Stock Market Live: Analyzing Today's Dow Futures And Dollar Movement

Table of Contents

Understanding Today's Dow Futures Performance

Dow Futures Contract Details

Dow futures contracts are derivative instruments that allow traders to speculate on the future price of the Dow Jones Industrial Average (DJIA). They're a valuable tool for predicting market direction and managing risk.

- Trading Mechanics: Dow futures contracts are traded on exchanges like the CME Group, with standardized contract sizes and specifications.

- Contract Sizes: Each contract represents a specific dollar amount of the DJIA.

- Margin Requirements: Traders need to maintain a certain level of margin in their accounts to cover potential losses.

- Current Dow Futures Prices: (Insert current Dow futures prices and percentage change from the previous day's close here. Example: "As of 10:00 AM EST, the December Dow futures contract is trading at 34,500, down 0.5% from yesterday's close.")

- Key Influencing Indicators: Economic data releases like the Non-Farm Payroll report, inflation data (CPI, PPI), and manufacturing PMI significantly influence Dow futures.

Analyzing the Dow Futures Chart

Technical analysis of the Dow futures chart is essential for identifying potential trading opportunities. Key support and resistance levels, along with chart patterns and indicators, provide valuable insights.

- Chart Patterns: Identifying patterns like head and shoulders, triangles, and double tops/bottoms can help predict future price movements.

- Technical Indicators: Moving averages (e.g., 50-day, 200-day), Relative Strength Index (RSI), and MACD are commonly used to assess momentum and potential reversals. (Include a relevant chart or graph visualizing the Dow futures chart with key support/resistance levels and indicators highlighted here.)

Impact of Global News on Dow Futures

Major global events and news significantly impact Dow futures. Political instability, geopolitical tensions, and unexpected economic announcements can cause significant price swings.

- Example 1: (Example: "The recent announcement of higher-than-expected inflation figures caused a sell-off in Dow futures, reflecting investor concerns about potential interest rate hikes.")

- Example 2: (Example: "Positive news regarding trade negotiations between the US and China boosted investor sentiment, leading to a rise in Dow futures.")

- Investor Sentiment: Monitoring news sources and social media sentiment can provide valuable insights into the overall market mood and its impact on Dow futures.

The Dollar's Movement and its Correlation with the Stock Market

Current State of the US Dollar Index (USDX)

The US Dollar Index (USDX) measures the value of the US dollar against a basket of other major currencies. Its movement is closely correlated with the stock market.

- USDX Composition: The USDX comprises currencies like the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc.

- Factors Impacting USDX: Interest rate differentials between the US and other countries, geopolitical events, and global economic growth significantly affect the USDX. (Include a chart showing the recent movement of the USDX here.)

USDX and its Relationship with Dow Futures

Changes in the dollar's value typically have an inverse relationship with Dow futures and the broader stock market.

- Strong Dollar Impact: A strong dollar can negatively impact the earnings of multinational companies, as their overseas revenue translates to fewer US dollars.

- Currency Fluctuations and Sentiment: Significant currency fluctuations can create uncertainty and affect investor sentiment, leading to volatility in the stock market.

Predicting Future Dollar Movement and its Impact on the Market

Predicting future USDX movements requires careful analysis of various economic indicators and geopolitical events.

- Potential Scenarios: (Example: "If the Federal Reserve announces further interest rate hikes, the USDX is likely to strengthen, potentially putting downward pressure on Dow futures.")

- Impact on Dow Futures: A stronger dollar generally leads to lower Dow futures prices, while a weaker dollar can boost them.

Conclusion

Our Stock Market Live analysis reveals a complex interplay between Dow futures and the dollar's movement. Understanding the correlation between these key indicators is crucial for effective investment strategies. Monitoring key economic data releases, global news events, and technical analysis of both Dow futures and the USDX provides a more comprehensive view of market dynamics.

Key Takeaways:

- Dow futures are valuable tools for predicting market direction.

- The USDX has a significant inverse correlation with the stock market.

- Monitoring both Dow futures and the USDX is essential for informed trading decisions.

Stay informed on the pulse of the market with our daily ‘Stock Market Live’ updates, ensuring you’re well-equipped to make informed trading decisions. Check back for further updates and future analyses of Dow futures and dollar movement.

Featured Posts

-

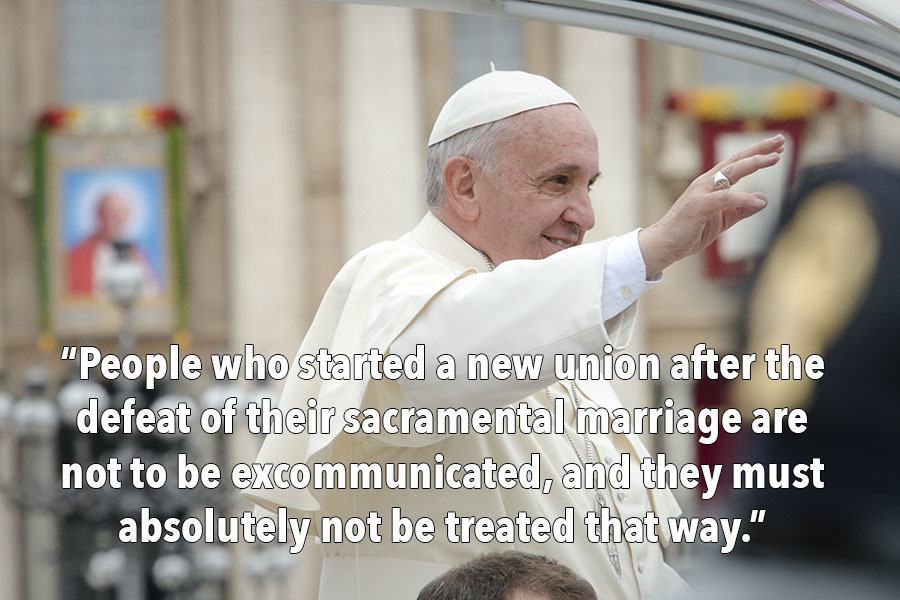

Death Of Pope Francis The End Of An Era Of Compassion

Apr 22, 2025

Death Of Pope Francis The End Of An Era Of Compassion

Apr 22, 2025 -

Turning Poop Into Podcast Gold How Ai Simplifies Scatological Document Analysis

Apr 22, 2025

Turning Poop Into Podcast Gold How Ai Simplifies Scatological Document Analysis

Apr 22, 2025 -

Managing Deportees Return To South Sudan A Coordinated Approach With The Us

Apr 22, 2025

Managing Deportees Return To South Sudan A Coordinated Approach With The Us

Apr 22, 2025 -

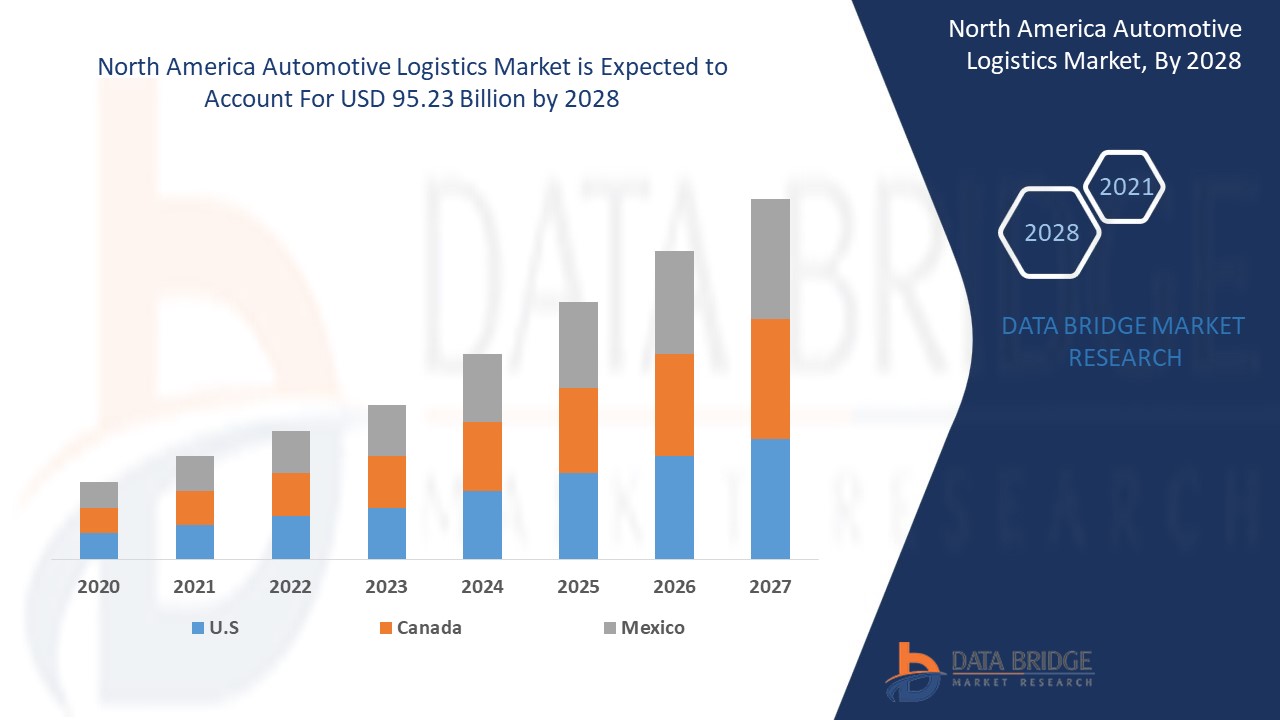

Chinas Automotive Market A Case Study Of Bmw And Porsches Challenges

Apr 22, 2025

Chinas Automotive Market A Case Study Of Bmw And Porsches Challenges

Apr 22, 2025 -

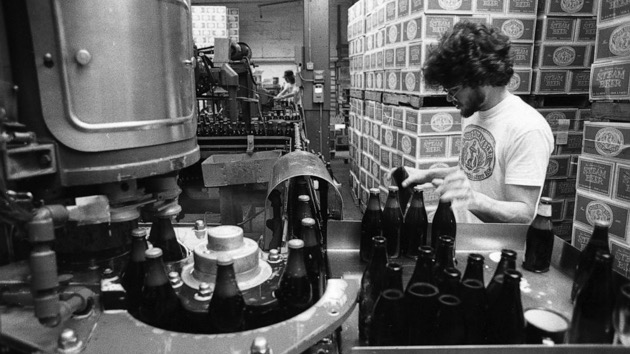

Anchor Brewing Company Shuts Down A Legacy Concludes After 127 Years

Apr 22, 2025

Anchor Brewing Company Shuts Down A Legacy Concludes After 127 Years

Apr 22, 2025