Hong Kong-Listed Chinese Stocks Rally Amidst Trade Truce Hopes

Table of Contents

Trade Truce Hopes Fuel Market Sentiment

Recent developments in US-China trade negotiations have injected a wave of optimism into the market. Positive statements from officials on both sides, hinting at potential breakthroughs and de-escalation of the trade war, have significantly boosted investor confidence. The possibility of easing tariffs and increased market access for Chinese companies has been a major catalyst for this rally. Reduced trade tensions translate directly into reduced uncertainty for businesses and investors, encouraging greater investment and driving up stock prices.

- Easing of Tariffs: The prospect of reduced or removed tariffs on Chinese goods significantly improves the profitability of many Hong Kong-listed companies.

- Increased Market Access: Improved trade relations could lead to greater market access for Chinese companies in the US and globally, fueling growth and investor interest.

- Reduced Uncertainty for Investors: A clearer trade landscape reduces the risk perceived by investors, making them more willing to invest in Chinese assets.

Performance of Key Sectors in Hong Kong's Stock Market

The rally in Hong Kong-listed Chinese stocks is not uniform across all sectors. Technology stocks have experienced particularly strong gains, driven by the easing of tech-related sanctions and the anticipation of increased demand. The financial sector has also seen a significant recovery, reflecting improved investor sentiment and expectations of stronger economic growth. The consumer goods sector has performed well, linked to potential increases in consumer spending fueled by a more stable economic outlook.

- Technology Sector Gains: Easing of tech-related sanctions and increased demand for Chinese technology products are driving significant gains.

- Financial Sector Recovery: Improved investor sentiment and expectations of stronger economic growth have boosted the financial sector.

- Consumer Goods Sector Performance: A more stable economic outlook and increased consumer confidence are contributing to the strong performance of consumer goods companies. (Charts and graphs illustrating sector performance would be included here).

Potential Risks and Cautions Regarding the Rally

While the current rally is promising, it's crucial to acknowledge potential risks. Geopolitical uncertainties remain, and a sudden resurgence of trade tensions could quickly reverse the positive momentum. The long-term implications of any trade agreement are still uncertain, and further regulatory changes within China could also impact market performance. Diversification remains a key strategy for mitigating risk.

- Geopolitical Instability: Regional geopolitical instability could negatively impact investor sentiment and market performance.

- Uncertainties Regarding the Long-Term Trade Agreement: The details and durability of any potential trade agreement remain uncertain.

- Potential for Further Regulatory Changes in China: Unexpected regulatory changes in China could impact the profitability and valuation of certain companies.

Investment Strategies for Hong Kong-Listed Chinese Stocks

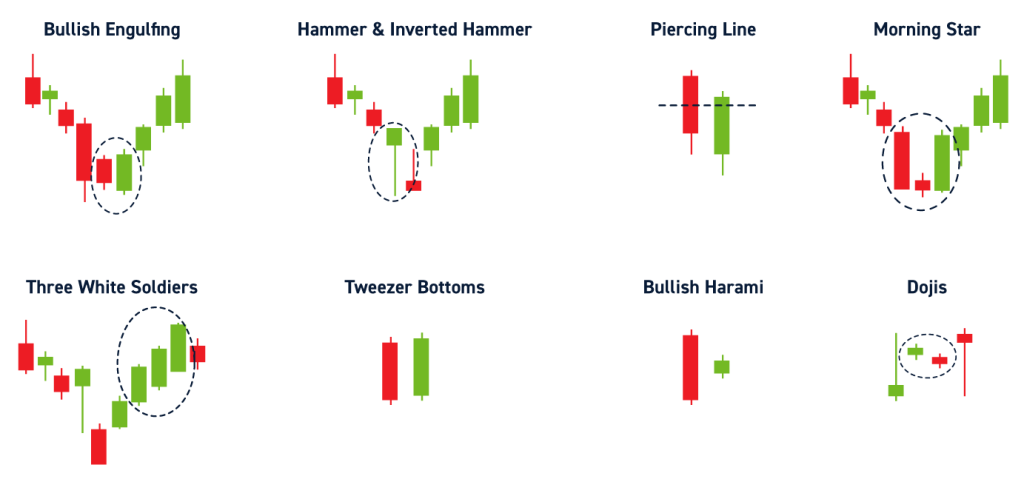

Given the current market conditions, a balanced investment strategy is crucial. Fundamental analysis, focusing on the financial health and long-term prospects of individual companies, is essential. Technical analysis, studying price charts and trends, can help identify optimal entry and exit points. Risk management and diversification across various sectors are paramount.

- Focus on Fundamentally Strong Companies: Invest in companies with a strong track record of profitability and sustainable growth.

- Diversify Across Sectors: Diversifying your portfolio across different sectors minimizes risk exposure.

- Monitor Macroeconomic Indicators Closely: Stay informed about macroeconomic trends and their potential impact on the market.

Conclusion: Navigating the Future of Hong Kong-Listed Chinese Stocks

The recent surge in Hong Kong-listed Chinese stocks is largely driven by optimism surrounding a potential US-China trade truce. While the prospects are positive, investors should remain cautious, aware of the potential risks associated with geopolitical instability and regulatory uncertainty. A well-researched, diversified investment strategy, incorporating both fundamental and technical analysis, is crucial for navigating the complexities of this market. Stay updated on Hong Kong-listed Chinese stocks by following relevant news and conducting thorough due diligence before making any investment decisions. Learn more about investing in Hong Kong-listed Chinese stocks and discover the potential of this dynamic market.

Featured Posts

-

Canadas Fiscal Future A Vision Of Responsibility

Apr 24, 2025

Canadas Fiscal Future A Vision Of Responsibility

Apr 24, 2025 -

Cad Decline A Deeper Look At Recent Currency Movements

Apr 24, 2025

Cad Decline A Deeper Look At Recent Currency Movements

Apr 24, 2025 -

Understanding The Value Of Middle Management Benefits For Companies And Employees

Apr 24, 2025

Understanding The Value Of Middle Management Benefits For Companies And Employees

Apr 24, 2025 -

Canadian Auto Dealers Propose Five Point Plan To Combat Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan To Combat Us Trade War

Apr 24, 2025 -

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025