High Stock Market Valuations: A BofA Analysis And Reasons For Investor Calm

Table of Contents

BofA's Analysis of Current Stock Market Valuations

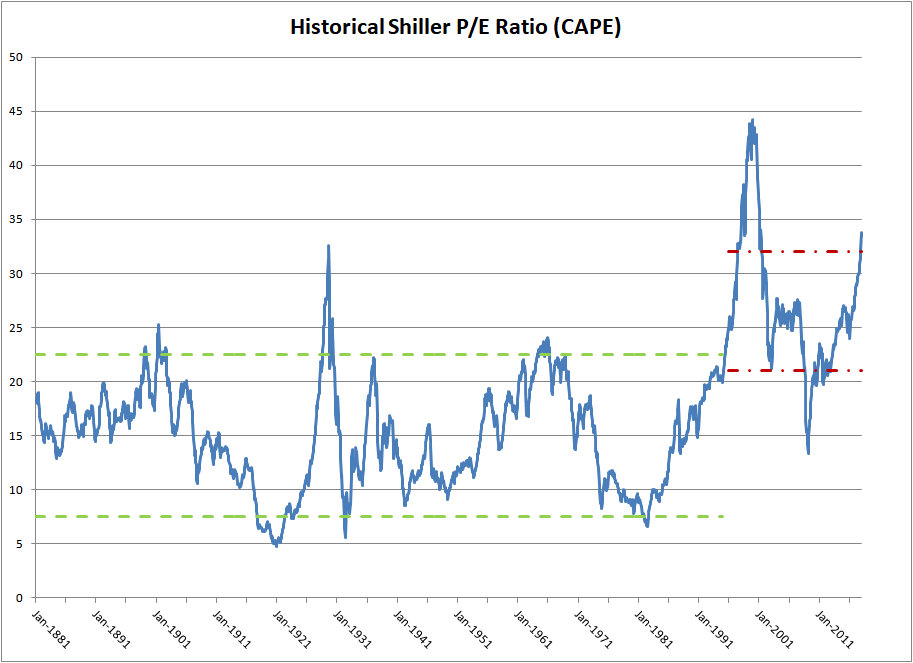

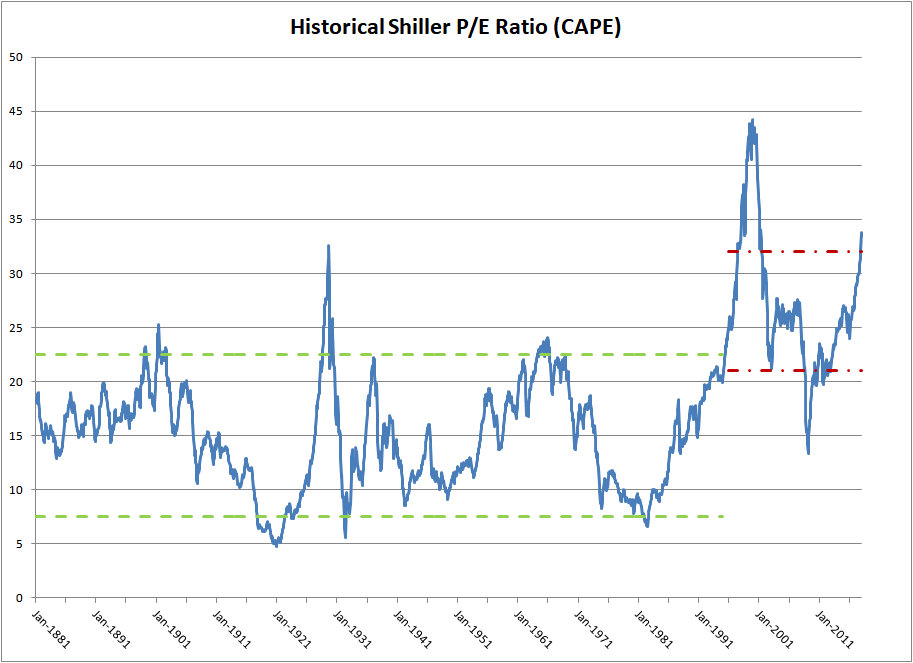

BofA's Global Research recently published an in-depth analysis of current stock market valuations, utilizing various metrics to gauge the market's health. Their findings suggest a level of valuation that is historically high, prompting careful consideration for investors. The analysis heavily relies on traditional valuation metrics such as the Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (CAPE or Shiller P/E), comparing current levels to historical averages.

- Key metrics used in BofA's valuation analysis: P/E ratio, Shiller P/E ratio, dividend yield, and market capitalization-to-GDP ratio.

- BofA's conclusions regarding the level of overvaluation: While BofA hasn't explicitly declared a specific percentage of overvaluation, their analysis indicates valuations are significantly above long-term historical averages, suggesting a degree of risk.

- Comparison to historical valuations: The report compared current P/E ratios to those observed during past market booms and busts, highlighting the current market's elevated position relative to historical norms. This comparison emphasizes the potential for future volatility.

Factors Contributing to Investor Calm Despite High Valuations

Despite the high stock market valuations, investor sentiment remains relatively calm. Several factors contribute to this apparent complacency:

- Low interest rate environment and its impact on valuations: Historically low interest rates have pushed investors towards higher-yielding assets, including stocks. This increased demand contributes to higher stock prices and valuations.

- Strong corporate earnings and their role in justifying high valuations: Many companies have reported robust earnings growth, providing some justification for the elevated valuations. However, this growth may not be sustainable in the long term.

- Investor confidence and expectations for future growth: Investors are largely optimistic about future economic growth and corporate profitability, potentially overlooking the risks associated with high valuations. This optimism fuels further investment and pushes prices higher.

- Potential impact of government stimulus and monetary policy: Continued government support and monetary easing measures have helped sustain economic activity and buoy market sentiment, further contributing to higher stock prices.

Potential Risks and Challenges Associated with High Stock Market Valuations

While the current market presents opportunities, it's crucial to acknowledge the inherent risks associated with high valuations:

- Risk of a market correction or crash: High valuations make the market more susceptible to corrections or even a crash, triggered by any negative economic news or shifts in investor sentiment.

- Increased market volatility and its potential impact on investors: High valuations often translate to increased market volatility, meaning larger and more frequent price swings. This increased volatility can lead to significant losses for investors who aren't prepared.

- Potential impact of rising interest rates on stock prices: If interest rates rise, the attractiveness of stocks relative to bonds diminishes, potentially leading to a decline in stock prices.

- Geopolitical risks and their potential effect on market valuations: Unforeseen geopolitical events, such as trade wars or international conflicts, can trigger market sell-offs and negatively impact valuations.

BofA's Outlook and Investment Strategies

BofA's outlook on the stock market remains cautiously optimistic, acknowledging the high valuations. Their suggested investment strategies emphasize diversification and risk management:

- BofA's prediction for short-term and long-term market performance: BofA's predictions are not publicly available in a single concise statement, but their research suggests a potential for volatility in the short term, with longer-term growth depending on various economic factors.

- Recommended investment strategies for navigating high valuations: BofA likely suggests a balanced portfolio approach, with diversification across asset classes and sectors. A focus on value stocks, rather than solely growth stocks, might also be recommended.

- Sectors expected to perform well/poorly according to BofA's analysis: Specific sector recommendations vary and change based on ongoing research. It's crucial to stay up-to-date on BofA's latest reports for detailed analysis.

High Stock Market Valuations: A Call to Informed Action

BofA's analysis highlights the current state of high stock market valuations and the factors contributing to investor complacency. While strong corporate earnings and low interest rates have supported the market, significant risks remain. A potential market correction, increased volatility, and the impact of rising interest rates or geopolitical events should all be considered. Therefore, informed decision-making is paramount. Understanding high stock valuations is crucial for effective investing. Conduct your own thorough research, consult with a qualified financial advisor, and develop a well-diversified investment strategy that aligns with your risk tolerance and financial goals. Successfully managing high stock market valuations requires proactive planning and a realistic assessment of potential risks and rewards.

Featured Posts

-

E Bay And Section 230 A Judges Ruling On Banned Chemical Listings

Apr 22, 2025

E Bay And Section 230 A Judges Ruling On Banned Chemical Listings

Apr 22, 2025 -

Responding To Trump Kyivs Options In The Ukraine Conflict

Apr 22, 2025

Responding To Trump Kyivs Options In The Ukraine Conflict

Apr 22, 2025 -

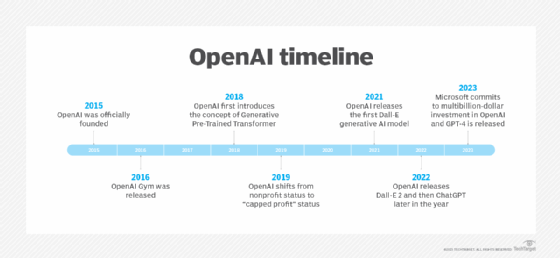

Revolutionizing Voice Assistant Development Open Ais 2024 Announcements

Apr 22, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Announcements

Apr 22, 2025 -

Economists React Understanding The Bank Of Canadas Interest Rate Decision

Apr 22, 2025

Economists React Understanding The Bank Of Canadas Interest Rate Decision

Apr 22, 2025 -

Exclusive Trump Administration To Slash 1 Billion In Harvard Funding

Apr 22, 2025

Exclusive Trump Administration To Slash 1 Billion In Harvard Funding

Apr 22, 2025