Tether And SoftBank Partner With Cantor In Potential $3 Billion Crypto SPAC

Table of Contents

Understanding the Players Involved

This ambitious venture brings together three titans with unique strengths and expertise. Let's examine each player's role:

Tether's Role

Tether, with its massive market capitalization and ubiquitous presence in the cryptocurrency ecosystem, brings significant weight to this partnership. Its stablecoin, USDT, is a cornerstone of the crypto market, facilitating trading and providing a relatively stable anchor in a volatile environment.

- Market Capitalization: Tether boasts one of the largest market caps in the crypto space, providing considerable financial backing for the SPAC.

- Influence in the Crypto Market: Tether's widespread adoption allows for easier access to a vast network of crypto investors and projects.

- Risks and Benefits: While Tether's involvement provides immense capital and credibility, its past controversies regarding reserve transparency need to be considered. However, its participation signals a vote of confidence in the future of the crypto market.

SoftBank's Contribution

SoftBank, known for its bold investments in disruptive technologies, brings a wealth of experience and a deep understanding of scaling high-growth companies. Their involvement signals a significant endorsement of the cryptocurrency market's potential.

- Investment Portfolio: SoftBank's portfolio includes some of the most successful tech companies globally, demonstrating their astute investment strategy.

- Previous Successful Investments: Their track record of identifying and nurturing high-growth businesses provides valuable insight and resources for the SPAC.

- Rationale for Entering the Crypto Space: SoftBank's foray into crypto suggests a belief in the long-term viability and growth of the digital asset sector.

Cantor Fitzgerald's Expertise

Cantor Fitzgerald, a leading financial institution with extensive experience in SPACs, provides crucial expertise in structuring and executing this complex transaction. Their network and experience are invaluable in navigating the regulatory landscape.

- Experience in SPAC Structuring and Execution: Cantor's expertise ensures a smooth and efficient process for the SPAC’s formation and subsequent acquisition.

- Network of Contacts: Their extensive network provides access to potential acquisition targets and investors.

- Contributions to the Deal's Success: Cantor's role is instrumental in managing the financial aspects, regulatory compliance, and overall success of the SPAC.

The Potential $3 Billion Crypto SPAC: Implications and Opportunities

This $3 billion crypto SPAC has the potential to reshape the cryptocurrency investment landscape.

Deal Structure and Objectives

The SPAC aims to raise $3 billion to acquire a target company in the cryptocurrency space. The acquisition target likely will be a company with significant growth potential and a strong track record.

- Potential Acquisition Targets: This could include leading cryptocurrency exchanges, blockchain infrastructure providers, innovative DeFi (Decentralized Finance) platforms, or other disruptive crypto companies.

- Anticipated Timeline: The timeline for identifying and acquiring a target company will depend on market conditions and regulatory approvals.

- Regulatory Considerations: Navigating the complex regulatory landscape surrounding cryptocurrencies will be a key challenge for the SPAC.

Market Impact and Future Projections

This partnership could significantly impact the crypto market by attracting mainstream institutional investment and boosting market capitalization.

- Potential Benefits for the Crypto Industry: Increased investment could fuel innovation and development within the cryptocurrency ecosystem.

- Potential Risks Associated with the Deal: Market volatility and regulatory uncertainty remain significant risks.

- Long-Term Projections for the Market: The success of the SPAC could accelerate the mainstream adoption of cryptocurrencies.

Strategic Advantages for Investors

The SPAC offers investors a unique opportunity to gain exposure to the high-growth potential of the cryptocurrency market with reduced risk compared to direct investments in individual cryptocurrencies.

- Risk Assessment for Investors: While the crypto market is volatile, the SPAC offers a degree of diversification and professional management.

- Potential Return on Investment: The potential for high returns is significant, given the rapid growth potential of the crypto industry.

- Comparison to Other Investment Opportunities: The SPAC offers an attractive alternative to other investment options, particularly for those seeking exposure to the crypto market.

Challenges and Risks Associated with the Partnership

Despite the significant potential, several challenges and risks must be addressed.

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies is constantly evolving, posing a significant challenge to the SPAC.

- Specific Regulatory Hurdles: Navigating varying regulatory frameworks across different jurisdictions will be crucial.

- Potential Legal Challenges: The possibility of legal challenges related to securities laws and other regulations exists.

- International Regulatory Differences: Harmonizing regulatory compliance across various international markets will be a complex undertaking.

Market Volatility and Risk

The inherent volatility of the cryptocurrency market presents a substantial risk for investors.

- Factors Influencing Market Volatility: Market sentiment, regulatory changes, and technological developments can significantly impact cryptocurrency prices.

- Risk Mitigation Strategies: Diversification and a long-term investment strategy can help mitigate some of the risks associated with market volatility.

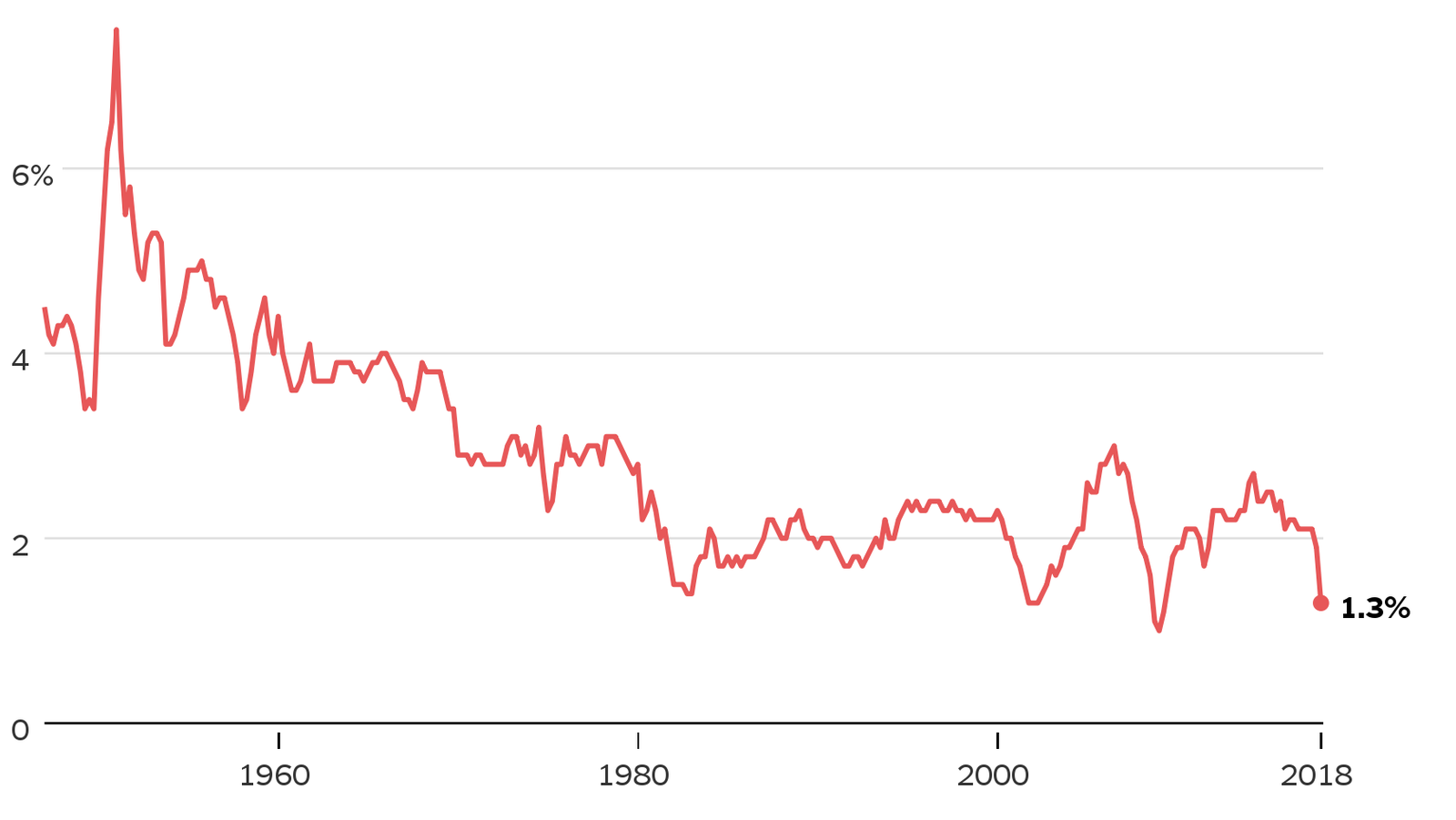

- Historical Market Data: Analyzing historical market data can help investors understand potential risks and opportunities.

Potential Conflicts of Interest

Transparency and ethical considerations are crucial to mitigate potential conflicts of interest between the partners.

- Potential Areas of Conflict: Potential conflicts could arise between the interests of the SPAC, its partners, and investors.

- Steps to Mitigate Conflicts: Establishing clear guidelines and mechanisms for conflict resolution will be essential.

- Ensuring Ethical Practices: Maintaining high ethical standards and transparency is critical to the success and reputation of the SPAC.

Conclusion

The partnership between Tether, SoftBank, and Cantor Fitzgerald to create a $3 billion crypto SPAC marks a pivotal moment in the cryptocurrency industry. This collaboration represents a significant influx of capital and expertise into the crypto market, potentially accelerating its growth and mainstream adoption. While regulatory uncertainty and market volatility pose challenges, the potential rewards are substantial. Tether's stablecoin influence, SoftBank's investment prowess, and Cantor Fitzgerald's SPAC expertise create a powerful synergy, poised to reshape the landscape of crypto investment. Stay informed about developments in the Tether, SoftBank, and Cantor Fitzgerald partnership and the emerging trends in the crypto SPAC market. Follow our updates for the latest news on this significant cryptocurrency investment.

Featured Posts

-

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

Tensions Flare South Carolina Voter Challenges Rep Nancy Mace

Apr 24, 2025

Tensions Flare South Carolina Voter Challenges Rep Nancy Mace

Apr 24, 2025 -

William Watson On The Liberal Platform Key Policies To Consider

Apr 24, 2025

William Watson On The Liberal Platform Key Policies To Consider

Apr 24, 2025 -

Canada Election Conservative Platform Focuses On Tax Cuts And Deficit Control

Apr 24, 2025

Canada Election Conservative Platform Focuses On Tax Cuts And Deficit Control

Apr 24, 2025 -

New Legal Obstacles Stalled Trumps Immigration Enforcement

Apr 24, 2025

New Legal Obstacles Stalled Trumps Immigration Enforcement

Apr 24, 2025