Trump Vows To Ban Congressional Stock Trading: Key Takeaways From Time Interview

Table of Contents

The Core Proposal: A Complete Ban on Congressional Stock Trading

Donald Trump's proposed ban on congressional stock trading aims for a complete prohibition of all stock transactions by members of Congress, their spouses, and their dependent children. This comprehensive approach seeks to eliminate any potential for conflicts of interest arising from financial investments influencing legislative decisions.

- Complete Prohibition: No buying, selling, or trading of individual stocks, bonds, or other securities.

- Encompassing Family Members: The ban extends to spouses and dependent children to prevent circumvention.

- Blind Trusts: While not explicitly stated in the Time interview, the potential use of blind trusts as an alternative might be considered to manage assets without direct involvement.

- Enforcement Mechanisms: The specifics of enforcement, including oversight bodies and penalty structures, remain largely undefined in Trump's proposal, posing a significant hurdle for implementation.

Implementing such a sweeping ban presents considerable legal and logistical challenges. Questions remain about the constitutionality of restricting lawmakers' personal financial activities, as well as the practical difficulties of monitoring compliance across hundreds of representatives and senators. The potential for legal challenges from affected individuals is also significant.

Reasons Behind Trump's Call for a Ban

Trump's call for a ban on congressional stock trading stems from a profound concern about conflicts of interest and the erosion of public trust in government. His arguments center around the idea that the current system allows for undue influence on legislation, potentially benefiting specific companies or industries at the expense of the broader public interest.

- Preventing Conflicts of Interest: The core argument is that the ability to profit from stock market movements based on inside knowledge gained through legislative activity undermines the integrity of the process.

- Restoring Public Trust: Trump views the ban as crucial for regaining public confidence in the government's commitment to ethical conduct.

- Enhancing Government Transparency: A ban would enhance the transparency of lawmakers' financial dealings, reducing the scope for speculation and suspicion.

- Political Motivation: While advocating for ethical reform, the proposal also carries significant political implications, potentially garnering support from voters disillusioned by perceived corruption in Washington.

The political motivations behind this proposal are multifaceted, potentially serving as both a genuine attempt at reform and a strategic move to gain political advantage.

Potential Impacts and Consequences of a Congressional Stock Trading Ban

A congressional stock trading ban could have profound consequences, both positive and negative. While it holds the potential to significantly improve public trust and reduce perceptions of corruption, it also presents certain drawbacks that need careful consideration.

- Positive Impacts:

- Increased public trust in government.

- Reduced perception of corruption and insider trading.

- Strengthened ethical standards for elected officials.

- Negative Impacts:

- Potential deterrent to qualified individuals seeking public office, particularly those with substantial personal wealth.

- Increased bureaucratic burden in monitoring compliance.

- Possible unintended consequences, like creating new loopholes or increasing reliance on alternative investment strategies.

Experts and politicians hold differing opinions on the matter. While some strongly support the ban as a necessary step for ethical reform, others express concerns about its potential negative impacts on attracting talented individuals to public service.

Comparison to Existing Regulations and Other Countries' Practices

Currently, US regulations governing congressional stock trading are relatively weak. The Stop Trading on Congressional Knowledge (STOCK) Act of 2012 attempted to address some of these issues, but it has proven insufficient to prevent conflicts of interest. This necessitates a more comprehensive approach.

- Limitations of Current Laws: The STOCK Act suffers from loopholes and weak enforcement mechanisms.

- International Best Practices: Several countries have stricter regulations, including outright bans or stricter reporting requirements. These provide valuable case studies for crafting effective policies. For example, New Zealand's relatively stringent rules could offer valuable insights.

A comparison with international standards reveals a spectrum of approaches, ranging from strict bans to more lenient disclosure requirements. Learning from best practices in other countries could be instrumental in designing an effective and comprehensive ban in the US.

Conclusion: The Future of Congressional Stock Trading: Actionable Insights from Trump's Proposal

Trump's proposed ban on congressional stock trading, as highlighted in the Time interview, represents a significant potential step towards greater government transparency and ethical reform. While the specifics of implementation and potential challenges remain, the core proposal – a complete ban encompassing family members – addresses the pressing need to restore public trust in government. The potential positive consequences, such as increased transparency and reduced perception of corruption, outweigh the potential negative impacts.

This call for a ban highlights the growing demand for stronger ethical standards in government. We encourage you to learn more about this issue, contact your representatives to voice your opinion, and participate in the ongoing discussion surrounding congressional stock trading bans and ethical reforms. The future of government transparency and public trust hinges on effective action. Engage in the conversation about ethical reform and a potential Congressional stock trading ban.

Featured Posts

-

How The Trump Administration Pressured Europe On Its Ai Rulebook

Apr 26, 2025

How The Trump Administration Pressured Europe On Its Ai Rulebook

Apr 26, 2025 -

Stock Market Analysis Dow Futures Chinas Economic Response And Tariff Concerns

Apr 26, 2025

Stock Market Analysis Dow Futures Chinas Economic Response And Tariff Concerns

Apr 26, 2025 -

Military Base Power Play Us And China Vie For Influence

Apr 26, 2025

Military Base Power Play Us And China Vie For Influence

Apr 26, 2025 -

Nintendo Switch 2 Pre Order Game Stop In Store Experience

Apr 26, 2025

Nintendo Switch 2 Pre Order Game Stop In Store Experience

Apr 26, 2025 -

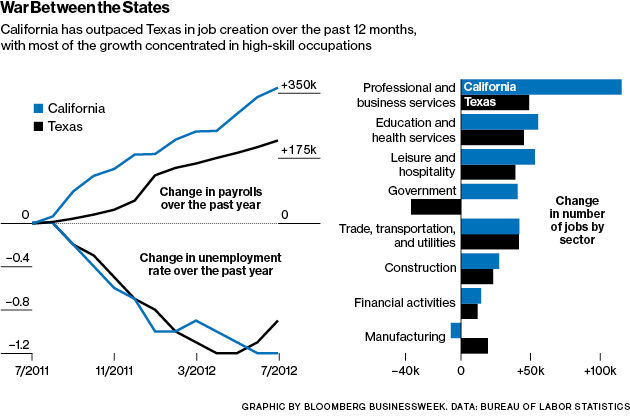

Economic Power Shift California Outpaces Japan

Apr 26, 2025

Economic Power Shift California Outpaces Japan

Apr 26, 2025