Market Analysis: Assessing The Future Of Chinese Stocks In Hong Kong

Table of Contents

Macroeconomic Factors Influencing Chinese Stocks in Hong Kong

China's Economic Growth and Policy: China's economic growth projections significantly impact the performance of Chinese stocks in Hong Kong. Government policies play a crucial role, shaping the regulatory environment and influencing investment decisions.

- Impact of the Belt and Road Initiative: This ambitious infrastructure project presents both opportunities and challenges for participating companies, impacting their stock valuations. Companies involved in construction, logistics, and related sectors could see increased activity and revenue.

- Regulatory Changes: Recent regulatory changes in China, such as antitrust regulations targeting tech giants and new data privacy laws, significantly impact the performance of Chinese stocks in Hong Kong. Companies need to adapt to these changes, impacting profitability and investor sentiment.

- Impact of Technological Advancements: China's push for technological self-reliance and advancements in areas like 5G, AI, and semiconductors create both risks and rewards for companies in these sectors. Successful adaptation to these technological shifts could lead to substantial growth. Keyword variations: China's economic outlook, Chinese government policy, regulatory environment Hong Kong.

Global Economic Conditions and Geopolitical Risks: The global economic climate and geopolitical uncertainties significantly influence the Hong Kong market volatility and the performance of Chinese stocks in Hong Kong.

- US-China Relations: The complex relationship between the US and China remains a major factor, influencing investor confidence and market sentiment. Trade tensions and geopolitical disagreements can trigger market fluctuations.

- Global Inflation and Interest Rate Hikes: Global inflation and subsequent interest rate hikes by central banks worldwide can impact capital flows into emerging markets like Hong Kong, affecting the valuation of Chinese stocks.

- Potential Trade Wars: The potential for escalating trade disputes between major economies can negatively affect the performance of companies heavily reliant on global trade. Keyword variations: Global economic impact, geopolitical risks, Hong Kong market volatility.

Industry-Specific Trends Shaping the Future of Chinese Stocks in Hong Kong

Technology Sector Outlook: The technology sector holds immense potential but faces significant challenges. Analyzing the growth prospects of Chinese tech giants listed in Hong Kong is crucial.

- 5G Development: The rollout of 5G infrastructure presents significant opportunities for companies involved in telecom, networking, and related technologies.

- AI Advancements: Advancements in artificial intelligence are transforming various industries, creating opportunities for companies specializing in AI-related products and services.

- Semiconductor Industry: China's ambition to become a leader in the semiconductor industry will shape the fortunes of companies operating in this sector. However, global competition and potential sanctions pose significant risks.

- Cybersecurity Concerns: Growing concerns about cybersecurity and data privacy are impacting investor sentiment and regulatory scrutiny of technology companies. Keyword variations: Tech stocks Hong Kong, Chinese tech giants, future of technology in China.

Financial Services and Real Estate Sectors: These traditional sectors remain significant components of the Hong Kong market.

- Interest Rate Sensitivity: The financial services sector is sensitive to interest rate changes, impacting profitability and investment valuations.

- Regulatory Changes in the Financial Sector: Regulatory reforms in the financial sector in both China and Hong Kong are reshaping the landscape, impacting operations and competitiveness.

- Property Market Dynamics: The Hong Kong property market, a key component of the economy, is subject to cyclical fluctuations and government policies.

- Potential for Consolidation: Consolidation within the financial services and real estate sectors is likely, leading to larger, more efficient entities. Keyword variations: Hong Kong property market, Chinese financial institutions, investment opportunities Hong Kong.

Investment Strategies for Chinese Stocks in Hong Kong

Risk Assessment and Diversification: Investing in Chinese stocks in Hong Kong involves inherent risks. A robust risk management and diversification strategy is essential.

- Understanding Political and Economic Risks: Investors must carefully assess political and economic risks associated with investing in China and Hong Kong.

- Diversifying Across Sectors and Geographies: Diversifying investments across different sectors and geographies reduces overall portfolio risk.

- Utilizing Hedging Strategies: Employing hedging strategies can mitigate potential losses arising from market fluctuations and unforeseen events. Keyword variations: Risk management Hong Kong, investment diversification, portfolio management Chinese stocks.

Identifying Growth Opportunities: Identifying growth opportunities within the Hong Kong-listed Chinese companies requires careful analysis.

- Focus on Companies with Strong Fundamentals: Investors should focus on companies with strong financial fundamentals, sustainable business models, and consistent profitability.

- Growth Potential and Competitive Advantages: Analyze companies with significant growth potential and competitive advantages within their respective industries.

- Analyze ESG Factors: Increasingly, investors consider Environmental, Social, and Governance (ESG) factors when making investment decisions. Keyword variations: Growth stocks Hong Kong, undervalued Chinese stocks, ESG investing in Hong Kong.

Conclusion

The future performance of Chinese stocks in Hong Kong hinges on a complex interplay of macroeconomic factors, industry-specific trends, and geopolitical events. While inherent risks exist, strategic investment approaches focusing on diversification, risk management, and identifying growth opportunities can potentially yield significant returns. Understanding the nuances of this market is key to successful investing. Conduct thorough research, stay informed about relevant policy changes and economic forecasts, and develop a well-defined investment strategy to navigate the opportunities and challenges presented by Chinese stocks in Hong Kong. Consider consulting with a financial advisor specializing in this area for personalized guidance.

Featured Posts

-

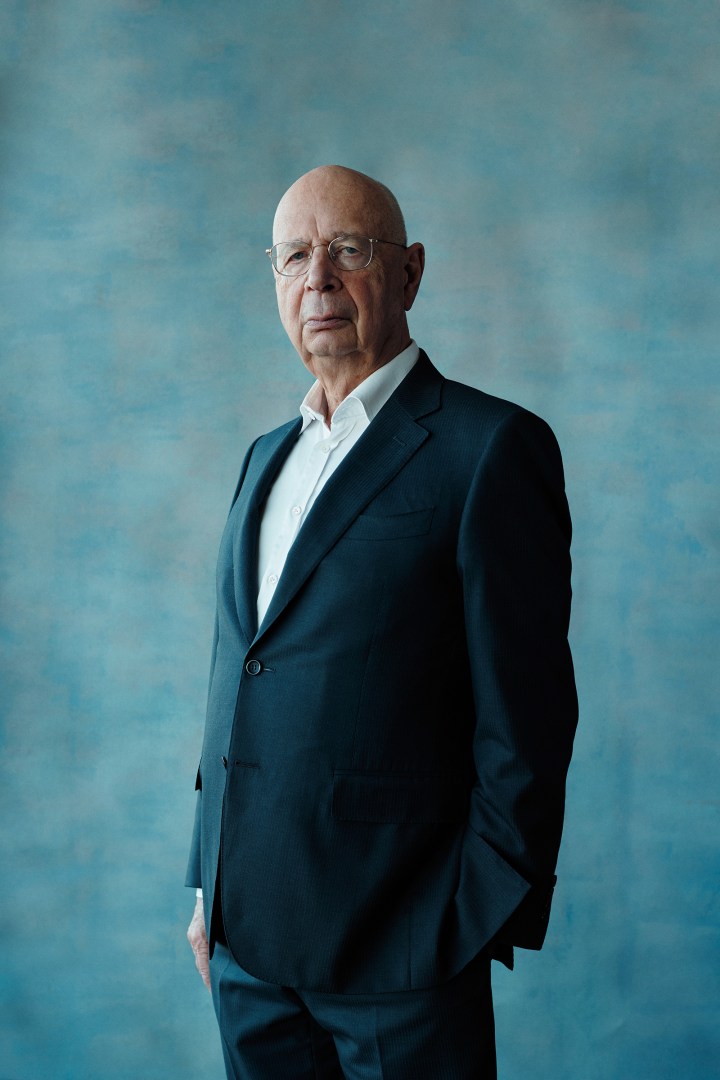

Klaus Schwab Under Scrutiny World Economic Forum Faces New Inquiry

Apr 24, 2025

Klaus Schwab Under Scrutiny World Economic Forum Faces New Inquiry

Apr 24, 2025 -

Sophie Nyweide Mammoth Noah Death Of Child Actor At 24 Confirmed

Apr 24, 2025

Sophie Nyweide Mammoth Noah Death Of Child Actor At 24 Confirmed

Apr 24, 2025 -

Canadian Auto Industry Fights Back A Five Point Plan To Counter Us Trade War

Apr 24, 2025

Canadian Auto Industry Fights Back A Five Point Plan To Counter Us Trade War

Apr 24, 2025 -

The Troubling Trend Of Betting On The Los Angeles Wildfires A Societal Commentary

Apr 24, 2025

The Troubling Trend Of Betting On The Los Angeles Wildfires A Societal Commentary

Apr 24, 2025 -

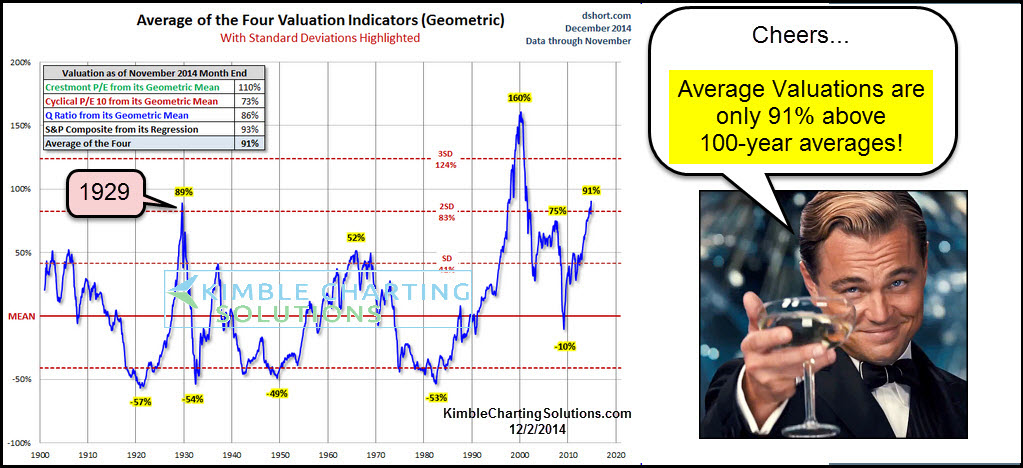

High Stock Market Valuations A Bof A Analysts Case For Investor Calm

Apr 24, 2025

High Stock Market Valuations A Bof A Analysts Case For Investor Calm

Apr 24, 2025