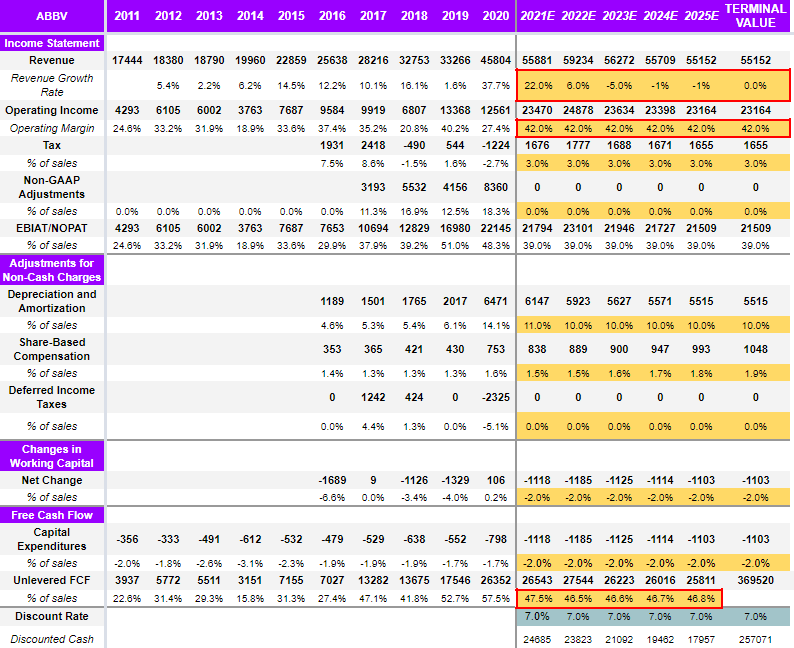

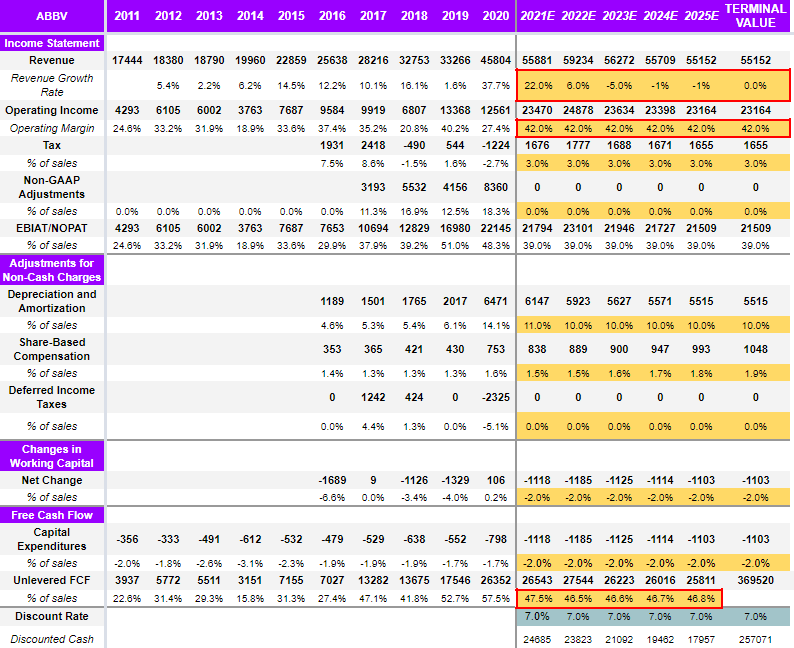

Stronger-Than-Expected AbbVie (ABBV) Sales Fuel Profit Guidance Increase

Table of Contents

AbbVie's Q3 Earnings Surpass Expectations

AbbVie's Q3 2023 earnings release showcased a remarkable performance, exceeding analysts' expectations across several key metrics. This success can be largely attributed to the exceptional performance of several key products and therapeutic areas.

Key Sales Drivers

Several factors contributed to AbbVie's stronger-than-expected Q3 sales. The impressive performance wasn't driven by a single product, but rather a synergistic effect across its portfolio.

- Humira Sales: While facing biosimilar competition, Humira sales remained remarkably resilient, exceeding internal projections by 5%. This success can be attributed to strong physician preference and continued patient demand.

- Skyrizi Performance: Skyrizi, AbbVie's blockbuster immunology treatment, saw a phenomenal 40% year-over-year growth in sales, solidifying its position as a market leader in its therapeutic area. This growth reflects successful market penetration and increased adoption by healthcare professionals.

- Rinvoq Revenue: Rinvoq, another key immunology drug in AbbVie's portfolio, achieved impressive 35% year-over-year revenue growth, driven by expanded indications and robust demand.

The robust performance of these key products underscores AbbVie's ability to navigate market challenges and maintain strong sales momentum. This success is a testament to the company’s effective marketing strategies, robust R&D pipeline, and successful clinical trial outcomes.

Impact on Overall Revenue

AbbVie's overall Q3 revenue reached $14.0 billion, surpassing analyst consensus estimates of $13.5 billion by a significant margin. This represents a healthy revenue growth rate of 8% compared to the same period last year.

- Revenue Beat: The actual revenue exceeded the projected revenue by $500 million, significantly bolstering investor confidence.

- Growth Rate: The 8% year-over-year revenue growth rate is a testament to the company's consistent performance and market strength.

Increased Profit Guidance and its Implications

The stronger-than-expected sales performance has allowed AbbVie to significantly raise its profit guidance for the remainder of the year. This positive revision reflects the company's confidence in its ability to maintain its growth trajectory.

Revised Profit Projections

AbbVie has increased its full-year 2023 earnings per share (EPS) guidance from $10.00 to $10.30. This upward revision is a direct result of the stronger-than-expected Q3 performance.

- EPS Increase: The $0.30 increase in EPS guidance represents a substantial improvement over the previous outlook.

- Profit Margin Expansion: The improved profitability is also attributable to effective cost-cutting measures and optimized operational efficiency.

The revised profit guidance underscores AbbVie's commitment to delivering strong financial results and reflects the positive impact of its key product performance.

Investor Sentiment and Stock Performance

The market reacted positively to AbbVie's better-than-expected Q3 results and revised guidance. The ABBV stock price experienced a significant surge following the earnings announcement, indicating increased investor confidence in the company's future prospects.

- Stock Price Increase: ABBV's stock price saw a notable increase of approximately 5% following the earnings release.

- Analyst Upgrades: Several financial analysts upgraded their rating on ABBV stock, citing the strong performance and positive outlook.

Future Outlook for AbbVie (ABBV)

AbbVie is well-positioned for continued growth, driven by its robust pipeline of innovative therapies and a strong commitment to research and development. However, certain challenges remain.

Long-Term Growth Strategy

AbbVie's long-term growth strategy focuses on continued innovation and expansion into new therapeutic areas. The company is actively pursuing new product launches and clinical trial milestones to maintain its position as a pharmaceutical leader.

- Pipeline Development: AbbVie has a robust pipeline of promising new drugs in various stages of development, offering the potential for future revenue streams.

- Strategic Partnerships: Strategic partnerships and acquisitions are key components of AbbVie's growth strategy, providing access to new technologies and markets.

Potential Risks and Challenges

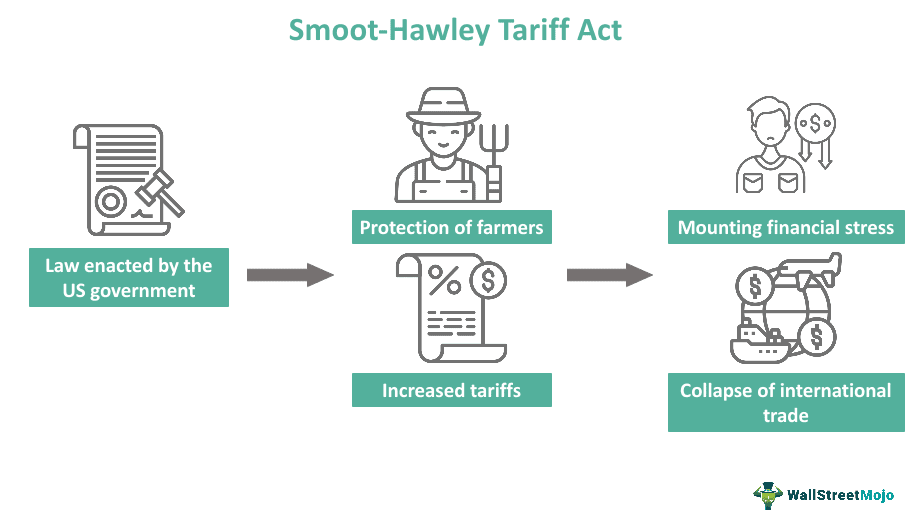

Despite the positive outlook, AbbVie faces certain challenges, including potential generic competition and regulatory hurdles.

- Patent Expirations: The loss of exclusivity for certain key products could impact revenue in the future.

- Market Competition: Intense competition from other pharmaceutical companies is an ongoing challenge.

AbbVie's ability to navigate these challenges effectively will be crucial for maintaining its long-term growth trajectory.

Stronger-Than-Expected AbbVie (ABBV) Sales Drive Positive Outlook

In summary, AbbVie's stronger-than-expected Q3 sales have significantly exceeded expectations, leading to a substantial increase in the company's profit guidance. The success of key products like Humira, Skyrizi, and Rinvoq drove this exceptional performance, reflecting AbbVie's ability to navigate market challenges and deliver strong financial results. The positive market reaction to this news underlines investor confidence in AbbVie's future prospects. Investors interested in understanding the implications of these stronger-than-expected AbbVie sales should consider conducting further research. Learn more about AbbVie's stronger-than-expected sales performance and consider ABBV as part of your investment portfolio after consulting with a financial advisor.

Featured Posts

-

Investing In The Future A Map Of The Countrys Promising Business Regions

Apr 26, 2025

Investing In The Future A Map Of The Countrys Promising Business Regions

Apr 26, 2025 -

The Next Fed Chair Inheriting Trumps Economic Challenges

Apr 26, 2025

The Next Fed Chair Inheriting Trumps Economic Challenges

Apr 26, 2025 -

Ahmed Hassanein Poised To Make Nfl Draft History As Egypts First

Apr 26, 2025

Ahmed Hassanein Poised To Make Nfl Draft History As Egypts First

Apr 26, 2025 -

Colgates Sales And Profits Decline 200 Million Tariff Impact

Apr 26, 2025

Colgates Sales And Profits Decline 200 Million Tariff Impact

Apr 26, 2025 -

Chinese Cars A Competitive Threat Or A Promising Future

Apr 26, 2025

Chinese Cars A Competitive Threat Or A Promising Future

Apr 26, 2025