Today's Stock Market: Dow Futures, China's Economic Stimulus, And Trade Uncertainty

Table of Contents

Dow Futures: A Leading Indicator of Market Sentiment

Dow Futures contracts are agreements to buy or sell the Dow Jones Industrial Average at a future date. They're considered a leading indicator because they often reflect investor sentiment before the actual market opens. Analyzing Dow Futures movements can provide valuable insights into the potential direction of the broader market.

Recent Dow Futures movements have been mixed, reflecting the ongoing uncertainty in the global economy. Sharp increases suggest bullish sentiment, while declines often foreshadow potential market corrections. Understanding these fluctuations is vital for effective trading strategies.

- Key factors influencing Dow Futures: Economic data releases (like inflation reports and employment numbers), geopolitical events (such as international conflicts or policy changes), and corporate earnings reports all significantly impact Dow Futures.

- Technical analysis of Dow Futures charts: Traders use technical analysis tools, examining support and resistance levels, trend lines, and chart patterns to predict future price movements. Identifying these patterns can help gauge potential market turning points.

- Impact of Dow Futures on investor behavior and trading strategies: Dow Futures influence investor decisions; positive futures contracts can boost confidence, while negative ones may prompt investors to take a more cautious approach, potentially leading to sell-offs. Sophisticated investors use futures contracts for hedging and speculation.

China's Economic Stimulus: Implications for Global Markets

China's recent economic stimulus package aims to boost growth amidst slowing economic activity and challenges in the property sector. This initiative has significant implications for global markets, influencing everything from commodity prices to technology stocks.

The stimulus package includes measures like increased infrastructure spending, tax cuts, and support for small and medium-sized enterprises. While aiming to re-ignite economic growth, it also poses potential risks.

- Specific measures included in the stimulus package: These range from direct fiscal spending on infrastructure projects to indirect measures supporting credit markets and consumer spending.

- Potential positive effects on global demand and supply chains: Increased Chinese demand could boost global commodity prices and benefit exporting nations. Improved supply chain efficiency could alleviate bottlenecks.

- Potential negative effects (e.g., inflation, debt levels): The stimulus could potentially lead to increased inflation if not managed effectively. Furthermore, increased government borrowing might worsen already high debt levels.

- Impact on specific sectors (e.g., technology, commodities): The stimulus may disproportionately benefit certain sectors like infrastructure and construction, while others might experience limited impact. Commodity prices are likely to be significantly affected.

Trade Uncertainty: Navigating Geopolitical Risks

The current global trade environment is characterized by significant uncertainty. Ongoing trade disputes and protectionist policies create volatility and impact investment decisions. Understanding these geopolitical risks is paramount for navigating today's stock market.

Trade wars and protectionist policies can disrupt supply chains, increase prices for consumers, and hinder economic growth. Companies heavily reliant on international trade are particularly vulnerable.

- Key trade agreements and their current status: The status of major trade agreements like the USMCA and the ongoing tensions between major economic powers are crucial factors influencing trade flows.

- Impact on specific industries and companies: Industries heavily reliant on exports or imports are especially affected by trade disputes, leading to uncertainty and potential financial difficulties.

- Strategies for mitigating trade-related risks: Investors may consider diversification across geographies and sectors, hedging strategies, and close monitoring of trade policy developments to minimize risks.

- Potential for future trade negotiations and agreements: The possibility of future trade agreements or the escalation of existing disputes directly impacts market sentiment and investment strategies.

Understanding and Responding to Today's Stock Market Dynamics

In conclusion, understanding today's stock market requires careful consideration of Dow Futures as indicators of market sentiment, the implications of China's economic stimulus, and the ongoing uncertainty surrounding global trade. These factors intricately intertwine, shaping market volatility and presenting both opportunities and risks for investors.

Successfully navigating today's stock market requires staying informed about these key indicators and adapting investment strategies accordingly. Continue monitoring Dow Futures, China’s economic policies, and global trade developments to make well-informed decisions. Consider subscribing to reputable financial news sources and consulting a financial advisor for personalized guidance to effectively manage your investments in today's dynamic market.

Featured Posts

-

Will Ahmed Hassanein Break Barriers In The Nfl Draft

Apr 26, 2025

Will Ahmed Hassanein Break Barriers In The Nfl Draft

Apr 26, 2025 -

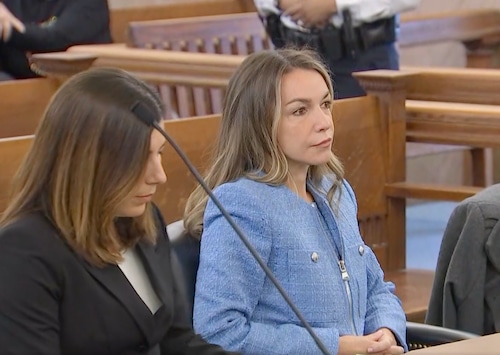

The Karen Read Case A Year By Year Breakdown Of Legal Proceedings

Apr 26, 2025

The Karen Read Case A Year By Year Breakdown Of Legal Proceedings

Apr 26, 2025 -

Green Bay Hosts Nfl Draft 2024 First Round Preview And Predictions

Apr 26, 2025

Green Bay Hosts Nfl Draft 2024 First Round Preview And Predictions

Apr 26, 2025 -

Memoir On The Horizon Cassidy Hutchinsons Account Of The January 6th Hearings

Apr 26, 2025

Memoir On The Horizon Cassidy Hutchinsons Account Of The January 6th Hearings

Apr 26, 2025 -

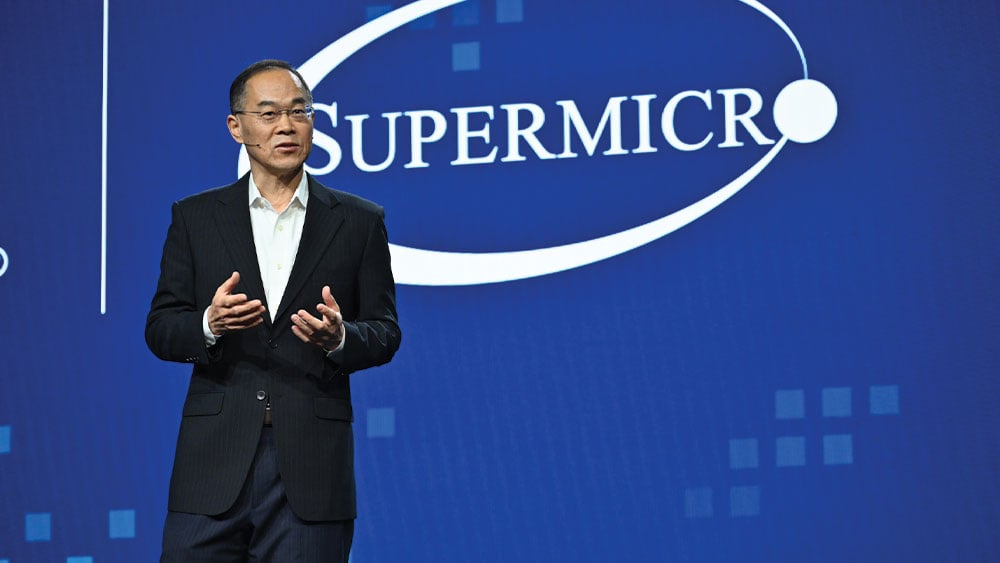

Economic Uncertainty Ceos On The Impact Of Trumps Tariffs

Apr 26, 2025

Economic Uncertainty Ceos On The Impact Of Trumps Tariffs

Apr 26, 2025