Market Surge: Dow's 1000-Point Rally Explained

Table of Contents

Economic Indicators Fueling the Dow's 1000-Point Rally

Several key economic indicators contributed to this impressive market surge and fueled the Dow Jones 1000-point rally.

Positive Earnings Reports and Corporate Performance

Strong corporate performance played a pivotal role. Many companies reported increased profits that exceeded analysts' expectations, signaling robust economic activity.

- Increased corporate profits: Numerous businesses reported significantly higher profits than predicted, showcasing strong financial health and resilience.

- Strong revenue growth: Revenue growth across diverse sectors, including technology, finance, and consumer goods, demonstrated widespread economic expansion.

- Improved consumer confidence: Increased consumer spending, driven by improved consumer confidence, fueled demand and boosted corporate earnings.

- Key Contributors: Tech giants like Apple and Microsoft, along with major financial institutions, significantly contributed to the overall stock market rally. Their strong performance spurred investor confidence and boosted the Dow.

Easing Inflation Concerns

Easing inflation played a crucial role in the market gains. Decreasing inflation rates suggested that the Federal Reserve's aggressive interest rate hikes might be nearing an end.

- Decreasing inflation rates: A slowdown in inflation, as measured by key indicators like the Consumer Price Index (CPI), reduced investor concerns about further interest rate increases.

- Impact on spending and investment: Lower inflation boosted consumer spending and encouraged businesses to increase investments, further stimulating economic growth and contributing to the stock market rally.

- Federal Reserve policy: The Federal Reserve's communication regarding its monetary policy and its apparent success in curbing inflation helped to calm market anxieties and support the Dow Jones 1000-point rally.

Geopolitical Stability and Reduced Uncertainty

A period of relative geopolitical stability also contributed to the positive market sentiment. Reduced global uncertainty boosted investor confidence.

- Reduced geopolitical tensions: A decrease in significant geopolitical conflicts and international disputes created a more favorable environment for investment.

- Improved global economic outlook: This improved outlook, stemming from reduced geopolitical risks, bolstered investor confidence and fueled the market surge.

- Positive global events: Specific positive geopolitical developments, such as diplomatic breakthroughs or easing of trade tensions, can significantly impact investor confidence and contribute to stock market recovery.

Investor Sentiment and Market Psychology Behind the Surge

The Dow's 1000-point rally wasn't solely driven by economic fundamentals; investor sentiment and market psychology played a significant role.

Increased Investor Confidence and Risk Appetite

A noticeable shift in investor behavior characterized the rally. Investors displayed increased confidence and a higher risk appetite.

- Positive investor behavior: Investors reacted positively to the improved economic data, leading to increased buying activity.

- Increased risk tolerance: The perception of reduced risk led investors to embrace higher-risk assets, further fueling the market gains.

- Positive media influence: Positive media coverage of the economic improvements and the stock market recovery reinforced the positive sentiment, creating a self-fulfilling prophecy.

Short Covering and Momentum Trading

Short covering and momentum trading amplified the rally, creating a powerful upward momentum.

- Short covering: Investors who had bet against the market (short selling) were forced to buy back shares to limit their losses, adding to the buying pressure.

- Momentum trading: This strategy, where investors buy assets that are already rising in price, further accelerated the upward movement of the market, contributing to the Dow Jones 1000-point rally.

- Risks of momentum trading: While momentum trading can be profitable, it also carries significant risks. Markets driven primarily by momentum are inherently volatile and prone to sudden corrections.

Analyzing the Sustainability of the Dow's 1000-Point Rally

While the 1000-point rally is impressive, its sustainability depends on several factors.

Potential Headwinds and Risks

Several potential risks could impact future market performance and moderate the bull market.

- Rising interest rates: Further interest rate increases by central banks could dampen economic growth and curb investor enthusiasm.

- Recessionary fears: Persistent fears of an economic recession could trigger a market correction or pullback.

- Geopolitical instability: A resurgence of geopolitical uncertainty could quickly reverse the positive market sentiment.

Long-Term Outlook and Investment Strategies

Navigating the current market requires a thoughtful approach.

- Diversification: Diversifying investments across different asset classes is crucial to mitigate risk.

- Risk management: Implementing robust risk management strategies is essential to protect your portfolio from potential market downturns.

- Long-term perspective: Maintaining a long-term investment horizon, rather than reacting to short-term market fluctuations, is vital for achieving financial goals.

Conclusion

The Dow's 1000-point rally is a multifaceted event driven by positive economic indicators, improved investor sentiment, and short-term market dynamics. Understanding the factors behind this significant Dow Jones 1000-point rally is crucial for investors. However, awareness of potential headwinds and a balanced, diversified investment strategy are essential. Stay informed about market trends and economic developments to make informed decisions regarding your investments. Understanding the factors behind this significant Dow Jones 1000-point rally will allow you to better prepare for future market fluctuations and capitalize on potential opportunities in the dynamic world of stock market trading. Learn more about navigating market surges and effective investment strategies by [link to relevant resource].

Featured Posts

-

From Tourist Hotspot To Tragedy A Swimmers Fate And The Sharks Of An Israeli Beach

Apr 24, 2025

From Tourist Hotspot To Tragedy A Swimmers Fate And The Sharks Of An Israeli Beach

Apr 24, 2025 -

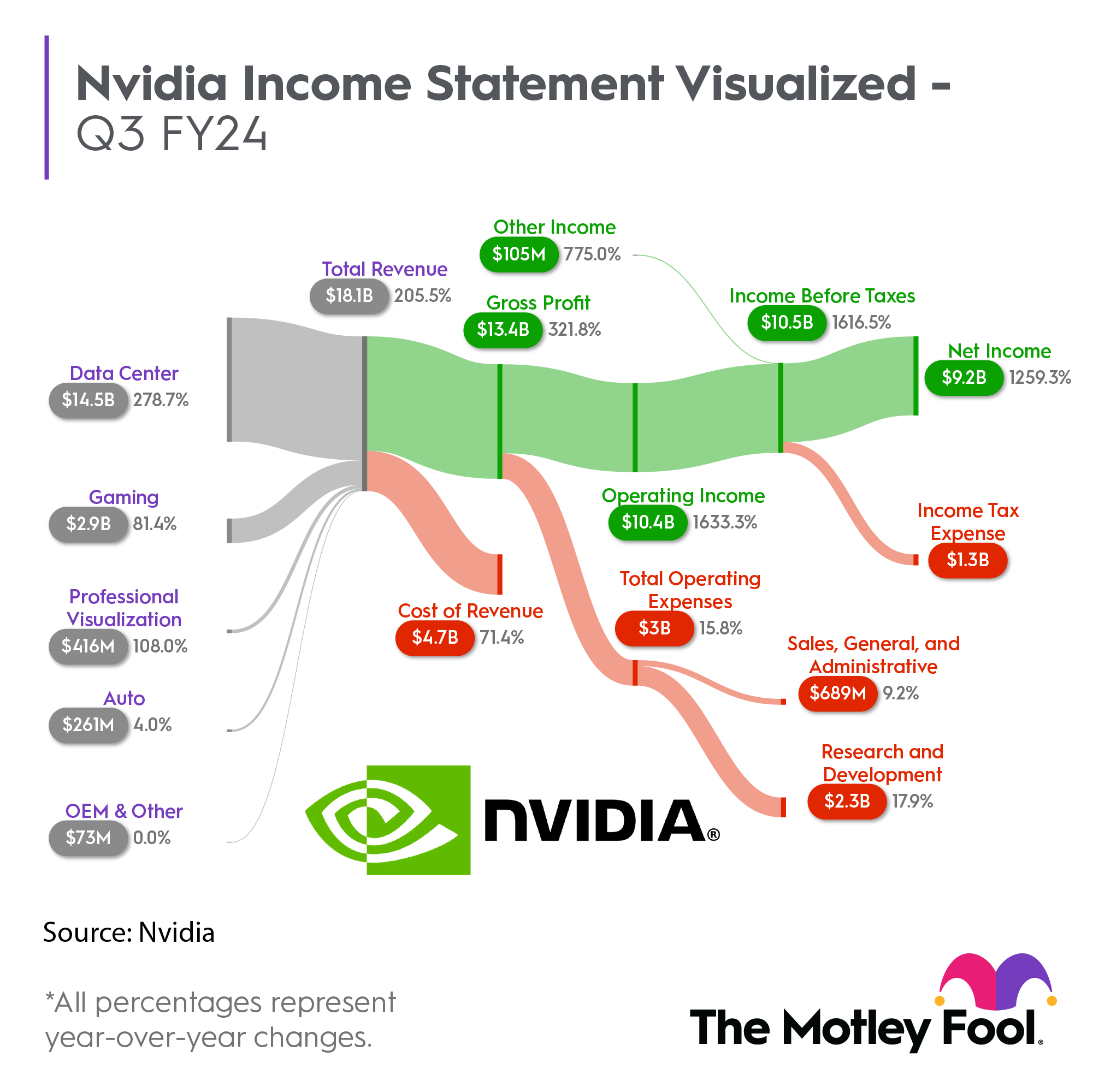

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025 -

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025 -

Navigate The Private Credit Boom 5 Essential Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigate The Private Credit Boom 5 Essential Dos And Don Ts For Job Seekers

Apr 24, 2025 -

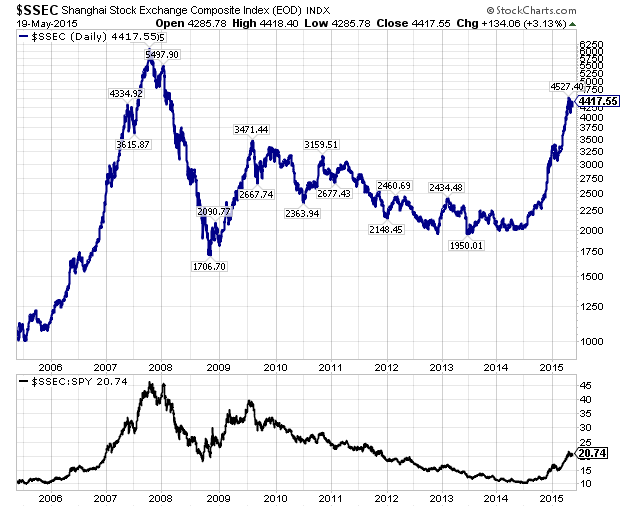

Chinese Stocks Listed In Hong Kong See Significant Gains

Apr 24, 2025

Chinese Stocks Listed In Hong Kong See Significant Gains

Apr 24, 2025