Unintended Consequences: Examining The True Cost Of Trump's Economic Goals

Table of Contents

The Impact of Tariffs on American Businesses and Consumers

The Trump administration implemented a series of tariffs, primarily targeting China, aiming to protect American industries and reduce the trade deficit. However, these tariffs had far-reaching and largely negative unintended consequences.

Increased Prices for Consumers

Tariffs directly increased the cost of imported goods, impacting consumer purchasing power and fueling inflation. This translated to higher prices for everyday items across various sectors.

- Clothing and textiles: Tariffs on imported fabrics and finished goods led to a noticeable increase in clothing prices.

- Electronics: Tariffs on components and finished electronic products increased the cost of smartphones, laptops, and other electronics.

- Steel and aluminum: Tariffs on these raw materials trickled down, increasing the price of cars, appliances, and construction materials.

For instance, a study by the Federal Reserve Bank of New York estimated that tariffs imposed in 2018 added approximately $100 to the annual cost for an average American family. This price hike disproportionately affected lower-income households, further exacerbating economic inequality.

Harm to American Businesses Relying on Imports

Many American businesses rely on imported materials and components for their production processes. Tariffs dramatically increased their input costs, impacting their competitiveness and profitability.

- Manufacturing: Companies in manufacturing sectors faced increased costs for raw materials, hindering production and forcing some to relocate operations overseas.

- Agriculture: Farmers faced higher prices for machinery and inputs, reducing their profit margins and impacting the overall agricultural economy.

"The tariffs have significantly impacted our ability to compete," stated the CEO of a small manufacturing firm in Ohio, highlighting the struggle faced by many businesses. Industry reports consistently showed decreased profitability and reduced investment in affected sectors.

Retaliatory Tariffs from Other Countries

The imposition of US tariffs triggered retaliatory measures from other countries, harming American exports and businesses. This sparked trade wars, significantly impacting trade balances.

- China's retaliatory tariffs: China implemented tariffs on numerous American agricultural products, significantly damaging the American farming sector.

- European Union tariffs: The EU responded with tariffs on American goods, impacting various industries and creating further economic uncertainty.

Charts depicting the decline in US exports to key trading partners during this period clearly illustrate the damaging effects of these trade wars. The unintended consequences included job losses, reduced economic growth, and increased global trade tensions.

The Effects of Deregulation on Environmental Protection and Public Health

The Trump administration pursued a policy of deregulation across various sectors, including environmental protection. While proponents argued this would stimulate economic growth, the consequences for the environment and public health proved significant.

Weakening Environmental Regulations

Numerous environmental regulations were weakened or rolled back, impacting air and water quality, and the protection of endangered species.

- Clean Power Plan rollback: The weakening of the Clean Power Plan led to increased carbon emissions and exacerbated climate change.

- Relaxation of auto emission standards: This resulted in higher levels of air pollution, negatively impacting public health.

- Reduced protection of wetlands and endangered species: This jeopardized biodiversity and ecological stability.

Scientific studies and reports consistently linked these deregulations to increased pollution levels and environmental damage. The long-term consequences include increased healthcare costs associated with pollution-related illnesses.

Increased Pollution and Health Risks

The weakening of environmental regulations directly translated into measurable increases in pollution levels and associated health risks.

- Air pollution: Increased air pollution led to a rise in respiratory illnesses, cardiovascular problems, and other health issues.

- Water pollution: Relaxed regulations on industrial waste discharge resulted in contaminated water sources, posing serious threats to human and ecological health.

Data from the Environmental Protection Agency (EPA) and independent research organizations documented increases in various pollutants and their correlation with negative health outcomes. These health consequences translate into significant long-term healthcare costs for individuals and the national healthcare system.

The National Debt and Long-Term Economic Stability

The combination of significant tax cuts and increased government spending led to a substantial increase in the national debt.

Tax Cuts and Increased Spending

The 2017 Tax Cuts and Jobs Act significantly reduced corporate and individual income taxes. Simultaneously, government spending increased, expanding the budget deficit and contributing to a dramatic rise in the national debt.

- Increased budget deficit: The annual budget deficit widened considerably during this period, adding trillions of dollars to the national debt.

- Reduced government revenue: The tax cuts significantly reduced government revenue, further exacerbating the debt problem.

Data from the Congressional Budget Office clearly illustrates the rapid growth of the national debt during this period. This increase in debt poses significant risks to long-term economic stability.

Impact on Future Generations

The massive increase in the national debt places a significant burden on future generations. They will inherit a substantially larger debt, limiting their economic opportunities and placing a strain on government resources.

- Reduced government spending on essential services: A larger debt necessitates increased interest payments, potentially crowding out spending on crucial areas like education, infrastructure, and healthcare.

- Higher taxes for future generations: Future generations may face higher taxes to service the national debt, reducing their disposable income and economic prospects.

Projections and forecasts indicate a considerable increase in debt-to-GDP ratio, suggesting a significant long-term economic burden for future generations.

Conclusion: Unintended Consequences and the Future of Economic Policy

This analysis clearly demonstrates that while some of Trump's economic policies may have yielded short-term gains, a deeper examination reveals significant unintended negative consequences that outweigh any perceived benefits. The detrimental effects on consumers, businesses, the environment, and long-term economic stability underscore the importance of carefully considering the full scope of potential impacts before implementing major economic policy changes. Understanding the true cost and unintended consequences of economic policies is crucial for informed decision-making. Let's demand a more thorough assessment of the long-term impacts before enacting sweeping economic changes, ensuring a more sustainable and equitable future.

Featured Posts

-

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue Delays Mission

Apr 22, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue Delays Mission

Apr 22, 2025 -

Sag Aftra Joins Wga Complete Hollywood Shutdown

Apr 22, 2025

Sag Aftra Joins Wga Complete Hollywood Shutdown

Apr 22, 2025 -

Millions Stolen Through Office365 Executive Account Hacks Fbi Charges Filed

Apr 22, 2025

Millions Stolen Through Office365 Executive Account Hacks Fbi Charges Filed

Apr 22, 2025 -

Saudi Aramcos Ev Push Collaboration With Byd On New Technologies

Apr 22, 2025

Saudi Aramcos Ev Push Collaboration With Byd On New Technologies

Apr 22, 2025 -

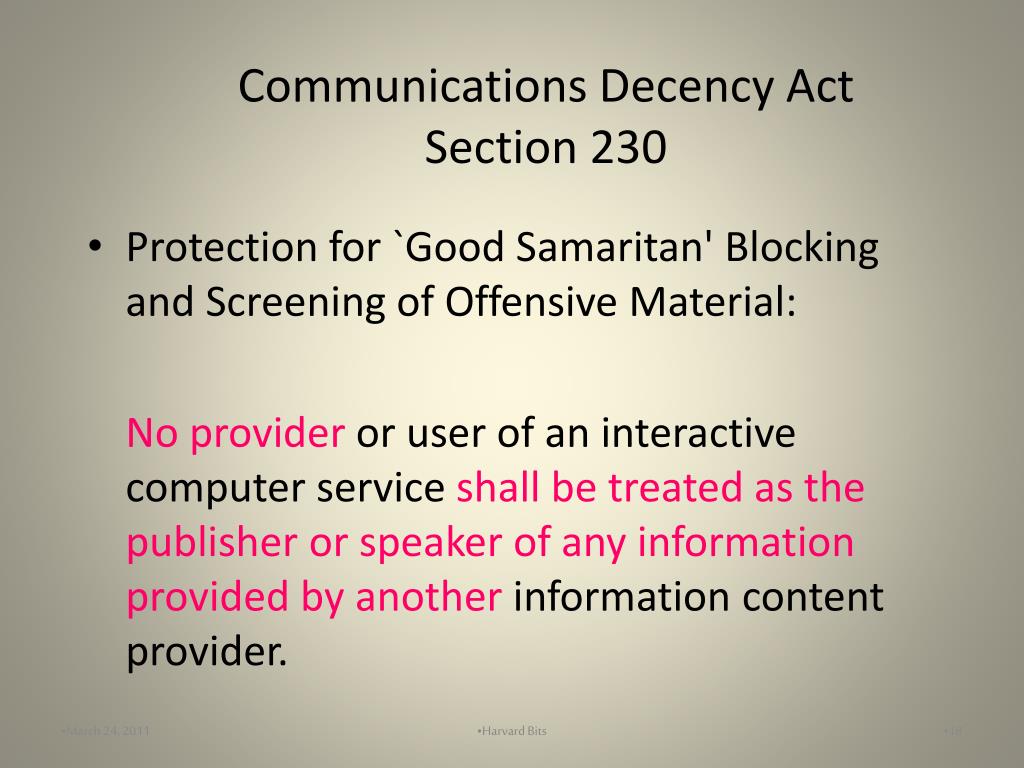

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025