Stock Market Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

BofA's Perspective on Current Stock Market Valuations

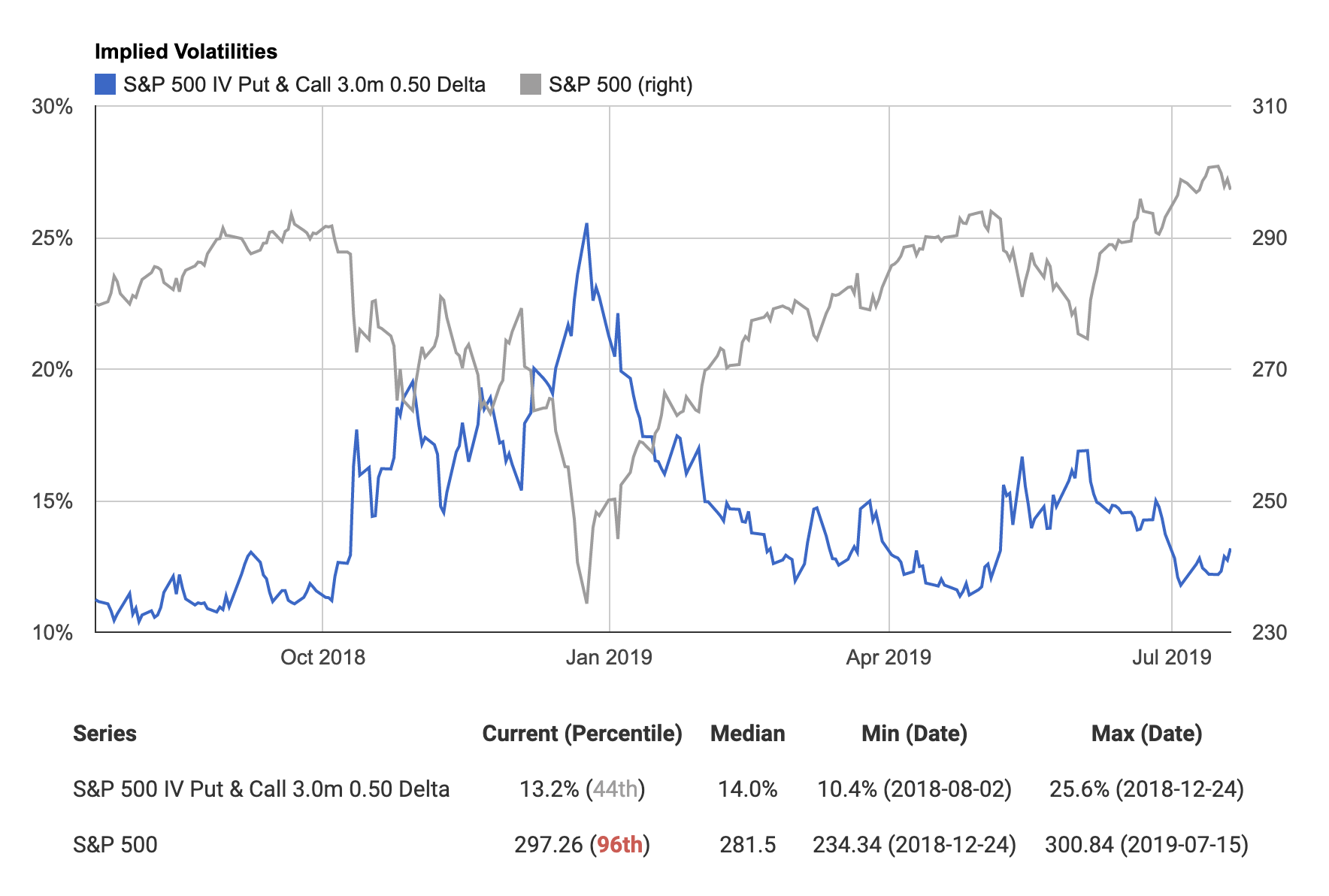

Bank of America's recent research reports offer a nuanced view of current stock market valuations. Their analysis acknowledges the elevated price-to-earnings (P/E) ratios and other valuation metrics across various market sectors, but it avoids a blanket condemnation of the overall market. BofA analysts consistently emphasize the importance of considering various factors beyond simple valuation ratios when assessing market health. Their reports, including the frequently updated "Global Investment Strategy" and specific sector analyses, are key sources for their perspective.

- Strong Corporate Earnings Growth: BofA analysts point to strong corporate earnings growth as a significant mitigating factor against high valuations. Many companies have demonstrated resilience and even exceeded expectations, justifying some of the premium valuations.

- Low Interest Rates: They highlight the impact of low interest rates on supporting asset prices. Lower discount rates used in valuation models translate to higher present values for future earnings, contributing to seemingly high valuations.

- Sector-Specific Growth Potential: BofA acknowledges elevated valuations but emphasizes the long-term growth potential of specific sectors, particularly in technology, healthcare, and renewable energy. They suggest focusing on companies within these sectors that demonstrate strong fundamentals and future growth prospects.

Understanding the Factors Driving High Valuations

Several macroeconomic factors contribute to the current high stock market valuations. These aren't necessarily indicators of an impending crash, but rather contextual elements that need to be considered when analyzing market data.

- Low Interest Rates and Discounted Cash Flow: Low interest rates significantly impact discounted cash flow (DCF) models, a common valuation tool. Lower discount rates result in higher present values for future cash flows, leading to higher valuations. This effect is amplified by quantitative easing policies implemented by central banks globally.

- Increased Liquidity from Quantitative Easing: The injection of massive liquidity into the financial system through quantitative easing programs has increased the overall demand for assets, including stocks, thereby pushing up prices.

- Strong Corporate Earnings in Key Sectors: Robust earnings growth in specific sectors, fueled by technological advancements and increased consumer spending, further supports elevated valuations.

- Technological Advancements and Growth Forecasts: Technological innovation drives expectations of significant future growth, justifying premium valuations for companies at the forefront of these advancements. This is particularly true in the tech sector and related industries.

Why Panic Selling is Unlikely to Be a Profitable Strategy

Reacting emotionally to market fluctuations, often fueled by fear, is rarely a profitable investment strategy. Panic selling, driven by short-term market volatility, can lead to significant losses.

- Market Timing is Difficult: Predicting short-term market movements with accuracy is nearly impossible. Attempting to time the market often results in selling low and buying high, leading to considerable losses.

- Long-Term Investment Strategy: A disciplined, long-term investment strategy is crucial for weathering market corrections. This approach focuses on consistent investing over the long haul, reducing the impact of short-term fluctuations.

- Market Corrections are Normal: History shows that market corrections are a normal part of the economic cycle. Rather than a sign of impending doom, they often present opportunities for long-term investors to buy quality assets at discounted prices.

- Opportunity Cost of Selling Low: Selling during a market downturn means missing out on potential future gains. The opportunity cost of selling low can significantly outweigh the perceived risk of holding on to assets.

Strategies for Navigating High Stock Market Valuations

While valuations are high, investors can adopt strategies to manage their portfolios effectively. These strategies emphasize long-term growth and risk mitigation.

- Diversification: Diversify across different asset classes (stocks, bonds, real estate, etc.) to reduce overall portfolio risk.

- Fundamental Analysis and Value Investing: Focus on fundamental analysis to identify undervalued companies with strong growth potential. Value investing can help mitigate the risk associated with high market valuations.

- Regular Portfolio Rebalancing: Regularly rebalance your portfolio to maintain your desired asset allocation. This strategy involves selling some assets that have performed well and buying those that have lagged.

- Alternative Investments: Consider alternative investment strategies, such as private equity or hedge funds, to diversify beyond traditional market exposure.

- Professional Financial Advice: Seek guidance from a qualified financial advisor to develop a personalized investment strategy aligned with your risk tolerance and financial goals.

Maintaining a Level Head in the Face of High Stock Market Valuations

In summary, while current stock market valuations are undeniably high, BofA's analysis, and other data points, suggest that panic selling is not the appropriate response. High valuations are influenced by several macroeconomic factors, including low interest rates and strong corporate earnings in key sectors. A long-term investment strategy, focusing on fundamental analysis and diversification, is more effective than attempting to time the market. Don't let fear dictate your investment decisions. Understand the nuances of stock market valuations and make informed choices based on a long-term perspective. Consult with a financial advisor to develop a personalized strategy that aligns with your goals. Remember, navigating stock market valuations effectively requires a calm, strategic approach.

Featured Posts

-

Jetour Dashing Pamer Tiga Pilihan Warna Baru Di Iims 2025

Apr 28, 2025

Jetour Dashing Pamer Tiga Pilihan Warna Baru Di Iims 2025

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025 -

A Road Trip Through The Florida Keys The Overseas Highway

Apr 28, 2025

A Road Trip Through The Florida Keys The Overseas Highway

Apr 28, 2025 -

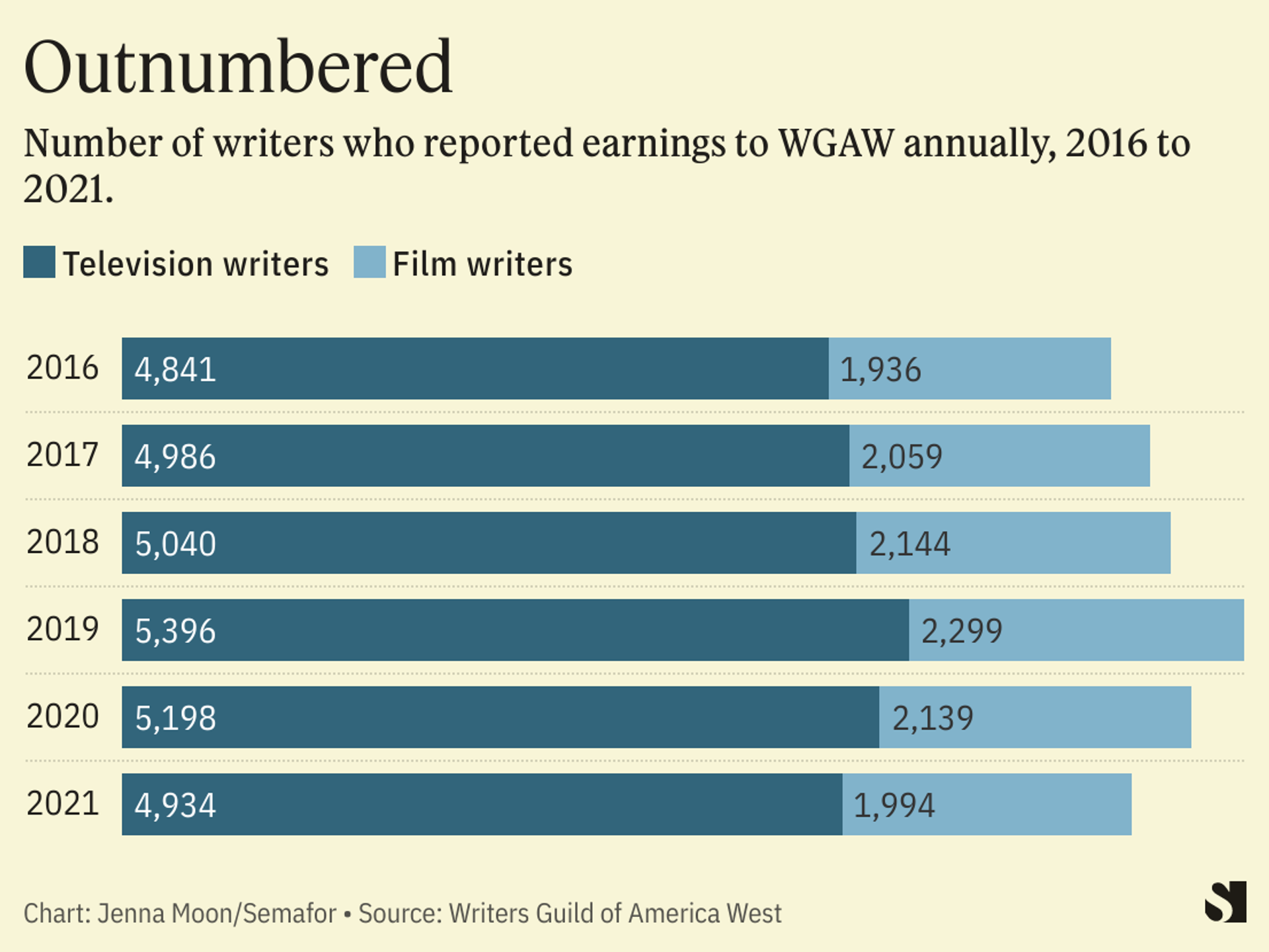

Actors And Writers Strike The Impact On Hollywood

Apr 28, 2025

Actors And Writers Strike The Impact On Hollywood

Apr 28, 2025 -

Market Volatility And Investor Behavior A Look At The Recent Crash

Apr 28, 2025

Market Volatility And Investor Behavior A Look At The Recent Crash

Apr 28, 2025