Higher Stock Prices, Higher Risks: What Investors Need To Know

Table of Contents

Understanding the Correlation Between Higher Stock Prices and Risk

Market Sentiment and Valuation: Investor optimism fuels rising stock prices. However, this exuberance can sometimes inflate prices beyond their justifiable valuations, leading to overvalued stocks. These overvalued assets become significantly more vulnerable to price corrections. Key valuation metrics, such as the Price-to-Earnings (P/E) ratio, help assess a stock's value relative to its earnings. A high P/E ratio frequently signals an overvalued stock, increasing its risk profile. Speculation and the fear of missing out (FOMO) further amplify this upward momentum, creating a potentially unsustainable market bubble.

- Overvalued stocks are significantly more susceptible to sharp price drops.

- Price-to-Earnings (P/E) ratios, along with other valuation metrics like Price-to-Sales (P/S) and Price-to-Book (P/B), are essential tools for assessing risk.

- Speculation and FOMO can inflate stock prices beyond their intrinsic value, drastically increasing investment risk.

Increased Volatility: Higher stock prices frequently correlate with amplified market volatility. This translates to larger and more frequent price swings in both upward and downward directions. News events, economic data releases, and shifts in investor sentiment can trigger substantial price fluctuations. In a highly valued market, even a moderate correction can result in significant losses for investors.

- High stock prices amplify market volatility, leading to larger price swings.

- Unexpected news events and economic indicators can disproportionately impact already volatile markets.

- Historical data consistently shows that periods of high stock prices are often followed by substantial market corrections.

Identifying and Managing Risk in a Bull Market

Navigating a market characterized by higher stock prices demands a proactive and strategic approach to risk management.

Diversification Strategies: Diversifying your investment portfolio is a cornerstone of effective risk mitigation. This involves distributing your investments across various asset classes, including stocks, bonds, real estate, and potentially alternative investments. Sector diversification, achieved by investing in companies across different industries, further reduces the impact of sector-specific downturns.

- Strategic asset allocation is vital for managing risk across your entire portfolio.

- Diversification across multiple sectors protects against industry-specific downturns and reduces overall portfolio volatility.

- Exchange-Traded Funds (ETFs) and mutual funds offer a convenient method for achieving broad market diversification.

Risk Tolerance Assessment: Before committing to any investment strategy, a thorough understanding of your own risk tolerance is crucial. Your risk tolerance reflects your capacity to withstand potential investment losses. Numerous questionnaires and online tools can help determine your personal risk profile. Knowing your risk tolerance guides investment decisions, enabling you to select investments aligned with your comfort level.

- Understanding your risk tolerance dictates the appropriate investment strategy: aggressive, moderate, or conservative.

- Several online tools and questionnaires can help assess your personal risk tolerance and inform your investment choices.

- Match your investment strategy with your risk tolerance to avoid undue stress and potential losses.

Utilizing Stop-Loss Orders: Stop-loss orders serve as a valuable risk management tool. A stop-loss order automatically sells a stock when it reaches a predefined price, limiting potential losses. While providing a safety net, it's crucial to understand their limitations, such as the risk of a "gap down," where the stock price drops significantly overnight, potentially bypassing your stop-loss order.

- Stop-loss orders automatically limit potential losses by selling a stock when it reaches a predetermined price.

- Stop-limit orders offer a more controlled approach, specifying both a stop price and a limit price for the sale.

- While valuable, stop-loss orders are not foolproof and may not always prevent all losses, particularly in highly volatile markets.

Conclusion

Higher stock prices, while potentially rewarding, inherently carry increased risk. Understanding this correlation and implementing effective risk management strategies are vital for long-term investment success. Diversification, a clear understanding of your risk tolerance, and the strategic use of tools like stop-loss orders are fundamental components of a resilient investment plan in a market with higher valuations. Don't let higher stock prices catch you off guard. Learn more about managing investment risk and start building a robust and diversified investment portfolio today! [Link to relevant resource on investment risk management]

Featured Posts

-

The Zuckerberg Trump Dynamic Implications For The Tech Industry

Apr 22, 2025

The Zuckerberg Trump Dynamic Implications For The Tech Industry

Apr 22, 2025 -

Saudi Aramcos Ev Push Collaboration With Byd On New Technologies

Apr 22, 2025

Saudi Aramcos Ev Push Collaboration With Byd On New Technologies

Apr 22, 2025 -

The Fracturing Relationship A Deep Dive Into The Us China Conflict And Cold War Concerns

Apr 22, 2025

The Fracturing Relationship A Deep Dive Into The Us China Conflict And Cold War Concerns

Apr 22, 2025 -

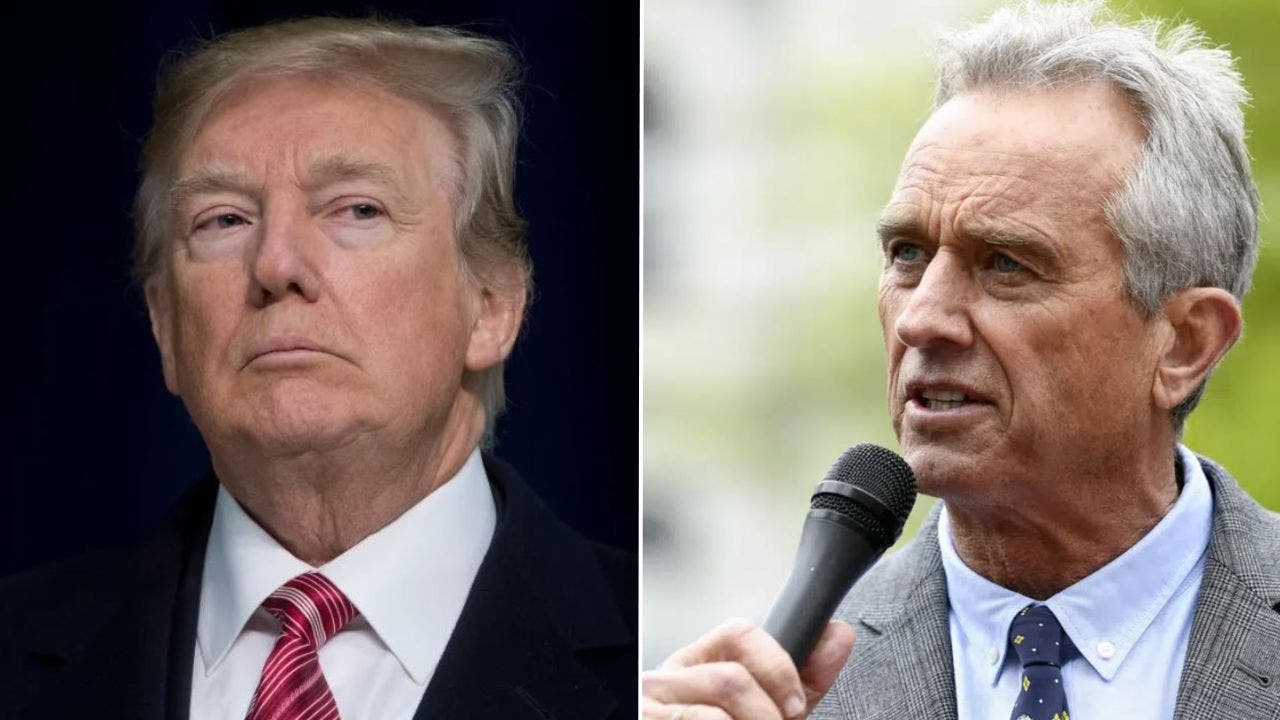

Obamacares Supreme Court Fate How Trumps Defense Could Help Rfk Jr

Apr 22, 2025

Obamacares Supreme Court Fate How Trumps Defense Could Help Rfk Jr

Apr 22, 2025 -

Dow Futures Drop Dollar Weakens Amid Trade And Tariff Concerns

Apr 22, 2025

Dow Futures Drop Dollar Weakens Amid Trade And Tariff Concerns

Apr 22, 2025