Stock Market Pain: Investors Push Prices Higher Despite Risks

Table of Contents

Ignoring the Risks: Why Investors Are Pushing Prices Higher

Several intertwined factors contribute to the current market behavior, where investors seem to be ignoring or downplaying significant risks.

The Role of Speculative Investing

The current market is characterized by a surge in speculative investing, driven by a desire for quick profits rather than long-term value.

- Increased retail investor participation: The accessibility of online brokerage accounts has led to a significant increase in retail investor participation, many of whom are less experienced and more prone to short-term trading strategies.

- The impact of meme stocks: The phenomenon of meme stocks, driven by social media hype and momentum trading, has further fueled speculative activity and market volatility.

- Options trading frenzy: The increased popularity of options trading allows for leveraged bets, magnifying both potential gains and losses, and contributing to market instability.

This short-term focus overshadows the fundamental analysis typically employed by long-term investors, leading to potentially unsustainable price increases and increased market volatility.

Central Bank Intervention and Monetary Policy

Central banks' efforts to stimulate economic growth through low interest rates and quantitative easing have played a significant role in inflating asset prices, including stocks.

- Effect of stimulus packages: Massive injections of liquidity into the financial system have provided ample capital for investment, pushing up asset prices across the board.

- Influence of central bank communication: Central bank communication about future monetary policy significantly impacts investor sentiment and market expectations. Any hint of a shift towards tighter monetary policy can trigger market corrections.

- Potential for future interest rate hikes: The anticipation of future interest rate hikes to combat inflation creates uncertainty, which can affect investor confidence and market stability.

These policies, while intended to boost the economy, can artificially inflate asset prices, creating a bubble that could burst when these policies are reversed or economic conditions worsen.

Fear of Missing Out (FOMO)

The psychological factor of Fear of Missing Out (FOMO) plays a crucial role in driving investor behavior.

- The herd mentality: Investors often follow the crowd, buying assets that are already rising in price, further fueling the upward trend.

- Social media influence: Social media platforms amplify market trends and can create a sense of urgency, prompting investors to jump on the bandwagon.

- The pressure to participate in market gains: The constant stream of positive news about market gains can create pressure on individuals to participate, even if they are uncomfortable with the associated risks.

FOMO can lead to irrational investment decisions, pushing prices beyond their fundamental value and increasing the risk of a significant market correction.

The Underlying Risks: What Could Trigger a Market Correction?

Despite the current upward trend, several underlying risks threaten the market's stability and could trigger a correction.

Inflation and Rising Interest Rates

Persistent inflation and rising interest rates pose significant threats to stock valuations.

- Erosion of purchasing power: High inflation erodes the purchasing power of consumers and can negatively impact corporate profits.

- Increased borrowing costs: Rising interest rates increase borrowing costs for businesses, hindering investment and potentially slowing economic growth.

- Impact on corporate earnings: Higher inflation and interest rates can squeeze corporate profit margins, leading to lower stock valuations.

These factors can significantly impact company performance and lead to a reassessment of stock prices.

Geopolitical Instability

Global conflicts and political uncertainty introduce significant volatility into the market.

- Supply chain disruptions: Geopolitical events can disrupt global supply chains, leading to shortages and price increases.

- Energy price volatility: Geopolitical tensions often lead to increased energy prices, affecting both businesses and consumers.

- Potential for escalating conflicts: Escalating conflicts can trigger further market uncertainty and volatility.

Geopolitical risks introduce an element of unpredictability that can significantly impact investor sentiment and market performance.

Overvalued Assets

Many argue that current stock prices are unsustainable in the long term, indicating potential overvaluation.

- Price-to-earnings ratios: High price-to-earnings ratios suggest that stocks are trading at premiums relative to their earnings, indicating potential overvaluation.

- Market capitalization: Rapid increases in market capitalization may suggest unsustainable growth and potential for future price corrections.

- Valuation metrics: Various valuation metrics, such as discounted cash flow analysis, can help assess whether stock prices are justified by underlying fundamentals.

These metrics can help identify potentially overvalued assets and anticipate potential future price corrections.

Conclusion

The current stock market situation presents a complex picture of "Stock Market Pain." Investors are pushing prices higher despite significant risks, driven by speculative investing, central bank intervention, and the psychological factor of FOMO. However, inflation, rising interest rates, geopolitical instability, and the potential for overvalued assets pose substantial threats to market stability and could trigger a significant correction. Understanding the complexities of Stock Market Pain is crucial for navigating these turbulent times. Don't let the current upward trend blind you to the potential risks. Take control of your investment strategy, and remember to conduct thorough research and seek professional financial advice before making any investment decisions. Ignoring the potential for Stock Market Pain could lead to significant losses.

Featured Posts

-

Unintended Consequences Examining The True Cost Of Trumps Economic Goals

Apr 22, 2025

Unintended Consequences Examining The True Cost Of Trumps Economic Goals

Apr 22, 2025 -

Pope Francis A Reflection On His Life And Papacy Following His Death

Apr 22, 2025

Pope Francis A Reflection On His Life And Papacy Following His Death

Apr 22, 2025 -

Open Ai Simplifies Voice Assistant Development 2024 Event Highlights

Apr 22, 2025

Open Ai Simplifies Voice Assistant Development 2024 Event Highlights

Apr 22, 2025 -

The Growing Pressure To Break Up Google Antitrust Concerns And The Future

Apr 22, 2025

The Growing Pressure To Break Up Google Antitrust Concerns And The Future

Apr 22, 2025 -

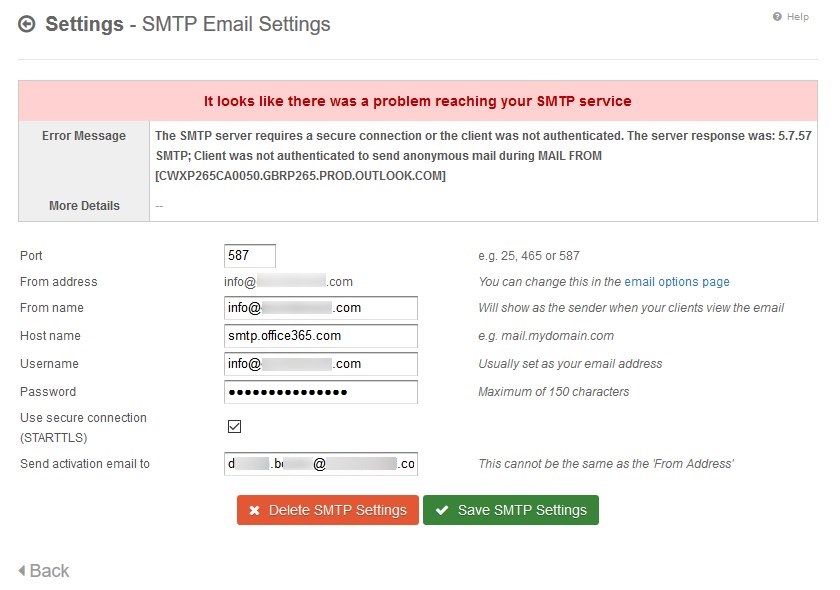

Millions Made From Executive Office365 Account Hacks Fbi Investigation

Apr 22, 2025

Millions Made From Executive Office365 Account Hacks Fbi Investigation

Apr 22, 2025