Land Your Dream Job: 5 Do's And Don'ts In The Private Credit Sector

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do: Network Strategically

Building a strong network is paramount in the private credit industry. It's not just about collecting business cards; it's about cultivating genuine relationships.

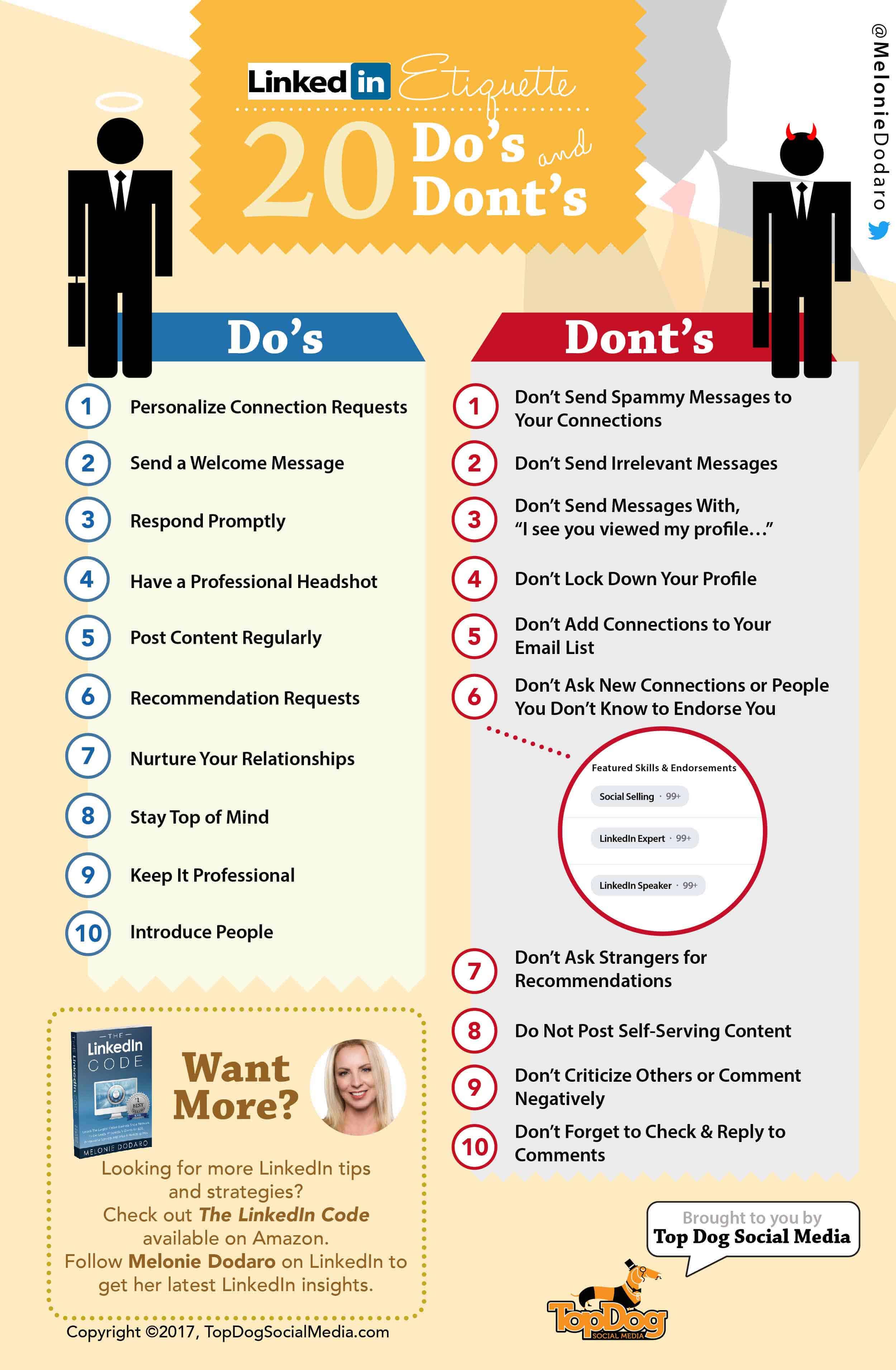

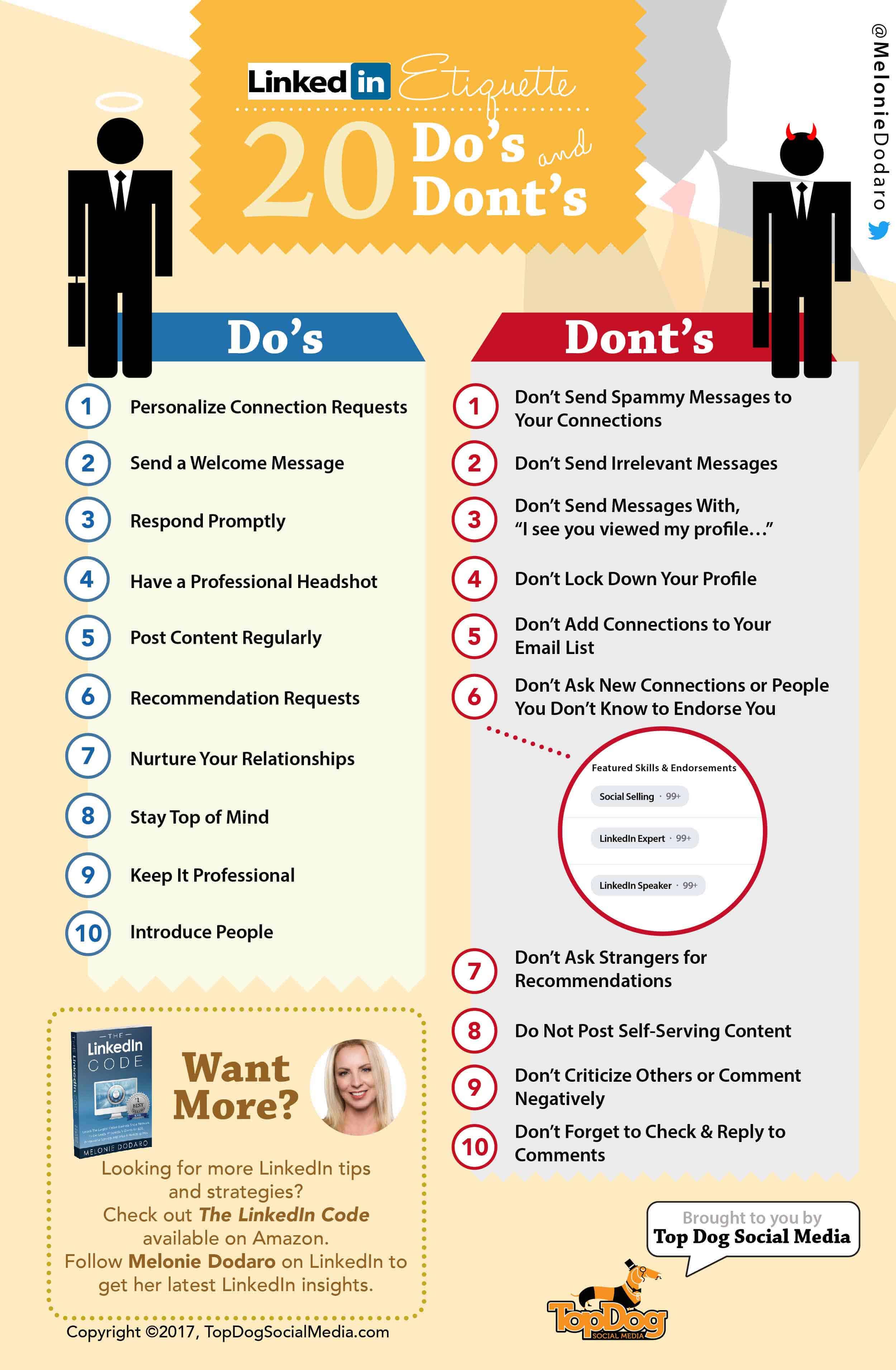

- LinkedIn Optimization: Optimize your LinkedIn profile to showcase your skills and experience relevant to private credit. Actively engage with industry professionals and join relevant groups.

- Industry Events: Attend conferences, workshops, and networking events focused on private credit, alternative investments, and financial analysis. These events provide invaluable opportunities to meet recruiters and potential employers.

- Informational Interviews: Reach out to professionals working in private credit firms for informational interviews. This is a great way to learn about the industry, gain insights, and build connections.

- Alumni Networks: Leverage your alumni network if you attended a reputable university with strong connections to the finance industry.

- Targeted Approach: Don't cast a wide net. Focus your networking efforts on specific firms and roles that align with your career aspirations and skillset.

Do: Showcase Specialized Skills

Private credit firms seek candidates with specific expertise. Highlighting your relevant skills is crucial.

- Financial Modeling Proficiency: Demonstrate your expertise in financial modeling, valuation, and credit analysis. Showcase your ability to build complex models and interpret financial data.

- Credit Analysis Expertise: Highlight your understanding of credit risk assessment, due diligence, and portfolio management techniques.

- Quantifiable Achievements: Quantify your accomplishments whenever possible using metrics and data to demonstrate your impact. For example, instead of saying "Improved efficiency," say "Improved efficiency by 15% through process optimization."

- Tailored Applications: Tailor your resume and cover letter to each specific job description, emphasizing the skills most relevant to the role.

- Certifications and Degrees: Showcase any relevant certifications (e.g., CFA, CAIA) or advanced degrees (e.g., MBA, Masters in Finance) that demonstrate your commitment to the field.

Do: Master the Interview Process

The interview process is your opportunity to shine. Preparation is key.

- STAR Method: Use the STAR method (Situation, Task, Action, Result) to structure your responses to behavioral questions. This method ensures your answers are concise, relevant, and impactful.

- Company Research: Thoroughly research the firm, its investment strategy, recent transactions, and its culture. Demonstrating your understanding shows initiative and genuine interest.

- Technical Preparation: Practice your responses to technical questions about financial modeling, valuation, and credit analysis. Be ready to discuss your experience with relevant software and tools.

- Insightful Questions: Ask insightful questions to demonstrate your interest and engagement. Avoid questions easily answered through basic online research.

- Follow-up: Send a thank-you note after each interview to reiterate your interest and express your gratitude.

Do: Craft a Compelling Narrative

Your resume and cover letter should tell a story, showcasing your career progression and highlighting relevant achievements.

- Action Verbs: Use strong action verbs to describe your accomplishments and responsibilities.

- Quantifiable Results: Quantify your accomplishments whenever possible to demonstrate your impact.

- Show, Don't Tell: Provide specific examples to illustrate your skills and experience.

- Transferable Skills: Highlight any relevant experience in sectors with transferable skills (e.g., banking, accounting, consulting).

- Professional Online Presence: Ensure your LinkedIn profile is polished, professional, and reflects your brand.

Do: Demonstrate Passion for Private Credit

Genuine enthusiasm is contagious. Show your passion for the industry and the specific firm.

- Industry Knowledge: Stay up-to-date on industry news and trends. Demonstrate your understanding of market dynamics and current events.

- Articulate Your Reasons: Clearly articulate your reasons for wanting to work in private credit and how your skills align with the firm's goals.

- Regulatory Understanding: Demonstrate a strong understanding of the regulatory landscape and compliance requirements within the private credit sector.

- Long-Term Commitment: Express a genuine long-term commitment to the field of private credit.

5 Don'ts in Your Private Credit Job Search

Don't: Submit Generic Applications

Each application should be tailored to the specific firm and role. Generic applications demonstrate a lack of effort and interest.

- Avoid Templates: Avoid using generic templates. Your resume and cover letter should be uniquely crafted for each application.

- Targeted Content: Focus on the specific requirements and responsibilities outlined in the job description.

- Error-Free Applications: Proofread meticulously to avoid grammatical errors and typos.

Don't: Underestimate the Importance of Research

Thorough research demonstrates your initiative and interest in the firm.

- Firm-Specific Knowledge: Research the firm's investment strategy, recent transactions, and its culture.

- Connect Skills: Connect your skills and experience to the firm's specific needs and opportunities.

- Prepare Questions: Prepare insightful questions to demonstrate your understanding and engagement.

Don't: Neglect Your Online Presence

Your online presence reflects your professional image. Ensure it's consistent and polished.

- LinkedIn Profile: Maintain an up-to-date and professional LinkedIn profile.

- Social Media: Be mindful of your social media activity and ensure it aligns with your career goals.

- Consistent Branding: Present a consistent professional image across all your online platforms.

Don't: Overlook the Details

Attention to detail demonstrates professionalism and competence.

- Proofreading: Proofread all application materials carefully for errors.

- Formatting: Ensure your resume and cover letter are professionally formatted.

- Prompt Follow-up: Follow up on your applications and interviews promptly.

Don't: Be Unprepared for Technical Questions

Technical expertise is crucial in private credit. Prepare thoroughly for technical questions.

- Financial Modeling Practice: Practice your financial modeling skills and be prepared to discuss your experience with relevant software.

- Accounting Fundamentals: Review fundamental accounting and finance concepts.

- Anticipate Questions: Anticipate common technical questions and prepare thoughtful, well-structured answers.

Conclusion

Landing your dream job in the private credit sector requires dedication and a strategic approach. By diligently following these do's and don'ts, focusing on networking, showcasing your specialized skills, and mastering the interview process, you can significantly increase your chances of securing a fulfilling career in private credit. Don't delay – start implementing these strategies today and land your dream private credit job!

Featured Posts

-

Ukraine War Russia Resumes Offensive After Easter Ceasefire

Apr 22, 2025

Ukraine War Russia Resumes Offensive After Easter Ceasefire

Apr 22, 2025 -

Stock Market Live Analyzing Todays Dow Futures And Dollar Movement

Apr 22, 2025

Stock Market Live Analyzing Todays Dow Futures And Dollar Movement

Apr 22, 2025 -

Is Blue Origins Failure More Significant Than Katy Perrys Controversies

Apr 22, 2025

Is Blue Origins Failure More Significant Than Katy Perrys Controversies

Apr 22, 2025 -

Fsu Security Breach Swift Police Response Fails To Quell Student Fears

Apr 22, 2025

Fsu Security Breach Swift Police Response Fails To Quell Student Fears

Apr 22, 2025 -

Pope Francis A Legacy Of Compassion

Apr 22, 2025

Pope Francis A Legacy Of Compassion

Apr 22, 2025