Private Credit's Widening Cracks: Assessing The Impact Of Market Instability

Table of Contents

Recent market volatility, fueled by rising interest rates and geopolitical uncertainty, has cast a shadow over various financial sectors. One area facing increasing scrutiny is the private credit market. While private credit, which encompasses loans and other debt financing outside of publicly traded markets, plays a vital role in providing capital to businesses, its inherent characteristics are now being tested by the current instability. This article will explore how market instability is exposing vulnerabilities within the private credit market, leading to potential consequences for investors and borrowers alike.

Rising Interest Rates and Their Impact on Private Credit Funds

Rising interest rates represent a significant headwind for private credit funds. The cost of borrowing for these funds has increased dramatically, impacting their ability to generate returns and manage existing portfolios. This increase directly affects their profitability and ability to compete with other investment vehicles.

- Increased borrowing costs: Funds relying on leverage to amplify returns now face substantially higher interest expenses, squeezing profit margins.

- Difficulty refinancing: Existing loans maturing need to be refinanced at significantly higher rates, leading to potential losses and reduced returns for investors.

- Higher default rates: Borrowers facing higher interest payments may struggle to meet their obligations, resulting in a rise in defaults and loan losses for private credit funds.

- Impact on fund performance: The combined effect of higher borrowing costs, refinancing challenges, and increased defaults significantly impacts the performance of private credit funds, potentially leading to underperformance compared to benchmarks.

- Potential for distressed asset sales: To manage liquidity and minimize losses, funds may be forced to sell assets at discounted prices, further impacting returns.

Reduced Liquidity and Market Volatility in the Private Credit Sector

Market volatility significantly impacts investor confidence and liquidity within the private credit sector. The inherent illiquidity of many private credit assets exacerbates this problem.

- Decreased investor confidence: Uncertainty in the market discourages new investments and may prompt existing investors to seek liquidity, putting downward pressure on valuations.

- Illiquidity concerns: The difficulty in quickly selling private credit assets creates significant liquidity risk. Investors may find themselves locked into investments with uncertain returns.

- Fire sales: When funds face pressure to raise cash, they may be forced into “fire sales,” selling assets at significantly below market value to meet obligations. This can further depress prices across the market.

- Impact on valuations: The combination of reduced investor confidence and illiquidity leads to significant challenges in accurately valuing private credit assets.

- Spread widening: The increased risk in the market leads to wider spreads between the yields on private credit assets and comparable risk-free investments, reflecting the heightened uncertainty.

The Increased Risk of Defaults and the Impact on Investors

Several factors contribute to a heightened risk of defaults in private credit portfolios, posing considerable challenges for investors.

- Increased default risk: As borrowing costs rise and economic conditions worsen, the risk of borrowers defaulting on their loans increases significantly.

- Credit quality deterioration: The creditworthiness of borrowers may deteriorate due to economic pressures, leading to a higher proportion of distressed assets in private credit portfolios.

- Impact on investor returns: Defaults and credit quality deterioration directly translate into capital losses and reduced returns for investors in private credit funds.

- Capital losses: Investors may experience substantial capital losses if defaults occur, especially in concentrated portfolios.

- Implications for portfolio diversification: Even well-diversified portfolios can suffer significant losses if the default rate in the private credit market rises substantially.

Regulatory Scrutiny and its Potential Effect on the Private Credit Market

Increased regulatory scrutiny is a growing concern for the private credit market. Regulators are increasingly focused on mitigating the risks associated with this sector.

- Regulatory changes: Expect increased regulatory oversight, potentially leading to new rules and regulations impacting private credit operations and lending standards.

- Increased compliance costs: Meeting new regulatory requirements will likely increase compliance costs for private credit funds, reducing profitability.

- Impact on fund operations: Changes in regulations may affect the operational structure and investment strategies of private credit funds.

- Potential for tighter lending standards: Increased regulatory pressure may lead to stricter lending standards, reducing the amount of capital available for borrowers.

- Effects on fund profitability: The increased costs of compliance and potentially tighter lending standards may significantly impact the profitability of private credit funds.

Conclusion: Understanding the Risks and Navigating the Future of Private Credit

Market instability has exposed significant vulnerabilities within the private credit market, highlighting the importance of robust risk management strategies. Rising interest rates, reduced liquidity, increased default risks, and growing regulatory scrutiny are all contributing to a more challenging environment. The future of private credit will likely involve adaptation and change, with a greater focus on responsible lending, enhanced due diligence, and a more sophisticated understanding of risk. To navigate the complexities of private credit investing in these uncertain times, seek expert guidance and conduct comprehensive due diligence. Understanding the intricacies of private debt and market instability is crucial for making informed investment decisions.

Featured Posts

-

Ariana Grandes Hair And Tattoo Transformation The Artists And Professionals Involved

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation The Artists And Professionals Involved

Apr 27, 2025 -

Ariana Grandes New Hair And Tattoos Seeking Professional Help For Image Changes

Apr 27, 2025

Ariana Grandes New Hair And Tattoos Seeking Professional Help For Image Changes

Apr 27, 2025 -

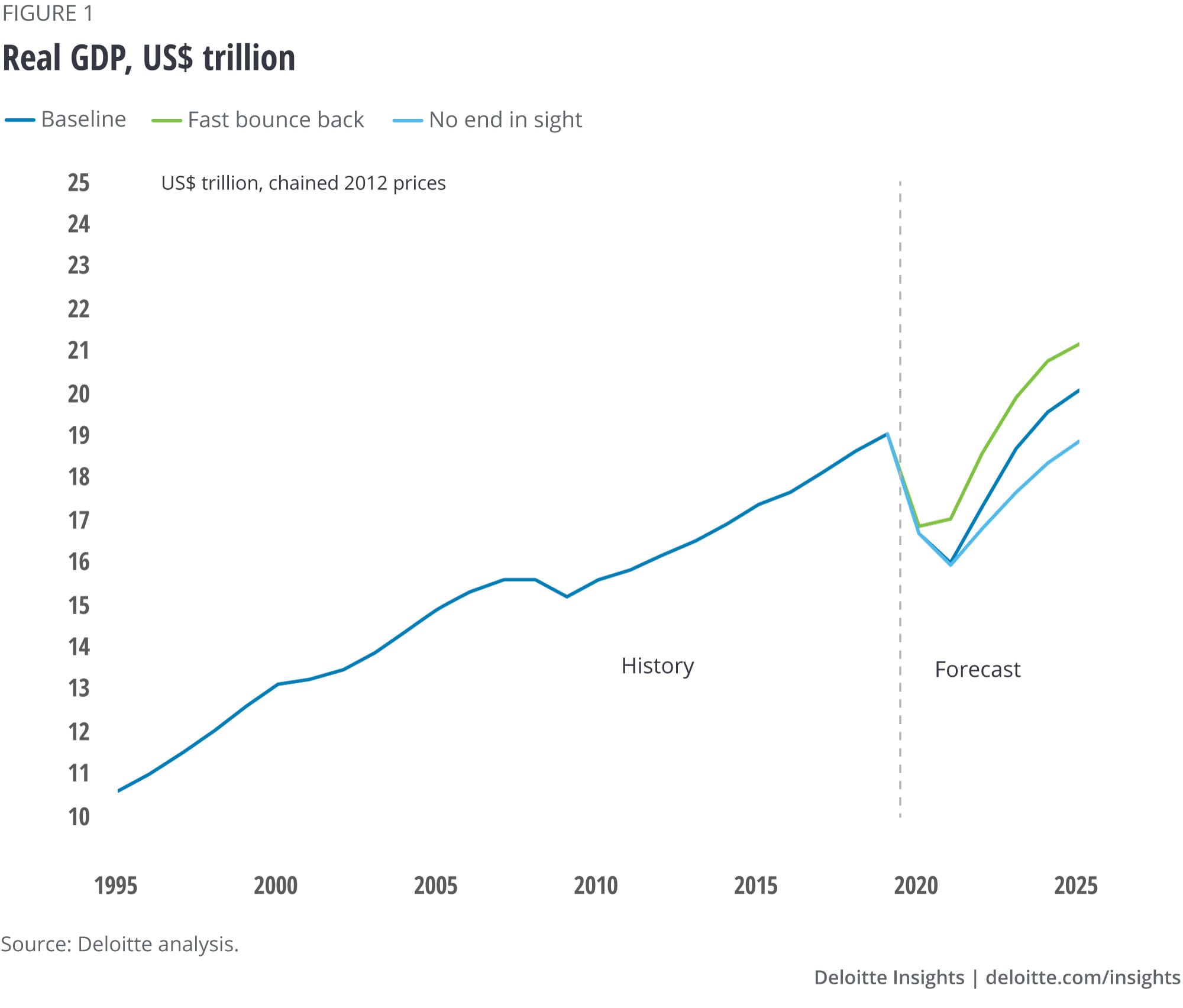

Us Growth To Slow Considerably Deloittes Economic Forecast

Apr 27, 2025

Us Growth To Slow Considerably Deloittes Economic Forecast

Apr 27, 2025 -

Patrick Schwarzeneggers Unseen Appearance In Ariana Grandes Video A White Lotus Connection

Apr 27, 2025

Patrick Schwarzeneggers Unseen Appearance In Ariana Grandes Video A White Lotus Connection

Apr 27, 2025 -

Kanopys Hidden Gems Free Movies And Tv Shows You Shouldnt Miss

Apr 27, 2025

Kanopys Hidden Gems Free Movies And Tv Shows You Shouldnt Miss

Apr 27, 2025