Dow Futures Drop, Dollar Weakens Amid Trade And Tariff Concerns

Table of Contents

Impact of Trade and Tariff Concerns on Dow Futures

The correlation between heightened trade tensions and the decline in Dow Futures is undeniable. The ongoing trade war, characterized by escalating tariffs and retaliatory measures between major global economies, is significantly impacting market sentiment. This uncertainty is causing investors to reassess their positions and adopt more cautious investment strategies.

-

Direct Correlation: Increased trade tensions lead to decreased business confidence, impacting corporate earnings forecasts and future investment plans. This directly translates to a decline in the value of futures contracts tied to the Dow Jones Industrial Average.

-

Specific Tariffs and Disputes: The recent imposition of tariffs on [mention specific examples, e.g., steel, aluminum, or specific goods between countries] has directly impacted businesses reliant on these imports/exports, causing ripple effects throughout the supply chain. This uncertainty creates a negative outlook on future profits, further depressing Dow Futures.

-

Investor Sentiment: Investor sentiment is currently characterized by fear and uncertainty. The lack of clarity regarding the future direction of trade policy is prompting many investors to adopt a risk-averse approach, leading to selling pressure and a drop in Dow Futures.

-

Shifts in Investment Strategies: Many investors are shifting towards more defensive investment strategies, moving away from riskier assets like stocks and into safer havens like government bonds or gold. This shift in capital allocation contributes to the downward pressure on Dow Futures.

-

Illustrative Charts/Graphs: [Insert relevant charts or graphs visually demonstrating the drop in Dow Futures correlated with specific trade-related news events].

Dollar Weakness and its Global Implications

The weakening US dollar is another significant consequence of the escalating trade tensions. A weaker dollar typically makes US exports more competitive on the global market, but this benefit is currently overshadowed by the overall negative impact of trade uncertainty.

-

Relationship to Trade Concerns: The weakening dollar is partly a reflection of investor concern about the economic consequences of the trade war. A decline in confidence in the US economy often leads to a decrease in demand for the US dollar.

-

Impact on US Exports and Imports: While a weaker dollar can boost exports, the uncertainty created by trade disputes can offset this benefit. Businesses may hesitate to invest in expansion or increase production due to the unpredictable trade environment. Increased import costs due to tariffs also negatively impact the economy.

-

Effects on Other Global Currencies and Markets: The weakening dollar impacts global currency exchange rates, affecting international trade and investment flows. Other currencies may appreciate or depreciate relative to the dollar, creating further market volatility.

-

Potential for Increased Inflation: Increased import costs due to tariffs and a weaker dollar can contribute to inflation within the US economy, potentially eroding consumer purchasing power.

-

Future Trajectory of the Dollar: The future trajectory of the dollar will largely depend on the resolution (or escalation) of trade disputes and the overall health of the US economy. Many analysts predict continued volatility in the near term.

Analyzing Market Volatility and Predicting Future Trends

The current market volatility is largely a result of the uncertainty surrounding trade policy and its impact on the global economy. Accurate prediction is challenging, but analyzing expert opinions and historical trends can provide some insight.

-

Current Market Volatility: The current level of market volatility is considered high, reflecting investor anxiety about the unpredictable nature of trade negotiations and their potential economic consequences.

-

Expert Opinions and Predictions: Many economic analysts predict continued market volatility in the short term. The future direction will depend heavily on the outcome of ongoing trade negotiations and the overall global economic climate. [Mention specific expert opinions and predictions, citing credible sources].

-

Strategies for Navigating Market Uncertainty: Diversification is crucial during times of market uncertainty. Investors should spread their investments across different asset classes to mitigate risk. Hedging strategies can also help protect against potential losses.

-

Managing Risk During This Period: Risk management involves careful monitoring of your portfolio, diversifying investments, and setting realistic expectations. Avoid making impulsive decisions based on short-term market fluctuations.

-

Potential Safe-Haven Assets: During periods of uncertainty, investors often turn to safe-haven assets, such as gold, government bonds, and other low-risk investments, to preserve capital.

Conclusion:

The recent drop in Dow Futures and the weakening dollar are largely attributed to the escalating trade and tariff concerns creating significant market volatility. The uncertainty surrounding future trade policies is causing investors to adopt more cautious strategies. It's crucial to stay informed about the latest developments. Stay updated on the latest developments regarding Dow Futures and the weakening dollar by regularly checking reputable financial news sources and market analysis platforms. Monitor the impact of trade and tariff concerns on Dow Futures and plan your investment strategy accordingly.

Featured Posts

-

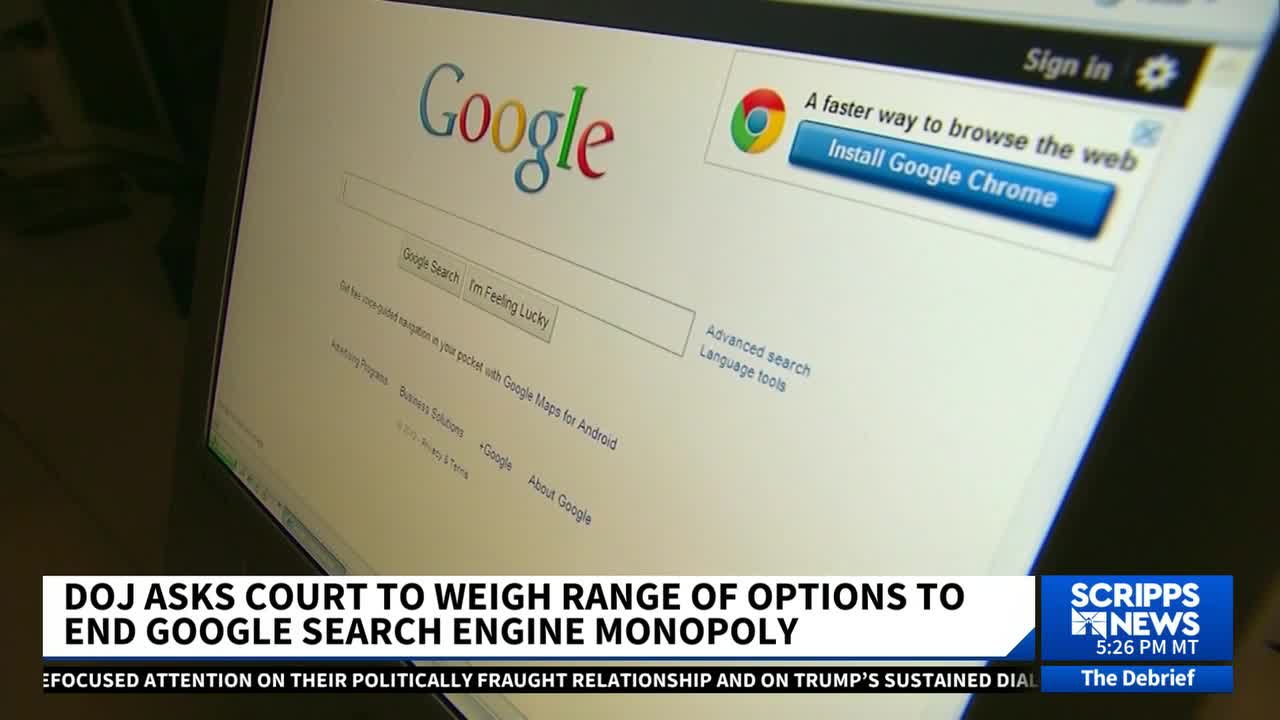

The Growing Pressure To Break Up Google Antitrust Concerns And The Future

Apr 22, 2025

The Growing Pressure To Break Up Google Antitrust Concerns And The Future

Apr 22, 2025 -

Ukraine War Russia Resumes Offensive After Easter Ceasefire

Apr 22, 2025

Ukraine War Russia Resumes Offensive After Easter Ceasefire

Apr 22, 2025 -

Russias Deadly Aerial Assault On Ukraine Us Peace Plan Efforts

Apr 22, 2025

Russias Deadly Aerial Assault On Ukraine Us Peace Plan Efforts

Apr 22, 2025 -

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 22, 2025

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 22, 2025 -

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 22, 2025

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 22, 2025