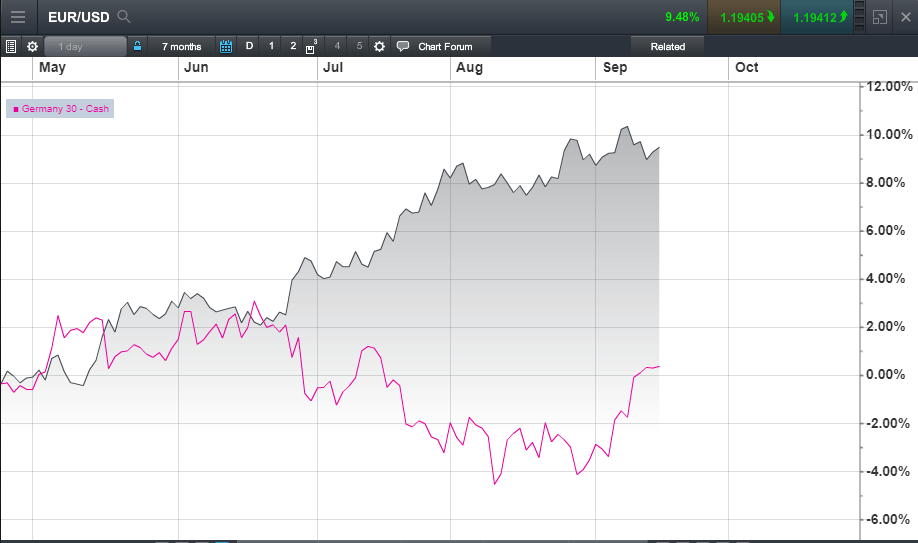

The Dax's Reaction To German Elections And Economic Indicators

Table of Contents

The Influence of German Elections on the DAX

German election results significantly impact investor sentiment and consequently, the DAX's performance. The formation of a new coalition government, the policies it promises, and the overall level of political stability all play a crucial role. Policy uncertainty, a common feature during coalition negotiations, can introduce volatility into the market.

-

Analysis of past election cycles and their immediate effect on the DAX: Examining previous election cycles reveals a clear correlation between election outcomes and short-term DAX fluctuations. For example, periods of strong coalition formation often lead to increased investor confidence and a rise in the DAX, while prolonged negotiations or unexpected results can trigger market uncertainty and declines.

-

Examination of policy promises from major parties and their potential implications for the German economy: Major parties' policy promises on fiscal policy, environmental regulations, and social welfare programs can significantly influence investor expectations. For instance, promises of increased government spending might boost investor confidence in certain sectors while simultaneously raising concerns about inflation. Conversely, promises of fiscal austerity may dampen short-term growth but could appeal to investors seeking long-term stability.

-

Discussion of the impact of coalition negotiations and the formation of a stable government on market stability: The time it takes to form a stable government after an election can create market uncertainty. Prolonged negotiations can lead to periods of high volatility, as investors wait for clarity on future policy directions. A swift and decisive formation of a coalition government usually translates into increased market stability and confidence.

-

The role of political uncertainty in creating volatility in the DAX: Political uncertainty is a major driver of DAX volatility. Unclear policy outcomes, potential shifts in government priorities, and the risk of political instability can all lead to increased market fluctuations, making it challenging for investors to predict market movements.

Key Economic Indicators and Their Impact on the DAX

Major economic indicators such as GDP growth, inflation rate, unemployment rate, consumer confidence, Purchasing Managers' Index (PMI), and interest rates profoundly influence the DAX's performance. The Bundesbank's monetary policy decisions and the broader Eurozone economy also play significant roles.

-

Explanation of how GDP growth, inflation, and unemployment affect investor sentiment and market valuations: Strong GDP growth generally translates to increased corporate earnings and higher investor confidence, leading to a rise in the DAX. Conversely, high inflation erodes purchasing power and can negatively impact corporate profits, potentially leading to a DAX decline. High unemployment rates signal a weakening economy, also negatively impacting investor sentiment.

-

Discussion of the significance of PMI and consumer confidence indices as leading indicators: The PMI and consumer confidence indices provide valuable insights into the future direction of the economy. A rising PMI indicates expanding manufacturing activity, while strong consumer confidence suggests increased spending and economic growth. These leading indicators can help predict future DAX movements.

-

Analysis of the impact of interest rate changes by the European Central Bank (ECB) on the DAX: ECB interest rate changes significantly affect the DAX. Lower interest rates generally stimulate borrowing and investment, boosting economic growth and potentially leading to a DAX rise. Higher interest rates, intended to combat inflation, can slow economic activity and potentially lead to a DAX decline.

-

The influence of global economic conditions and the Eurozone economy on the German market: Germany's export-oriented economy is highly sensitive to global economic conditions and the performance of the Eurozone. Global economic slowdowns or crises in the Eurozone can negatively impact German companies and the DAX.

-

The role of the Bundesbank's monetary policy decisions: The Bundesbank, Germany's central bank, plays a crucial role in influencing the DAX through its monetary policy decisions. Its actions, often coordinated with the ECB, influence interest rates, credit availability, and ultimately, economic activity and investor sentiment.

Inflation's Impact on the DAX

Inflation's effect on the DAX is multifaceted. High inflation erodes purchasing power, impacting consumer spending and corporate profitability. It can also lead to the ECB raising interest rates, potentially slowing economic growth. The DAX's reaction to inflation depends on the interplay of these factors and investor expectations about future inflation. Companies with pricing power might be less affected than others, making sector-specific analysis essential.

Understanding the Interplay Between Elections and Economic Indicators

The effects of elections and economic indicators are not mutually exclusive but rather interact in complex ways. Election outcomes can exacerbate existing economic challenges or, conversely, provide a boost during periods of economic uncertainty.

-

Examples of situations where election outcomes exacerbated existing economic challenges or conversely mitigated negative economic trends: For example, a government prioritizing austerity measures during a recession might further dampen economic growth, impacting the DAX negatively. Conversely, a government implementing stimulus packages during a downturn could help mitigate the negative effects and support the DAX.

-

Discussion of strategies for investors to navigate the uncertainty created by this interplay: Diversification, hedging strategies, and a thorough understanding of macroeconomic factors are crucial for investors navigating this complex interplay. Regular monitoring of economic indicators and political developments helps in informed decision-making.

-

Importance of considering both short-term and long-term impacts: Investors need to consider both short-term market volatility and long-term economic trends when making investment decisions. While elections can create short-term uncertainty, the long-term economic policies of the new government have more significant implications for the DAX's future performance.

Conclusion

The DAX's performance is intricately linked to both German elections and key economic indicators. Understanding this complex relationship is vital for making informed investment decisions. Political stability, economic growth, inflation rates, and ECB policies all play significant roles in shaping the DAX's trajectory. Investors must continuously monitor these factors to navigate the dynamic landscape of the German stock market successfully. Stay ahead of the curve by regularly monitoring German elections and key economic indicators to optimize your DAX investment strategy. Further research into the Bundesbank's monetary policy statements and analyses from reputable financial institutions will provide deeper insights into future DAX performance.

Featured Posts

-

20

Apr 27, 2025

20

Apr 27, 2025 -

Jabeur Falls To Rybakina In Hard Fought Mubadala Open Match

Apr 27, 2025

Jabeur Falls To Rybakina In Hard Fought Mubadala Open Match

Apr 27, 2025 -

Pne Ag Veroeffentlichung Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Pne Ag Veroeffentlichung Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Posthaste Uncertain Future For Canadian Auto Workers Amidst Trump Tariff Threats

Apr 27, 2025

Posthaste Uncertain Future For Canadian Auto Workers Amidst Trump Tariff Threats

Apr 27, 2025 -

Monte Carlo Masters 2025 Djokovics Straight Sets Loss To Tabilo

Apr 27, 2025

Monte Carlo Masters 2025 Djokovics Straight Sets Loss To Tabilo

Apr 27, 2025