cyclically adjusted price-to-earnings ratio), and other proprietary models. Their analysis considers these metrics within a broad historical context, allowing for a nuanced understanding of current valuations.

- BofA's Findings: BofA's recent report (specific report citation needed here if available) indicates that while valuations are elevated compared to historical averages, they are not at levels typically associated with imminent market crashes. For example, the Shiller PE might be above its long-term average, but not drastically so, suggesting a less extreme valuation compared to previous market peaks. (Insert specific numerical data from BofA's report here, e.g., "The Shiller PE currently stands at X, compared to a long-term average of Y").

- BofA's Interpretation: BofA interprets these elevated valuations as reflecting a combination of factors, including low interest rates (historically low, at the time of the report) and strong corporate earnings growth. They argue that these factors partially justify the higher valuations.

- Comparison with Other Analysts: While BofA's view is relatively optimistic, it's important to note that other analysts hold varying perspectives. Some might argue that valuations are excessively high and pose significant downside risk, while others may concur with BofA's assessment of relatively reasonable valuation levels given current economic conditions. Comparing these different views provides a more comprehensive understanding of the current market landscape.

Addressing Concerns About High Inflation and Interest Rates

High inflation and rising interest rates are significant concerns for investors. These factors can impact company profitability and investor sentiment, potentially leading to lower stock prices. BofA addresses these concerns directly in their report.

- Inflation and Interest Rates Already Priced In?: BofA's analysis suggests that a significant portion of the impact of high inflation and interest rates is already reflected in current stock prices. The market, in their view, has largely anticipated these macroeconomic challenges.

- Investor Adjustments: BofA likely recommends that investors adjust their portfolio allocations to account for this increased economic uncertainty. This might involve diversifying into less interest-rate-sensitive assets or adopting a more defensive investment posture.

- Hedging Strategies: Depending on their risk tolerance, BofA may suggest hedging strategies such as utilizing options or other derivative instruments to mitigate potential losses resulting from further interest rate hikes or increased inflation. (Example quote from BofA report needed here).

The Role of Corporate Earnings Growth in Justifying Valuations

BofA's valuation analysis incorporates projections for future corporate earnings growth. This is a crucial component, as strong earnings growth can support higher valuations.

- Earnings Growth Projections: BofA likely provides projections for future earnings growth across various sectors. (Insert specific data and/or ranges from BofA's report here). These projections are crucial to evaluating whether current valuations are sustainable.

- Influence on Valuation View: Stronger-than-expected earnings growth could justify current valuations, while weaker-than-expected growth might suggest that valuations are stretched.

- Earnings Growth and Valuation Relationship: BofA's analysis will demonstrate a direct correlation between projected earnings growth and the justified valuation levels. A chart (if available from BofA's report) illustrating this relationship would visually reinforce this argument.

BofA's Recommendations for Investors

Based on their valuation analysis and macroeconomic considerations, BofA provides specific recommendations for investors.

- Investment Strategy: BofA’s recommendation might be to maintain a relatively balanced portfolio, potentially favoring sectors that are expected to perform well even in a less favorable economic environment. (e.g., defensive sectors like consumer staples or healthcare). A "buy-and-hold" strategy might be suggested, but with a focus on carefully selected, fundamentally sound companies.

- Sector Focus: BofA likely recommends focusing on sectors projected for robust growth, even amidst inflationary pressures and rising interest rates.

- Risk Tolerance: The suggested investment strategy will reflect the level of risk tolerance that BofA deems appropriate for the current market climate. They likely stress the importance of a diversified portfolio and a well-defined risk management plan.

- Risk Assessment: While BofA's outlook is relatively optimistic, they will undoubtedly outline the potential risks associated with their recommendations, including the possibility of further market corrections or economic slowdowns.

Conclusion: Maintaining Calm in the Face of Shifting Stock Market Valuations

BofA's analysis suggests that while stock market valuations are elevated, they are not excessively so when considering macroeconomic factors and projected corporate earnings growth. Their relatively calm assessment offers a counterpoint to the prevailing anxiety surrounding current market conditions. Key takeaways include the importance of considering the broader economic context, understanding the role of earnings growth in supporting valuations, and carefully considering a diversified investment strategy aligned with one’s individual risk tolerance.

Understanding stock market valuations is crucial for informed investment decisions. Conduct your own thorough research, considering various perspectives and incorporating insights like those provided by BofA, to make sound investment choices. Stay informed about current stock market valuations to navigate the market effectively and achieve your long-term financial goals.

Featured Posts

-

Congressional Stock Trading Ban Trumps Stance In Recent Time Interview

Apr 26, 2025

Congressional Stock Trading Ban Trumps Stance In Recent Time Interview

Apr 26, 2025 -

Analysis Trump Administrations Impact On European Ai Rulebook

Apr 26, 2025

Analysis Trump Administrations Impact On European Ai Rulebook

Apr 26, 2025 -

A Geographic Overview Of The Countrys New Business Hotspots

Apr 26, 2025

A Geographic Overview Of The Countrys New Business Hotspots

Apr 26, 2025 -

Trump On Congressional Stock Trading Ban A Time Magazine Interview

Apr 26, 2025

Trump On Congressional Stock Trading Ban A Time Magazine Interview

Apr 26, 2025 -

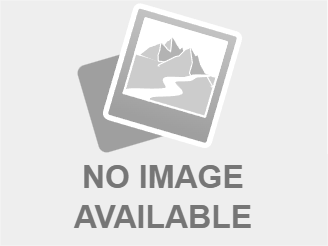

Post Roe America How Over The Counter Birth Control Changes The Game

Apr 26, 2025

Post Roe America How Over The Counter Birth Control Changes The Game

Apr 26, 2025