Canada Election: Conservative Platform Focuses On Tax Cuts And Deficit Control

Table of Contents

Proposed Tax Cuts

The Conservative Party's platform promises substantial tax cuts aimed at boosting economic activity and benefiting individual Canadians and businesses.

Individual Income Tax Reductions

The Conservatives propose reducing individual income tax rates across various brackets. While specific percentages may vary depending on the election cycle and platform updates, past proposals have included:

- Lowering the highest marginal tax rate: A reduction in the top tax bracket could provide significant tax relief for high-income earners.

- Targeted tax cuts for middle-income earners: The party may also propose reductions in lower tax brackets, aiming to benefit a larger segment of the population.

- Enhanced tax credits and deductions: Potential changes could include increasing the Canada Child Benefit or introducing new tax credits to support families and specific demographics.

These proposed changes aim to leave more disposable income in the hands of Canadians, potentially stimulating consumer spending and boosting economic growth. However, the actual impact on average Canadians will depend on the specific details of the final tax plan.

Corporate Tax Rate Cuts

The Conservative platform typically includes proposals to lower the corporate tax rate. The rationale is that this will encourage businesses to invest, expand, and create jobs, ultimately leading to increased economic activity and government revenue.

- Reduced corporate tax burden: Lowering the corporate tax rate could make Canada more competitive internationally, attracting investment and fostering economic growth.

- Stimulating job creation: Businesses might be incentivized to hire more employees if their tax burden is reduced.

- Increased investment in research and development: A lower corporate tax rate could encourage greater investment in innovation and technological advancements.

However, critics argue that such cuts could disproportionately benefit large corporations at the expense of social programs and other public services. The actual impact on job creation and investment will depend on various economic factors and the overall business climate.

Deficit Reduction Strategies

The Conservative Party aims to balance the budget while implementing substantial tax cuts, employing a multi-pronged approach focusing on spending cuts, increased efficiency, and economic growth initiatives.

Spending Cuts

To achieve deficit reduction, the Conservatives often propose targeted spending cuts. Past platforms have suggested reviewing spending across various government departments and programs. Specific targets may include:

- Reducing spending on social programs: This is a highly controversial area, with potential negative impacts on vulnerable populations.

- Cutting administrative costs: Improving the efficiency of government operations could free up resources for other priorities.

- Re-evaluating infrastructure projects: This could involve prioritizing projects based on their economic and social benefits.

The social and economic consequences of such cuts need careful consideration. Analysis of the potential impact on specific communities and sectors is crucial for a balanced evaluation of the Conservative approach.

Increased Efficiency

The Conservatives often pledge to improve government efficiency and eliminate wasteful spending. This may involve:

- Modernizing government operations: Implementing digital technologies and streamlining administrative processes could enhance efficiency and reduce costs.

- Reducing bureaucratic red tape: Streamlining regulations and reducing administrative burdens on businesses could boost economic activity.

- Improving procurement practices: More efficient procurement processes could save taxpayers money and reduce waste.

The success of these measures will depend on the effectiveness of implementation and the political will to carry out necessary reforms.

Economic Growth Initiatives

A key element of the Conservative plan is to stimulate economic growth to boost government revenues and naturally reduce the deficit. This may involve:

- Tax incentives for businesses: These incentives could encourage investment, expansion, and job creation.

- Deregulation: Reducing unnecessary regulations can foster entrepreneurship and create a more favorable business environment.

- Investment in infrastructure: Investing in roads, bridges, and other infrastructure projects can create jobs and improve economic productivity.

The effectiveness of these measures will depend on the overall economic climate and the soundness of the policies implemented. A thorough analysis of potential risks and benefits is needed for a complete understanding of their potential impact.

Potential Economic Impacts and Criticisms

The Conservative platform’s impact on the Canadian economy is subject to debate and carries both potential benefits and drawbacks.

Economic Growth Projections

The Conservative party often presents optimistic economic growth projections based on their policies. However, independent economists may offer different assessments, leading to diverse viewpoints on the feasibility and potential magnitude of economic growth.

Impact on Inequality

Critics argue that substantial tax cuts disproportionately benefit high-income earners, potentially exacerbating income inequality. The degree of this impact depends on the specific tax policies adopted.

Criticisms and Counterarguments

The Conservative approach faces criticism regarding the potential for insufficient deficit reduction, the impact on essential social services, and the potential negative consequences of unbridled economic growth on environmental sustainability and social equity. Conversely, proponents argue that lower taxes incentivize work, investment, and overall economic prosperity.

Conclusion

The Canada Conservative Platform centers on a strategy combining tax cuts and deficit reduction. While proposed individual and corporate tax reductions aim to stimulate economic growth, the success depends on spending cuts, improved efficiency, and effective economic growth initiatives. However, potential negative impacts such as increased income inequality and the feasibility of deficit reduction require careful consideration. To participate fully in the upcoming election, it’s crucial to thoroughly understand the Canada Conservative Platform and its multifaceted implications. Further research into the party’s official website and independent analyses of their proposals is strongly encouraged.

Featured Posts

-

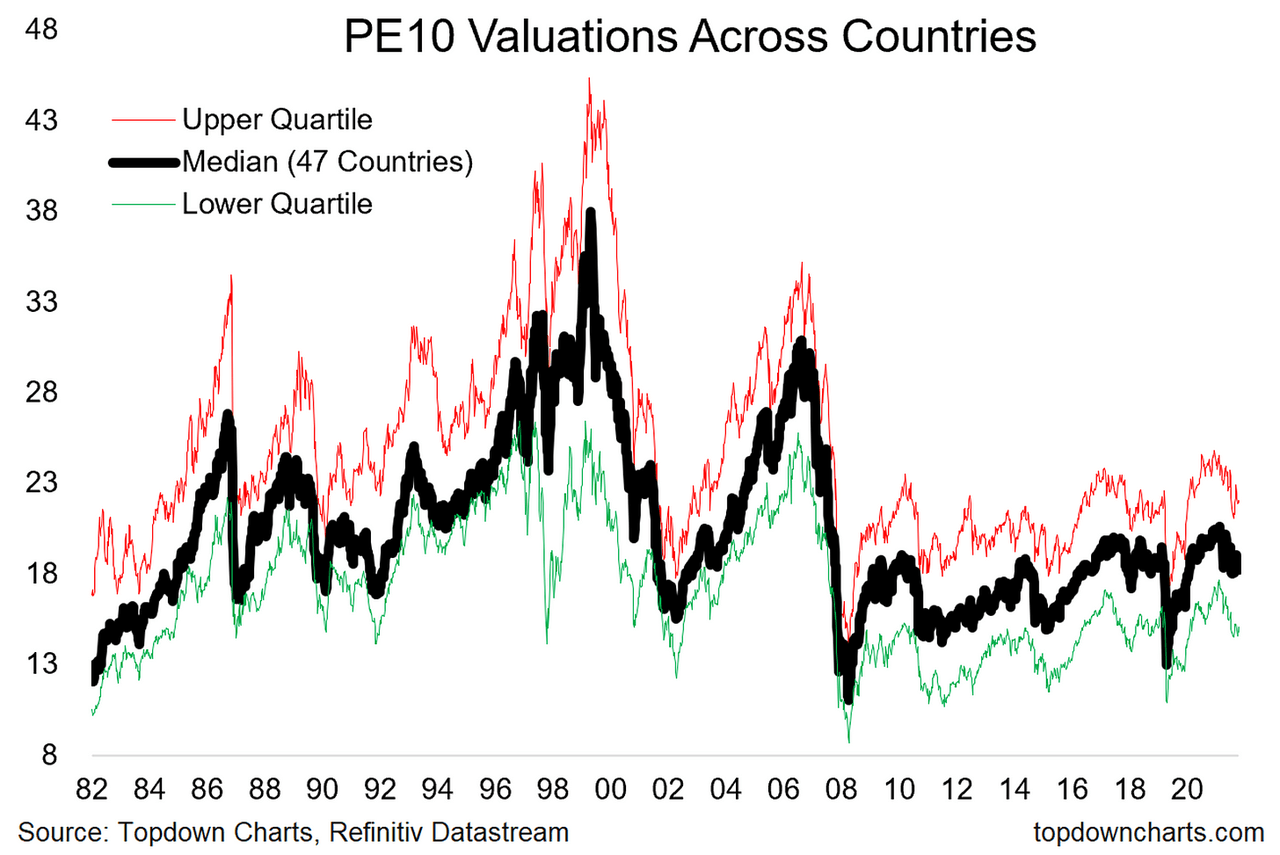

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

Apr 24, 2025

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

Apr 24, 2025 -

The China Factor Assessing Risks And Opportunities For Automakers Bmw Porsche Etc

Apr 24, 2025

The China Factor Assessing Risks And Opportunities For Automakers Bmw Porsche Etc

Apr 24, 2025 -

Luxury Car Brands Face Headwinds In China Case Studies Of Bmw And Porsche

Apr 24, 2025

Luxury Car Brands Face Headwinds In China Case Studies Of Bmw And Porsche

Apr 24, 2025 -

Anchor Brewing Companys 127 Year Run Comes To An End

Apr 24, 2025

Anchor Brewing Companys 127 Year Run Comes To An End

Apr 24, 2025 -

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

Apr 24, 2025

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

Apr 24, 2025