The Next Fed Chair: Inheriting Trump's Economic Challenges

Table of Contents

Inflation and Interest Rate Management

The current inflationary environment presents a significant challenge for the next Fed Chair. Balancing economic growth with price stability requires a delicate touch, particularly given the inherited interest rate policies. The Trump administration's economic policies, including significant tax cuts and increased government spending, contributed to a period of robust economic growth but also fueled inflationary pressures.

- Analysis of current inflation rates and their causes: Inflation rates remain elevated above the Federal Reserve's target, driven by factors such as supply chain disruptions, increased demand, and rising energy prices. Understanding the complex interplay of these factors is crucial for effective monetary policy.

- Discussion of the effectiveness of previous interest rate adjustments: The Federal Reserve has already begun raising interest rates to combat inflation. The effectiveness of these adjustments will be a key indicator of the future course of monetary policy. The impact on borrowing costs for businesses and consumers needs careful consideration.

- Exploration of potential future monetary policy tools: Beyond interest rate adjustments, the Fed might explore other tools, such as quantitative tightening (QT), to manage inflation. The effectiveness and potential side effects of these tools must be carefully weighed.

- Assessment of the risks of a recession triggered by aggressive interest rate hikes: Aggressive interest rate hikes carry the risk of triggering a recession by slowing economic growth too sharply. Balancing the need to control inflation with the need to avoid a recession is a critical challenge.

The National Debt and Fiscal Policy

The Trump era saw a significant increase in the national debt due to tax cuts and increased government spending. This legacy poses a substantial challenge for the next Fed Chair. High national debt can limit the Fed's ability to effectively manage the economy, potentially constraining its response to future economic downturns.

- Analysis of the growth of the national debt under the Trump administration: The national debt increased dramatically during the Trump administration, largely due to the 2017 tax cuts and increased military spending. This increase significantly impacts future fiscal policy options.

- Discussion of the long-term implications of high national debt: High national debt can lead to higher interest rates, reduced economic growth, and increased vulnerability to economic shocks. This necessitates careful fiscal planning and consideration of debt reduction strategies.

- Exploration of potential fiscal policy adjustments needed to address the debt: Addressing the national debt requires a combination of spending cuts and revenue increases. The next Fed Chair will need to work closely with Congress to develop sustainable fiscal policies.

- Assessment of the impact of fiscal policy on monetary policy effectiveness: Fiscal and monetary policies are interconnected. The effectiveness of monetary policy can be significantly impacted by the fiscal choices of the government.

Trade Wars and Global Economic Uncertainty

The Trump administration's trade policies, including tariffs and trade disputes, created significant uncertainty in the global economy. These policies had a lasting impact on supply chains, inflation, and international relations. The next Fed Chair will need to navigate this complex landscape while considering the interconnectedness of the US economy with the global economy.

- Assessment of the impact of tariffs on inflation and supply chains: Tariffs imposed during the trade wars disrupted supply chains and contributed to inflationary pressures. The ripple effects of these policies continue to be felt.

- Discussion of the ongoing trade disputes and their economic consequences: Lingering trade disputes and uncertainty can negatively impact business investment and economic growth. The Fed Chair needs to factor these external risks into their monetary policy decisions.

- Exploration of the potential for further trade conflicts under a new administration: The risk of further trade conflicts remains, adding to the complexity of the economic environment. The Fed must be prepared for potential shocks and disruptions.

- Analysis of the effect of global uncertainty on the US economy: Global economic uncertainty can amplify domestic economic challenges and complicate the Fed's ability to manage the economy effectively.

The Legacy of Deregulation

The Trump administration pursued a policy of deregulation, rolling back regulations in various sectors, including finance. This has implications for financial stability and systemic risk. The next Fed Chair will need to assess the impact of these deregulatory measures and determine the appropriate level of regulatory oversight.

- Assessment of the impact of deregulation on financial stability: Reduced regulation can potentially increase systemic risk and vulnerability to financial crises. Careful monitoring and potential adjustments to regulatory frameworks are necessary.

- Discussion of the potential for increased systemic risk: The easing of financial regulations could lead to higher levels of risk-taking in the financial sector, increasing the potential for future financial instability.

- Exploration of potential regulatory changes the next Fed Chair may need to implement: The next Fed Chair may need to implement regulatory changes to mitigate potential risks arising from the prior deregulation.

Conclusion

The next Fed Chair faces a daunting set of economic challenges, directly inherited from the Trump era. Successfully navigating inflation, managing the national debt, addressing lingering trade issues, and considering the impact of deregulation will require exceptional leadership and effective monetary policy strategies. The ability to adapt to unforeseen economic shocks and maintain economic stability will be paramount. Understanding the complexities of the Trump administration's economic legacy is crucial for comprehending the challenges facing the next Fed Chair and the future of the US economy. Stay informed about developments in monetary policy and the ongoing economic debate surrounding the next Fed Chair's appointment.

Featured Posts

-

Analysis Trump Administrations Impact On European Ai Rulebook

Apr 26, 2025

Analysis Trump Administrations Impact On European Ai Rulebook

Apr 26, 2025 -

Todays Stock Market Dow Futures Chinas Economic Stimulus And Trade Uncertainty

Apr 26, 2025

Todays Stock Market Dow Futures Chinas Economic Stimulus And Trade Uncertainty

Apr 26, 2025 -

Wildfire Speculation Examining The Market For Los Angeles Fire Bets

Apr 26, 2025

Wildfire Speculation Examining The Market For Los Angeles Fire Bets

Apr 26, 2025 -

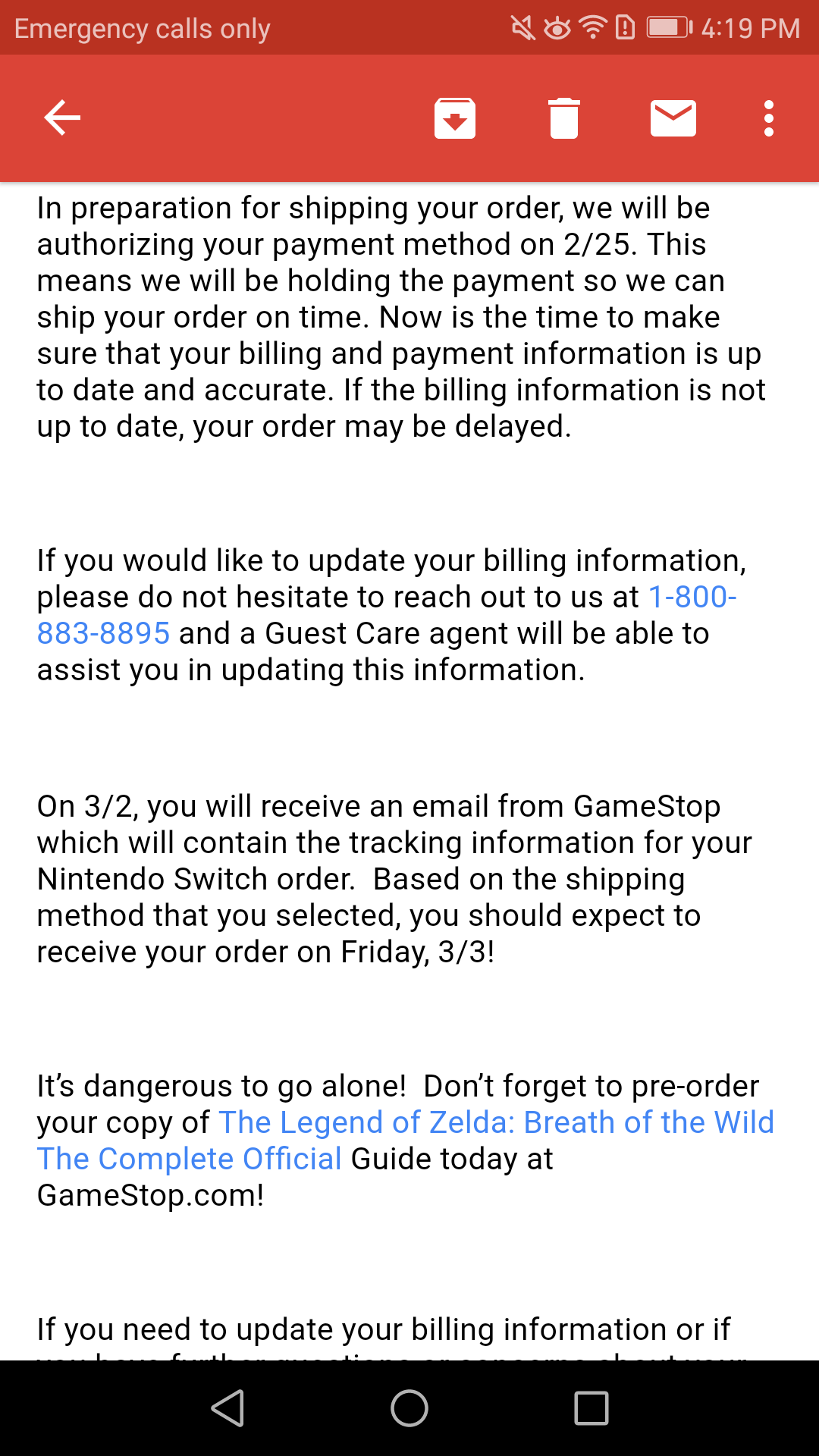

Landing A Switch 2 Preorder My Game Stop Experience

Apr 26, 2025

Landing A Switch 2 Preorder My Game Stop Experience

Apr 26, 2025 -

Abb Vie Abbv Raises Profit Outlook Strong Sales From Newer Drugs

Apr 26, 2025

Abb Vie Abbv Raises Profit Outlook Strong Sales From Newer Drugs

Apr 26, 2025