US Growth To Slow Considerably: Deloitte's Economic Forecast

Table of Contents

Deloitte's reputation for producing insightful and accurate economic analyses makes this forecast particularly noteworthy. Their rigorous methodology and deep understanding of economic trends provide a valuable perspective on the future trajectory of the US economy. Our aim is to dissect the key predictions within Deloitte's report to better understand the challenges and opportunities that lie ahead.

Key Predictions of Deloitte's US Economic Forecast

Deloitte's overall forecast paints a picture of significantly reduced US economic growth in the coming years. This slowdown is projected to be more pronounced than previously anticipated, representing a notable shift from the relatively robust growth experienced in recent years.

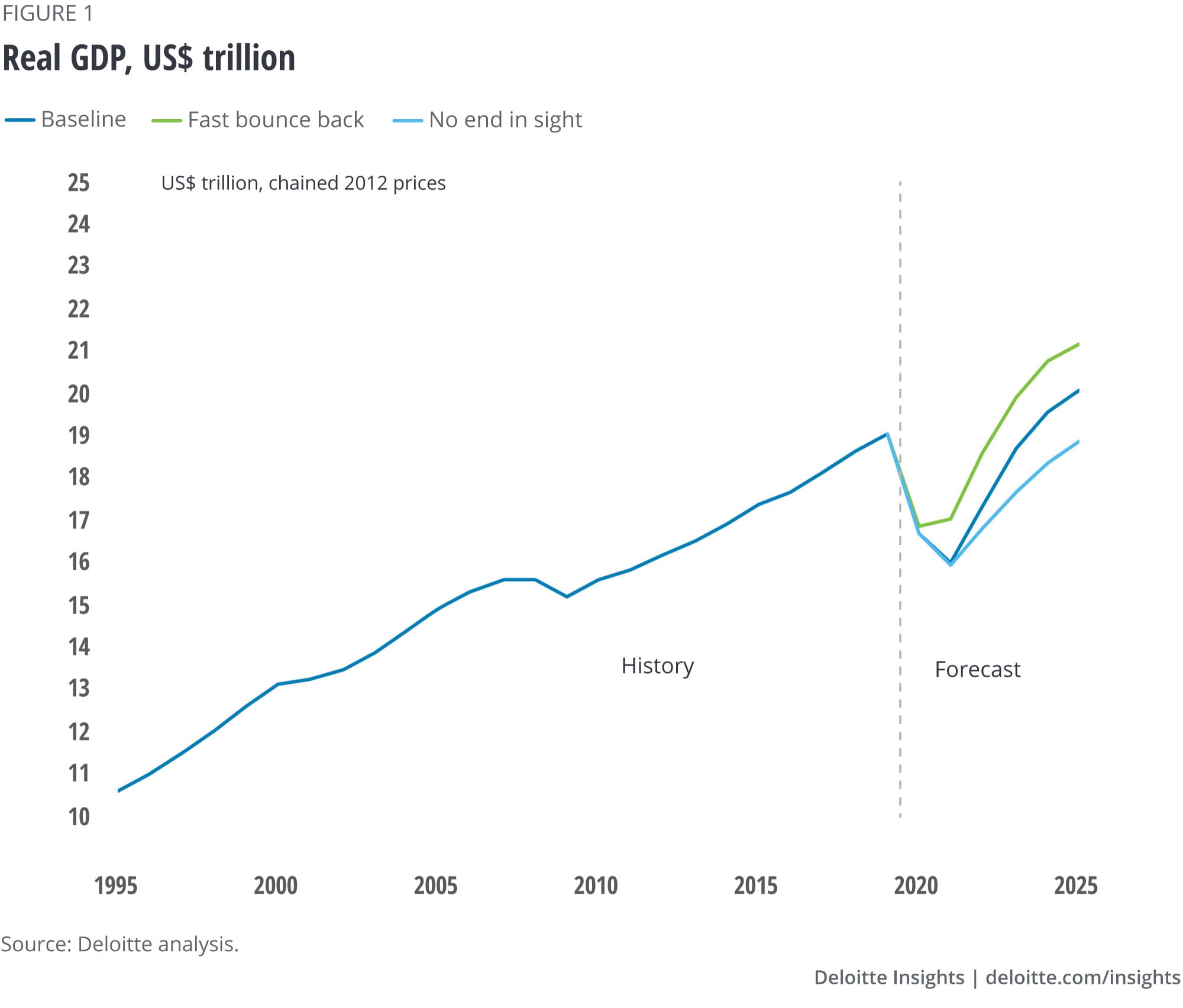

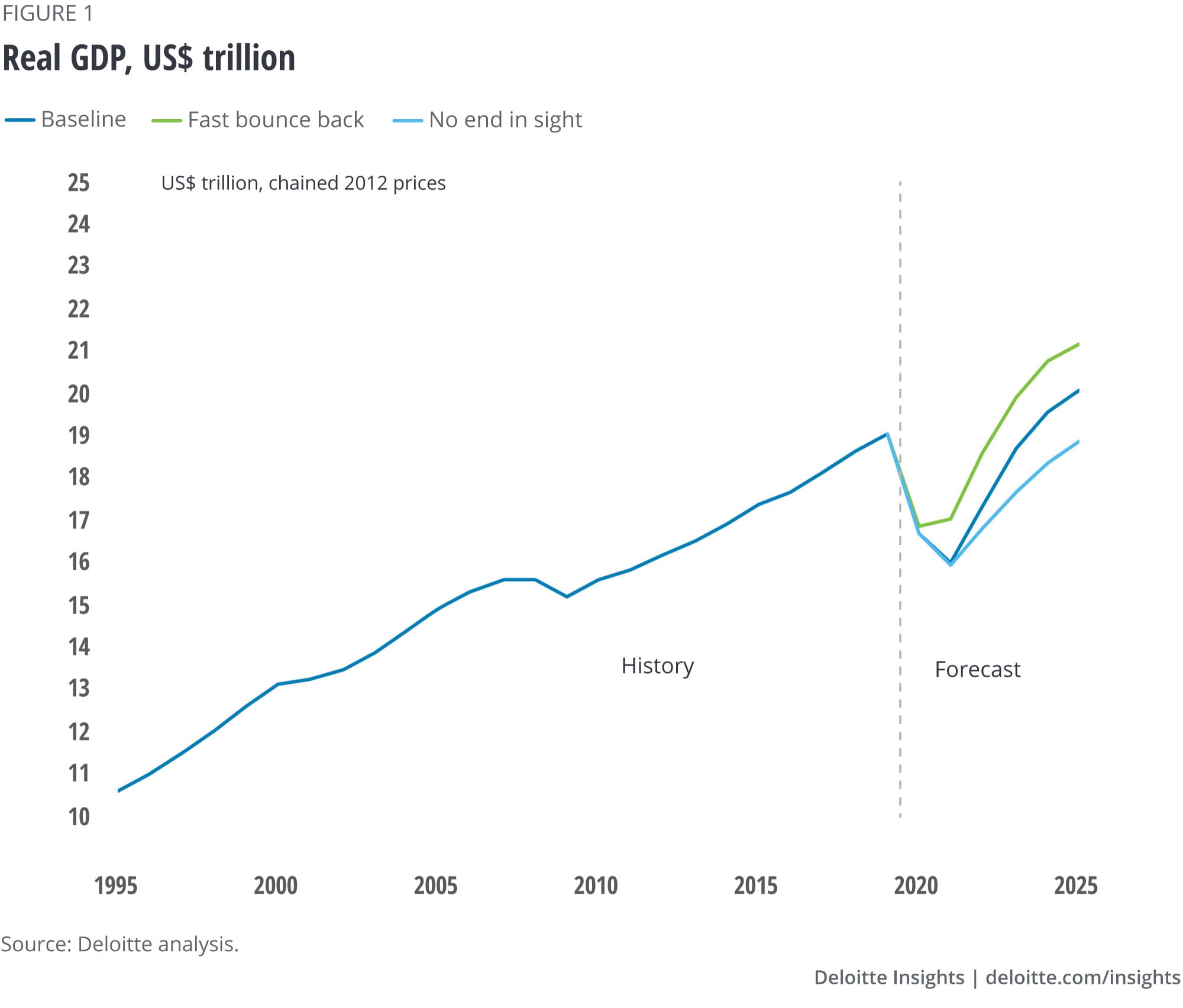

GDP Growth Projections

Deloitte projects a marked decrease in the GDP growth rate. Instead of the robust growth seen in previous years, a more moderate pace is expected.

- 2024: Projected GDP growth of 1.5%, down from 2.5% in 2023.

- 2025: Further slowdown to a projected GDP growth rate of 1.0%.

- 2026: A potential slight recovery to 1.2%, though still significantly below previous years' performance.

These projections represent a considerable economic slowdown compared to the average GDP growth rates observed over the past decade. While Deloitte's forecast remains subject to revision based on evolving economic conditions, the current prediction points to a period of significantly weaker economic outlook.

Inflation and Interest Rates

Deloitte's forecast indicates that inflation rates, while declining from their peak, will remain elevated throughout the forecast period. This persistent inflation, coupled with the Federal Reserve's monetary policy, is expected to lead to continued interest rate hikes, albeit at a slower pace than previously witnessed.

- Projected inflation rate for 2024: 3.0%

- Projected inflation rate for 2025: 2.5%

- Interest rates are expected to peak in mid-2024 before slowly declining.

The interplay between inflation, interest rates, and consumer confidence will be critical in determining the severity and duration of the economic slowdown. High interest rates increase borrowing costs, potentially dampening business investment and consumer spending.

Labor Market Trends

Deloitte's analysis suggests a mixed picture for the US labor market. While unemployment is expected to remain relatively low, significant wage growth is unlikely to keep pace with inflation, potentially impacting consumer confidence and spending power.

- Projected unemployment rate for 2024: 4.0%

- Projected unemployment rate for 2025: 4.5%

- Wage growth is projected to moderate, failing to fully offset the impact of inflation.

The potential for labor shortages in certain sectors remains, although overall labor market dynamics are likely to soften.

Underlying Factors Driving the Slowdown

The projected slowdown in US economic growth is attributed to a confluence of global and domestic factors.

Global Economic Headwinds

Significant global economic uncertainty continues to pose risks.

- Geopolitical risks: Ongoing geopolitical instability and conflicts contribute to global economic uncertainty and disrupt supply chains.

- Supply chain issues: While easing somewhat, lingering supply chain disruptions continue to constrain production and increase costs.

- Trade wars: International trade tensions can lead to increased costs and reduced trade volumes, negatively impacting US economic growth.

These global economic headwinds contribute significantly to the predicted slowdown.

Domestic Economic Challenges

Several domestic economic factors exacerbate the challenges.

- High inflation: Persistent high inflation erodes purchasing power and reduces consumer spending.

- Rising interest rates: Increased borrowing costs stifle business investment and consumer spending.

- Potential consumer spending slowdown: Uncertainty surrounding the economic outlook may lead consumers to curb spending.

These domestic economic factors further amplify the pressure on US economic growth.

Potential Implications of the Slowdown

The projected slowdown carries significant implications across the board.

- Businesses: Reduced investment, hiring freezes, and potential bankruptcies in vulnerable sectors.

- Consumers: Reduced purchasing power, decreased consumer confidence, and potential job losses.

- Overall economy: Potential for a mild recession, increased market volatility, and slower economic recovery.

Understanding these potential implications is crucial for navigating the economic landscape ahead.

Navigating the Slowdown in US Economic Growth

Deloitte's forecast underlines a substantial slowdown in US economic growth, driven by a combination of global and domestic factors, impacting the GDP growth rate, inflation, interest rates, and labor markets. Understanding these predictions is vital for businesses and investors to adapt their strategies and mitigate potential risks. For a complete and detailed analysis of the US economic outlook and to formulate effective responses to the projected challenges and opportunities, we urge you to consult Deloitte's full report. [Link to Deloitte's Report Here]. Understanding the nuances of the US growth forecast and US economic projections is key to navigating this period of economic transition.

Featured Posts

-

Open Thread Community Discussion February 16 2025

Apr 27, 2025

Open Thread Community Discussion February 16 2025

Apr 27, 2025 -

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025 -

February 16 2025 Open Thread For Community Discussion

Apr 27, 2025

February 16 2025 Open Thread For Community Discussion

Apr 27, 2025 -

Ariana Grandes Dramatic Hair And Tattoo Transformation

Apr 27, 2025

Ariana Grandes Dramatic Hair And Tattoo Transformation

Apr 27, 2025 -

Movies And Shows To Watch On Kanopy A Free Streaming Guide

Apr 27, 2025

Movies And Shows To Watch On Kanopy A Free Streaming Guide

Apr 27, 2025