Creditor Seeks Financial Transparency From Denise Richards' Husband

Table of Contents

The Creditor's Claim and the Demand for Financial Transparency

At the heart of the legal dispute lies a creditor's claim against Aaron Phypers, reportedly stemming from unpaid loans related to a business venture. The exact nature of the debt remains partially undisclosed due to ongoing legal proceedings, however, the creditor is aggressively pursuing financial transparency to ascertain the full extent of Phypers' assets and liabilities. Their demand for transparency is rooted in their inability to secure repayment despite repeated attempts to contact Phypers.

The creditor's request for financial transparency includes a comprehensive range of documents:

- Bank statements covering the past several years.

- Tax returns, both personal and business-related.

- Detailed business records, including contracts, invoices, and profit and loss statements.

- Records of all assets, including real estate holdings, investments, and personal property.

The creditor's primary concern is the perceived lack of cooperation and the obfuscation of financial information by Phypers, raising serious doubts about his ability and willingness to repay the debt. The legal grounds for their demand are based on standard contract law and the creditor’s right to pursue all available legal avenues to recover the outstanding amount. This includes the right to demand full financial disclosure to assess Phypers' capacity to repay the debt.

Denise Richards' Involvement and Potential Implications

Denise Richards' involvement stems from her marital relationship with Aaron Phypers. Depending on the jurisdiction and the nature of the assets involved, community property laws could expose Richards' personal assets to potential legal action by the creditor. This is a significant consideration, as the legal ramifications for both Richards and Phypers are substantial.

The creditor could potentially take several legal actions against Richards, depending on the specifics of the case:

- Filing a lawsuit seeking to attach community property assets to satisfy the debt.

- Seeking a judgment against Richards if her financial dealings are deemed intertwined with Phypers' business ventures.

- Pursuing legal action if Richards is found to have knowingly participated in concealing assets or obstructing the creditor's efforts to collect the debt.

The potential impact on Richards' personal finances and reputation is considerable, underscoring the far-reaching consequences of a lack of financial transparency in a marital context. The case highlights the critical importance of understanding the legal implications of financial entanglements within a marriage, particularly where business dealings are involved.

The Importance of Financial Transparency in Business and Personal Relationships

Maintaining financial transparency, both in business and personal relationships, is crucial for avoiding disputes and building strong, trusting partnerships. Open and honest financial communication fosters a foundation of mutual understanding and accountability. The benefits are multifaceted:

- Protection against legal disputes and financial difficulties: Clear financial records provide a robust defense against accusations of fraud, misrepresentation, or breach of contract.

- Strengthening trust and communication in personal relationships: Open communication about finances promotes transparency and avoids misunderstandings that can erode the relationship.

- Ensuring smooth business operations and preventing conflicts: Shared financial information facilitates collaborative decision-making, prevents misunderstandings and ensures smooth business operations.

Best Practices for Maintaining Financial Transparency

Implementing best practices for financial transparency is a proactive approach to safeguarding against future difficulties. This involves:

- Regularly reviewing financial records to detect any discrepancies or inconsistencies.

- Maintaining clear and organized documentation of all financial transactions.

- Establishing open communication with financial partners, including spouses and business associates.

- Seeking professional financial advice from accountants and lawyers to ensure compliance with all relevant laws and regulations. This ensures proper legal and accounting practices are followed.

Conclusion

The case of the creditor seeking financial transparency from Denise Richards' husband serves as a stark reminder of the crucial role transparency plays in both personal and professional financial matters. Failure to maintain clear and accessible financial records can lead to significant legal battles and severe financial repercussions. By prioritizing financial transparency and implementing best practices, individuals and businesses can protect themselves from potential liabilities and build stronger, more stable relationships. Learn more about the importance of financial transparency and how to protect yourself from similar situations by consulting with legal and financial professionals.

Featured Posts

-

Fealyat Fn Abwzby Tbda 19 Nwfmbr

Apr 28, 2025

Fealyat Fn Abwzby Tbda 19 Nwfmbr

Apr 28, 2025 -

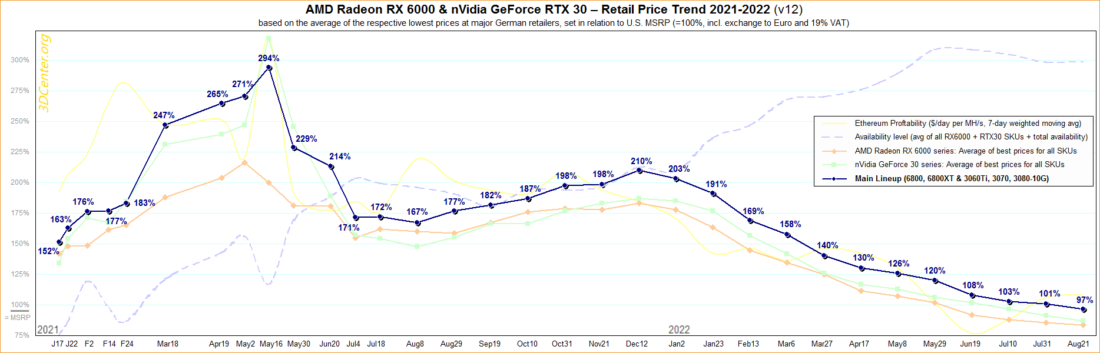

The Resurgence Of High Gpu Prices Factors And Forecasts

Apr 28, 2025

The Resurgence Of High Gpu Prices Factors And Forecasts

Apr 28, 2025 -

Analyzing The Market Crash Professional Selling And Retail Investor Response

Apr 28, 2025

Analyzing The Market Crash Professional Selling And Retail Investor Response

Apr 28, 2025 -

Mwedna Me Fn Abwzby 19 Nwfmbr

Apr 28, 2025

Mwedna Me Fn Abwzby 19 Nwfmbr

Apr 28, 2025 -

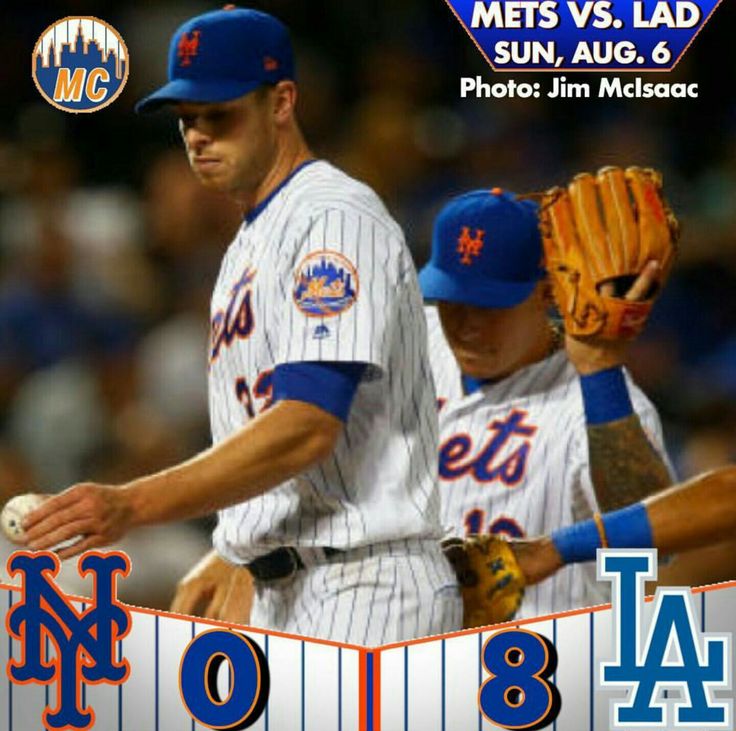

6 3 Twins Victory Mets Lose Second Game Of Series

Apr 28, 2025

6 3 Twins Victory Mets Lose Second Game Of Series

Apr 28, 2025