U.S. Dollar's Bleak Outlook: Worst Start Since Nixon?

Table of Contents

Inflation and the U.S. Dollar's Decline

Persistent Inflation Eroding Purchasing Power

High inflation is a primary driver of the U.S. dollar's decline. Persistent increases in the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) index are eroding the purchasing power of the dollar, both domestically and internationally.

- Reduced Real Income: Inflation reduces the real value of wages and savings, leading to decreased consumer spending and overall demand for the dollar.

- Weakened Consumer Confidence: High inflation fuels uncertainty and pessimism, further dampening consumer spending and investment.

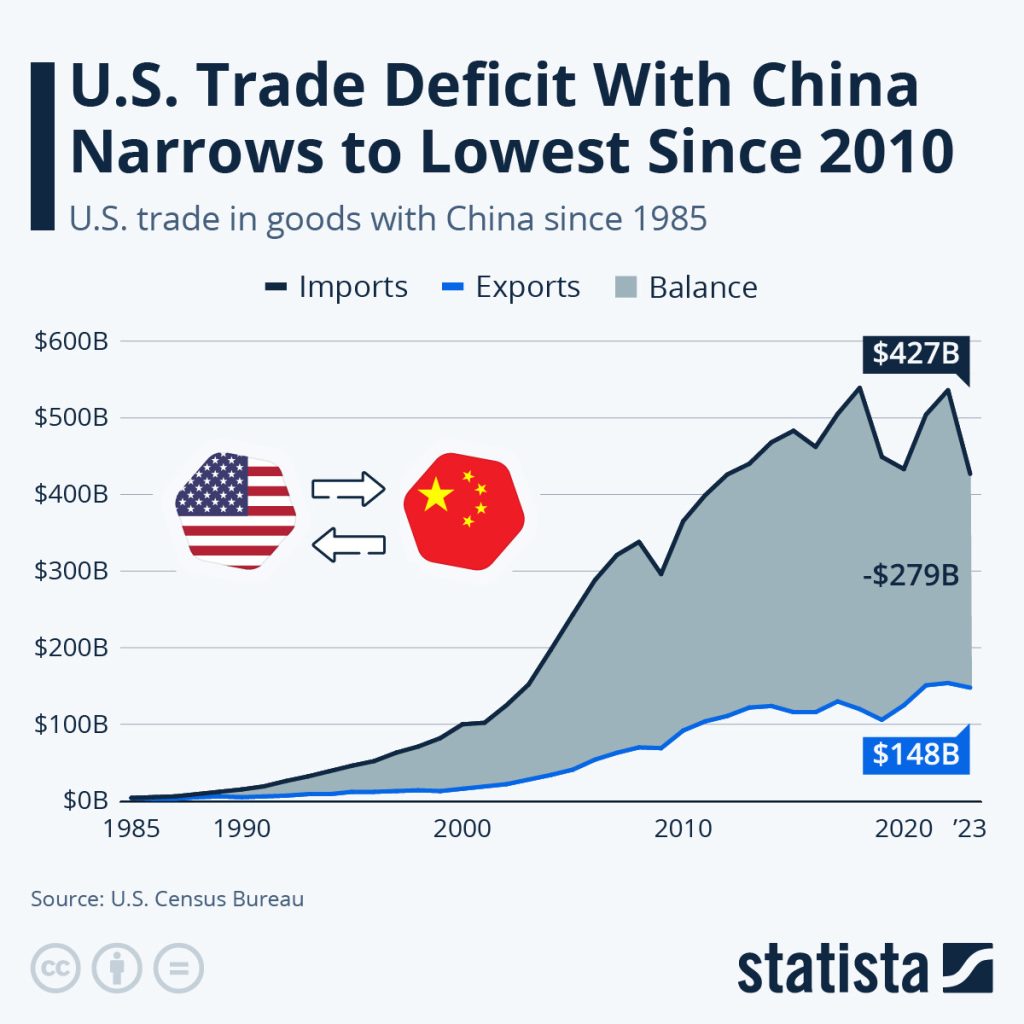

- International Impact: A weaker dollar makes U.S. goods and services more expensive for foreign buyers, impacting exports and the U.S. trade balance.

The Federal Reserve's Response and its Limitations

The Federal Reserve (Fed) has responded to inflation by aggressively raising interest rates, aiming to cool down the economy and curb price increases. However, these actions have limitations and potential drawbacks.

- Recessionary Risks: Aggressive interest rate hikes can stifle economic growth, potentially leading to a recession.

- Quantitative Tightening: The Fed's quantitative tightening policy, aimed at reducing the money supply, also carries risks of disrupting financial markets and slowing economic activity.

- Market Volatility: The Fed's actions often cause significant volatility in financial markets, impacting the dollar's value in the short term.

Geopolitical Factors and the Dollar's Global Role

The War in Ukraine and Energy Prices

The ongoing war in Ukraine has significantly impacted global energy markets, contributing to inflationary pressures and dollar weakness.

- Energy Price Volatility: The conflict has disrupted global energy supplies, leading to volatile energy prices that fuel inflation globally.

- Sanctions and Economic Disruption: International sanctions imposed on Russia have further destabilized the global economy, affecting the demand for the dollar.

- Uncertainty and Risk Aversion: Geopolitical uncertainty leads to increased risk aversion in global financial markets, impacting the attractiveness of the dollar as a safe-haven asset.

Rise of Alternative Currencies and De-Dollarization Efforts

Several countries are actively seeking to diversify their foreign exchange reserves away from the U.S. dollar, signaling a potential decline in the dollar's dominance.

- De-dollarization Initiatives: Countries like China and Russia are actively promoting alternative payment systems and seeking to reduce their reliance on the dollar.

- BRICS Nations' Influence: The BRICS nations (Brazil, Russia, India, China, and South Africa) are exploring alternatives to the dollar-dominated global financial system.

- Cryptocurrencies and Digital Assets: The rise of cryptocurrencies and digital assets presents a potential challenge to the dollar's hegemony, offering alternative store-of-value options.

Comparing the Current Situation to the Post-Nixon Era

The Nixon Shock and its Long-Term Consequences

The Nixon shock of 1971, which involved closing the gold window and ending the Bretton Woods system, marked a significant shift in the global monetary system.

- End of the Gold Standard: The abandonment of the gold standard led to a transition to a fiat currency system, making the dollar's value dependent on government policy and market forces.

- Increased Currency Volatility: The post-Nixon era saw increased volatility in exchange rates and a more complex global monetary landscape.

- Inflationary Pressures: The shift away from the gold standard contributed to inflationary pressures in the following decades.

Similarities and Differences Between Then and Now

While the current situation presents certain similarities to the post-Nixon era, there are also key differences.

- Similarities: Both periods feature high inflation and significant geopolitical uncertainty.

- Differences: Globalization and technological advancements, particularly the rise of digital currencies, are key differences between the two eras. The current situation also involves a more interconnected global economy, potentially amplifying the effects of dollar weakness. The speed and scale of de-dollarization efforts also differ significantly.

Conclusion

The U.S. dollar's bleak outlook is a result of a complex interplay of persistent inflation, geopolitical instability, and growing de-dollarization efforts. While the current situation shares some similarities with the post-Nixon era, the speed and scale of the ongoing changes present unique challenges. Understanding the factors contributing to this concerning situation is crucial for navigating the current economic landscape. Stay informed about upcoming economic data and consider diversifying your portfolio to mitigate risks associated with the potential decline of the U.S. dollar. The future of the U.S. dollar remains uncertain, demanding careful consideration of its prospects in the evolving global financial system.

Featured Posts

-

Analyzing The Mets Rival A Starting Pitchers Breakout Season

Apr 28, 2025

Analyzing The Mets Rival A Starting Pitchers Breakout Season

Apr 28, 2025 -

China Eases Trade Tensions Targeted Tariff Exemptions For Us Products

Apr 28, 2025

China Eases Trade Tensions Targeted Tariff Exemptions For Us Products

Apr 28, 2025 -

Jetour Dashing Pamer Tiga Pilihan Warna Baru Di Iims 2025

Apr 28, 2025

Jetour Dashing Pamer Tiga Pilihan Warna Baru Di Iims 2025

Apr 28, 2025 -

Emotional Goodbye Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025

Emotional Goodbye Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025 -

Creditor Seeks Financial Transparency From Denise Richards Husband

Apr 28, 2025

Creditor Seeks Financial Transparency From Denise Richards Husband

Apr 28, 2025